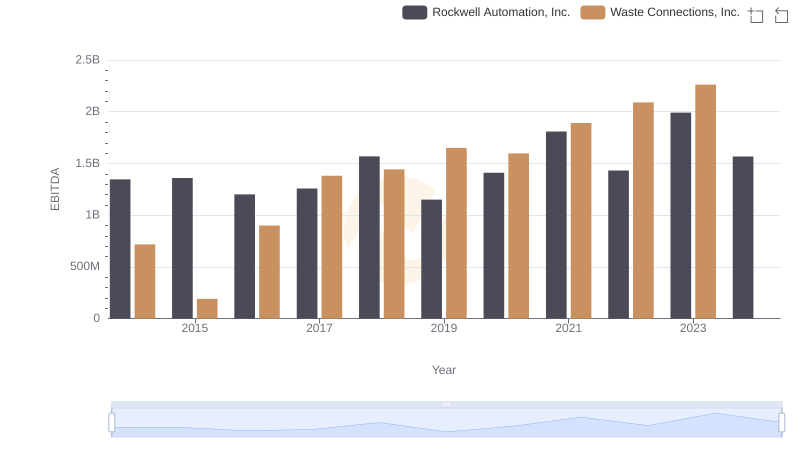

| __timestamp | Dover Corporation | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1533084000 | 717805000 |

| Thursday, January 1, 2015 | 1259375000 | 191002871 |

| Friday, January 1, 2016 | 1186472000 | 900371894 |

| Sunday, January 1, 2017 | 1304041000 | 1380632000 |

| Monday, January 1, 2018 | 1138930000 | 1442229014 |

| Tuesday, January 1, 2019 | 1241114000 | 1650754605 |

| Wednesday, January 1, 2020 | 1232722000 | 1597555000 |

| Friday, January 1, 2021 | 1797268000 | 1891001000 |

| Saturday, January 1, 2022 | 1711499000 | 2090554149 |

| Sunday, January 1, 2023 | 1718774000 | 2261354000 |

| Monday, January 1, 2024 | 1206355000 | 2389779000 |

Unleashing the power of data

In the ever-evolving landscape of industrial services, Waste Connections, Inc. and Dover Corporation have emerged as formidable players. Over the past decade, from 2014 to 2023, these companies have demonstrated significant growth in their EBITDA, a key indicator of financial health and operational efficiency.

Waste Connections, Inc. has shown a remarkable upward trajectory, with its EBITDA increasing by over 215% from 2014 to 2023. This growth reflects the company's strategic expansions and operational efficiencies. In contrast, Dover Corporation, while maintaining a steady growth, has seen a more modest increase of approximately 12% over the same period.

The data highlights a pivotal shift in 2017 when Waste Connections, Inc. surpassed Dover Corporation in EBITDA, marking a new era of competition. By 2023, Waste Connections, Inc.'s EBITDA was approximately 32% higher than that of Dover Corporation, underscoring its dominant position in the industry.

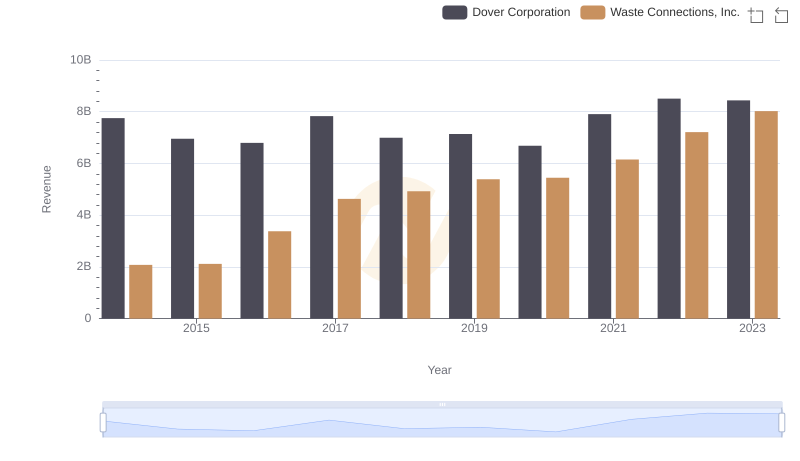

Revenue Showdown: Waste Connections, Inc. vs Dover Corporation

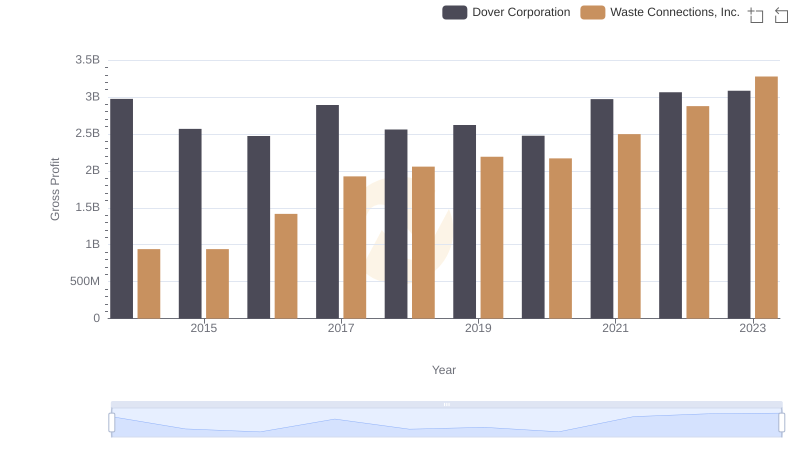

Waste Connections, Inc. and Dover Corporation: A Detailed Gross Profit Analysis

EBITDA Performance Review: Waste Connections, Inc. vs Rockwell Automation, Inc.

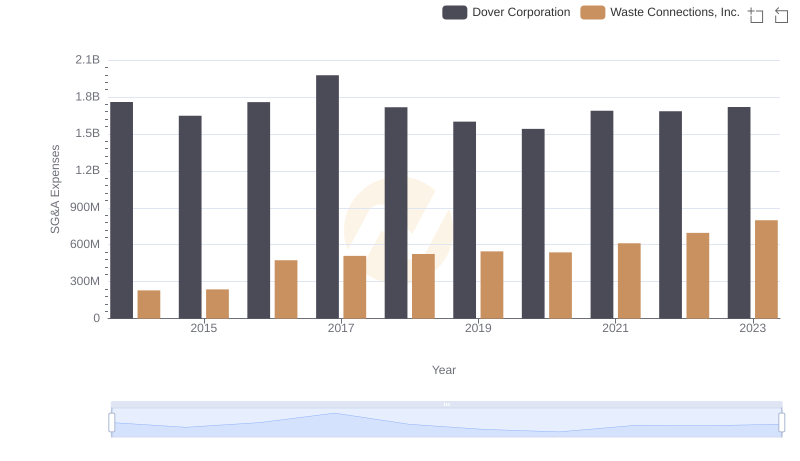

Comparing SG&A Expenses: Waste Connections, Inc. vs Dover Corporation Trends and Insights

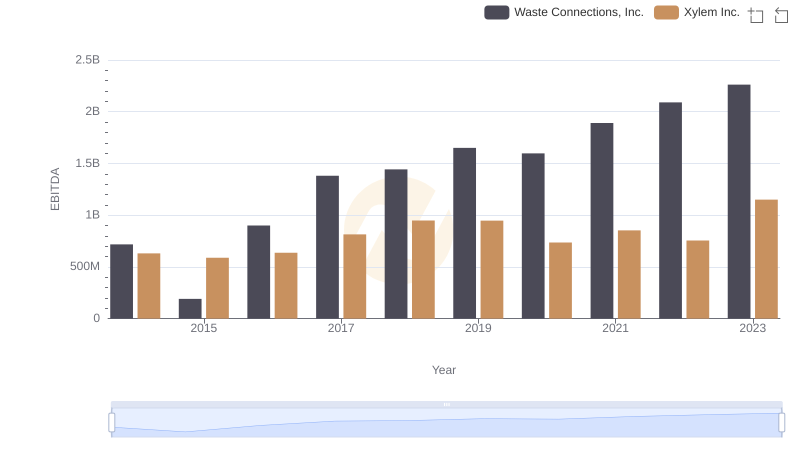

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs Xylem Inc.

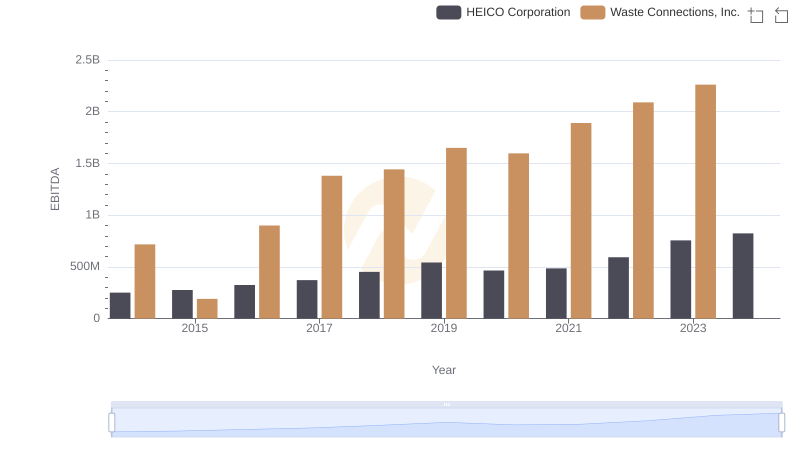

EBITDA Performance Review: Waste Connections, Inc. vs HEICO Corporation

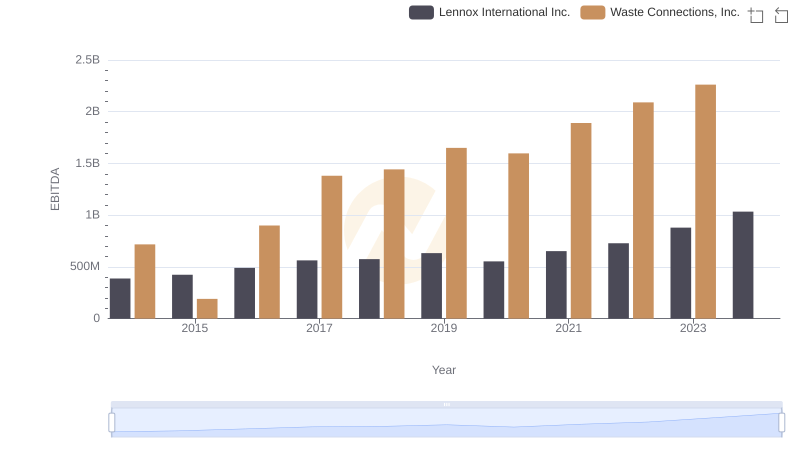

A Side-by-Side Analysis of EBITDA: Waste Connections, Inc. and Lennox International Inc.

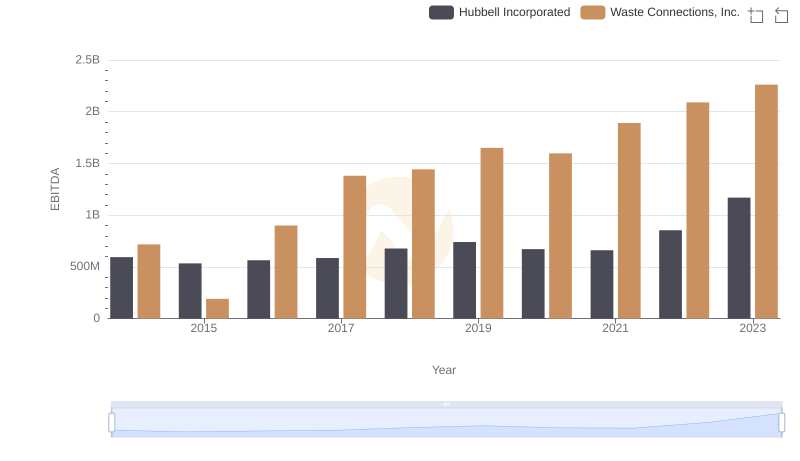

Waste Connections, Inc. vs Hubbell Incorporated: In-Depth EBITDA Performance Comparison

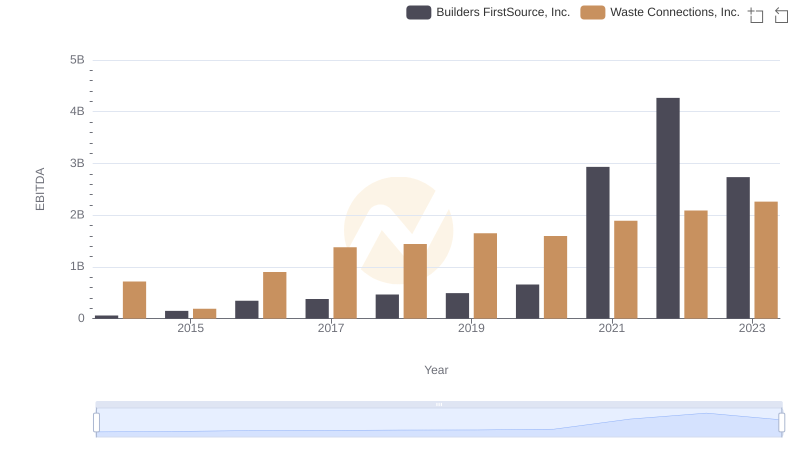

Waste Connections, Inc. vs Builders FirstSource, Inc.: In-Depth EBITDA Performance Comparison

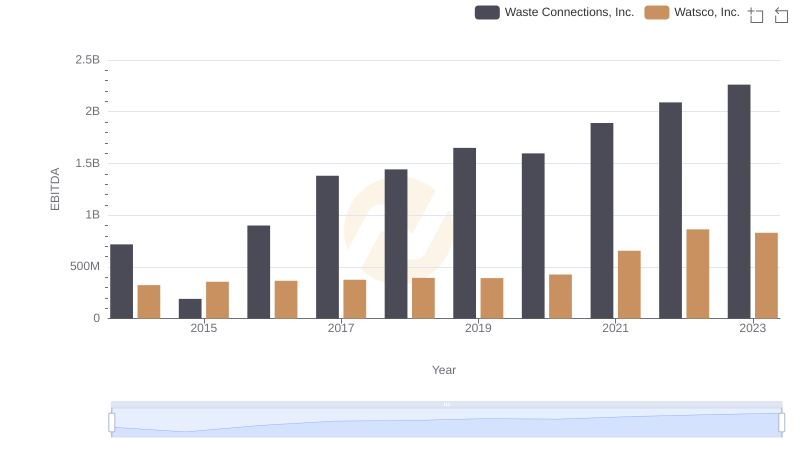

EBITDA Analysis: Evaluating Waste Connections, Inc. Against Watsco, Inc.