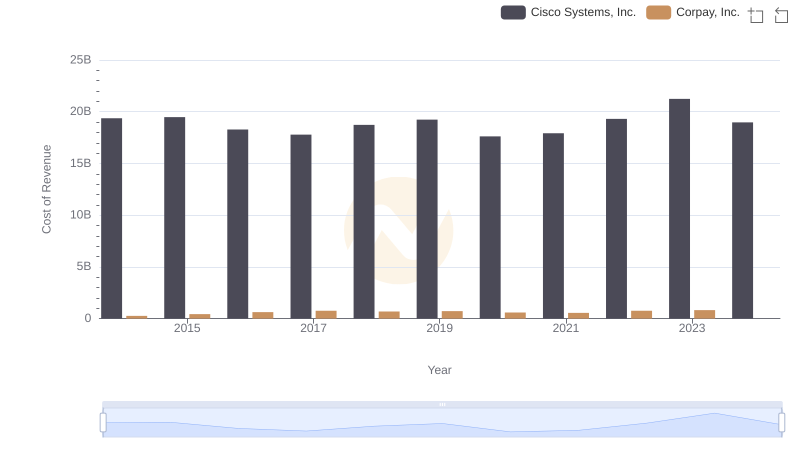

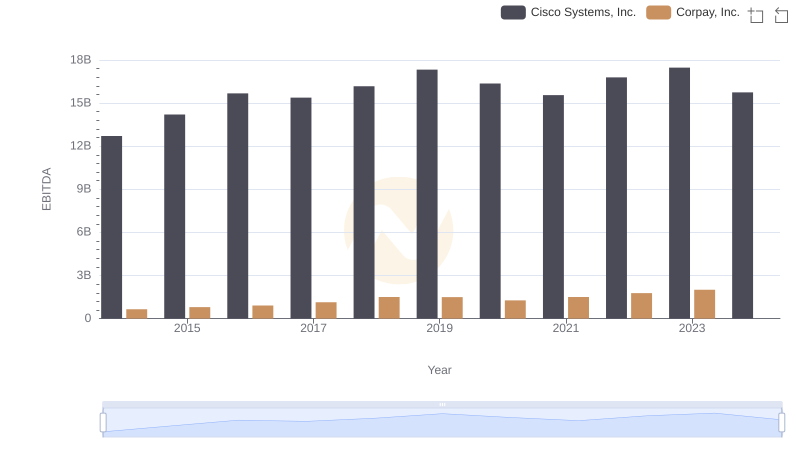

| __timestamp | Cisco Systems, Inc. | Corpay, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 27769000000 | 929799000 |

| Thursday, January 1, 2015 | 29681000000 | 1263535000 |

| Friday, January 1, 2016 | 30960000000 | 1209581000 |

| Sunday, January 1, 2017 | 30224000000 | 1493201000 |

| Monday, January 1, 2018 | 30606000000 | 1740908000 |

| Tuesday, January 1, 2019 | 32666000000 | 1922804000 |

| Wednesday, January 1, 2020 | 31683000000 | 1792492000 |

| Friday, January 1, 2021 | 31894000000 | 2273917000 |

| Saturday, January 1, 2022 | 32248000000 | 2662422000 |

| Sunday, January 1, 2023 | 35753000000 | 2937811000 |

| Monday, January 1, 2024 | 34828000000 | 3974589000 |

In pursuit of knowledge

In the ever-evolving landscape of technology and finance, Cisco Systems, Inc. and Corpay, Inc. have carved distinct paths. Over the past decade, Cisco has consistently demonstrated robust growth, with its gross profit surging by approximately 29% from 2014 to 2023. This tech behemoth, renowned for its networking solutions, reached a peak gross profit of $35.75 billion in 2023, showcasing its resilience and adaptability in a competitive market.

Conversely, Corpay, a leader in business payments, has shown a steady upward trajectory, with its gross profit increasing by over 200% from 2014 to 2022. Despite missing data for 2024, Corpay's growth narrative remains compelling, reflecting its strategic expansion and innovation in financial services.

This comparison not only highlights the contrasting growth patterns of these industry leaders but also underscores the dynamic nature of their respective sectors.

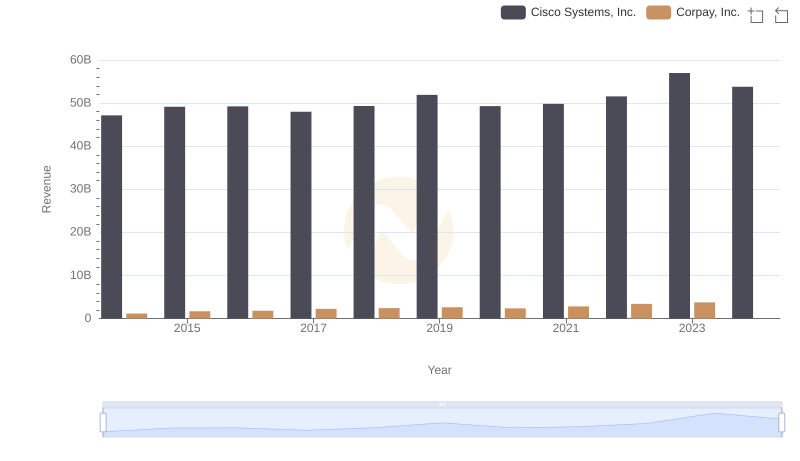

Revenue Showdown: Cisco Systems, Inc. vs Corpay, Inc.

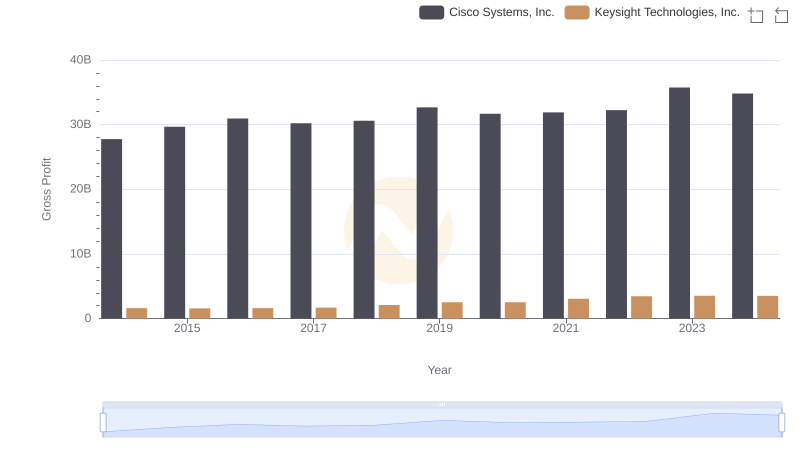

Gross Profit Analysis: Comparing Cisco Systems, Inc. and Keysight Technologies, Inc.

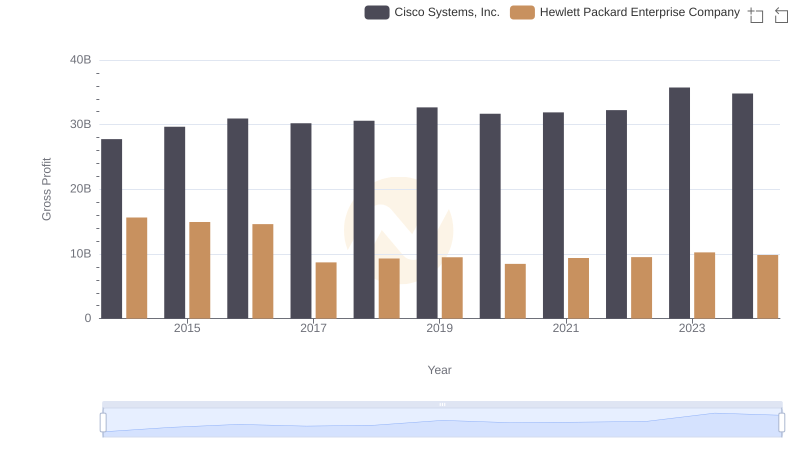

Key Insights on Gross Profit: Cisco Systems, Inc. vs Hewlett Packard Enterprise Company

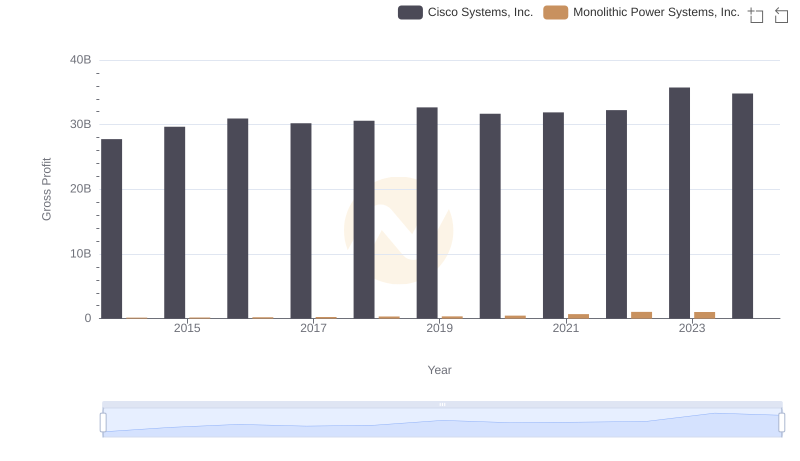

Key Insights on Gross Profit: Cisco Systems, Inc. vs Monolithic Power Systems, Inc.

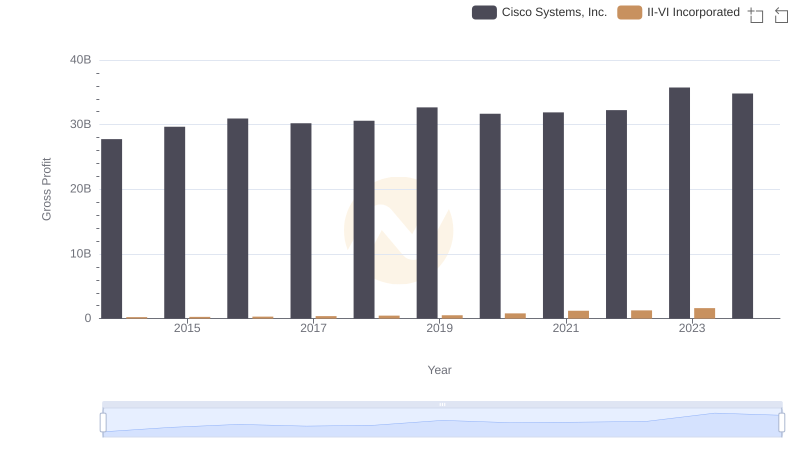

Gross Profit Analysis: Comparing Cisco Systems, Inc. and II-VI Incorporated

Cost of Revenue Comparison: Cisco Systems, Inc. vs Corpay, Inc.

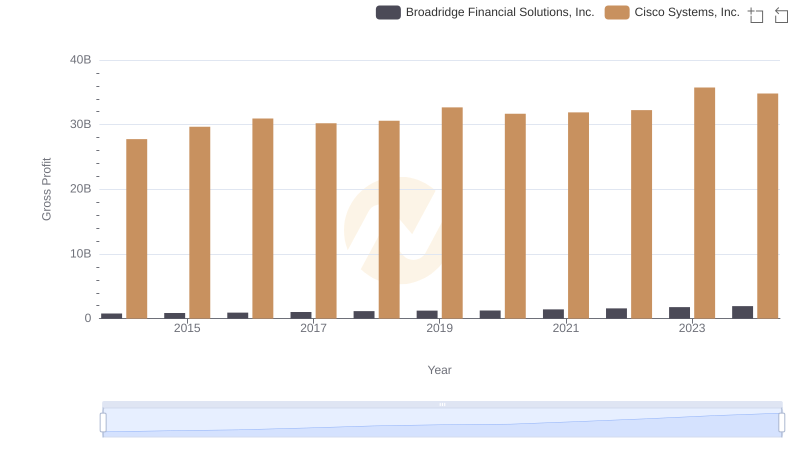

Gross Profit Comparison: Cisco Systems, Inc. and Broadridge Financial Solutions, Inc. Trends

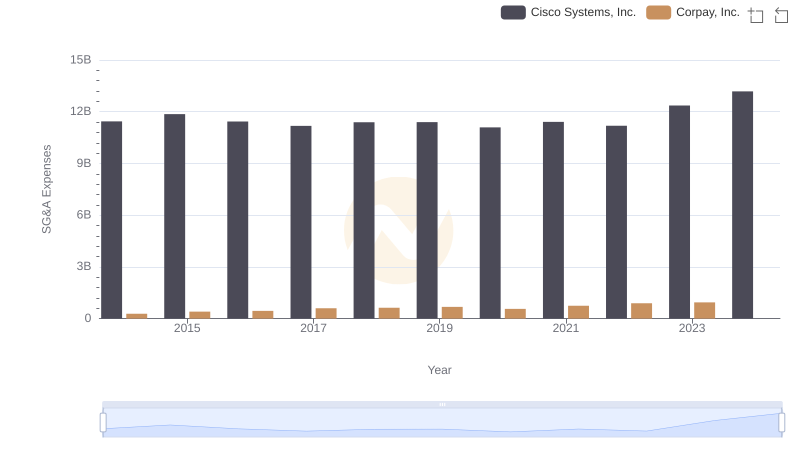

Cisco Systems, Inc. and Corpay, Inc.: SG&A Spending Patterns Compared

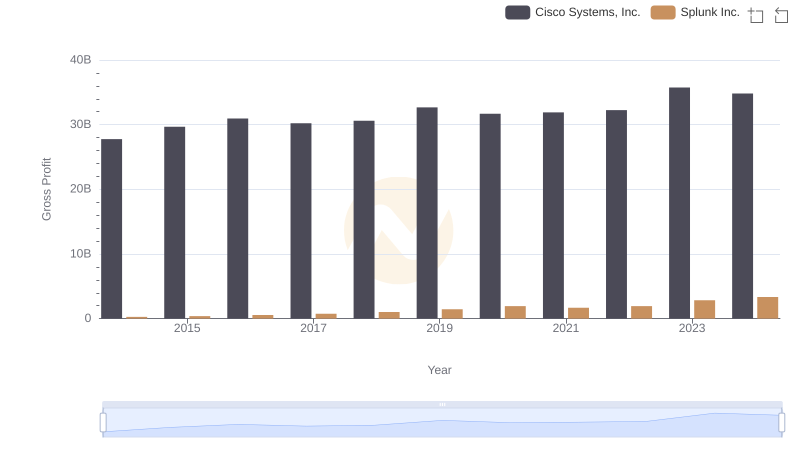

Gross Profit Comparison: Cisco Systems, Inc. and Splunk Inc. Trends

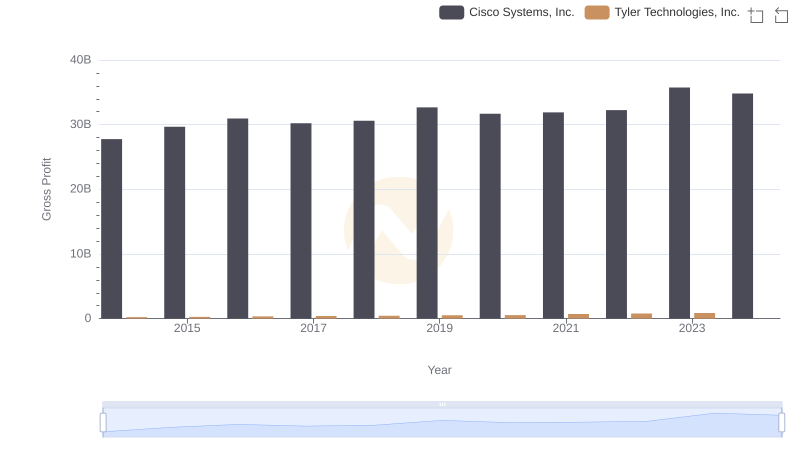

Gross Profit Analysis: Comparing Cisco Systems, Inc. and Tyler Technologies, Inc.

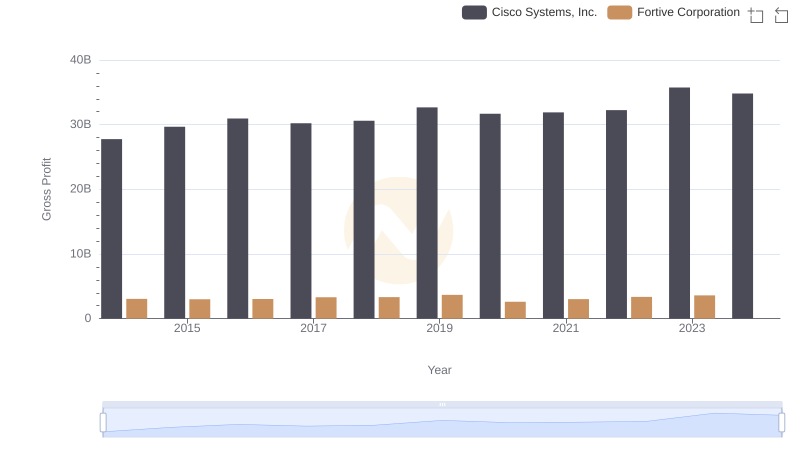

Key Insights on Gross Profit: Cisco Systems, Inc. vs Fortive Corporation

EBITDA Metrics Evaluated: Cisco Systems, Inc. vs Corpay, Inc.