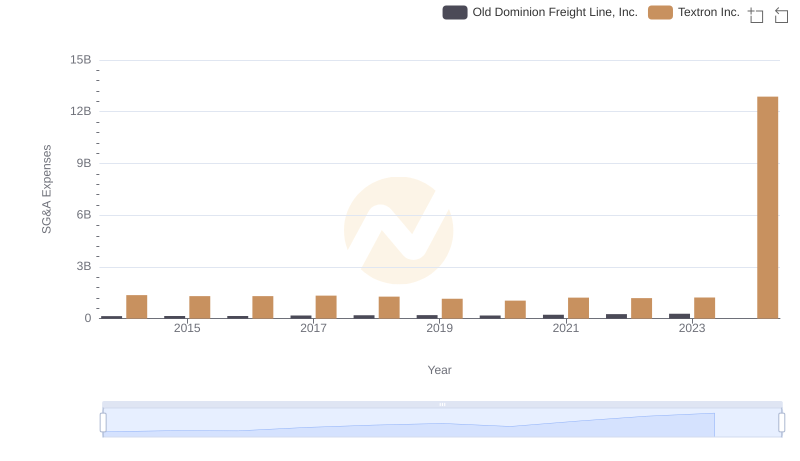

| __timestamp | Old Dominion Freight Line, Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 248220000 |

| Thursday, January 1, 2015 | 153589000 | 254990000 |

| Friday, January 1, 2016 | 152391000 | 283529000 |

| Sunday, January 1, 2017 | 177205000 | 323270000 |

| Monday, January 1, 2018 | 194368000 | 382676000 |

| Tuesday, January 1, 2019 | 206125000 | 382389000 |

| Wednesday, January 1, 2020 | 184185000 | 417523000 |

| Friday, January 1, 2021 | 223757000 | 464599000 |

| Saturday, January 1, 2022 | 258883000 | 539933000 |

| Sunday, January 1, 2023 | 281053000 | 743700000 |

| Monday, January 1, 2024 | 773900000 |

Infusing magic into the data realm

In the competitive landscape of logistics and auction services, Old Dominion Freight Line, Inc. and RB Global, Inc. have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Old Dominion Freight Line, Inc. has seen a steady increase in SG&A expenses, growing approximately 94% from 2014 to 2023. Meanwhile, RB Global, Inc. experienced a more dramatic rise, with expenses surging by nearly 200% in the same period.

Old Dominion's consistent growth reflects its strategic investments in operational efficiency, while RB Global's sharp increase suggests aggressive expansion and market penetration strategies. As of 2023, RB Global's SG&A expenses are more than double those of Old Dominion, highlighting differing business models and market approaches. This analysis provides a window into how these industry leaders manage their operational costs in a dynamic economic environment.

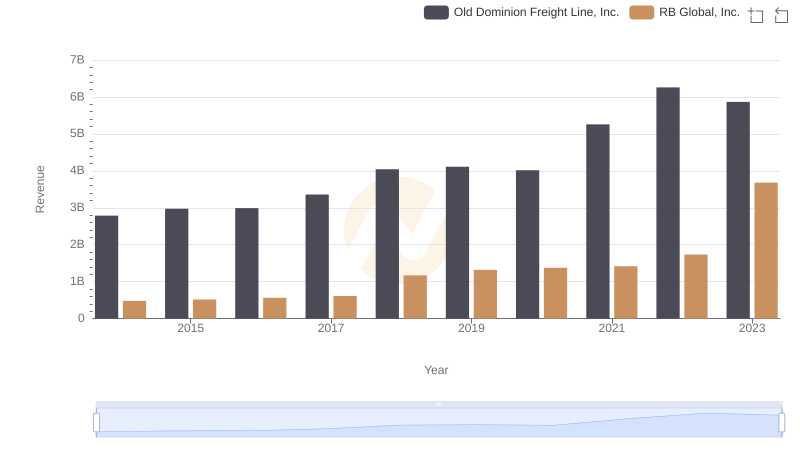

Breaking Down Revenue Trends: Old Dominion Freight Line, Inc. vs RB Global, Inc.

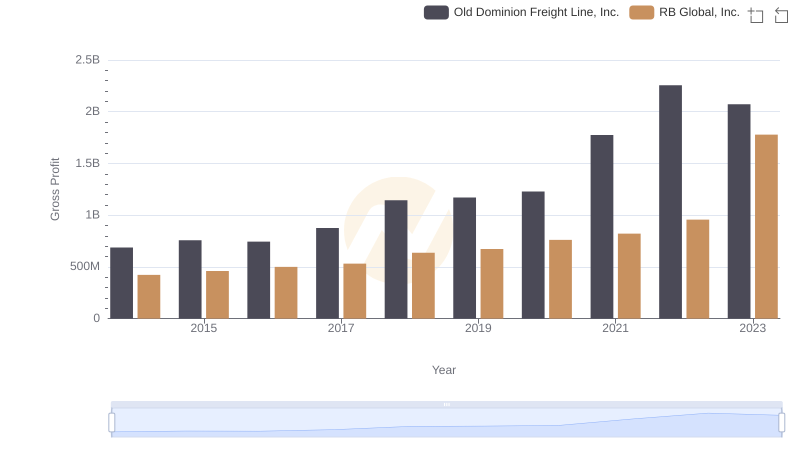

Key Insights on Gross Profit: Old Dominion Freight Line, Inc. vs RB Global, Inc.

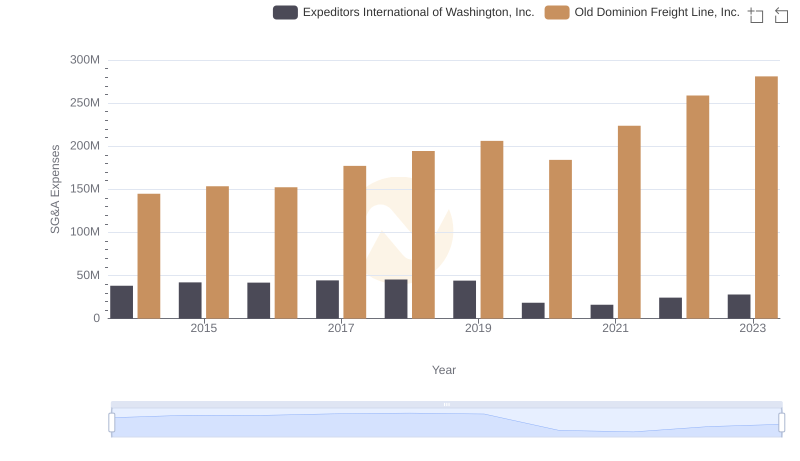

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Textron Inc.

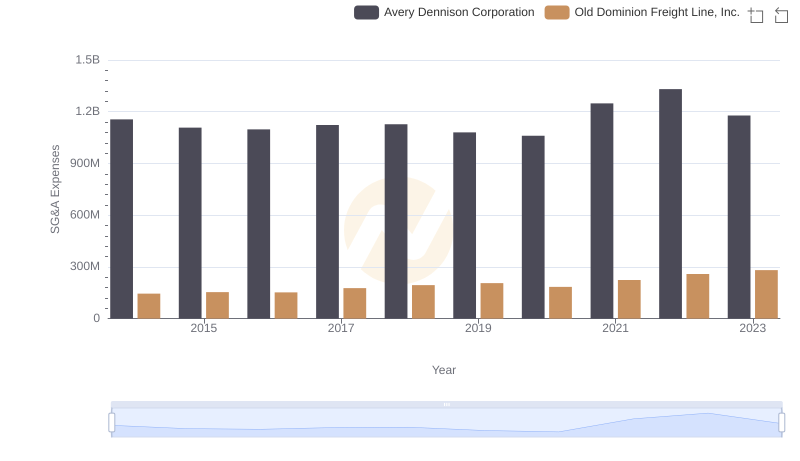

Cost Management Insights: SG&A Expenses for Old Dominion Freight Line, Inc. and Avery Dennison Corporation

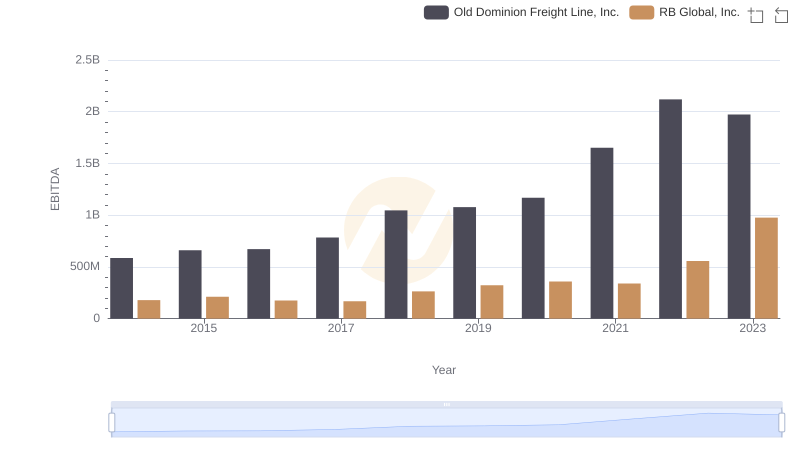

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against RB Global, Inc.