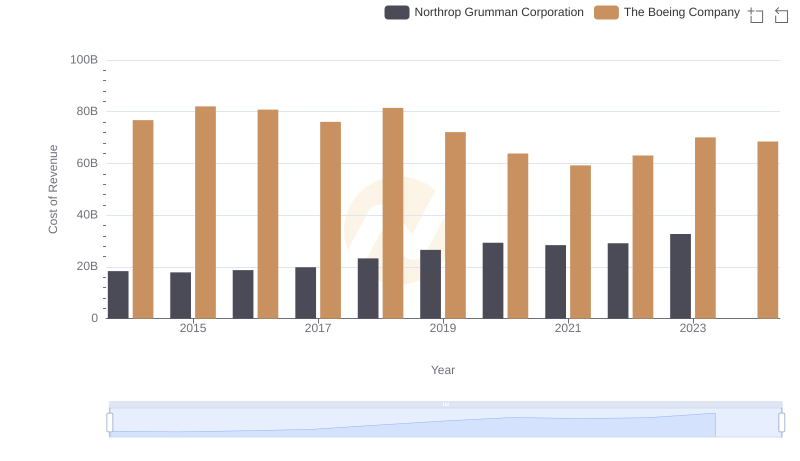

| __timestamp | The Boeing Company | TransDigm Group Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 76752000000 | 1105032000 |

| Thursday, January 1, 2015 | 82088000000 | 1257270000 |

| Friday, January 1, 2016 | 80790000000 | 1443348000 |

| Sunday, January 1, 2017 | 76066000000 | 1519659000 |

| Monday, January 1, 2018 | 81490000000 | 1633616000 |

| Tuesday, January 1, 2019 | 72093000000 | 2413932000 |

| Wednesday, January 1, 2020 | 63843000000 | 2456000000 |

| Friday, January 1, 2021 | 59237000000 | 2285000000 |

| Saturday, January 1, 2022 | 63078000000 | 2330000000 |

| Sunday, January 1, 2023 | 70070000000 | 2743000000 |

| Monday, January 1, 2024 | 68508000000 | 3268000000 |

Unlocking the unknown

In the competitive world of aerospace, The Boeing Company and TransDigm Group Incorporated have shown contrasting trends in their cost of revenue over the past decade. From 2014 to 2024, Boeing's cost of revenue has seen a decline of approximately 11%, dropping from its peak in 2015. This reflects the challenges Boeing faced, particularly during the 2019-2021 period, where costs plummeted by nearly 20% due to global disruptions.

Conversely, TransDigm Group has experienced a steady rise, with costs increasing by nearly 200% over the same period. This growth trajectory highlights TransDigm's expanding footprint in the aerospace sector, even as it navigates the complexities of a post-pandemic world. As we look to the future, these trends offer a fascinating glimpse into the strategic maneuvers of two industry titans.

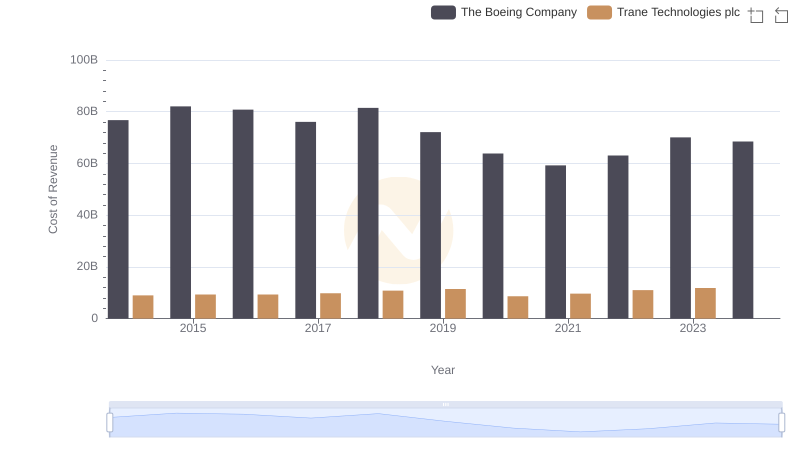

Comparing Cost of Revenue Efficiency: The Boeing Company vs Trane Technologies plc

Cost of Revenue Comparison: The Boeing Company vs 3M Company

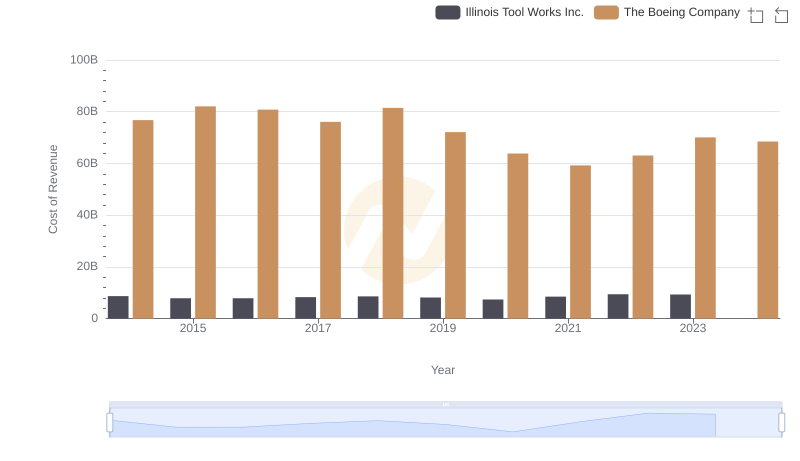

Cost Insights: Breaking Down The Boeing Company and Illinois Tool Works Inc.'s Expenses

Cost of Revenue Trends: The Boeing Company vs Emerson Electric Co.

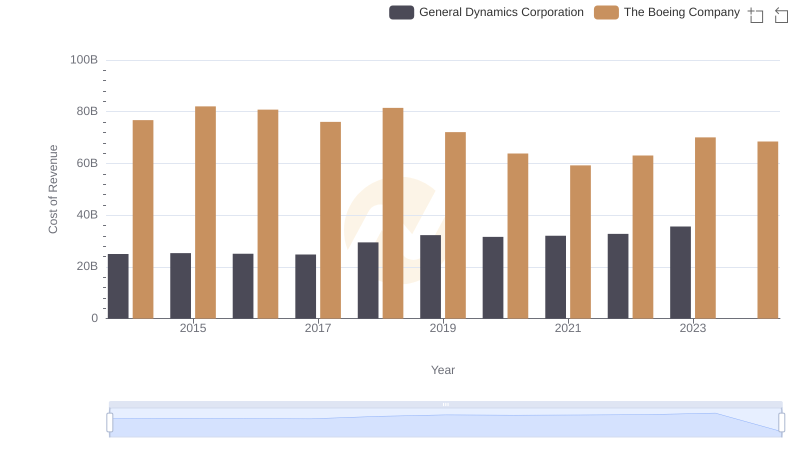

Cost of Revenue: Key Insights for The Boeing Company and General Dynamics Corporation

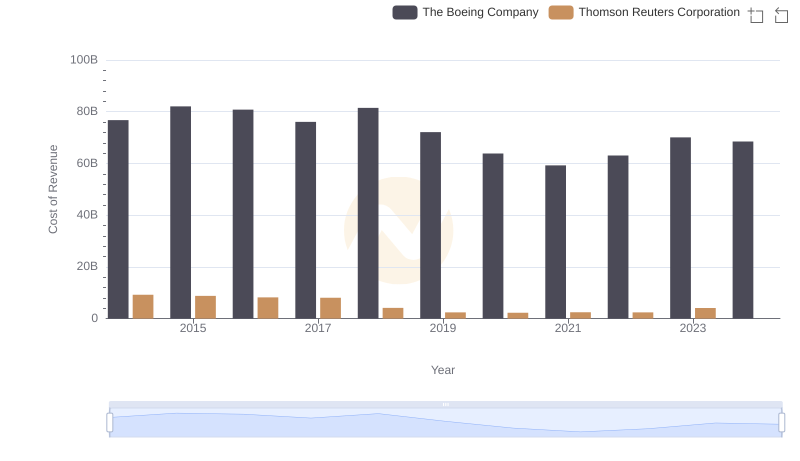

Analyzing Cost of Revenue: The Boeing Company and Thomson Reuters Corporation

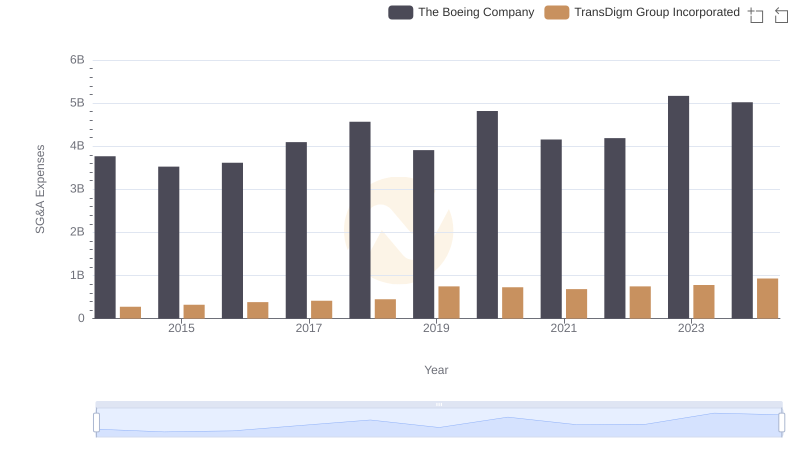

The Boeing Company and TransDigm Group Incorporated: SG&A Spending Patterns Compared

Analyzing Cost of Revenue: The Boeing Company and Northrop Grumman Corporation