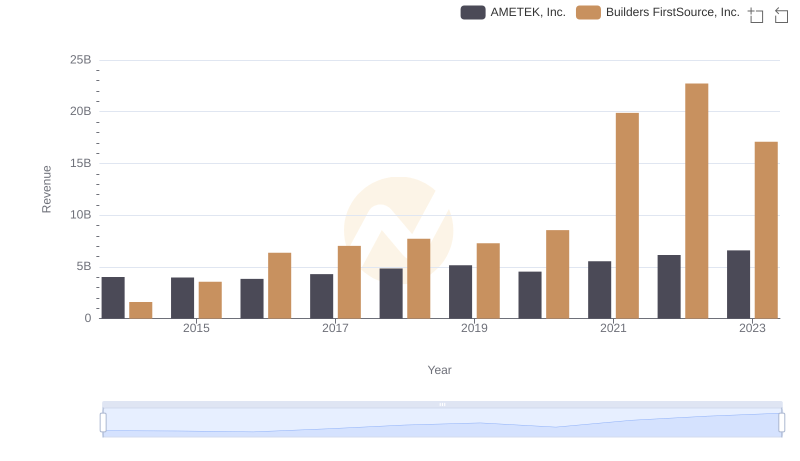

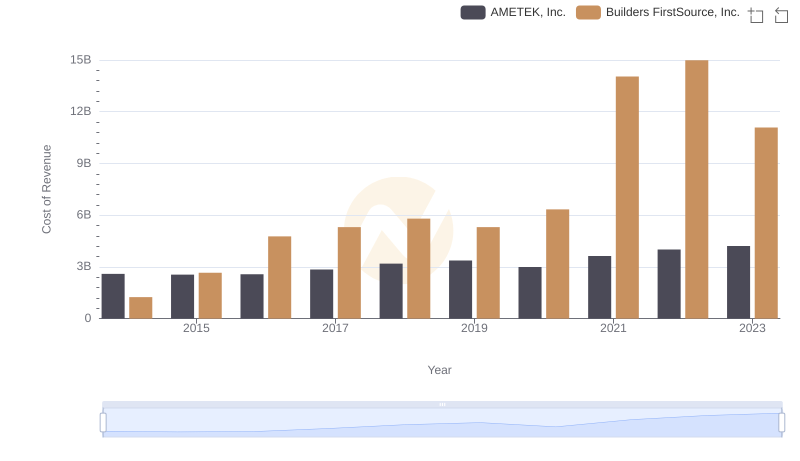

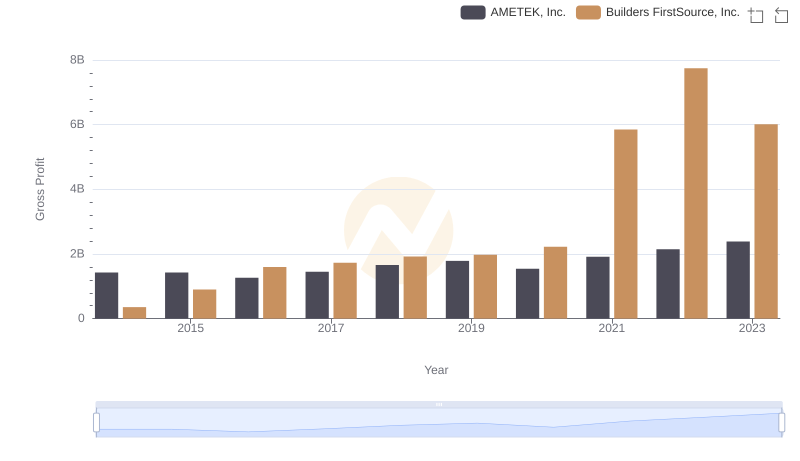

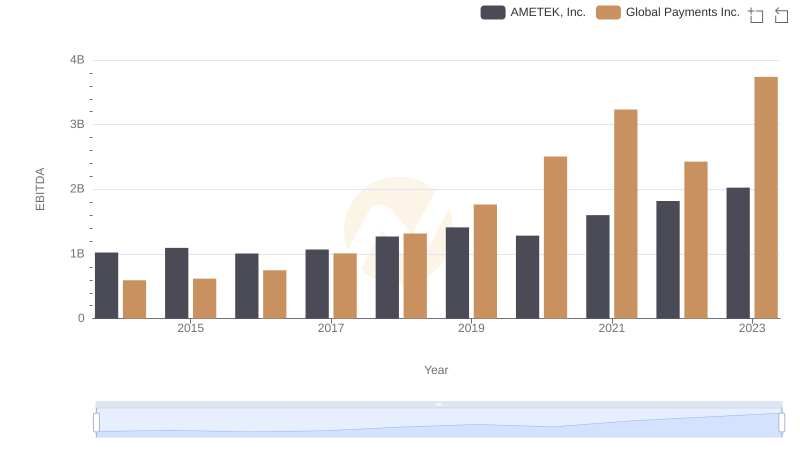

| __timestamp | AMETEK, Inc. | Builders FirstSource, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1023344000 | 60008000 |

| Thursday, January 1, 2015 | 1093776000 | 148897000 |

| Friday, January 1, 2016 | 1007213000 | 346129000 |

| Sunday, January 1, 2017 | 1068174000 | 378096000 |

| Monday, January 1, 2018 | 1269415000 | 466874000 |

| Tuesday, January 1, 2019 | 1411422000 | 492344000 |

| Wednesday, January 1, 2020 | 1283159000 | 660420000 |

| Friday, January 1, 2021 | 1600782000 | 2934776000 |

| Saturday, January 1, 2022 | 1820119000 | 4267346000 |

| Sunday, January 1, 2023 | 2025843000 | 2734594000 |

| Monday, January 1, 2024 | 1779562000 |

Unleashing insights

In the ever-evolving landscape of the American stock market, two companies have shown remarkable trajectories in their EBITDA performance over the past decade. AMETEK, Inc., a global leader in electronic instruments and electromechanical devices, has consistently demonstrated steady growth. From 2014 to 2023, AMETEK's EBITDA increased by nearly 98%, reflecting its robust business model and strategic acquisitions.

On the other hand, Builders FirstSource, Inc., a major supplier of building materials, has experienced a more volatile yet impressive growth. Its EBITDA skyrocketed by over 4,400% during the same period, peaking in 2022. This surge underscores the company's aggressive expansion and the booming construction industry.

While AMETEK's growth is characterized by stability, Builders FirstSource's journey is a testament to rapid expansion and market adaptation. Investors and analysts alike should keep a keen eye on these contrasting yet compelling narratives.

Breaking Down Revenue Trends: AMETEK, Inc. vs Builders FirstSource, Inc.

Cost of Revenue Comparison: AMETEK, Inc. vs Builders FirstSource, Inc.

Gross Profit Trends Compared: AMETEK, Inc. vs Builders FirstSource, Inc.

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Global Payments Inc.

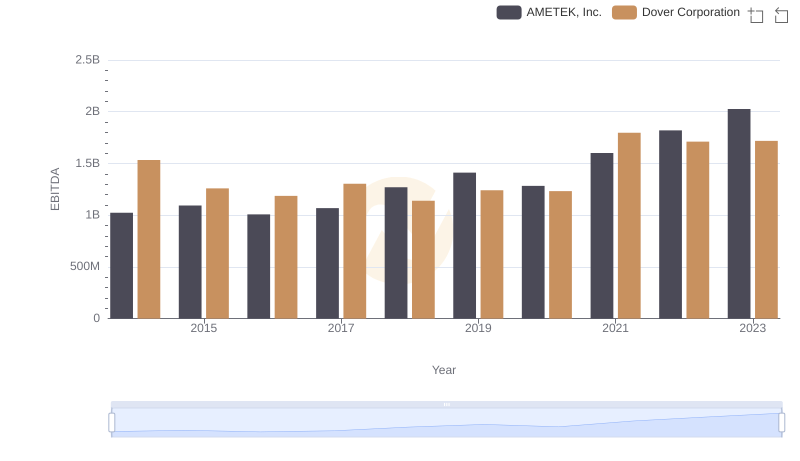

A Professional Review of EBITDA: AMETEK, Inc. Compared to Dover Corporation

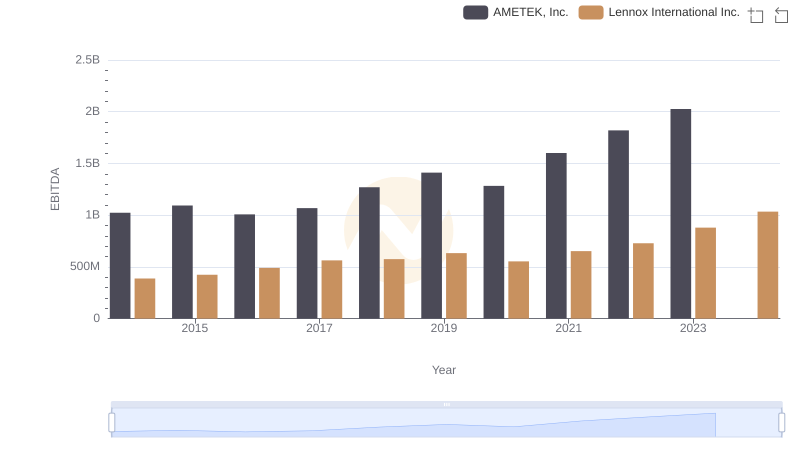

AMETEK, Inc. vs Lennox International Inc.: In-Depth EBITDA Performance Comparison

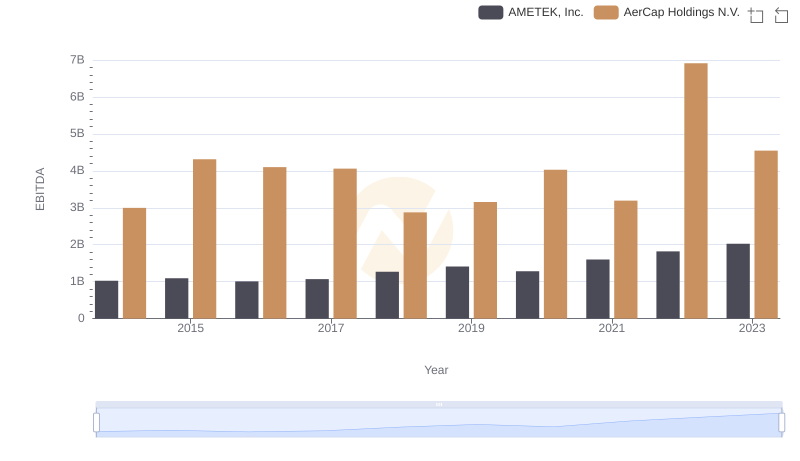

AMETEK, Inc. vs AerCap Holdings N.V.: In-Depth EBITDA Performance Comparison

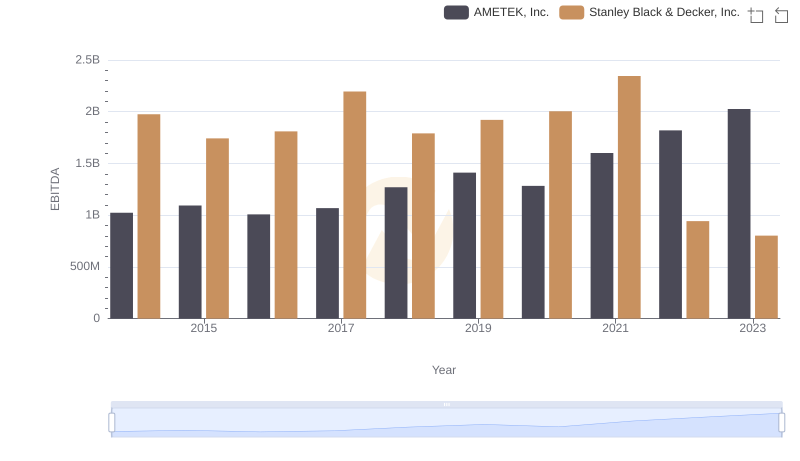

Comparative EBITDA Analysis: AMETEK, Inc. vs Stanley Black & Decker, Inc.