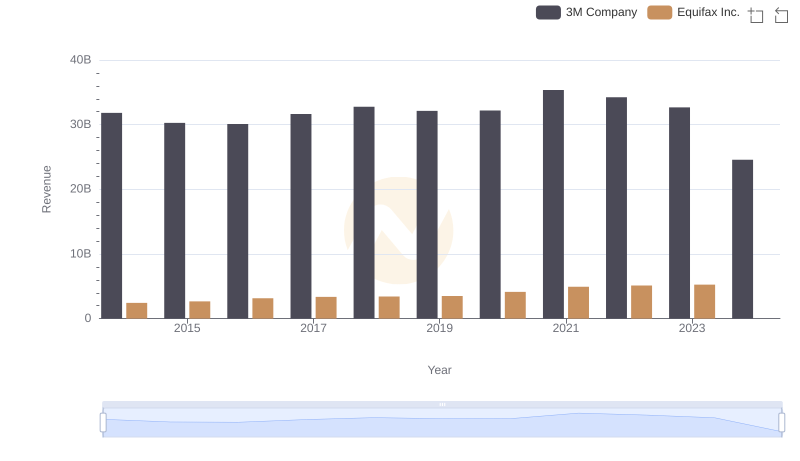

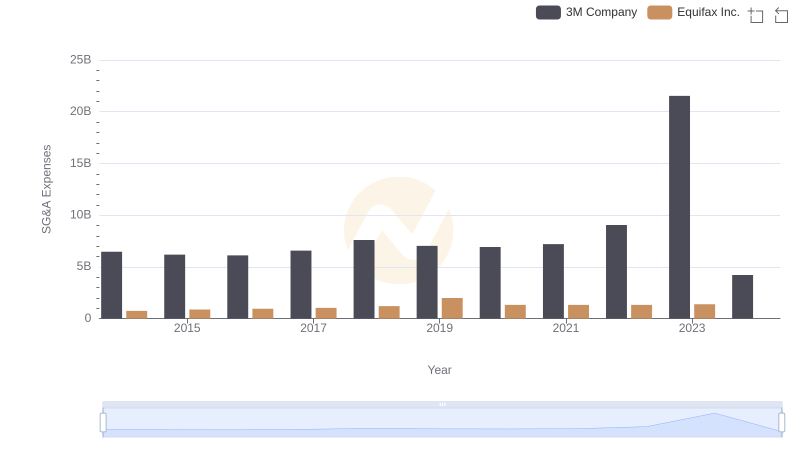

| __timestamp | 3M Company | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 16447000000 | 844700000 |

| Thursday, January 1, 2015 | 15383000000 | 887400000 |

| Friday, January 1, 2016 | 15040000000 | 1113400000 |

| Sunday, January 1, 2017 | 16001000000 | 1210700000 |

| Monday, January 1, 2018 | 16682000000 | 1440400000 |

| Tuesday, January 1, 2019 | 17136000000 | 1521700000 |

| Wednesday, January 1, 2020 | 16605000000 | 1737400000 |

| Friday, January 1, 2021 | 18795000000 | 1980900000 |

| Saturday, January 1, 2022 | 19232000000 | 2177200000 |

| Sunday, January 1, 2023 | 18477000000 | 2335100000 |

| Monday, January 1, 2024 | 14447000000 | 0 |

Unleashing the power of data

In the ever-evolving landscape of corporate America, the cost of revenue is a critical metric that reflects a company's efficiency in managing its production expenses. This comparison between 3M Company and Equifax Inc. from 2014 to 2023 offers a fascinating glimpse into their financial strategies.

3M Company, a stalwart in the industrial sector, has shown a consistent upward trend in its cost of revenue. From 2014 to 2023, 3M's cost of revenue increased by approximately 12%, peaking in 2022. This growth reflects 3M's expanding operations and its ability to scale production efficiently.

Equifax Inc., a leader in consumer credit reporting, has experienced a more dramatic increase. Over the same period, Equifax's cost of revenue surged by nearly 176%, highlighting its aggressive expansion and investment in data security and technology.

It's worth noting that data for Equifax in 2024 is missing, which could indicate a reporting delay or strategic changes. This absence invites speculation about Equifax's future financial maneuvers.

In conclusion, while both companies have increased their cost of revenue, the pace and scale differ significantly, reflecting their unique market positions and strategic priorities.

3M Company vs Equifax Inc.: Examining Key Revenue Metrics

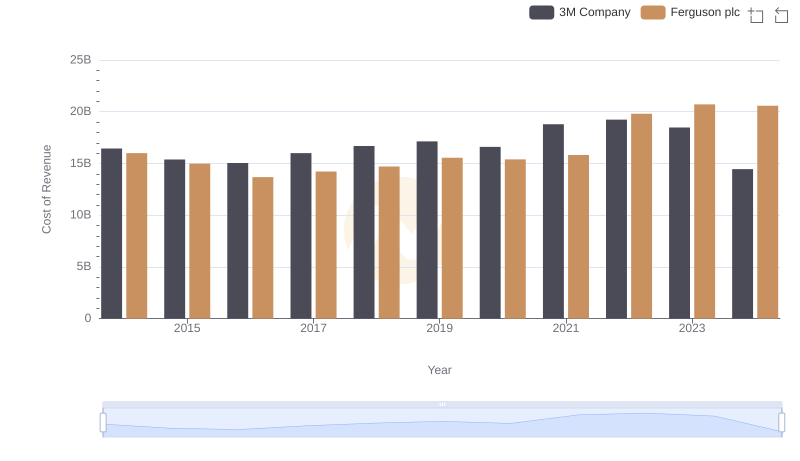

Cost of Revenue: Key Insights for 3M Company and Ferguson plc

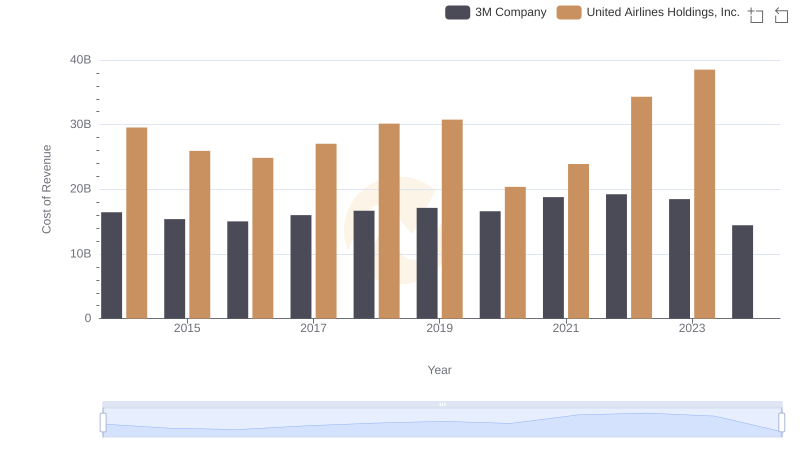

Cost Insights: Breaking Down 3M Company and United Airlines Holdings, Inc.'s Expenses

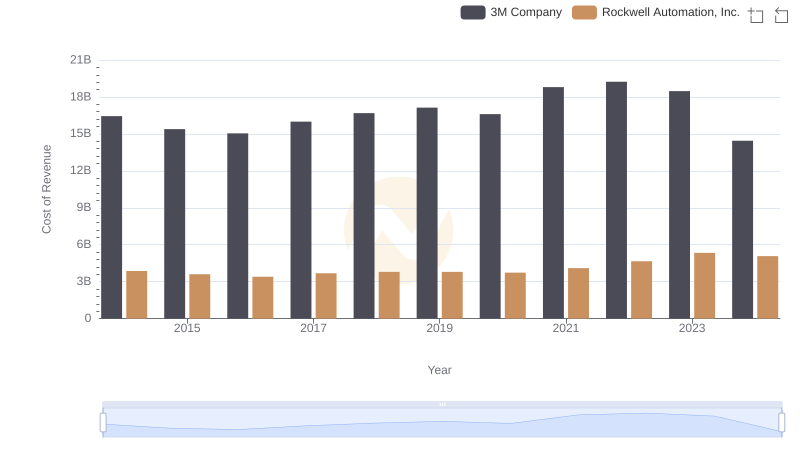

3M Company vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

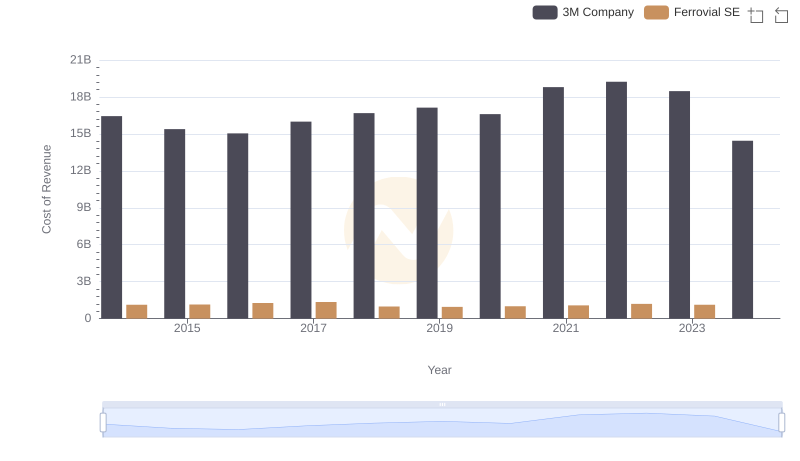

Cost of Revenue Trends: 3M Company vs Ferrovial SE

Key Insights on Gross Profit: 3M Company vs Equifax Inc.

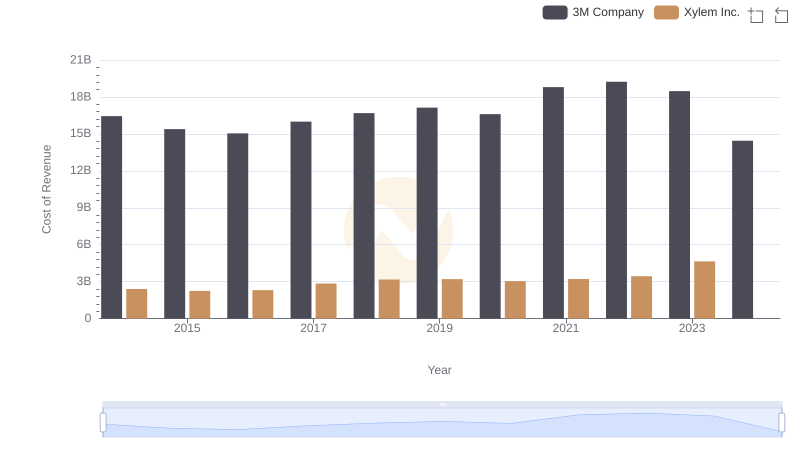

3M Company vs Xylem Inc.: Efficiency in Cost of Revenue Explored

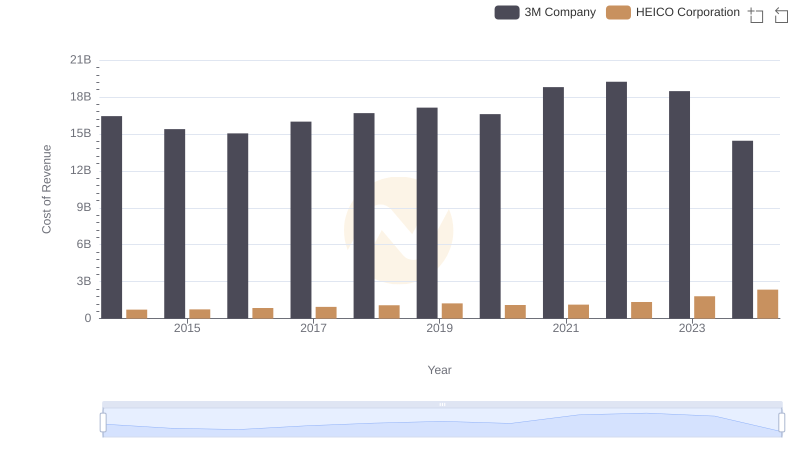

Comparing Cost of Revenue Efficiency: 3M Company vs HEICO Corporation

Comparing SG&A Expenses: 3M Company vs Equifax Inc. Trends and Insights