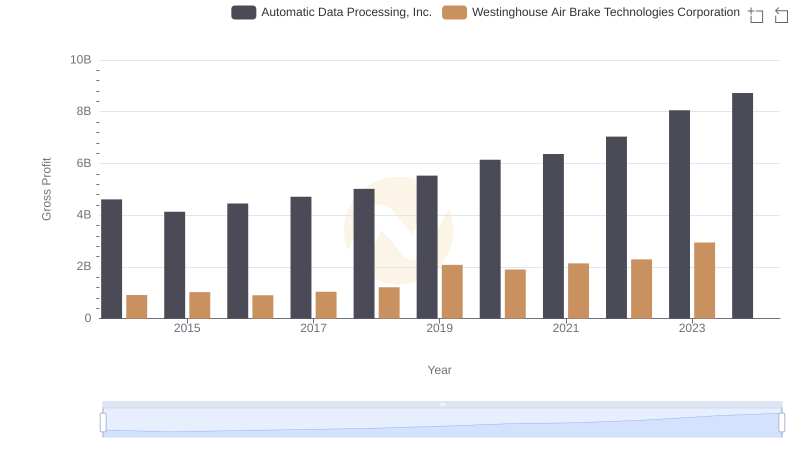

| __timestamp | Automatic Data Processing, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 3044454000 |

| Thursday, January 1, 2015 | 10560800000 | 3307998000 |

| Friday, January 1, 2016 | 11290500000 | 2931188000 |

| Sunday, January 1, 2017 | 11982400000 | 3881756000 |

| Monday, January 1, 2018 | 12859300000 | 4363547000 |

| Tuesday, January 1, 2019 | 13613300000 | 8200000000 |

| Wednesday, January 1, 2020 | 14589800000 | 7556100000 |

| Friday, January 1, 2021 | 15005400000 | 7822000000 |

| Saturday, January 1, 2022 | 16498300000 | 8362000000 |

| Sunday, January 1, 2023 | 18012200000 | 9677000000 |

| Monday, January 1, 2024 | 19202600000 | 10387000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding revenue trends is crucial for investors and analysts alike. This analysis delves into the revenue trajectories of two industry giants: Automatic Data Processing, Inc. (ADP) and Westinghouse Air Brake Technologies Corporation (WAB).

From 2014 to 2023, ADP has demonstrated a robust growth pattern, with its revenue increasing by approximately 62%, from $11.8 billion to $18 billion. This consistent upward trend highlights ADP's resilience and adaptability in a competitive market. In contrast, WAB's revenue journey has been more volatile, yet it still achieved a commendable growth of around 218% from 2014 to 2023, peaking at nearly $9.7 billion.

While ADP's growth reflects steady expansion, WAB's trajectory underscores its dynamic response to market demands. Notably, data for 2024 is incomplete, leaving room for speculation on future performance.

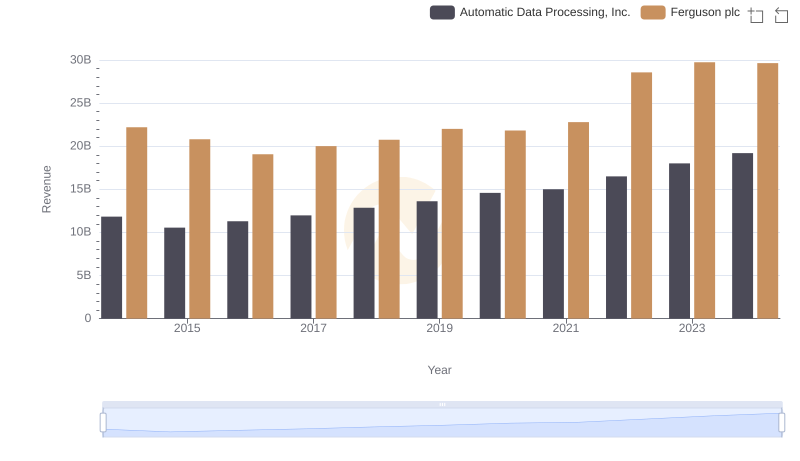

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Ferguson plc

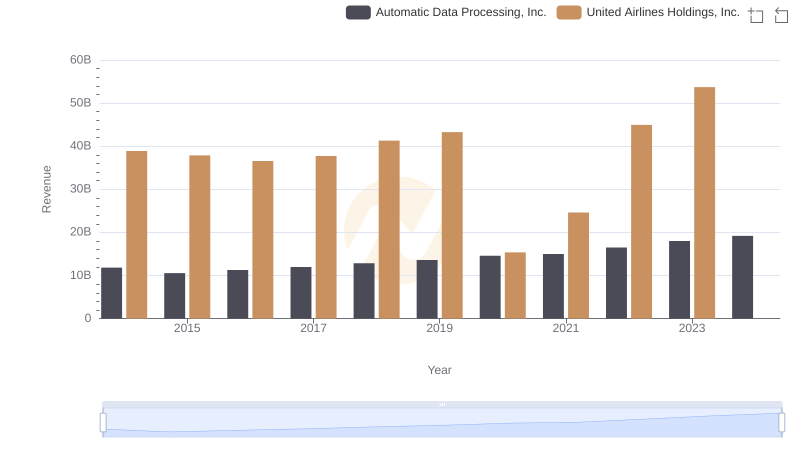

Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.: Examining Key Revenue Metrics

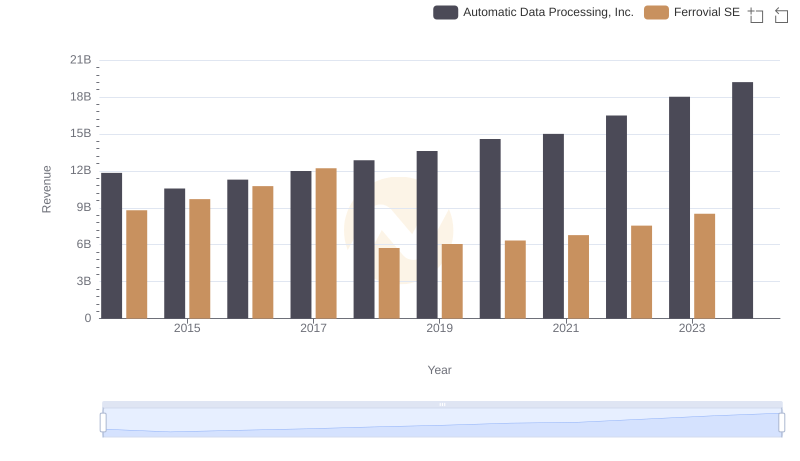

Revenue Insights: Automatic Data Processing, Inc. and Ferrovial SE Performance Compared

Gross Profit Comparison: Automatic Data Processing, Inc. and Westinghouse Air Brake Technologies Corporation Trends

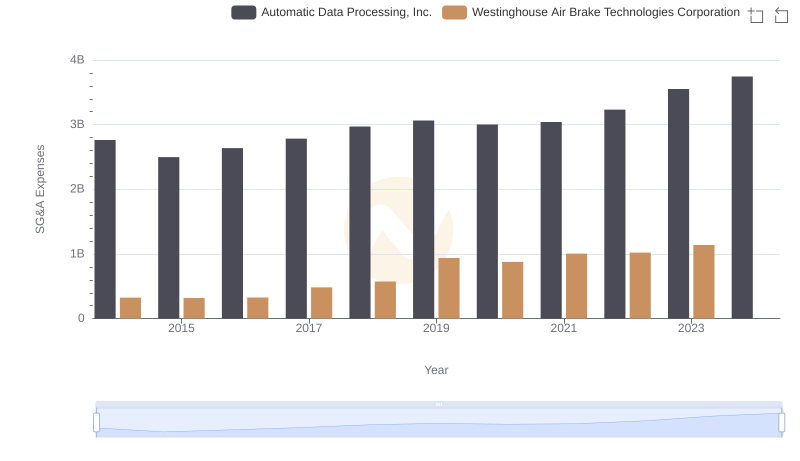

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

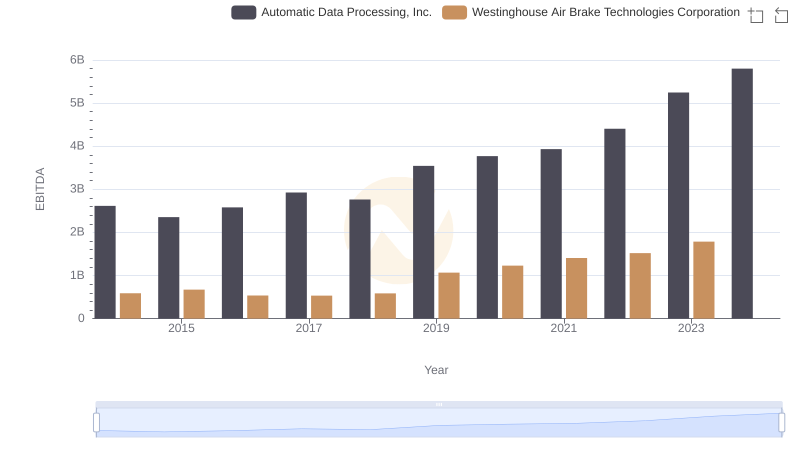

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation