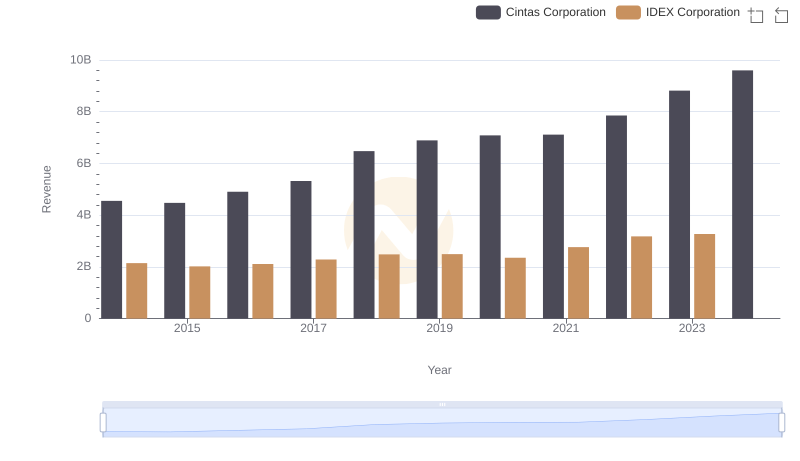

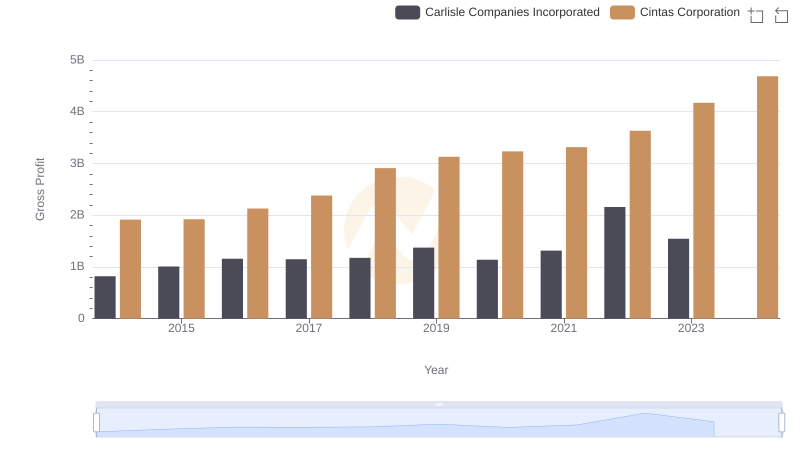

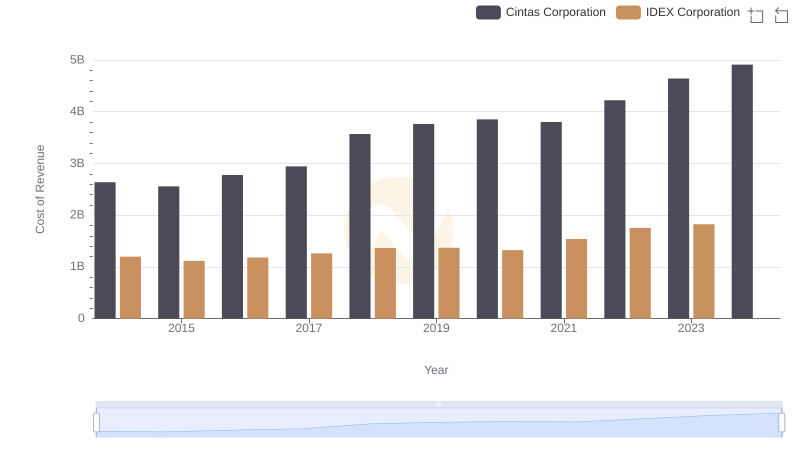

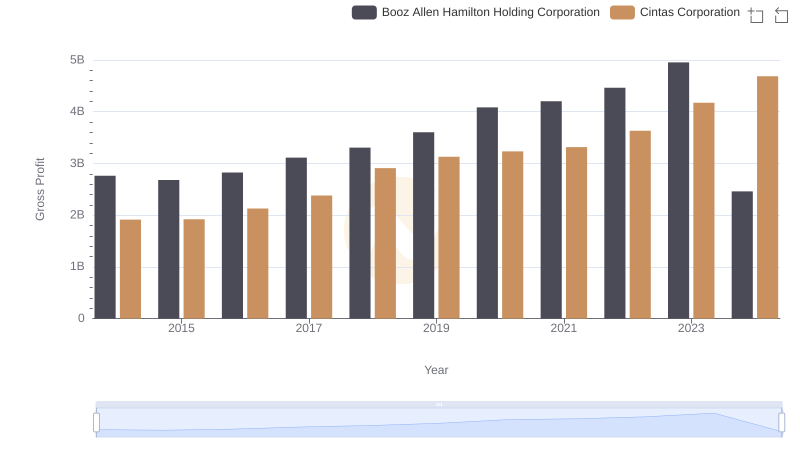

| __timestamp | Cintas Corporation | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 949315000 |

| Thursday, January 1, 2015 | 1921337000 | 904315000 |

| Friday, January 1, 2016 | 2129870000 | 930767000 |

| Sunday, January 1, 2017 | 2380295000 | 1026678000 |

| Monday, January 1, 2018 | 2908523000 | 1117895000 |

| Tuesday, January 1, 2019 | 3128588000 | 1125034000 |

| Wednesday, January 1, 2020 | 3233748000 | 1027424000 |

| Friday, January 1, 2021 | 3314651000 | 1224500000 |

| Saturday, January 1, 2022 | 3632246000 | 1426900000 |

| Sunday, January 1, 2023 | 4173368000 | 1448500000 |

| Monday, January 1, 2024 | 4686416000 | 1454800000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, Cintas Corporation and IDEX Corporation have showcased intriguing trends in their gross profit margins over the past decade. From 2014 to 2023, Cintas Corporation has seen a remarkable growth of over 145% in its gross profit, starting from approximately $1.9 billion in 2014 to an impressive $4.2 billion in 2023. This growth trajectory highlights Cintas's robust business strategies and market adaptability.

Conversely, IDEX Corporation, while maintaining steady growth, has experienced a more modest increase of around 53% in the same period, with gross profits rising from about $949 million to $1.45 billion. The data for 2024 is incomplete, but the trends suggest a continued upward trajectory for both companies. This comparison not only underscores the dynamic nature of these corporations but also offers valuable insights into their financial health and strategic direction.

Comparing Revenue Performance: Cintas Corporation or IDEX Corporation?

Gross Profit Comparison: Cintas Corporation and Carlisle Companies Incorporated Trends

Cintas Corporation vs IDEX Corporation: Efficiency in Cost of Revenue Explored

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Gross Profit Analysis

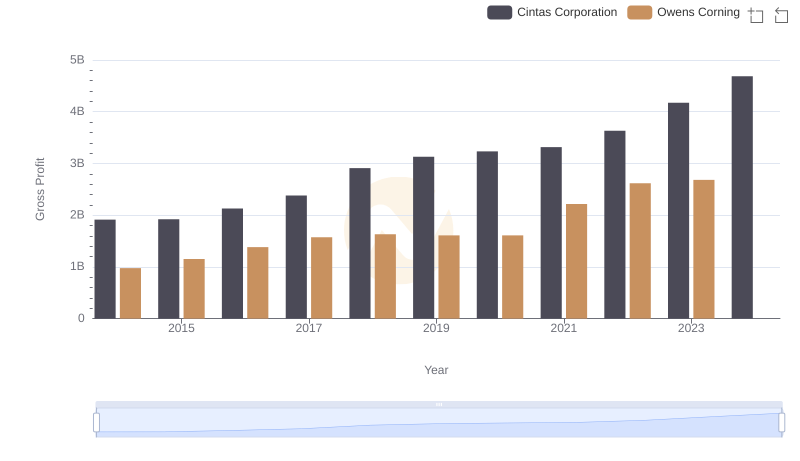

Who Generates Higher Gross Profit? Cintas Corporation or Owens Corning

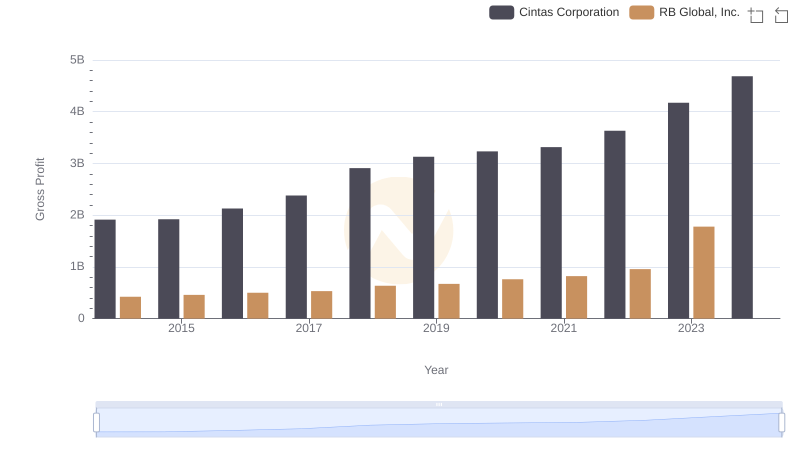

Key Insights on Gross Profit: Cintas Corporation vs RB Global, Inc.

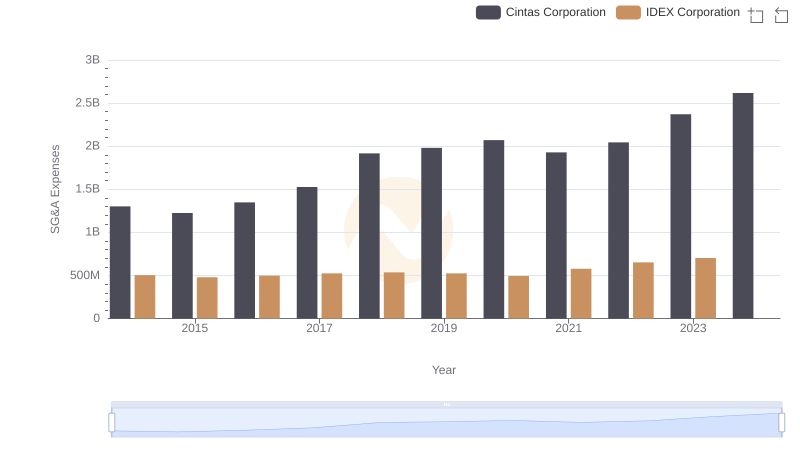

Operational Costs Compared: SG&A Analysis of Cintas Corporation and IDEX Corporation

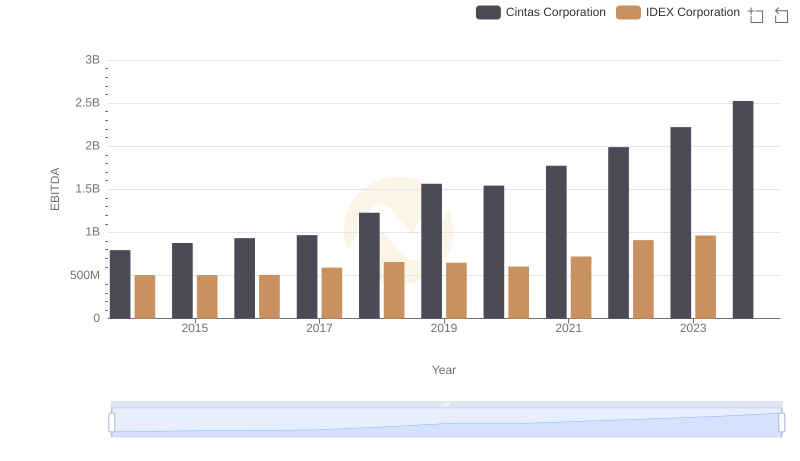

A Side-by-Side Analysis of EBITDA: Cintas Corporation and IDEX Corporation