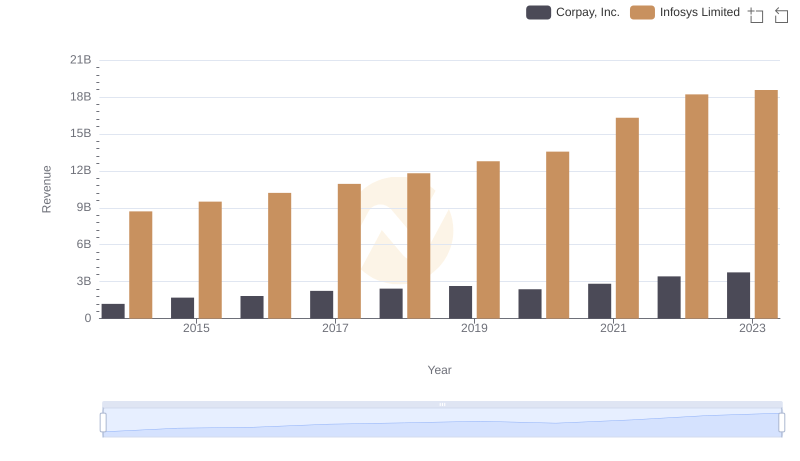

| __timestamp | Corpay, Inc. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 929799000 | 3337000000 |

| Thursday, January 1, 2015 | 1263535000 | 3551000000 |

| Friday, January 1, 2016 | 1209581000 | 3762000000 |

| Sunday, January 1, 2017 | 1493201000 | 3938000000 |

| Monday, January 1, 2018 | 1740908000 | 4112000000 |

| Tuesday, January 1, 2019 | 1922804000 | 4228000000 |

| Wednesday, January 1, 2020 | 1792492000 | 4733000000 |

| Friday, January 1, 2021 | 2273917000 | 5315000000 |

| Saturday, January 1, 2022 | 2662422000 | 5503000000 |

| Sunday, January 1, 2023 | 2937811000 | 5466000000 |

| Monday, January 1, 2024 | 3974589000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding the financial health of companies is crucial. This analysis delves into the gross profit trends of two industry giants: Infosys Limited and Corpay, Inc., from 2014 to 2023.

Infosys Limited, a leader in IT services, has shown a consistent upward trajectory in gross profit over the past decade. Starting at approximately $3.3 billion in 2014, Infosys has seen a robust growth of around 64%, reaching over $5.5 billion by 2022. This growth underscores Infosys's strategic expansion and innovation in the tech sector.

Corpay, Inc., a key player in financial services, has experienced a remarkable surge in gross profit, growing by over 215% from 2014 to 2023. This rapid increase, from $930 million to nearly $2.94 billion, highlights Corpay's aggressive market strategies and expansion.

Both companies have demonstrated impressive growth, with Infosys maintaining steady progress and Corpay achieving rapid expansion. These trends reflect broader industry dynamics and strategic business decisions.

Revenue Showdown: Infosys Limited vs Corpay, Inc.

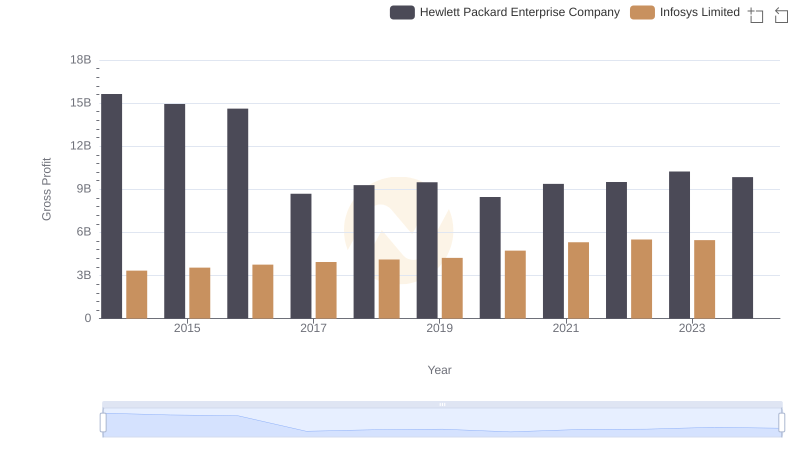

Gross Profit Trends Compared: Infosys Limited vs Hewlett Packard Enterprise Company

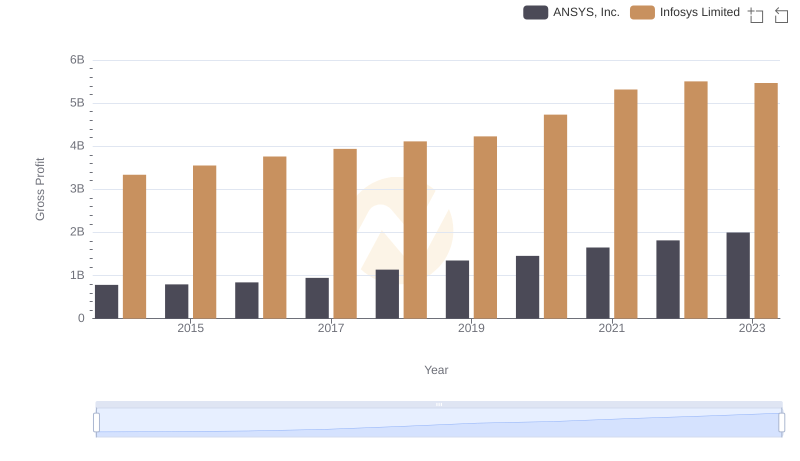

Key Insights on Gross Profit: Infosys Limited vs ANSYS, Inc.

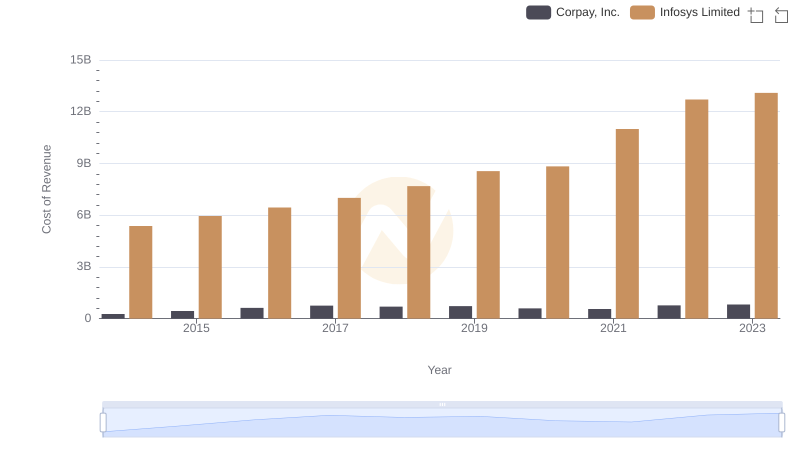

Analyzing Cost of Revenue: Infosys Limited and Corpay, Inc.

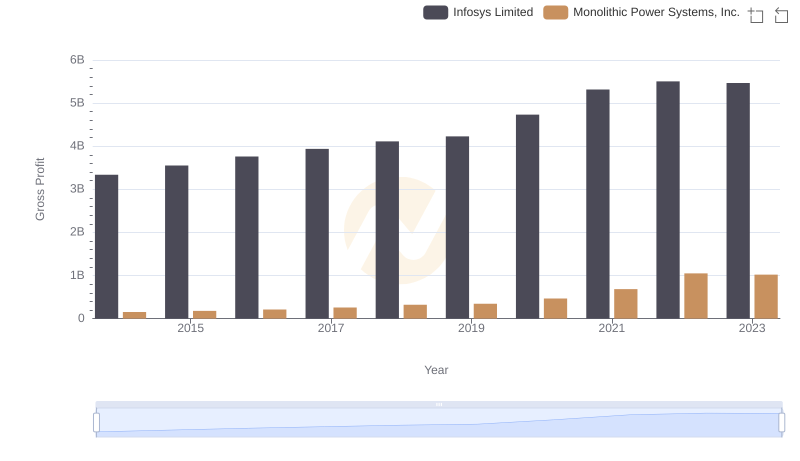

Infosys Limited and Monolithic Power Systems, Inc.: A Detailed Gross Profit Analysis

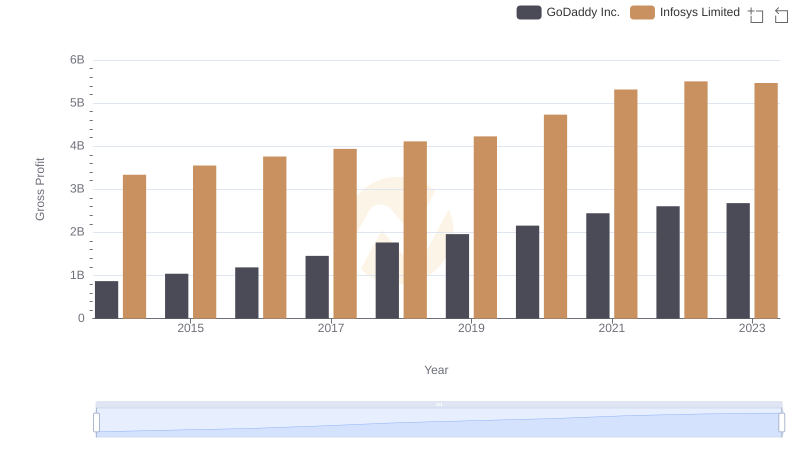

Gross Profit Trends Compared: Infosys Limited vs GoDaddy Inc.

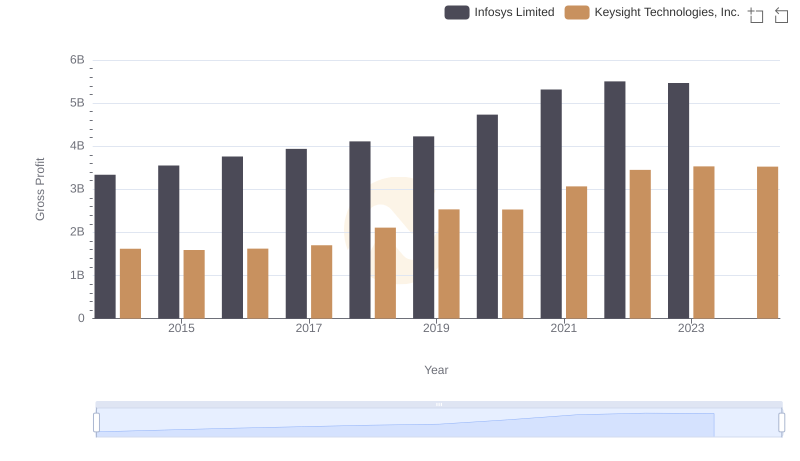

Gross Profit Comparison: Infosys Limited and Keysight Technologies, Inc. Trends

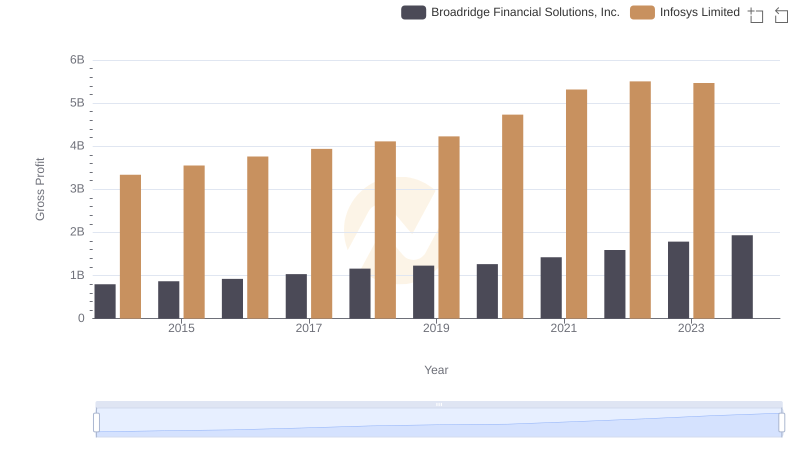

Gross Profit Comparison: Infosys Limited and Broadridge Financial Solutions, Inc. Trends

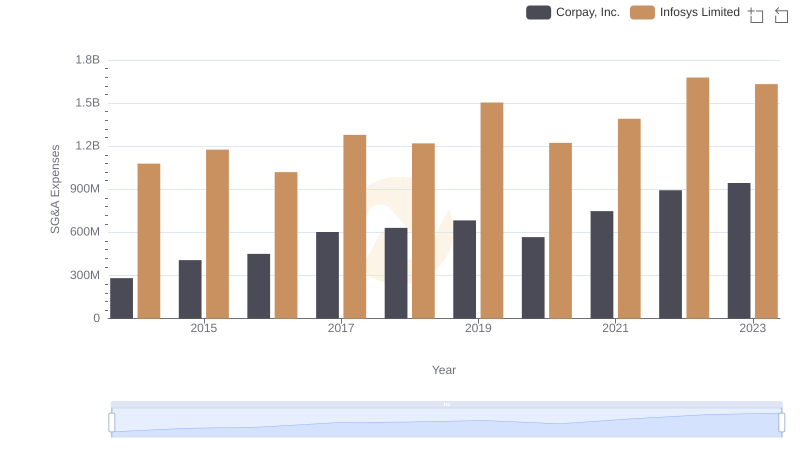

Comparing SG&A Expenses: Infosys Limited vs Corpay, Inc. Trends and Insights

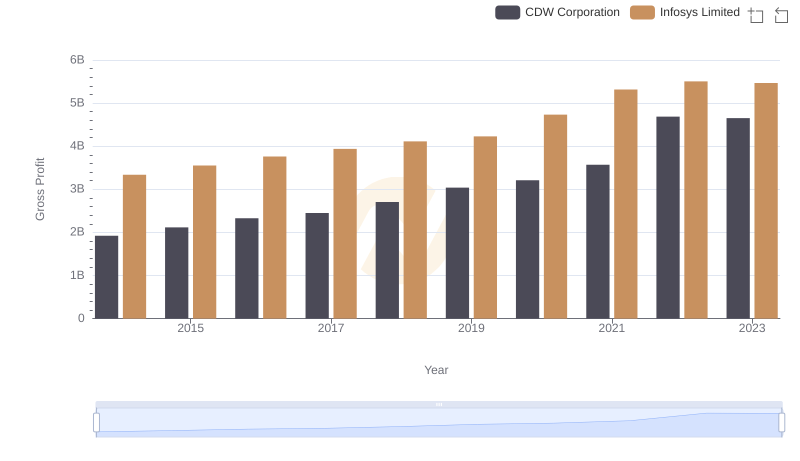

Who Generates Higher Gross Profit? Infosys Limited or CDW Corporation

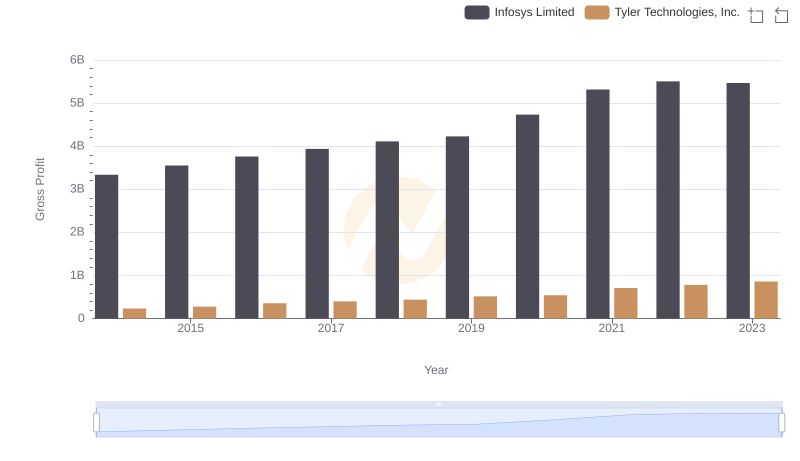

Gross Profit Trends Compared: Infosys Limited vs Tyler Technologies, Inc.

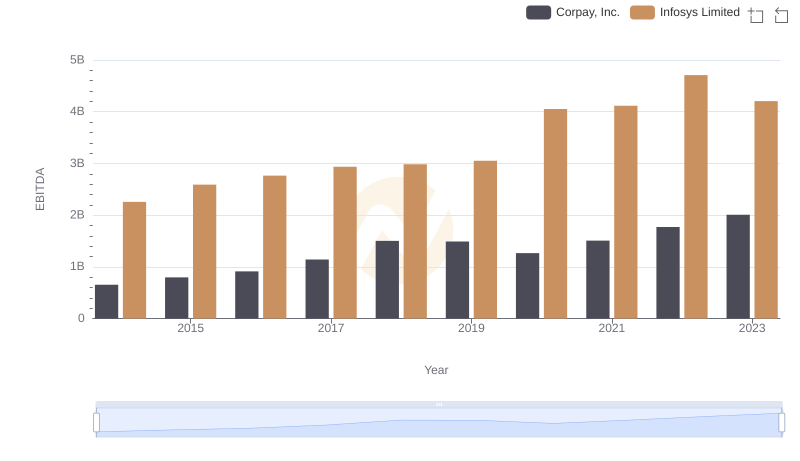

Infosys Limited and Corpay, Inc.: A Detailed Examination of EBITDA Performance