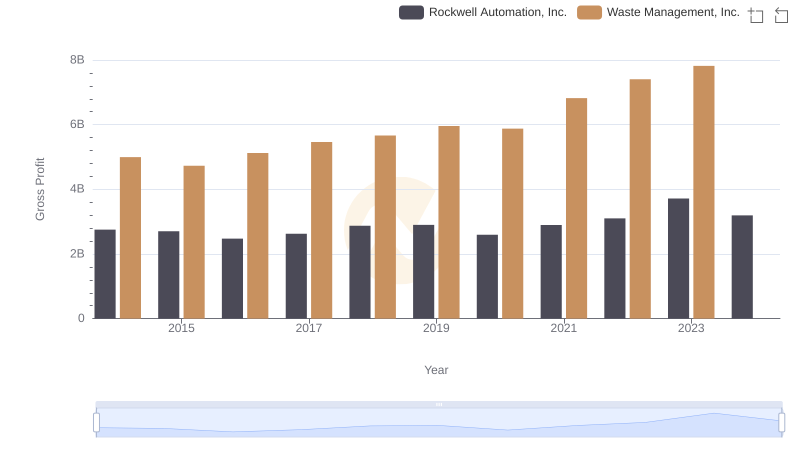

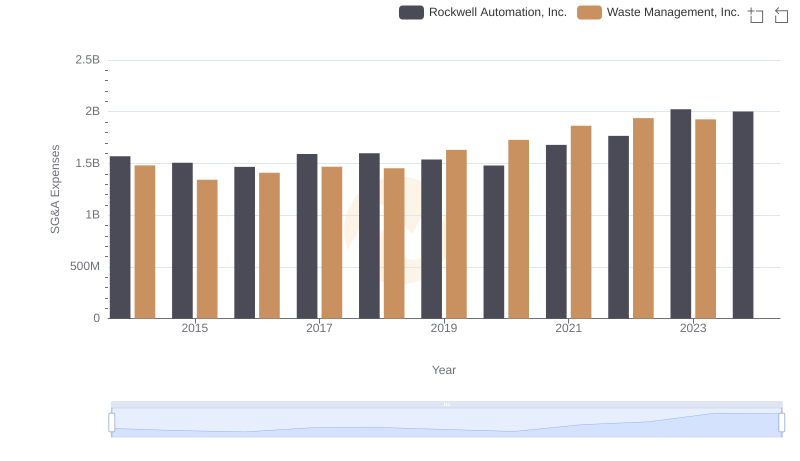

| __timestamp | Rockwell Automation, Inc. | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3869600000 | 9002000000 |

| Thursday, January 1, 2015 | 3604800000 | 8231000000 |

| Friday, January 1, 2016 | 3404000000 | 8486000000 |

| Sunday, January 1, 2017 | 3687100000 | 9021000000 |

| Monday, January 1, 2018 | 3793800000 | 9249000000 |

| Tuesday, January 1, 2019 | 3794700000 | 9496000000 |

| Wednesday, January 1, 2020 | 3734600000 | 9341000000 |

| Friday, January 1, 2021 | 4099700000 | 11111000000 |

| Saturday, January 1, 2022 | 4658400000 | 12294000000 |

| Sunday, January 1, 2023 | 5341000000 | 12606000000 |

| Monday, January 1, 2024 | 5070800000 | 13383000000 |

Igniting the spark of knowledge

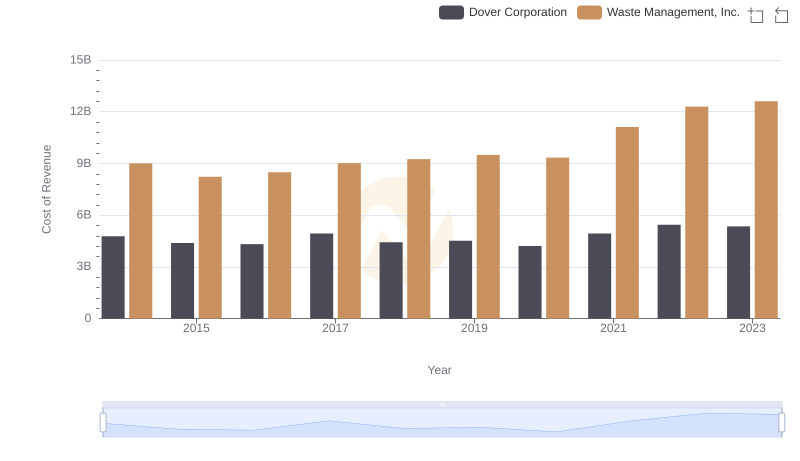

In the ever-evolving landscape of industrial and waste management sectors, understanding cost dynamics is crucial. Over the past decade, Waste Management, Inc. and Rockwell Automation, Inc. have showcased intriguing trends in their cost of revenue. From 2014 to 2023, Waste Management, Inc. consistently reported higher costs, peaking at approximately $12.6 billion in 2023, reflecting a 40% increase from 2014. This rise underscores the growing operational expenses in waste management. Conversely, Rockwell Automation, Inc. experienced a 38% increase, reaching around $5.3 billion in 2023. Notably, 2024 data for Waste Management, Inc. remains unavailable, hinting at potential shifts or reporting delays. These insights highlight the distinct financial trajectories of these industry giants, offering a window into their strategic priorities and market challenges. As businesses navigate economic uncertainties, such data-driven insights become invaluable for stakeholders and investors alike.

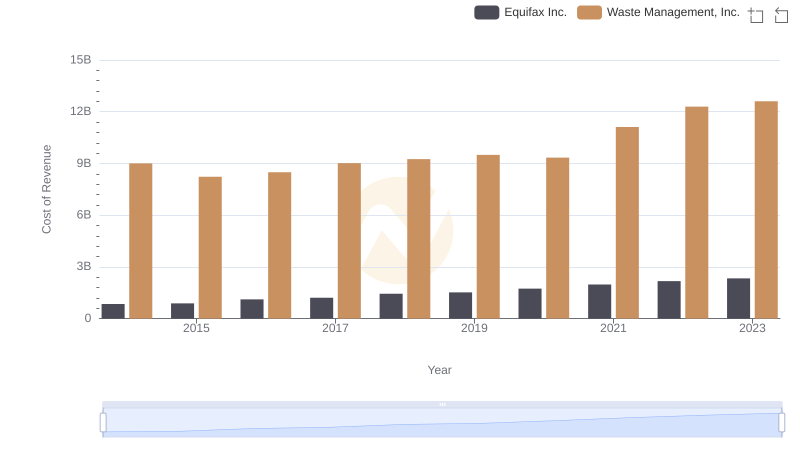

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Equifax Inc.

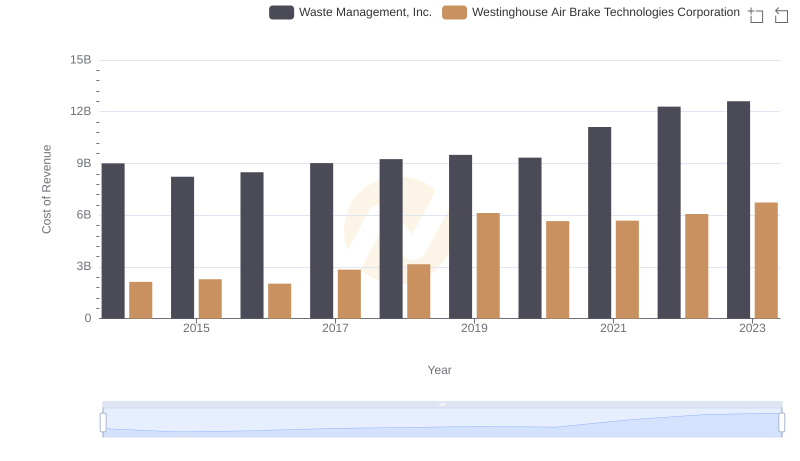

Cost of Revenue Comparison: Waste Management, Inc. vs Westinghouse Air Brake Technologies Corporation

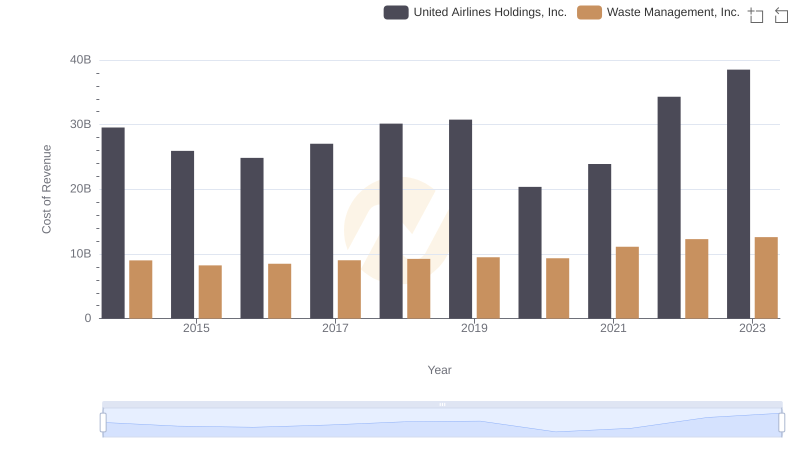

Cost Insights: Breaking Down Waste Management, Inc. and United Airlines Holdings, Inc.'s Expenses

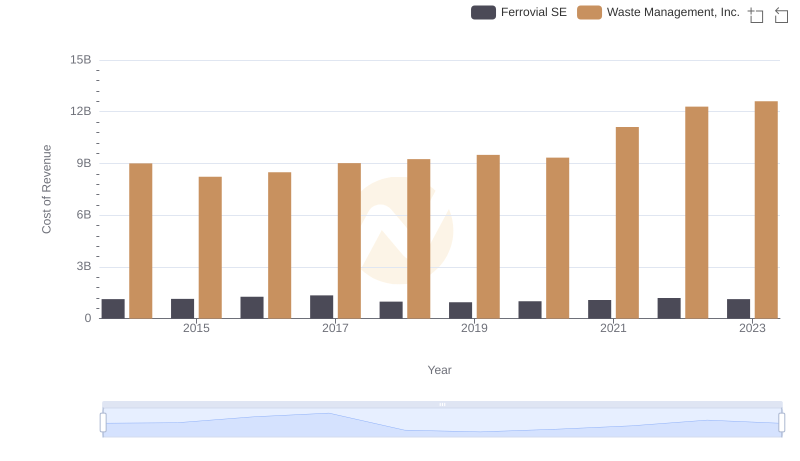

Cost of Revenue Comparison: Waste Management, Inc. vs Ferrovial SE

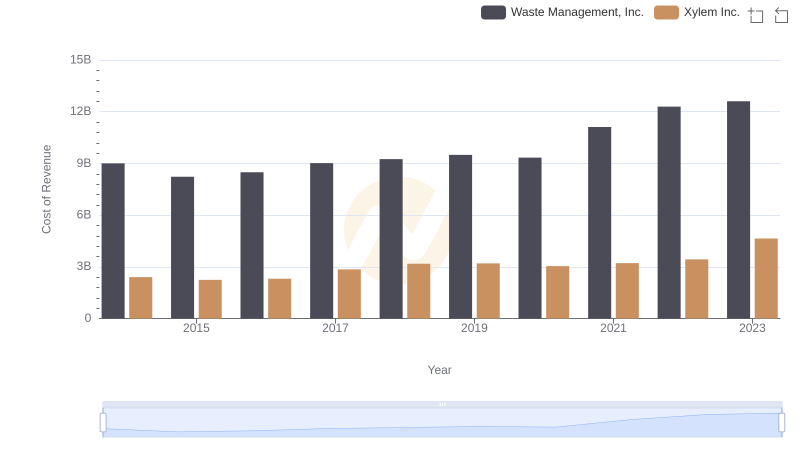

Cost of Revenue: Key Insights for Waste Management, Inc. and Xylem Inc.

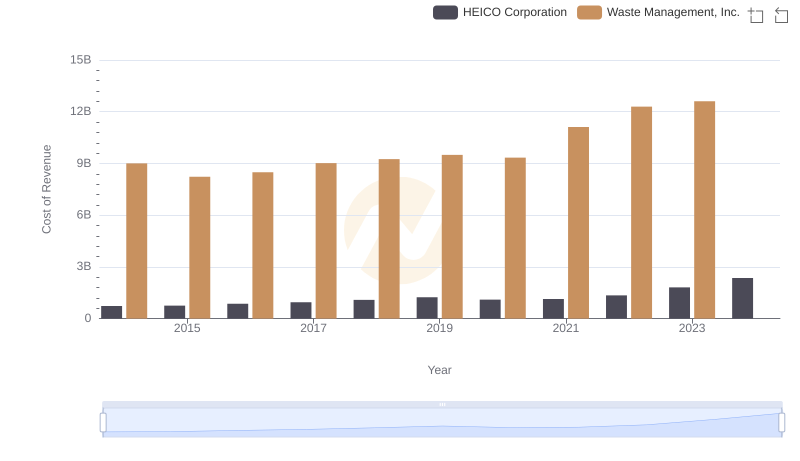

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs HEICO Corporation

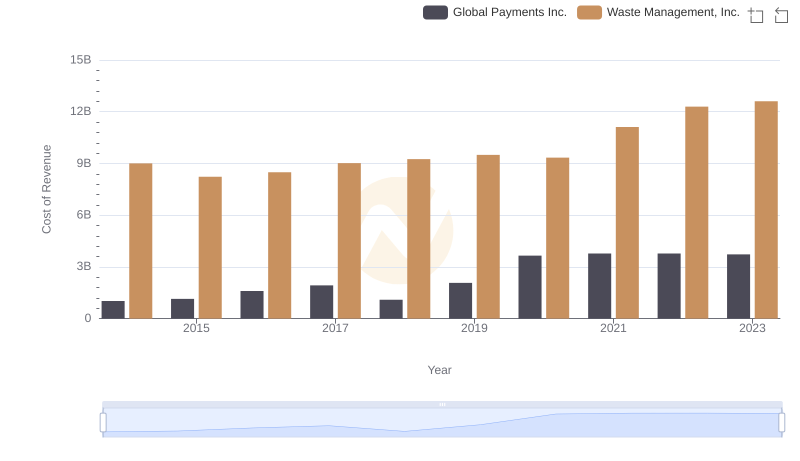

Cost of Revenue Trends: Waste Management, Inc. vs Global Payments Inc.

Gross Profit Comparison: Waste Management, Inc. and Rockwell Automation, Inc. Trends

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Dover Corporation

Cost Management Insights: SG&A Expenses for Waste Management, Inc. and Rockwell Automation, Inc.