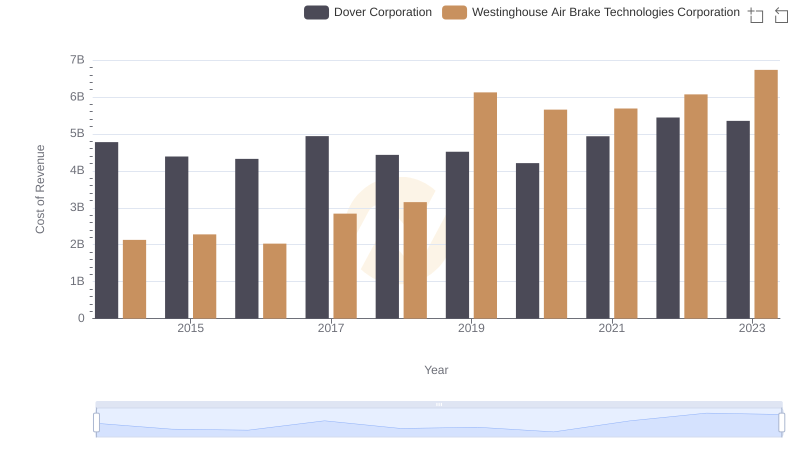

| __timestamp | Dover Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2974249000 | 913534000 |

| Thursday, January 1, 2015 | 2568144000 | 1026153000 |

| Friday, January 1, 2016 | 2471969000 | 901541000 |

| Sunday, January 1, 2017 | 2890377000 | 1040597000 |

| Monday, January 1, 2018 | 2559556000 | 1211731000 |

| Tuesday, January 1, 2019 | 2620938000 | 2077600000 |

| Wednesday, January 1, 2020 | 2474019000 | 1898700000 |

| Friday, January 1, 2021 | 2969786000 | 2135000000 |

| Saturday, January 1, 2022 | 3063556000 | 2292000000 |

| Sunday, January 1, 2023 | 3084633000 | 2944000000 |

| Monday, January 1, 2024 | 2958621000 | 3366000000 |

Data in motion

In the competitive landscape of industrial manufacturing, the financial performance of companies like Dover Corporation and Westinghouse Air Brake Technologies Corporation (WAB) offers intriguing insights. Over the past decade, Dover Corporation has consistently outperformed WAB in terms of gross profit, with an average of approximately 2.8 billion USD annually. However, WAB has shown remarkable growth, nearly tripling its gross profit from 2014 to 2023.

From 2014 to 2023, Dover's gross profit increased by about 4%, while WAB's surged by over 220%. This significant growth for WAB highlights its strategic advancements and market adaptability. Notably, in 2023, WAB's gross profit reached nearly 2.9 billion USD, closing the gap with Dover's 3.1 billion USD.

These trends underscore the dynamic nature of the industrial sector, where strategic innovation and market positioning can dramatically alter financial trajectories.

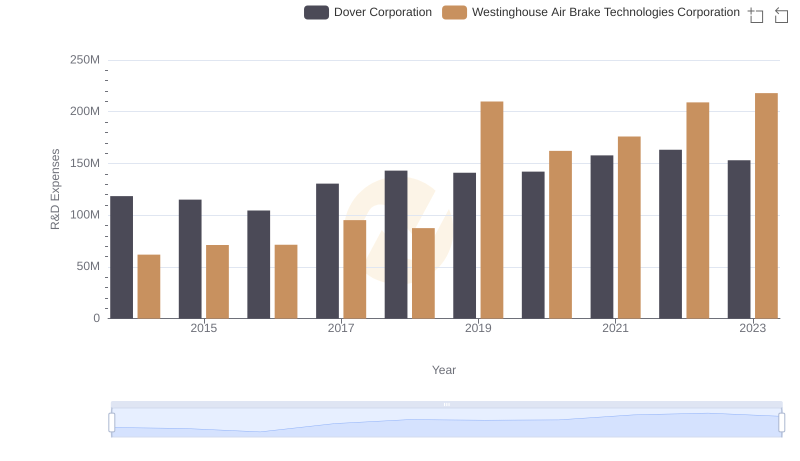

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Dover Corporation's Expenses

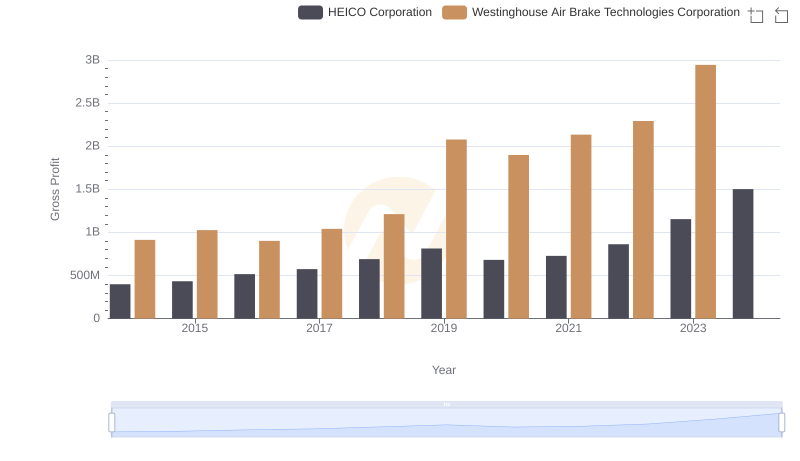

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and HEICO Corporation Trends

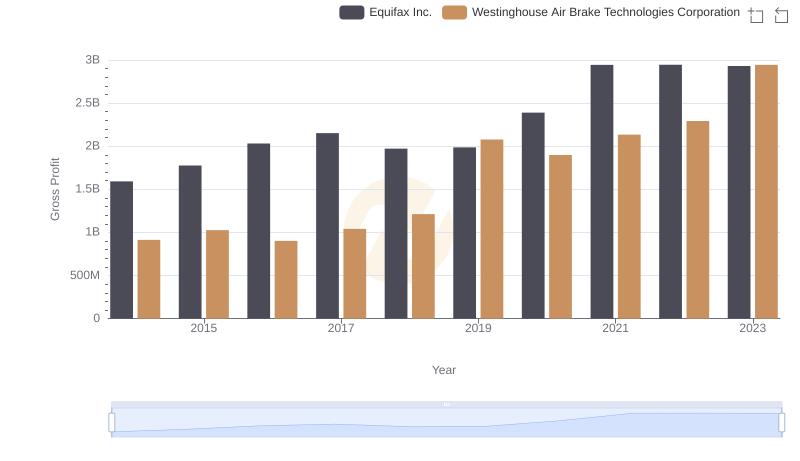

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: A Gross Profit Performance Breakdown

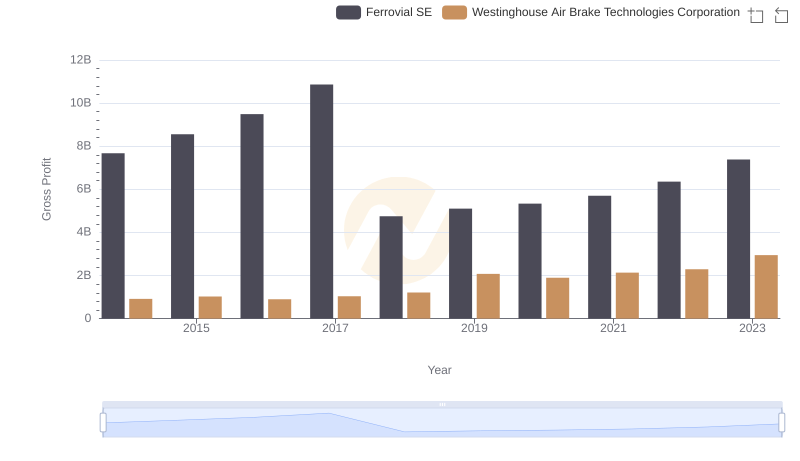

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Ferrovial SE

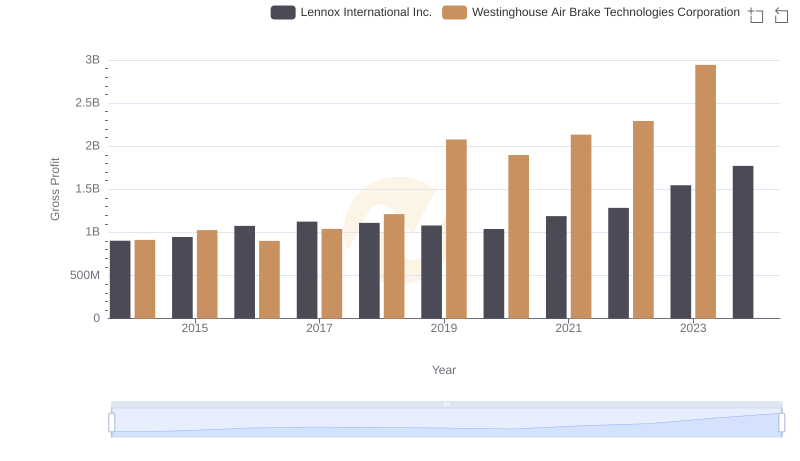

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Lennox International Inc. Trends

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Dover Corporation Allocate Funds

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Dover Corporation