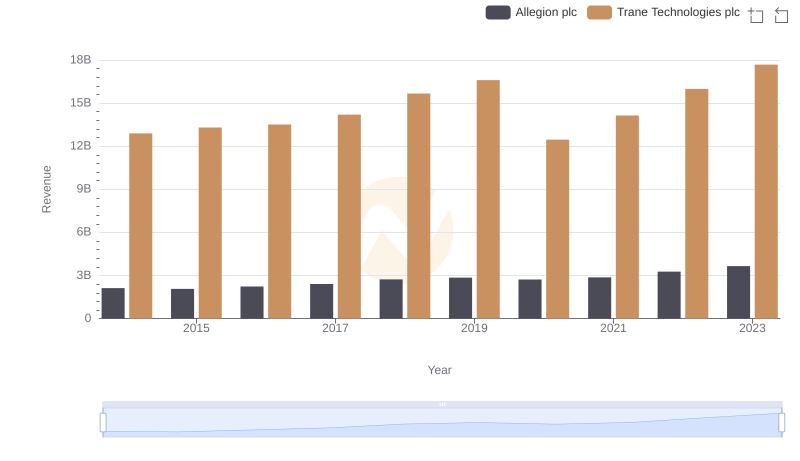

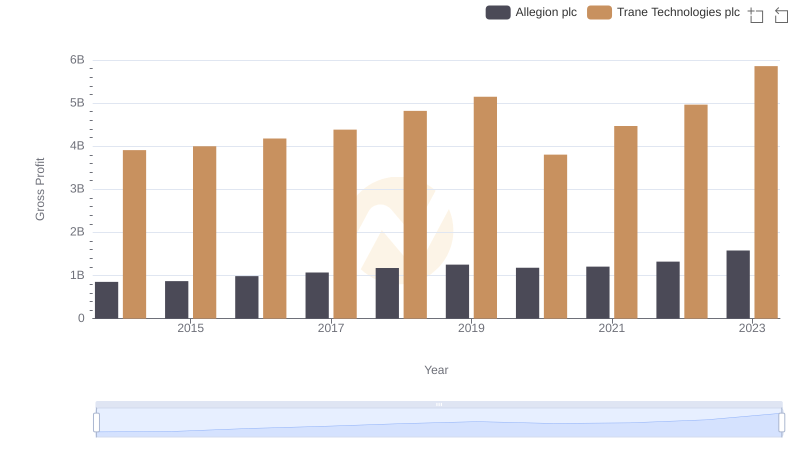

| __timestamp | Allegion plc | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1264600000 | 8982800000 |

| Thursday, January 1, 2015 | 1199000000 | 9301600000 |

| Friday, January 1, 2016 | 1252700000 | 9329300000 |

| Sunday, January 1, 2017 | 1337500000 | 9811600000 |

| Monday, January 1, 2018 | 1558400000 | 10847600000 |

| Tuesday, January 1, 2019 | 1601700000 | 11451500000 |

| Wednesday, January 1, 2020 | 1541100000 | 8651300000 |

| Friday, January 1, 2021 | 1662500000 | 9666800000 |

| Saturday, January 1, 2022 | 1949500000 | 11026900000 |

| Sunday, January 1, 2023 | 2069300000 | 11820400000 |

| Monday, January 1, 2024 | 2103700000 | 12757700000 |

Cracking the code

In the ever-evolving landscape of industrial giants, Trane Technologies plc and Allegion plc have showcased intriguing cost dynamics over the past decade. From 2014 to 2023, Trane Technologies consistently outpaced Allegion in cost of revenue, with figures peaking at approximately $11.8 billion in 2023, marking a 32% increase from 2014. Allegion, while smaller in scale, demonstrated a robust growth trajectory, with its cost of revenue rising by 64% over the same period, reaching around $2.1 billion in 2023.

This data highlights the contrasting scales and growth strategies of these two companies. Trane Technologies, with its larger operational footprint, reflects a steady expansion, while Allegion's sharper growth rate suggests aggressive market penetration and operational scaling. As the industrial sector continues to evolve, these insights provide a window into the strategic maneuvers of these key players.

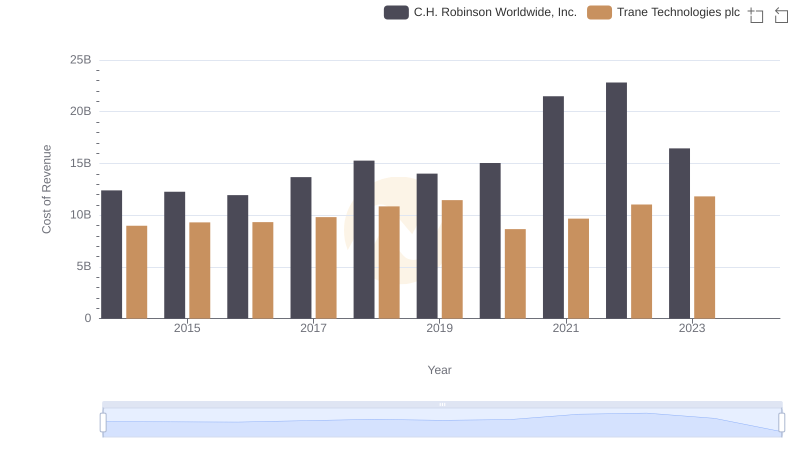

Cost of Revenue Trends: Trane Technologies plc vs C.H. Robinson Worldwide, Inc.

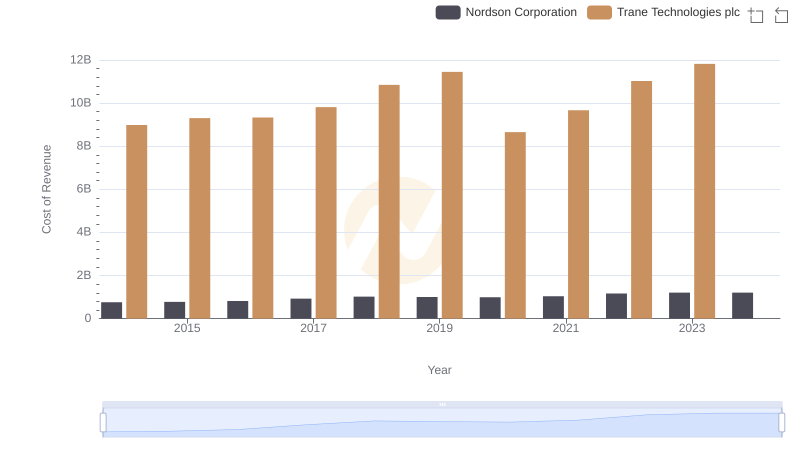

Cost of Revenue: Key Insights for Trane Technologies plc and Nordson Corporation

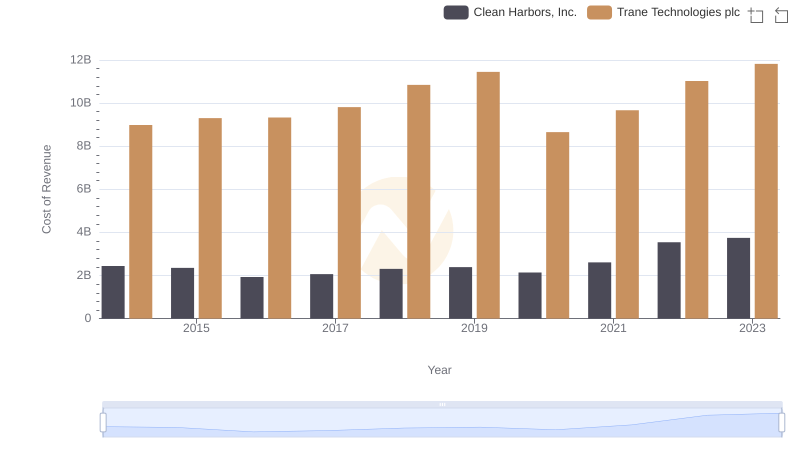

Cost Insights: Breaking Down Trane Technologies plc and Clean Harbors, Inc.'s Expenses

Breaking Down Revenue Trends: Trane Technologies plc vs Allegion plc

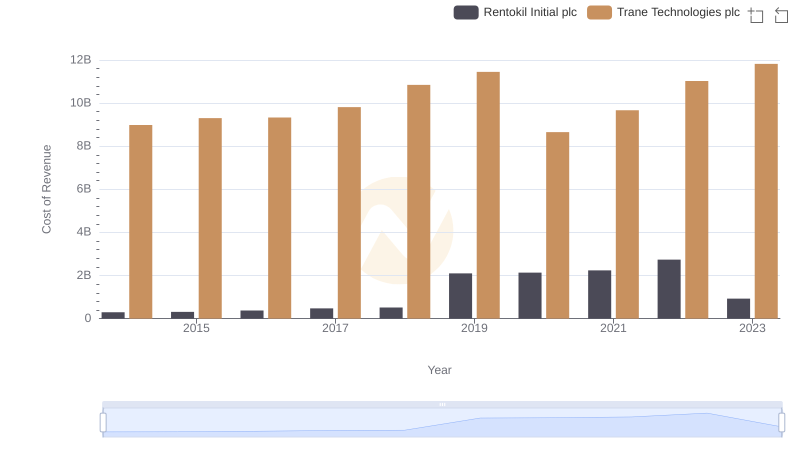

Trane Technologies plc vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

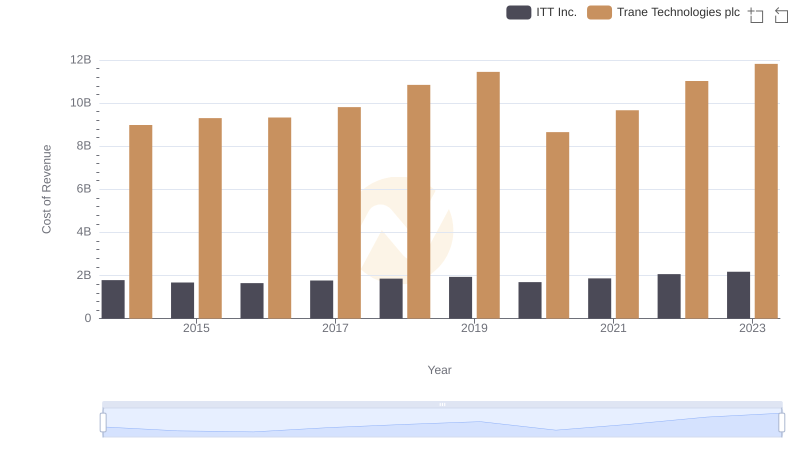

Cost of Revenue: Key Insights for Trane Technologies plc and ITT Inc.

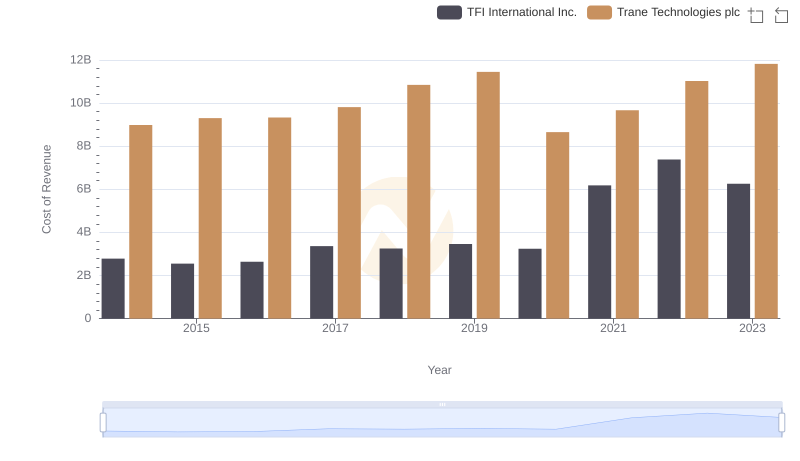

Trane Technologies plc vs TFI International Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing Trane Technologies plc and Allegion plc

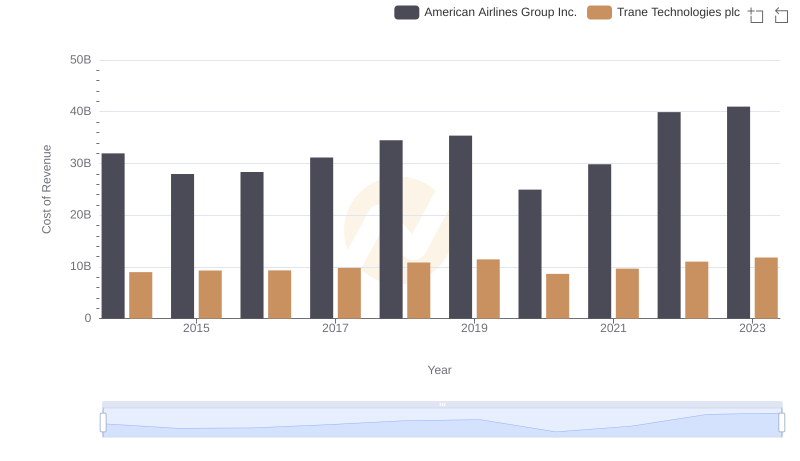

Analyzing Cost of Revenue: Trane Technologies plc and American Airlines Group Inc.

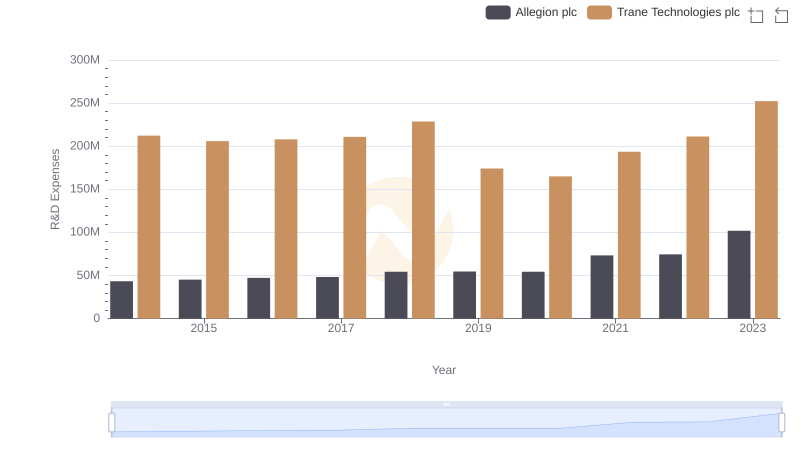

Research and Development: Comparing Key Metrics for Trane Technologies plc and Allegion plc

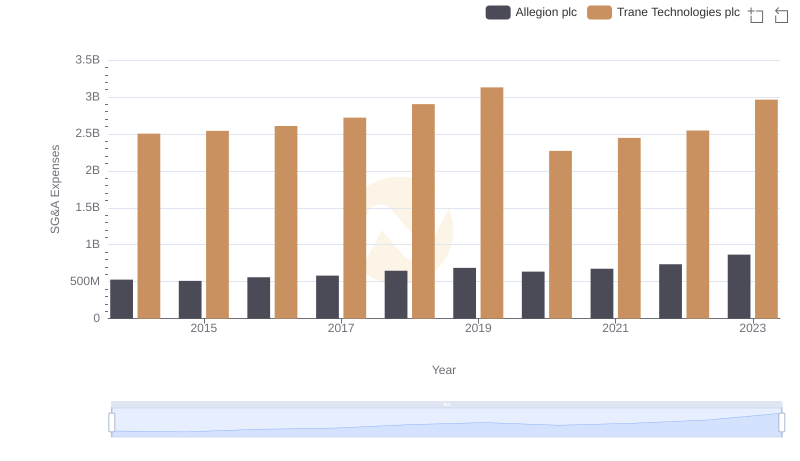

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Allegion plc