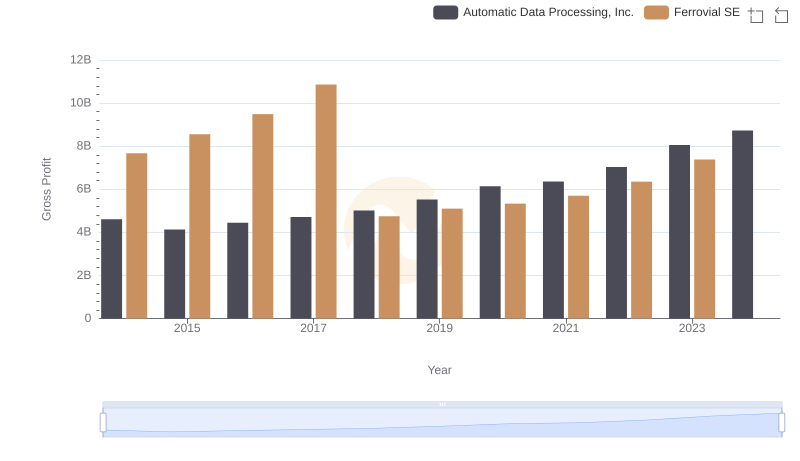

| __timestamp | Automatic Data Processing, Inc. | Ferrovial SE |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 8802000000 |

| Thursday, January 1, 2015 | 10560800000 | 9699000000 |

| Friday, January 1, 2016 | 11290500000 | 10758000000 |

| Sunday, January 1, 2017 | 11982400000 | 12209000000 |

| Monday, January 1, 2018 | 12859300000 | 5737000000 |

| Tuesday, January 1, 2019 | 13613300000 | 6054000000 |

| Wednesday, January 1, 2020 | 14589800000 | 6341000000 |

| Friday, January 1, 2021 | 15005400000 | 6778000000 |

| Saturday, January 1, 2022 | 16498300000 | 7551000000 |

| Sunday, January 1, 2023 | 18012200000 | 8514000000 |

| Monday, January 1, 2024 | 19202600000 |

Unleashing the power of data

In the ever-evolving landscape of global business, Automatic Data Processing, Inc. (ADP) and Ferrovial SE stand as titans in their respective industries. Over the past decade, ADP has demonstrated a robust revenue growth trajectory, with a remarkable 63% increase from 2014 to 2023. This growth underscores ADP's resilience and adaptability in the face of economic fluctuations.

Conversely, Ferrovial SE, a leader in infrastructure and mobility, experienced a more volatile revenue pattern. Despite a peak in 2017, Ferrovial's revenue saw a significant dip in 2018, followed by a gradual recovery. By 2023, Ferrovial's revenue had increased by approximately 3% from its 2014 figures.

The data highlights the contrasting growth strategies and market dynamics faced by these two companies. While ADP's consistent upward trend reflects its strong market position, Ferrovial's fluctuations suggest a more complex interplay of market forces.

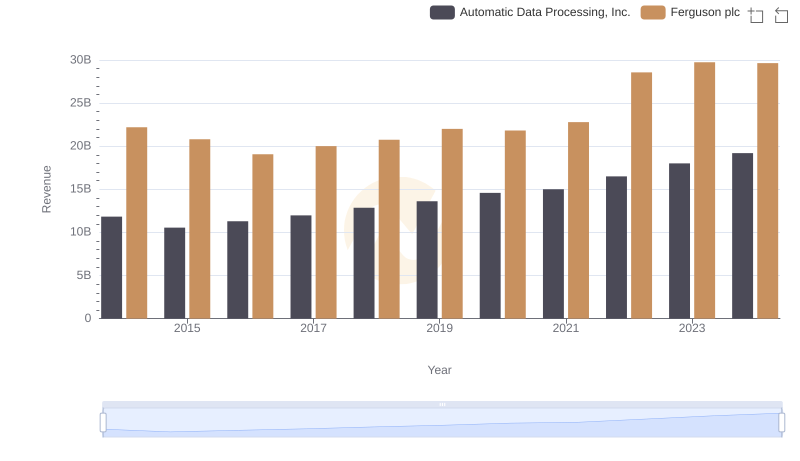

Annual Revenue Comparison: Automatic Data Processing, Inc. vs Ferguson plc

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Westinghouse Air Brake Technologies Corporation

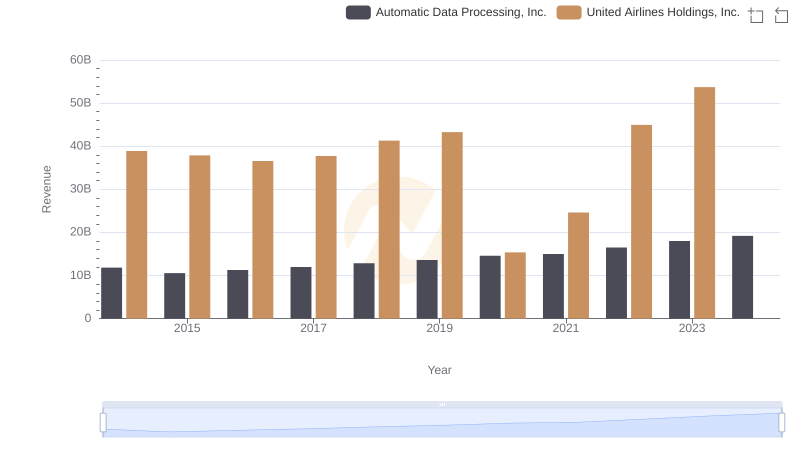

Automatic Data Processing, Inc. vs United Airlines Holdings, Inc.: Examining Key Revenue Metrics

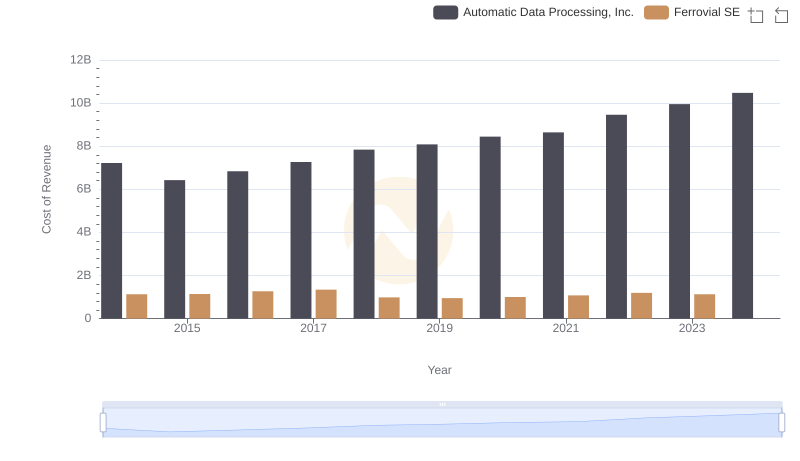

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Ferrovial SE

Gross Profit Comparison: Automatic Data Processing, Inc. and Ferrovial SE Trends