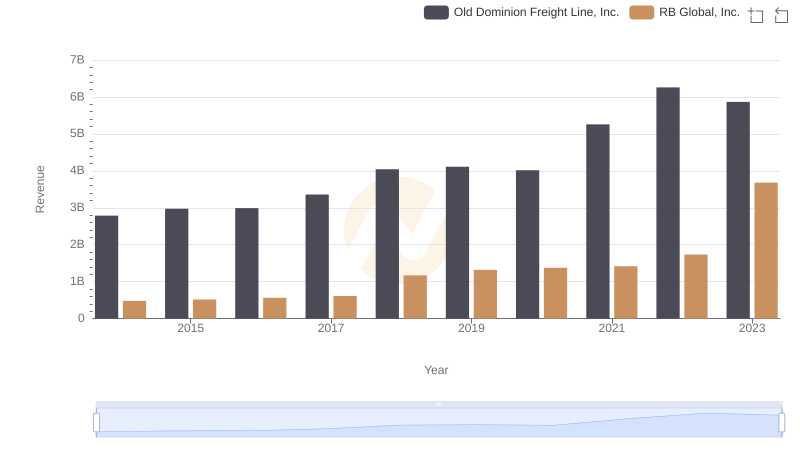

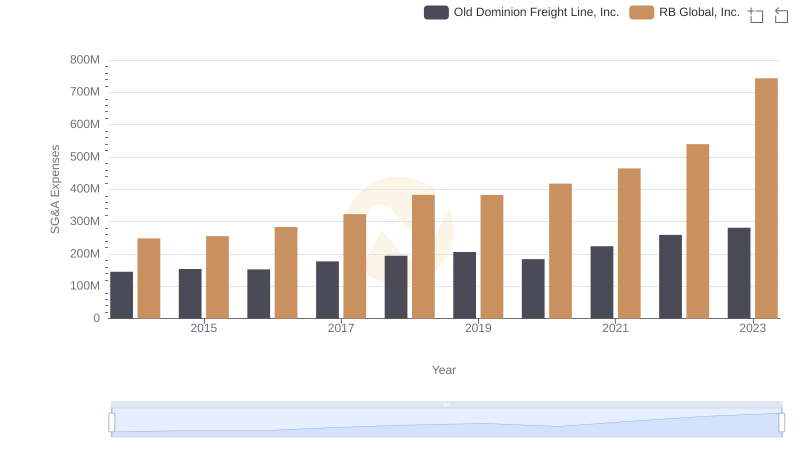

| __timestamp | Old Dominion Freight Line, Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 585590000 | 178851000 |

| Thursday, January 1, 2015 | 660570000 | 211417000 |

| Friday, January 1, 2016 | 671786000 | 174791291 |

| Sunday, January 1, 2017 | 783749000 | 168379000 |

| Monday, January 1, 2018 | 1046059000 | 263653000 |

| Tuesday, January 1, 2019 | 1078007000 | 322140110 |

| Wednesday, January 1, 2020 | 1168149000 | 358617000 |

| Friday, January 1, 2021 | 1651501000 | 339928424 |

| Saturday, January 1, 2022 | 2118962000 | 557399151 |

| Sunday, January 1, 2023 | 1972689000 | 975874087 |

| Monday, January 1, 2024 | 761100000 |

Unleashing the power of data

In the competitive landscape of freight and logistics, Old Dominion Freight Line, Inc. and RB Global, Inc. have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Old Dominion Freight Line has consistently outperformed RB Global in terms of EBITDA, reflecting its robust operational efficiency and market strategy.

Old Dominion's EBITDA surged by approximately 237% from 2014 to 2023, peaking in 2022 with a staggering 2.12 billion USD. This growth underscores its strategic investments and market adaptability. In contrast, RB Global, while experiencing a significant 446% increase in EBITDA, reached its highest point in 2023 with 975 million USD, indicating a strong recovery and expansion strategy.

This analysis highlights the dynamic shifts in the logistics sector, where strategic foresight and operational excellence define market leaders.

Breaking Down Revenue Trends: Old Dominion Freight Line, Inc. vs RB Global, Inc.

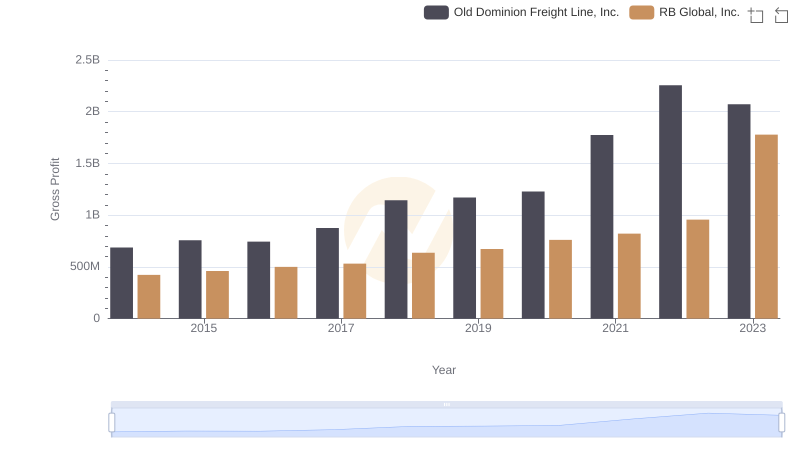

Key Insights on Gross Profit: Old Dominion Freight Line, Inc. vs RB Global, Inc.

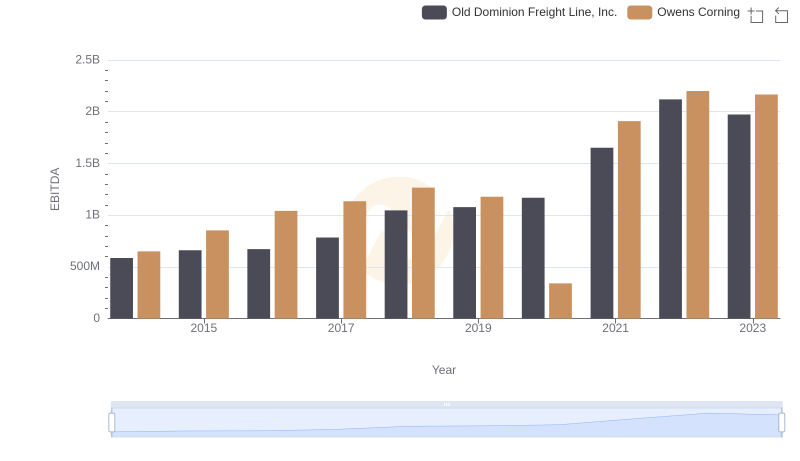

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Owens Corning

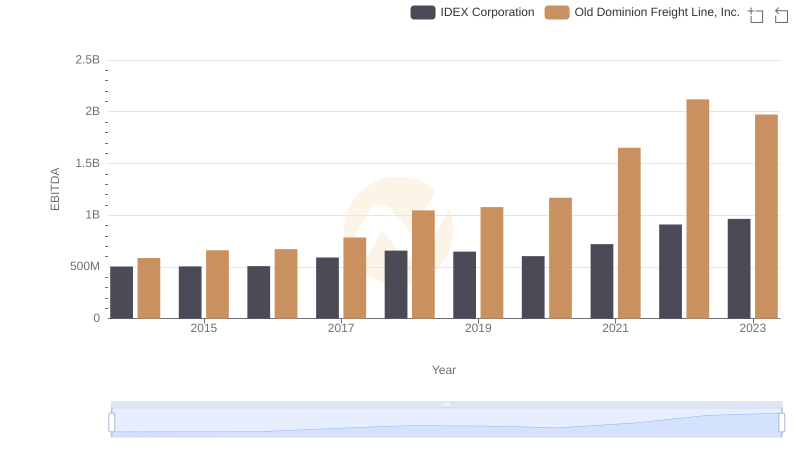

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and IDEX Corporation

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and RB Global, Inc.

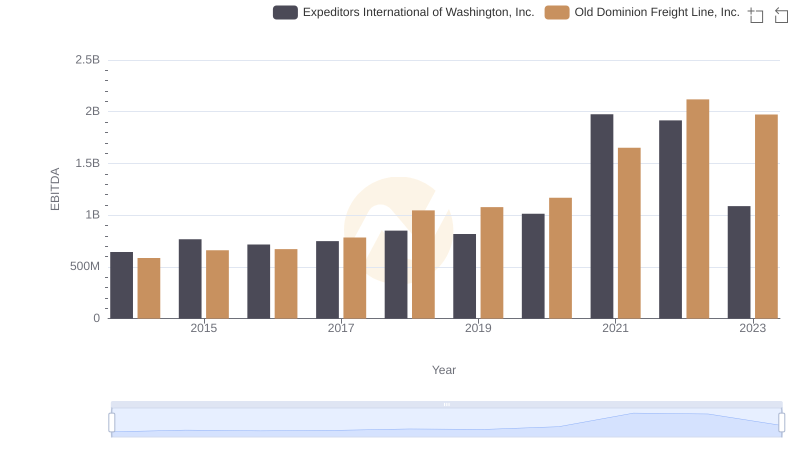

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

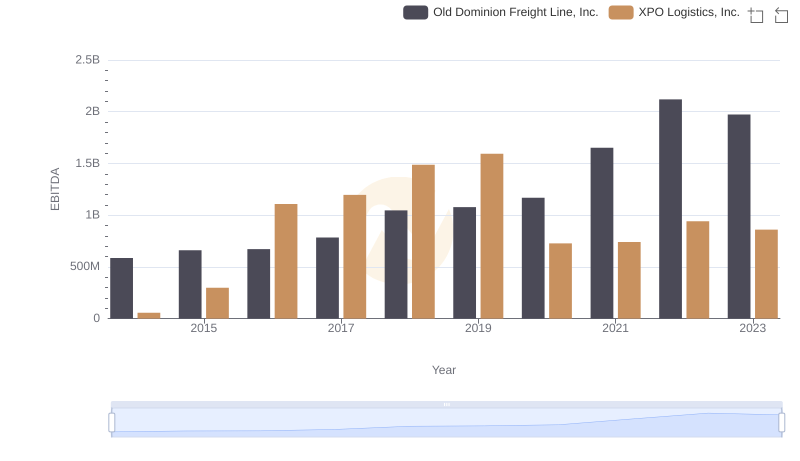

Old Dominion Freight Line, Inc. and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance

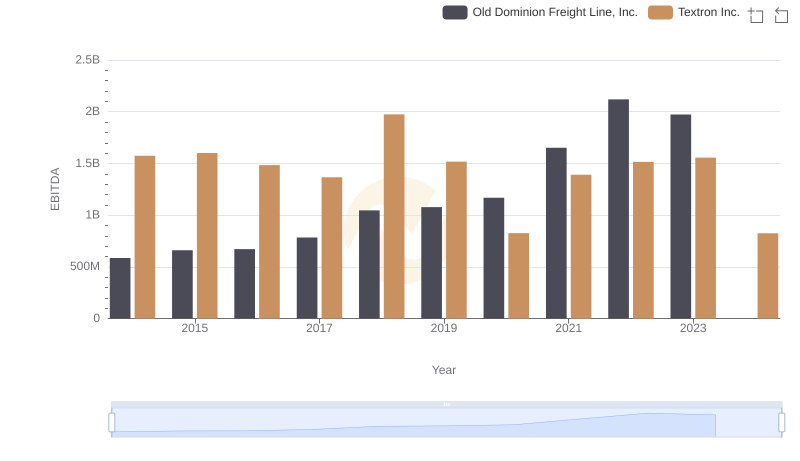

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Textron Inc.

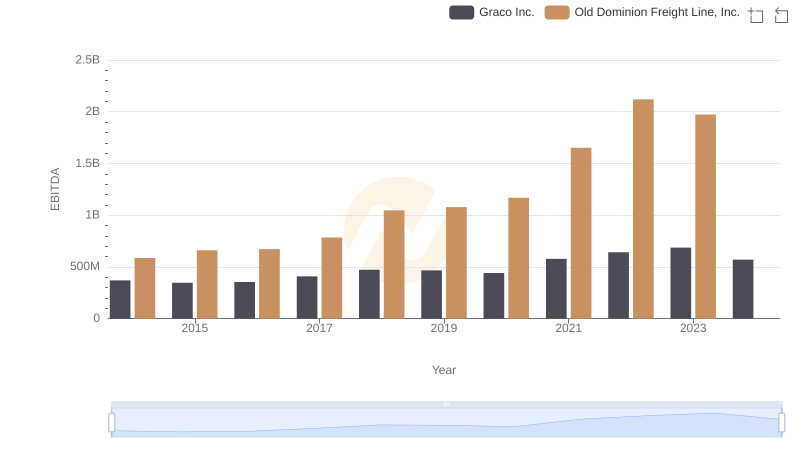

Comparative EBITDA Analysis: Old Dominion Freight Line, Inc. vs Graco Inc.

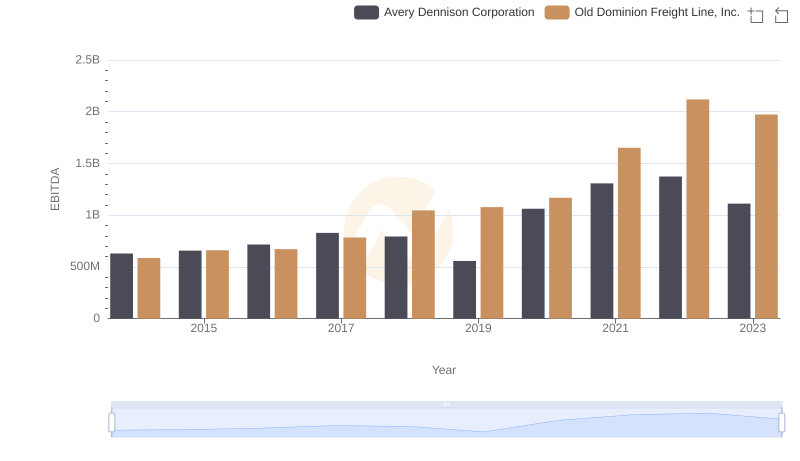

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Avery Dennison Corporation