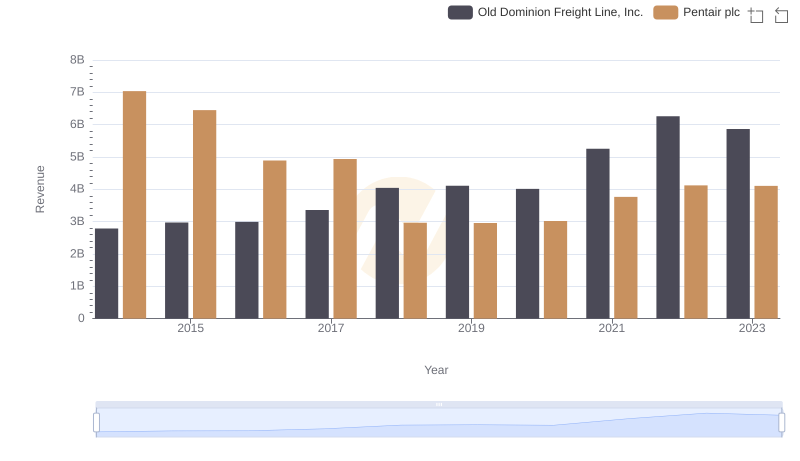

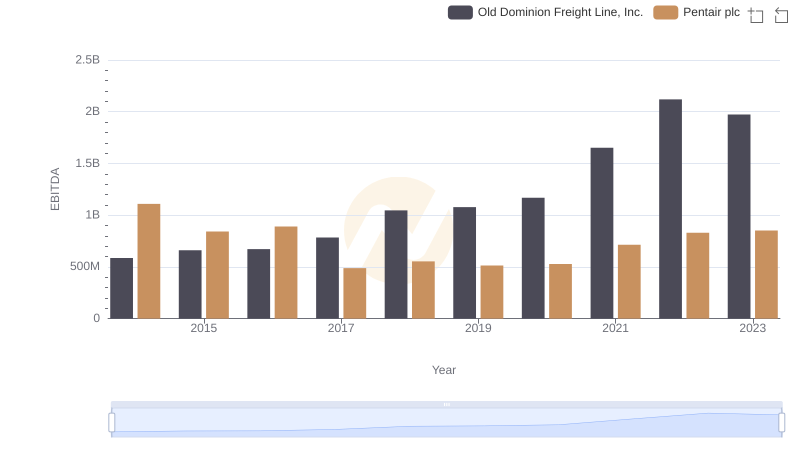

| __timestamp | Old Dominion Freight Line, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2100409000 | 4563000000 |

| Thursday, January 1, 2015 | 2214943000 | 4263200000 |

| Friday, January 1, 2016 | 2246890000 | 3095900000 |

| Sunday, January 1, 2017 | 2482732000 | 3107400000 |

| Monday, January 1, 2018 | 2899452000 | 1917400000 |

| Tuesday, January 1, 2019 | 2938895000 | 1905700000 |

| Wednesday, January 1, 2020 | 2786531000 | 1960200000 |

| Friday, January 1, 2021 | 3481268000 | 2445600000 |

| Saturday, January 1, 2022 | 4003951000 | 2757200000 |

| Sunday, January 1, 2023 | 3793953000 | 2585300000 |

| Monday, January 1, 2024 | 2484000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate efficiency, the cost of revenue is a critical metric. From 2014 to 2023, Old Dominion Freight Line, Inc. and Pentair plc have showcased contrasting trends in managing this crucial expense. Old Dominion Freight Line, Inc. has demonstrated a remarkable 80% increase in cost efficiency, peaking in 2022 with a 4 billion cost of revenue. This growth reflects their strategic prowess in optimizing operational costs. Conversely, Pentair plc has seen a 43% reduction in their cost of revenue, dropping from 4.6 billion in 2014 to 2.6 billion in 2023. This decline suggests a significant shift in their operational strategy, possibly focusing on leaner processes or divestitures. As these companies navigate the complexities of their respective industries, their cost management strategies offer valuable insights into achieving sustainable growth.

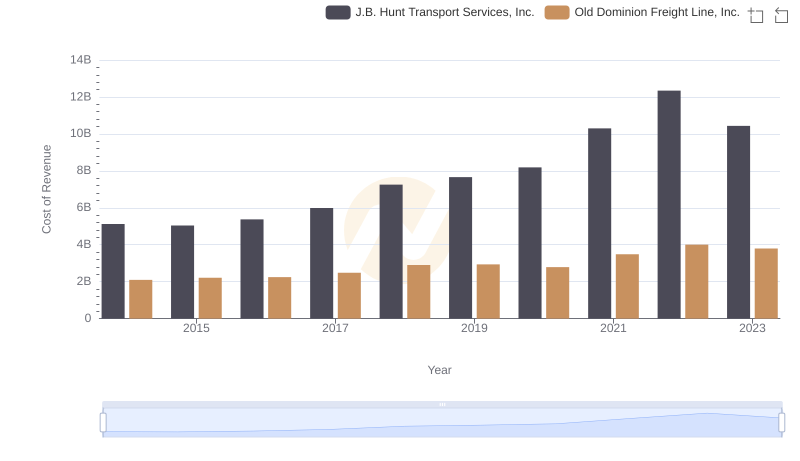

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and J.B. Hunt Transport Services, Inc.

Old Dominion Freight Line, Inc. or Pentair plc: Who Leads in Yearly Revenue?

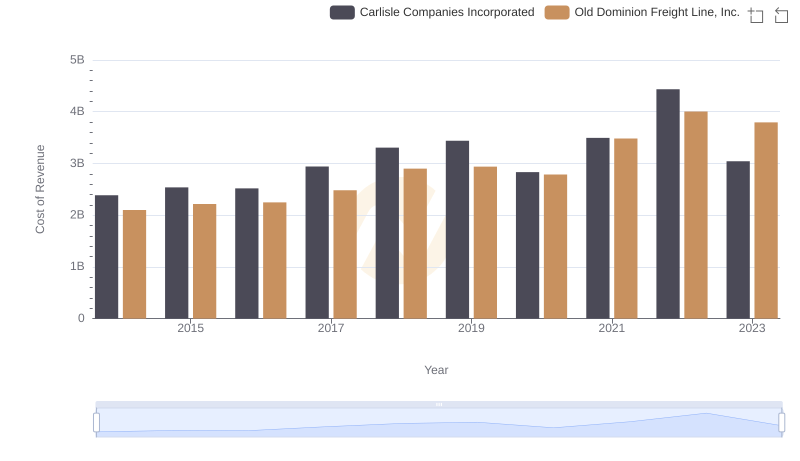

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated

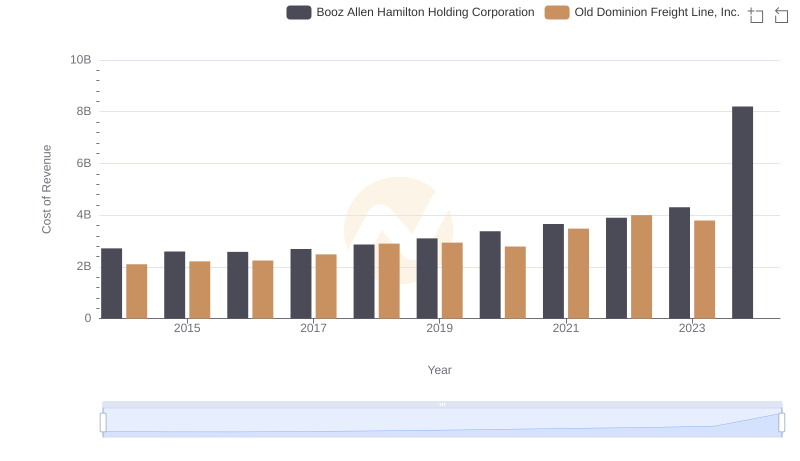

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and Booz Allen Hamilton Holding Corporation

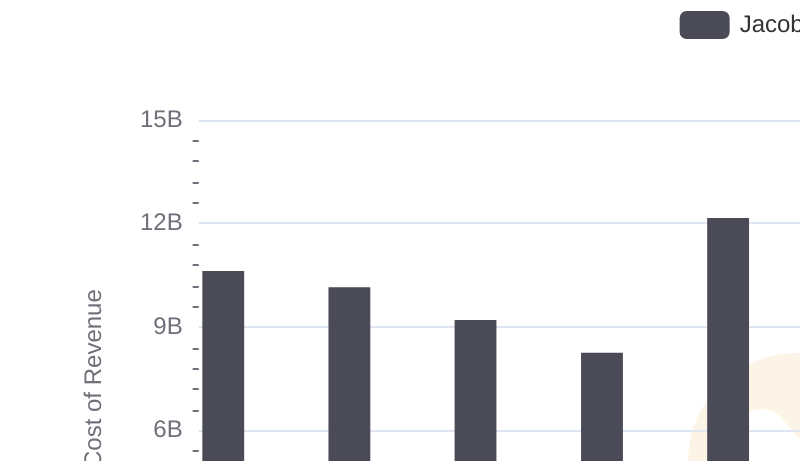

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Pentair plc