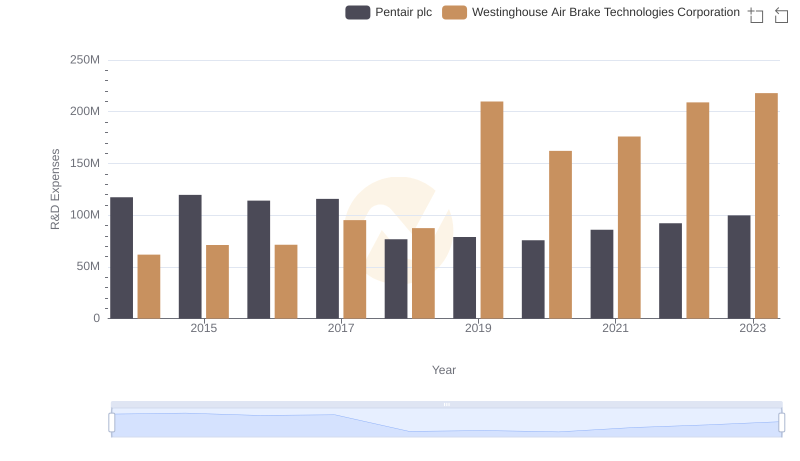

| __timestamp | Dover Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 118411000 | 61886000 |

| Thursday, January 1, 2015 | 115037000 | 71213000 |

| Friday, January 1, 2016 | 104479000 | 71375000 |

| Sunday, January 1, 2017 | 130536000 | 95166000 |

| Monday, January 1, 2018 | 143033000 | 87450000 |

| Tuesday, January 1, 2019 | 140957000 | 209900000 |

| Wednesday, January 1, 2020 | 142101000 | 162100000 |

| Friday, January 1, 2021 | 157826000 | 176000000 |

| Saturday, January 1, 2022 | 163300000 | 209000000 |

| Sunday, January 1, 2023 | 153111000 | 218000000 |

| Monday, January 1, 2024 | 0 | 206000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Westinghouse Air Brake Technologies Corporation and Dover Corporation have demonstrated distinct strategies in their R&D allocations.

From 2014 to 2023, Dover Corporation's R&D expenses have shown a steady increase, peaking in 2022 with a 38% rise from 2014. Meanwhile, Westinghouse Air Brake Technologies Corporation has exhibited a more aggressive approach, with a remarkable 252% increase in R&D spending over the same period. This surge underscores their strategic focus on innovation and technological advancement.

These trends highlight the contrasting approaches of these industrial giants: Dover's consistent growth versus Westinghouse's dynamic expansion. As the industry continues to evolve, these R&D investments will likely play a pivotal role in shaping their competitive edge.

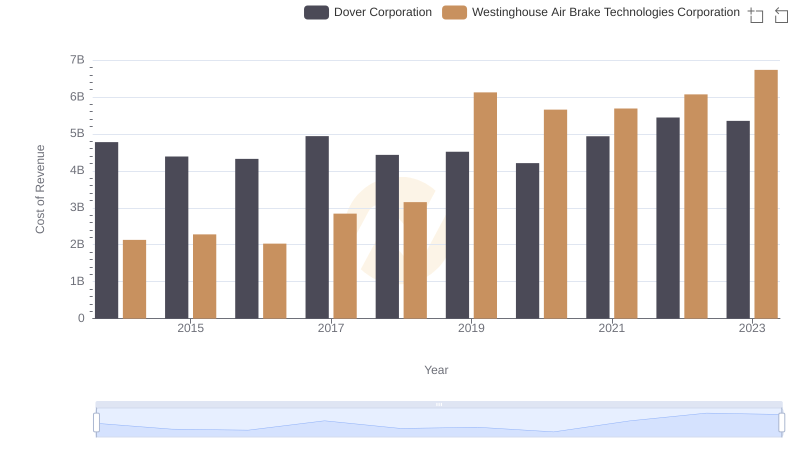

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Dover Corporation's Expenses

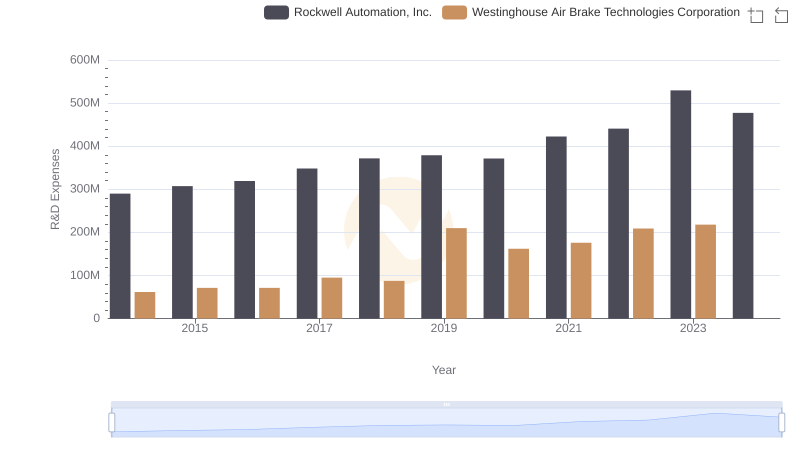

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Strategic Focus on R&D Spending

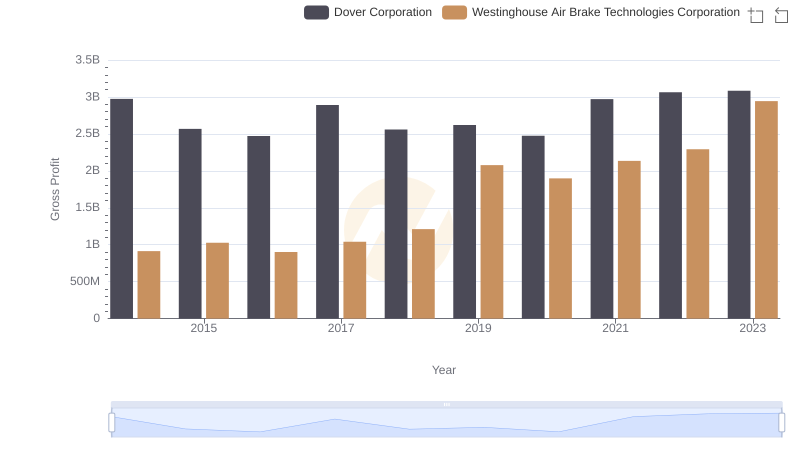

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Dover Corporation Trends

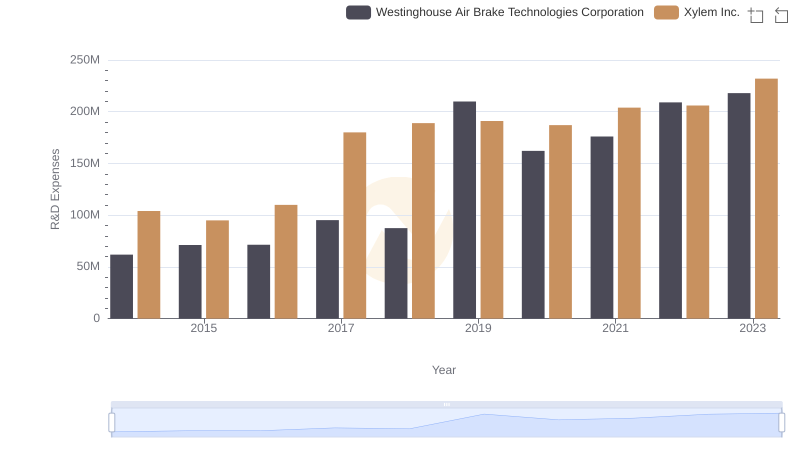

Westinghouse Air Brake Technologies Corporation or Xylem Inc.: Who Invests More in Innovation?

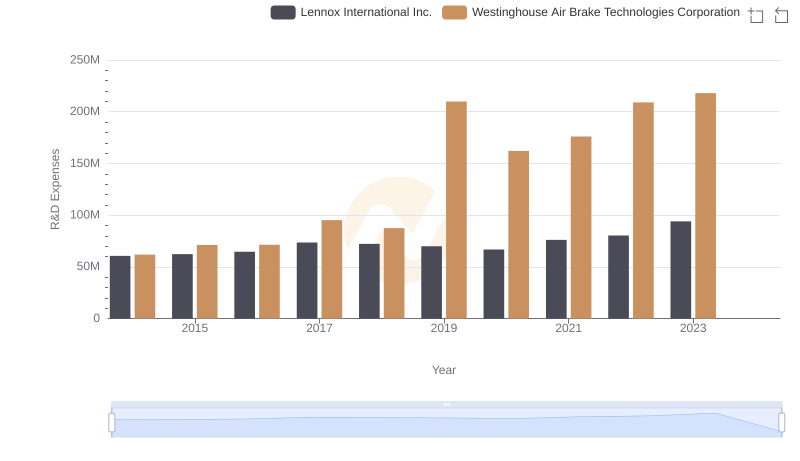

Research and Development Expenses Breakdown: Westinghouse Air Brake Technologies Corporation vs Lennox International Inc.

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Dover Corporation

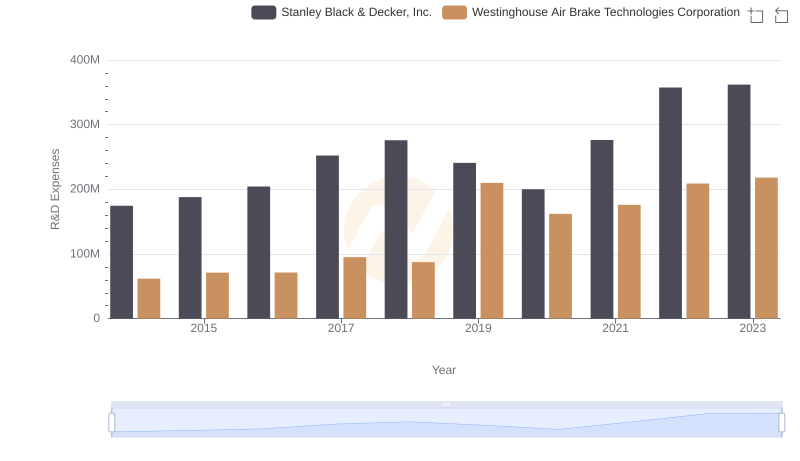

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.

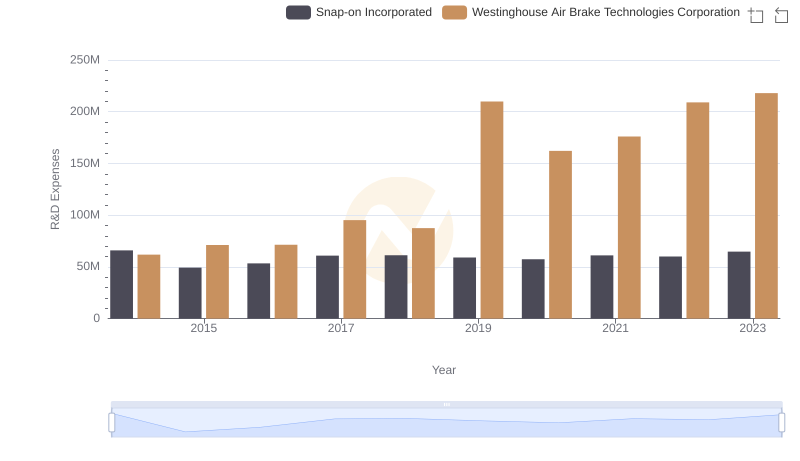

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated Allocate Funds

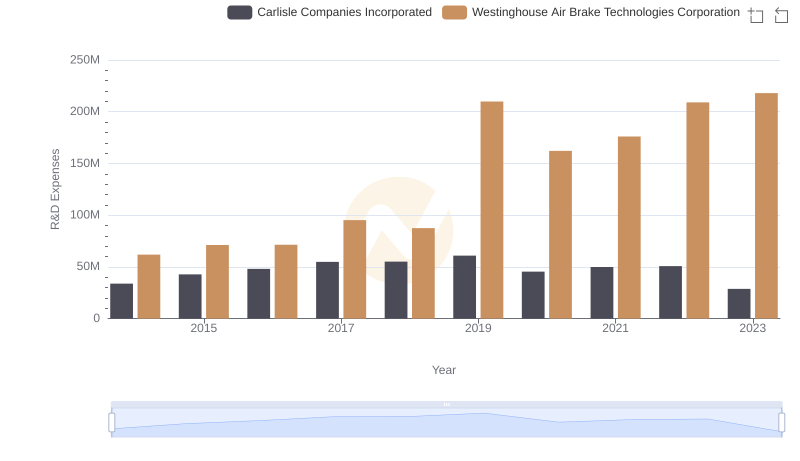

Research and Development Investment: Westinghouse Air Brake Technologies Corporation vs Carlisle Companies Incorporated

Comparing Innovation Spending: Westinghouse Air Brake Technologies Corporation and Pentair plc