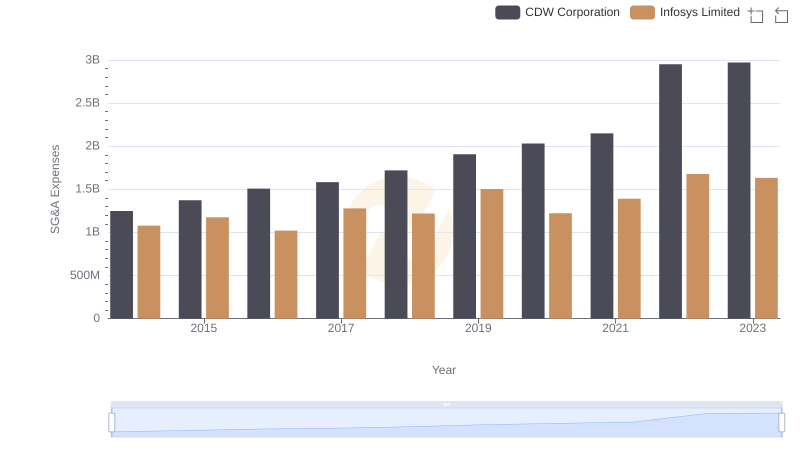

| __timestamp | CDW Corporation | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 1921300000 | 3337000000 |

| Thursday, January 1, 2015 | 2115800000 | 3551000000 |

| Friday, January 1, 2016 | 2327200000 | 3762000000 |

| Sunday, January 1, 2017 | 2449900000 | 3938000000 |

| Monday, January 1, 2018 | 2706900000 | 4112000000 |

| Tuesday, January 1, 2019 | 3039900000 | 4228000000 |

| Wednesday, January 1, 2020 | 3210100000 | 4733000000 |

| Friday, January 1, 2021 | 3568500000 | 5315000000 |

| Saturday, January 1, 2022 | 4686600000 | 5503000000 |

| Sunday, January 1, 2023 | 4652400001 | 5466000000 |

| Monday, January 1, 2024 | 4602400000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, companies continuously strive to optimize their financial performance. One critical metric that reflects a company's efficiency in managing its production costs relative to its revenue is gross profit. This article delves into the gross profit figures of two prominent players in their respective industries: Infosys Limited and CDW Corporation.

Infosys Limited, headquartered in Bengaluru, India, is a global leader in technology services and consulting. Founded in 1981, Infosys has grown to become a powerhouse in the IT sector, providing innovative solutions to clients worldwide. On the other hand, CDW Corporation, based in Lincolnshire, Illinois, specializes in IT products and services. Established in 1984, CDW has emerged as a significant player in the technology marketplace, catering to a diverse clientele, including government, education, and healthcare sectors.

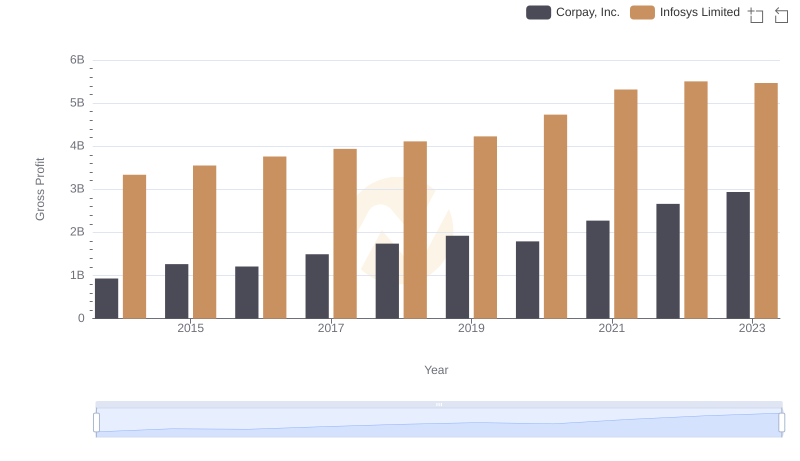

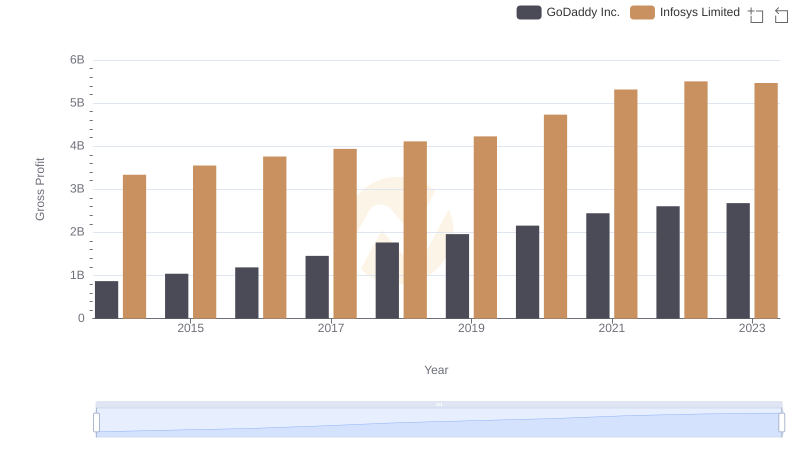

Analyzing the gross profit trends from 2014 to 2023 reveals intriguing insights into the financial health of both companies. Over this period, Infosys Limited consistently outperformed CDW Corporation in gross profit generation. For instance, in 2014, Infosys reported a gross profit of approximately $3.34 billion, while CDW's gross profit stood at around $1.92 billion. This trend of superior performance continued, with Infosys achieving a peak gross profit of approximately $5.5 billion in 2022, compared to CDW's high of about $4.69 billion in the same year.

The data indicates that Infosys Limited has maintained an impressive average annual growth rate of roughly 7% in gross profit over the last decade. In contrast, CDW Corporation experienced a more modest growth rate of around 5% during the same timeframe. This disparity highlights Infosys's robust business model and its ability to adapt to the rapidly changing technological landscape.

In 2021, both companies showcased remarkable growth, with Infosys reaching a gross profit of $5.3 billion, while CDW reported $3.57 billion. This represents a striking 48% difference in favor of Infosys. The gap narrowed slightly in 2023, with Infosys at $5.47 billion and CDW at $4.65 billion, yet the trend remains consistent, with Infosys leading by approximately 18%.

The comparative analysis of gross profit between Infosys Limited and CDW Corporation underscores the former's dominance in the technology sector. With a higher average gross profit and a stronger growth trajectory, Infosys stands out as a leader in financial performance. As businesses worldwide continue to navigate the complexities of the digital age, understanding these financial metrics becomes crucial for investors and stakeholders alike. The data not only reflects the companies' operational efficiency but also provides valuable insights into their market positioning and strategic direction.

As we look to the future, it will be fascinating to observe how these two companies adapt to emerging challenges and opportunities in the technology landscape, and whether CDW can close the gap in gross profit generation in the coming years.

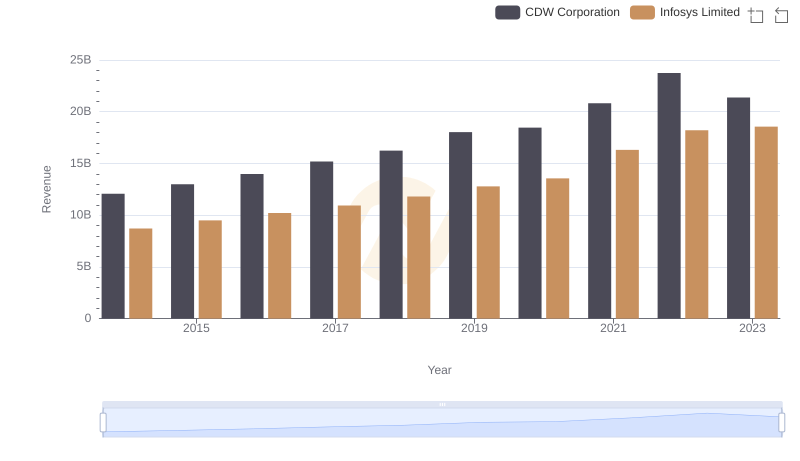

Revenue Insights: Infosys Limited and CDW Corporation Performance Compared

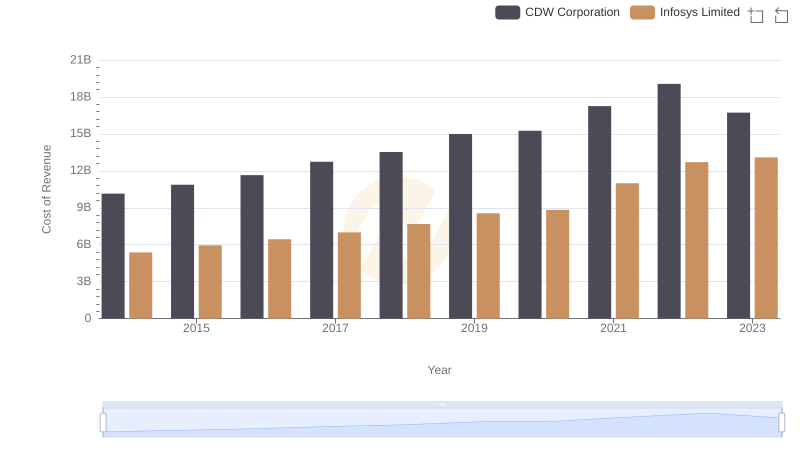

Cost of Revenue: Key Insights for Infosys Limited and CDW Corporation

Gross Profit Analysis: Comparing Infosys Limited and Corpay, Inc.

Gross Profit Trends Compared: Infosys Limited vs GoDaddy Inc.

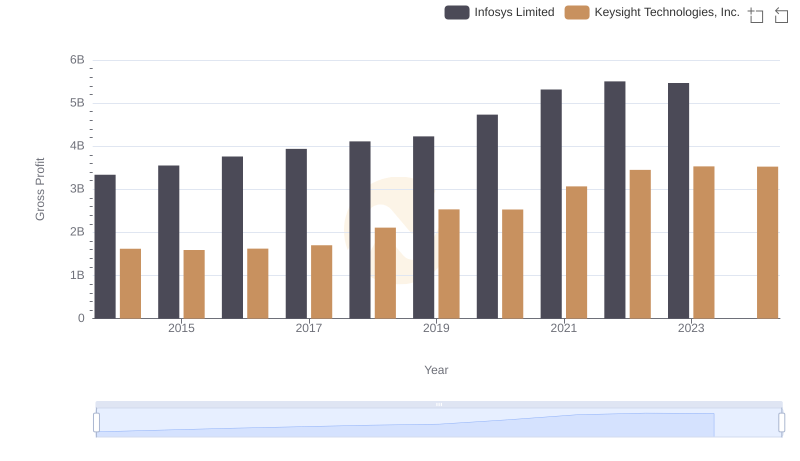

Gross Profit Comparison: Infosys Limited and Keysight Technologies, Inc. Trends

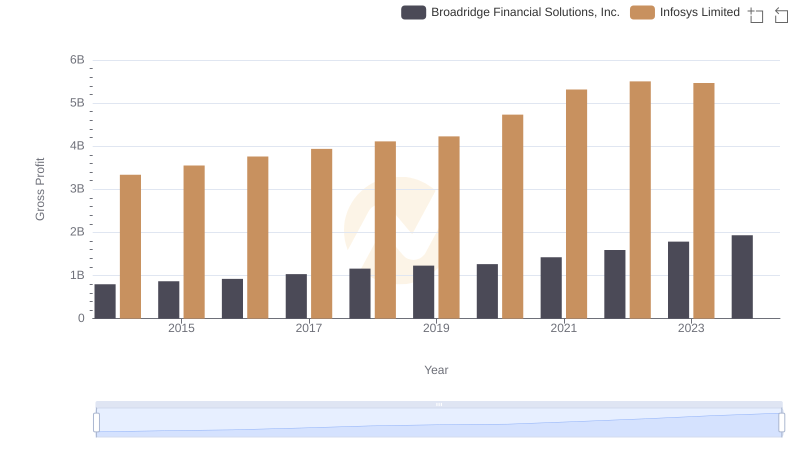

Gross Profit Comparison: Infosys Limited and Broadridge Financial Solutions, Inc. Trends

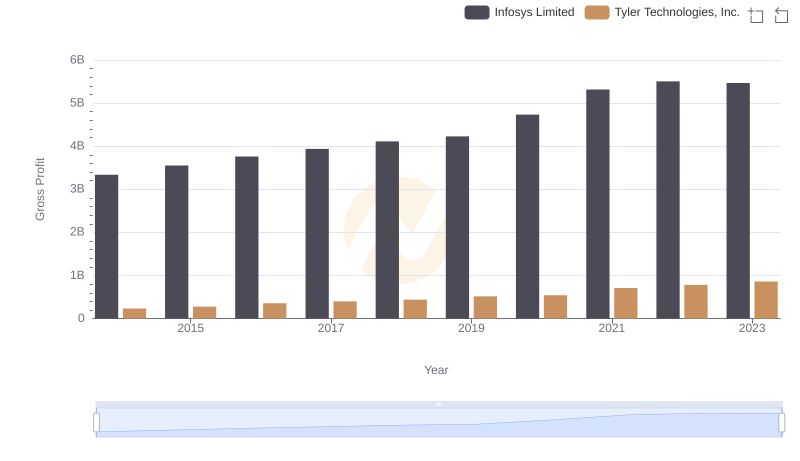

Gross Profit Trends Compared: Infosys Limited vs Tyler Technologies, Inc.

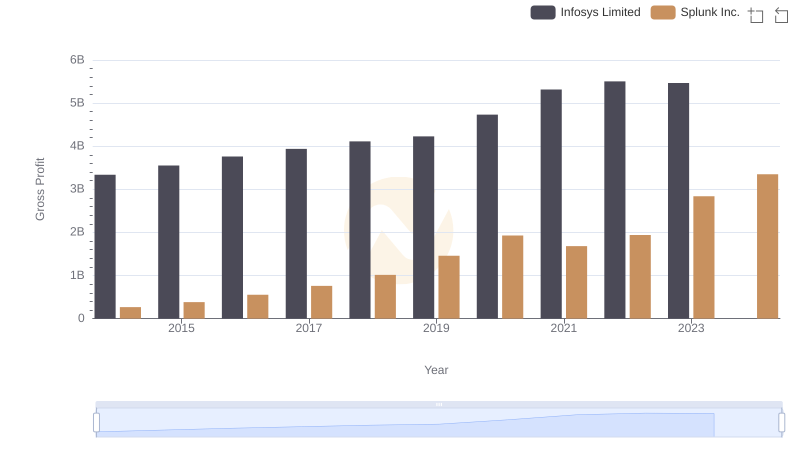

Infosys Limited and Splunk Inc.: A Detailed Gross Profit Analysis

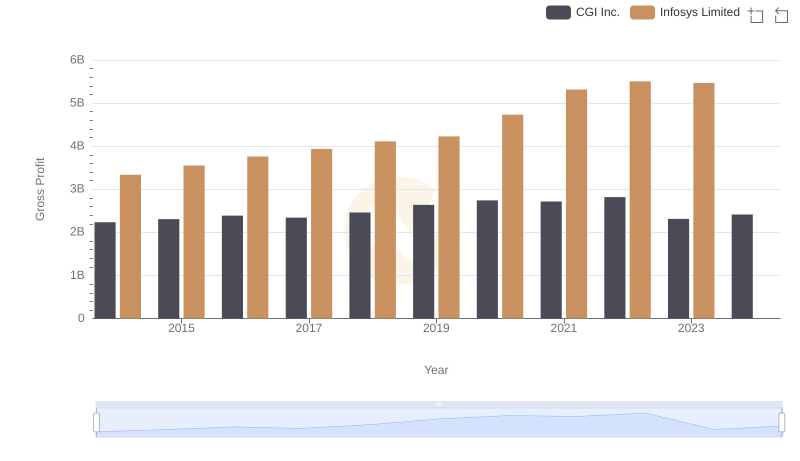

Gross Profit Comparison: Infosys Limited and CGI Inc. Trends

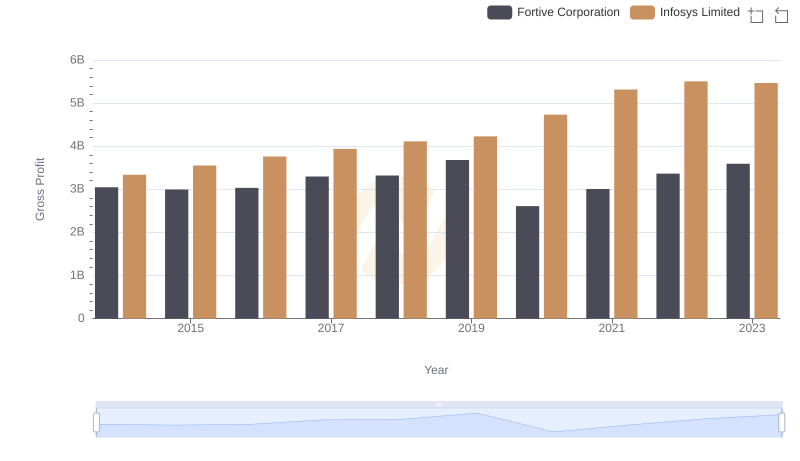

Infosys Limited and Fortive Corporation: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Infosys Limited and CDW Corporation

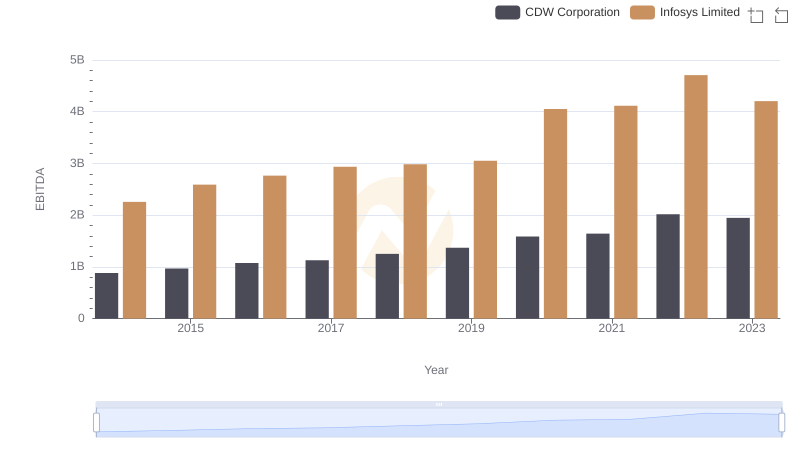

EBITDA Performance Review: Infosys Limited vs CDW Corporation