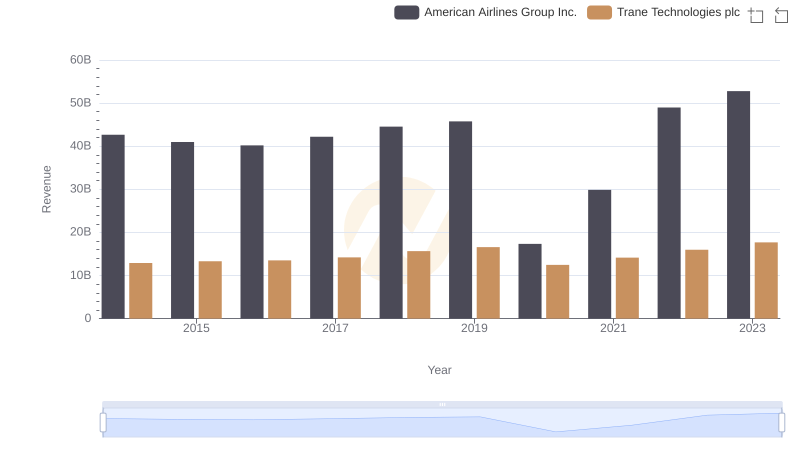

| __timestamp | American Airlines Group Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 31939000000 | 8982800000 |

| Thursday, January 1, 2015 | 27967000000 | 9301600000 |

| Friday, January 1, 2016 | 28339000000 | 9329300000 |

| Sunday, January 1, 2017 | 31154000000 | 9811600000 |

| Monday, January 1, 2018 | 34490000000 | 10847600000 |

| Tuesday, January 1, 2019 | 35379000000 | 11451500000 |

| Wednesday, January 1, 2020 | 24933000000 | 8651300000 |

| Friday, January 1, 2021 | 29855000000 | 9666800000 |

| Saturday, January 1, 2022 | 39934000000 | 11026900000 |

| Sunday, January 1, 2023 | 40978000000 | 11820400000 |

| Monday, January 1, 2024 | 12757700000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for assessing a company's efficiency and profitability. This analysis delves into the cost of revenue trends for Trane Technologies plc and American Airlines Group Inc. from 2014 to 2023.

American Airlines Group Inc. has experienced a significant fluctuation in its cost of revenue, peaking in 2023 with a 28% increase from its lowest point in 2020. This reflects the airline industry's volatile nature, influenced by global events and economic shifts. In contrast, Trane Technologies plc has shown a more stable growth pattern, with a 37% increase over the same period, highlighting its resilience and consistent market demand.

These insights provide a window into the strategic financial maneuvers of two major players in their respective industries, offering valuable lessons for investors and analysts alike.

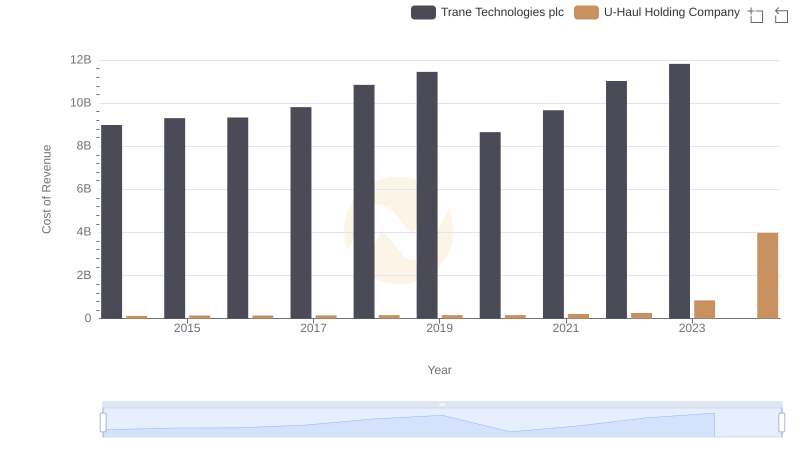

Cost Insights: Breaking Down Trane Technologies plc and U-Haul Holding Company's Expenses

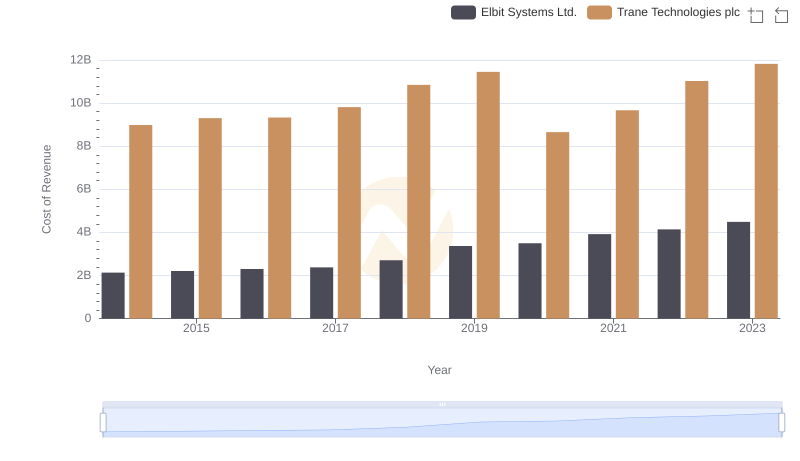

Cost of Revenue Comparison: Trane Technologies plc vs Elbit Systems Ltd.

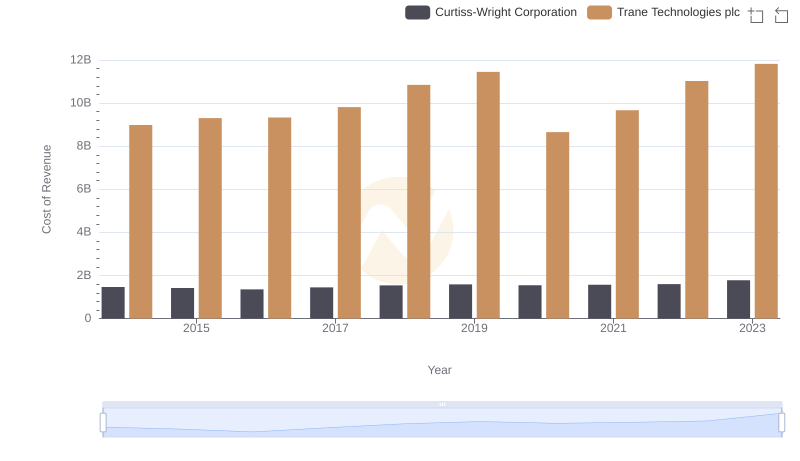

Analyzing Cost of Revenue: Trane Technologies plc and Curtiss-Wright Corporation

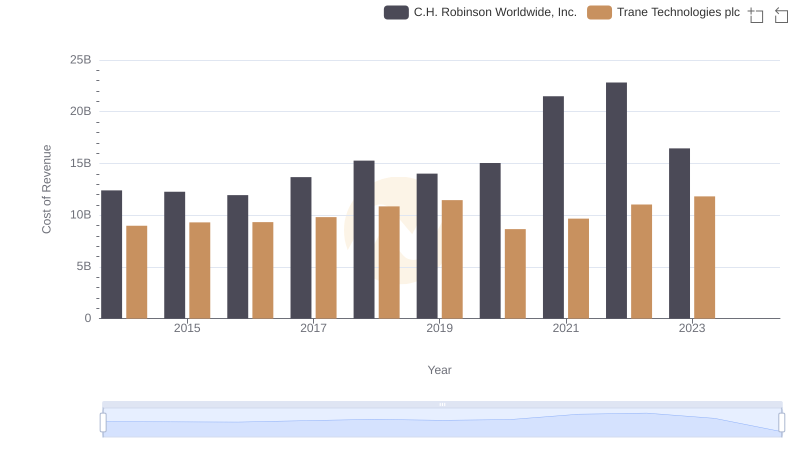

Cost of Revenue Trends: Trane Technologies plc vs C.H. Robinson Worldwide, Inc.

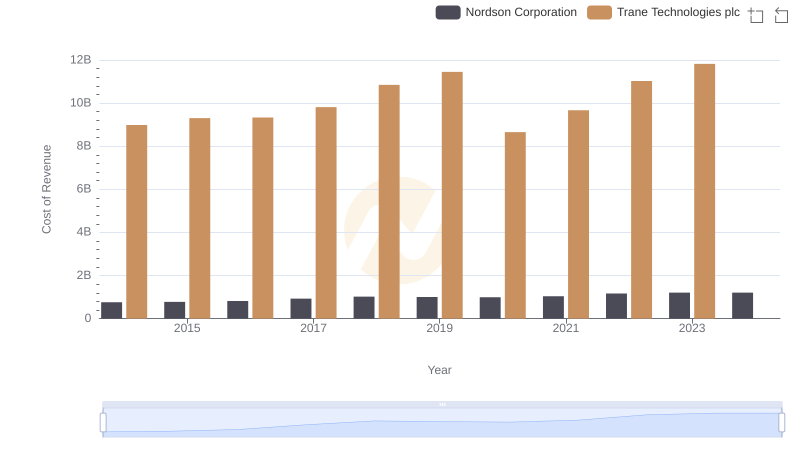

Cost of Revenue: Key Insights for Trane Technologies plc and Nordson Corporation

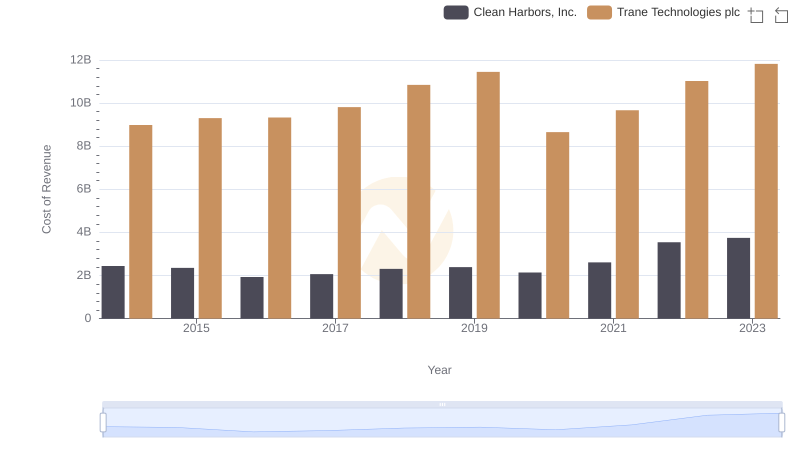

Cost Insights: Breaking Down Trane Technologies plc and Clean Harbors, Inc.'s Expenses

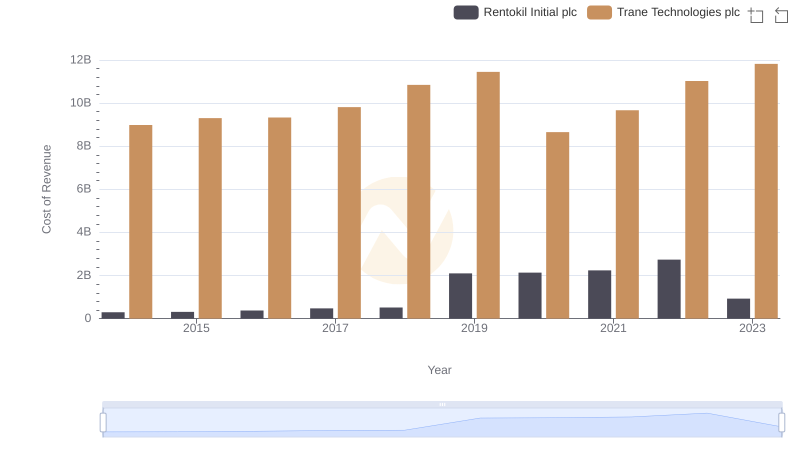

Trane Technologies plc vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

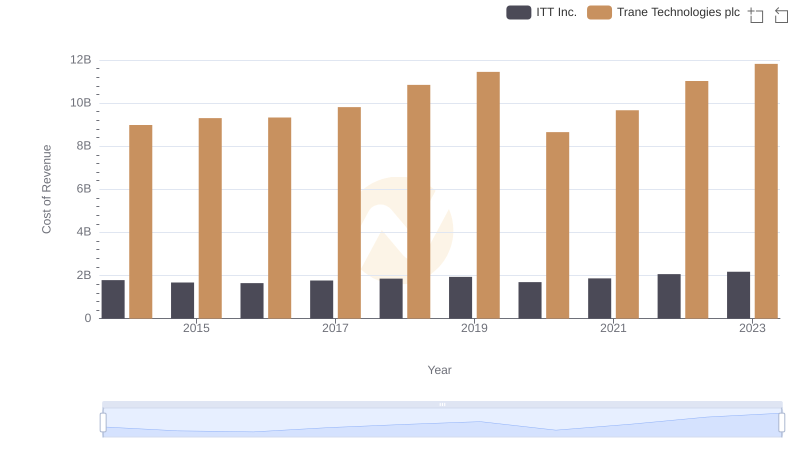

Cost of Revenue: Key Insights for Trane Technologies plc and ITT Inc.

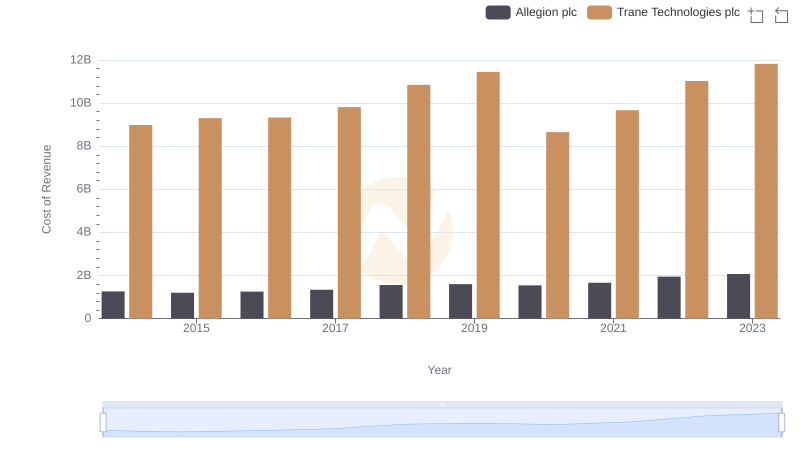

Cost of Revenue: Key Insights for Trane Technologies plc and Allegion plc

Trane Technologies plc vs American Airlines Group Inc.: Examining Key Revenue Metrics

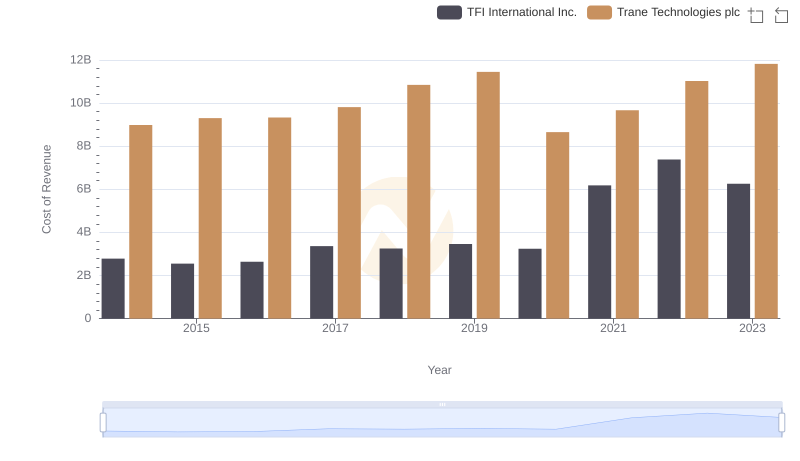

Trane Technologies plc vs TFI International Inc.: Efficiency in Cost of Revenue Explored

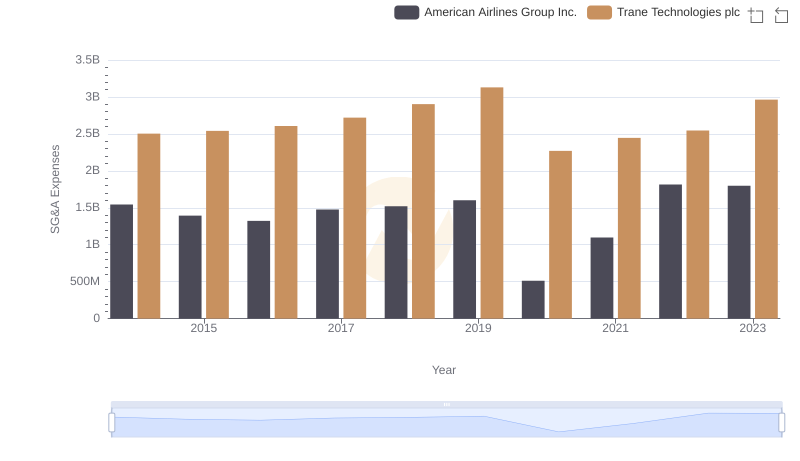

Selling, General, and Administrative Costs: Trane Technologies plc vs American Airlines Group Inc.