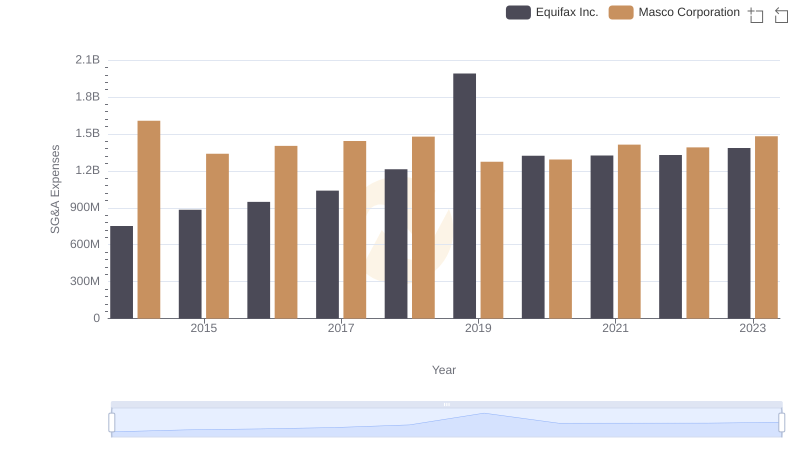

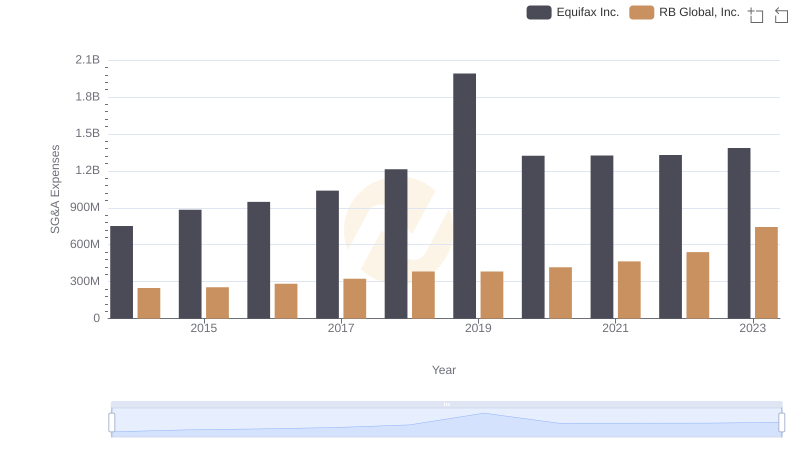

| __timestamp | Equifax Inc. | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 152469000 |

| Thursday, January 1, 2015 | 884300000 | 166799000 |

| Friday, January 1, 2016 | 948200000 | 185436000 |

| Sunday, January 1, 2017 | 1039100000 | 273440000 |

| Monday, January 1, 2018 | 1213300000 | 323587000 |

| Tuesday, January 1, 2019 | 1990200000 | 383981000 |

| Wednesday, January 1, 2020 | 1322500000 | 348076000 |

| Friday, January 1, 2021 | 1324600000 | 395533000 |

| Saturday, January 1, 2022 | 1328900000 | 570191000 |

| Sunday, January 1, 2023 | 1385700000 | 590242000 |

| Monday, January 1, 2024 | 1450500000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Equifax Inc. and J.B. Hunt Transport Services, Inc. have demonstrated contrasting trends in their SG&A expenditures. From 2014 to 2023, Equifax's SG&A expenses surged by approximately 84%, peaking in 2019. This increase reflects strategic investments and operational expansions. In contrast, J.B. Hunt's SG&A expenses grew by nearly 287% during the same period, indicating a robust scaling of operations and possibly a response to increased market competition. Notably, 2022 and 2023 saw J.B. Hunt's expenses rise sharply, suggesting a strategic pivot or expansion. These insights underscore the dynamic nature of corporate financial strategies and highlight the importance of SG&A management in maintaining competitive advantage.

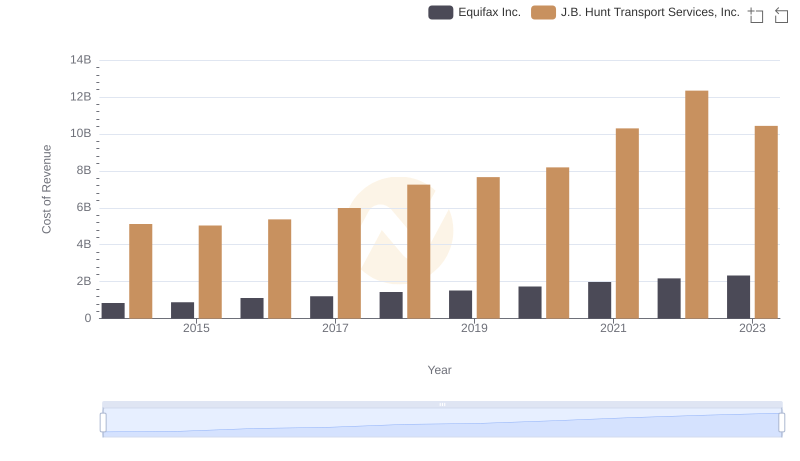

Cost of Revenue Trends: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

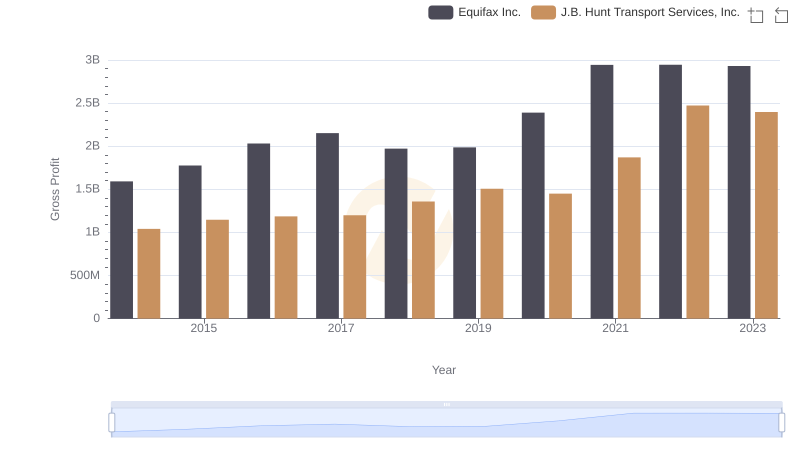

Gross Profit Analysis: Comparing Equifax Inc. and J.B. Hunt Transport Services, Inc.

Who Optimizes SG&A Costs Better? Equifax Inc. or Masco Corporation

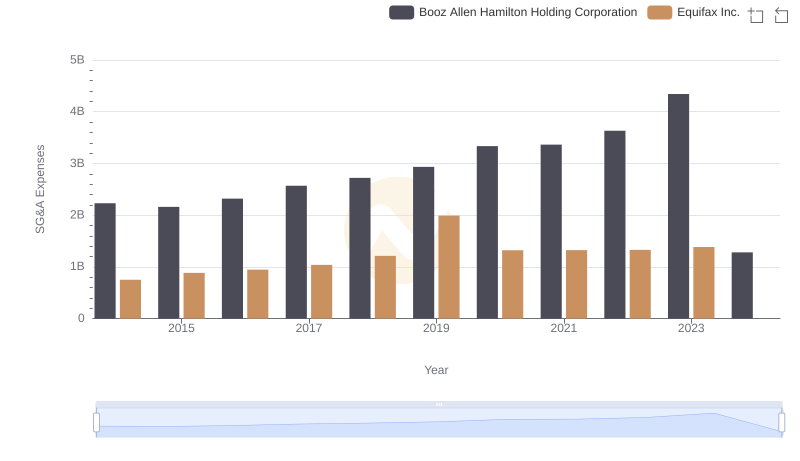

Equifax Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Equifax Inc. vs RB Global, Inc.