| __timestamp | 3M Company | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 16447000000 | 29569000000 |

| Thursday, January 1, 2015 | 15383000000 | 25952000000 |

| Friday, January 1, 2016 | 15040000000 | 24856000000 |

| Sunday, January 1, 2017 | 16001000000 | 27056000000 |

| Monday, January 1, 2018 | 16682000000 | 30165000000 |

| Tuesday, January 1, 2019 | 17136000000 | 30786000000 |

| Wednesday, January 1, 2020 | 16605000000 | 20385000000 |

| Friday, January 1, 2021 | 18795000000 | 23913000000 |

| Saturday, January 1, 2022 | 19232000000 | 34315000000 |

| Sunday, January 1, 2023 | 18477000000 | 38518000000 |

| Monday, January 1, 2024 | 14447000000 | 37643000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding cost structures is pivotal. This analysis delves into the cost of revenue trends for two industry giants: 3M Company and United Airlines Holdings, Inc., from 2014 to 2023. Over this period, 3M's cost of revenue exhibited a relatively stable trajectory, peaking in 2022 with a 15% increase from 2014, before a notable dip in 2024. In contrast, United Airlines experienced more volatility, with costs surging by 30% from 2014 to 2023, reflecting the airline industry's dynamic nature.

While 3M's costs remained consistent, United Airlines' fluctuations highlight the impact of external factors like fuel prices and global events. The absence of 2024 data for United Airlines suggests potential reporting delays or strategic shifts. This comparative study underscores the importance of cost management in sustaining competitive advantage.

Cost of Revenue Comparison: 3M Company vs Ingersoll Rand Inc.

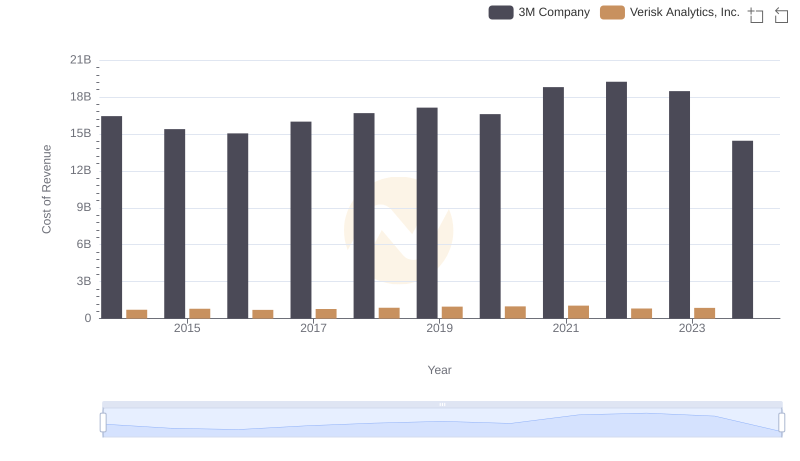

Cost Insights: Breaking Down 3M Company and Verisk Analytics, Inc.'s Expenses

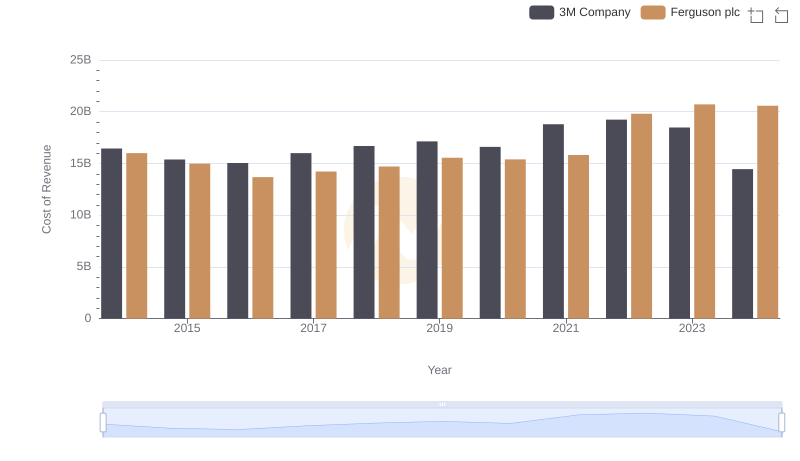

Cost of Revenue: Key Insights for 3M Company and Ferguson plc

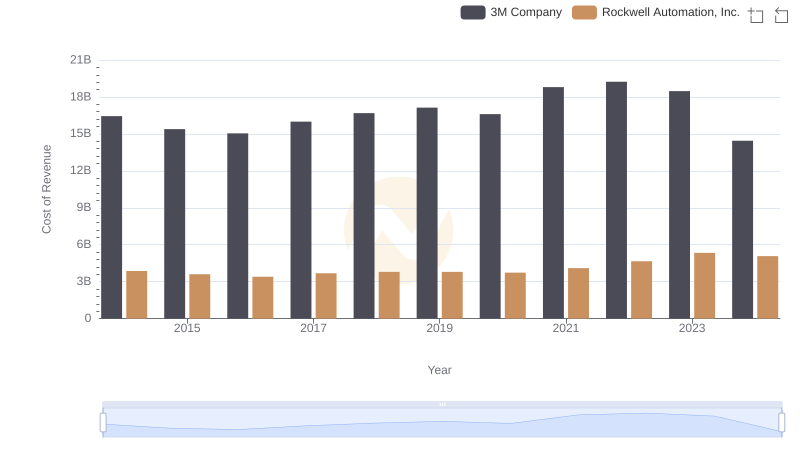

3M Company vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

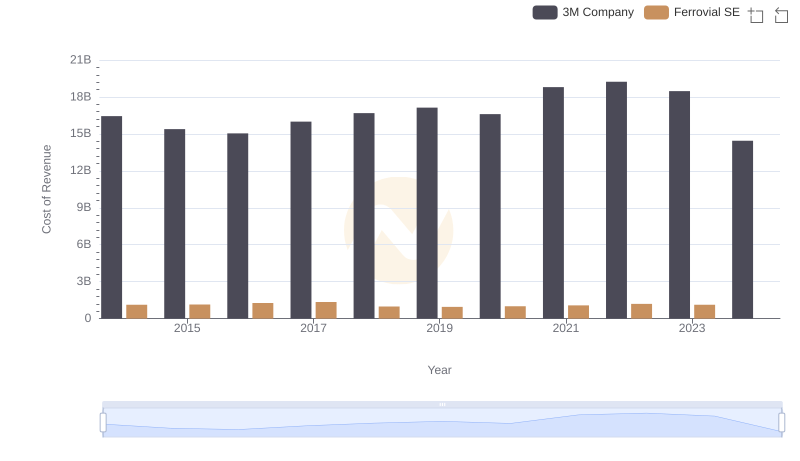

Cost of Revenue Trends: 3M Company vs Ferrovial SE

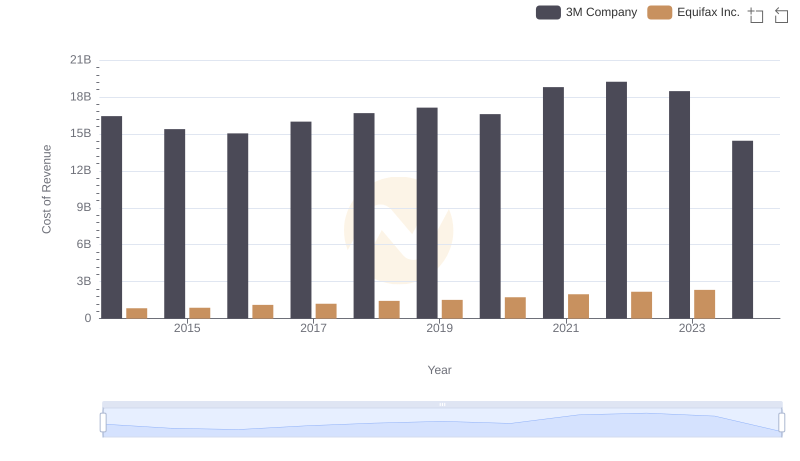

Cost of Revenue Comparison: 3M Company vs Equifax Inc.

3M Company vs United Airlines Holdings, Inc.: SG&A Expense Trends

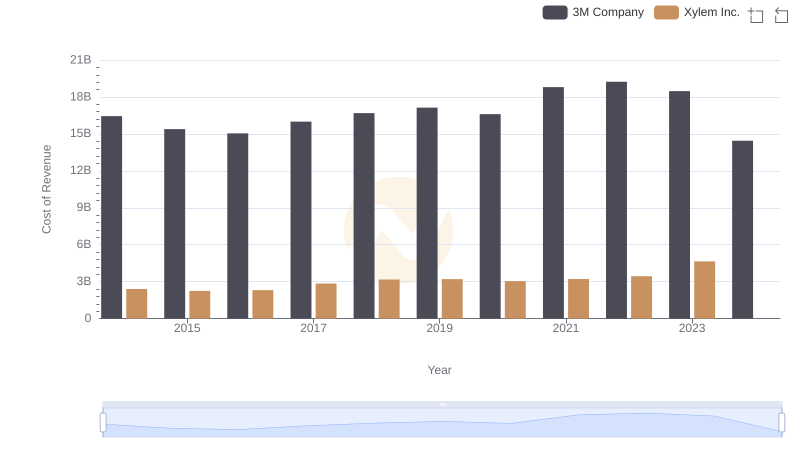

3M Company vs Xylem Inc.: Efficiency in Cost of Revenue Explored

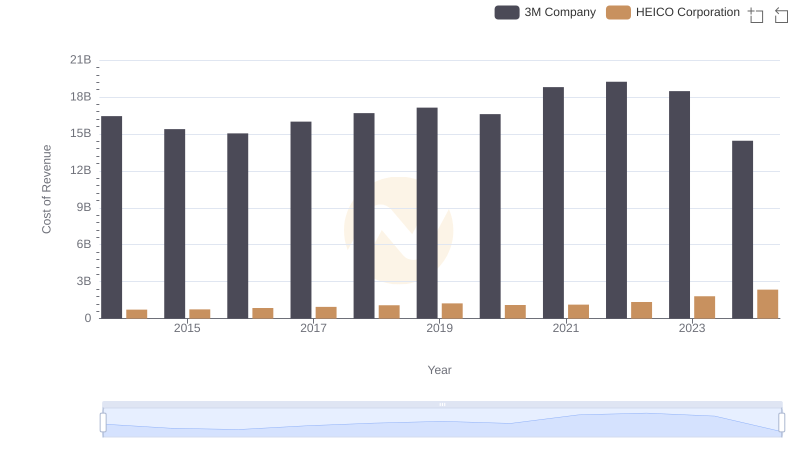

Comparing Cost of Revenue Efficiency: 3M Company vs HEICO Corporation