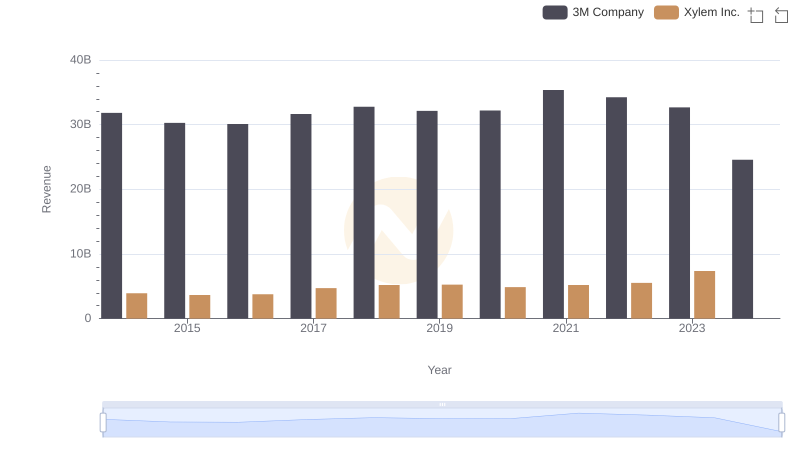

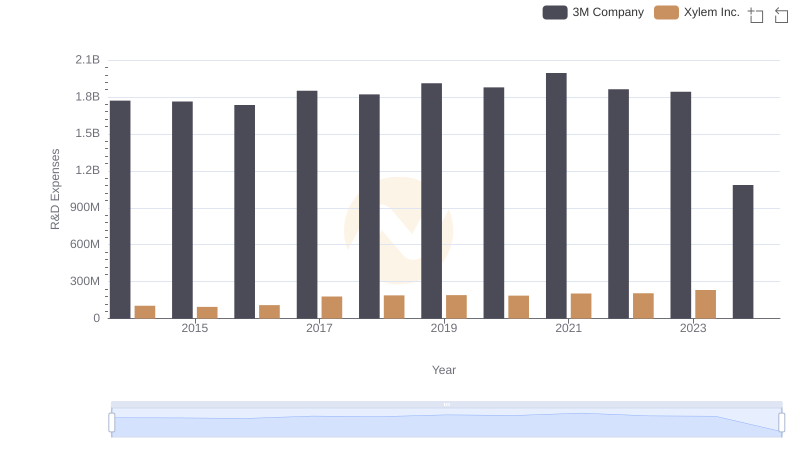

| __timestamp | 3M Company | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 16447000000 | 2403000000 |

| Thursday, January 1, 2015 | 15383000000 | 2249000000 |

| Friday, January 1, 2016 | 15040000000 | 2310000000 |

| Sunday, January 1, 2017 | 16001000000 | 2856000000 |

| Monday, January 1, 2018 | 16682000000 | 3181000000 |

| Tuesday, January 1, 2019 | 17136000000 | 3203000000 |

| Wednesday, January 1, 2020 | 16605000000 | 3046000000 |

| Friday, January 1, 2021 | 18795000000 | 3220000000 |

| Saturday, January 1, 2022 | 19232000000 | 3438000000 |

| Sunday, January 1, 2023 | 18477000000 | 4647000000 |

| Monday, January 1, 2024 | 14447000000 |

Cracking the code

In the ever-evolving landscape of industrial giants, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for 3M Company and Xylem Inc. from 2014 to 2023. Over this decade, 3M consistently maintained a higher cost of revenue, peaking in 2022 with a 15% increase from 2014. Meanwhile, Xylem Inc. showcased a remarkable growth trajectory, with its cost of revenue nearly doubling by 2023, reflecting a strategic expansion.

This comparative analysis highlights the dynamic strategies of these industry leaders, offering insights into their operational efficiencies.

Annual Revenue Comparison: 3M Company vs Xylem Inc.

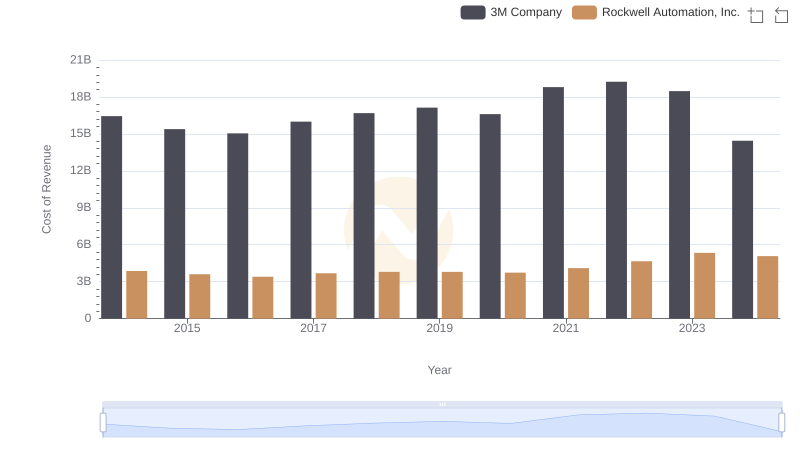

3M Company vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

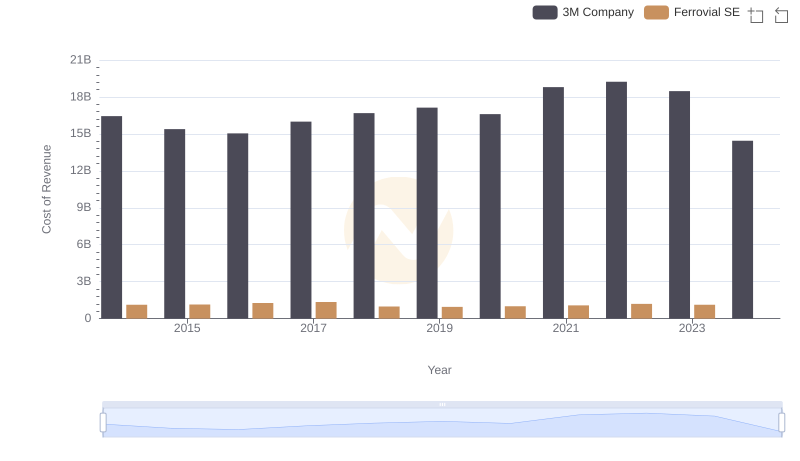

Cost of Revenue Trends: 3M Company vs Ferrovial SE

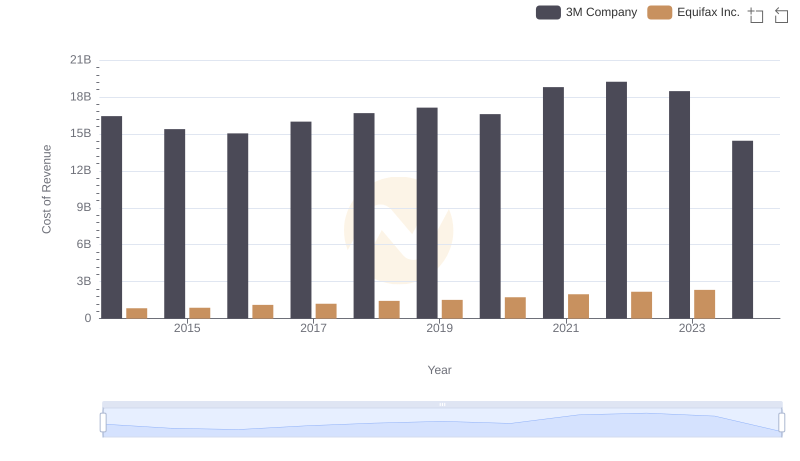

Cost of Revenue Comparison: 3M Company vs Equifax Inc.

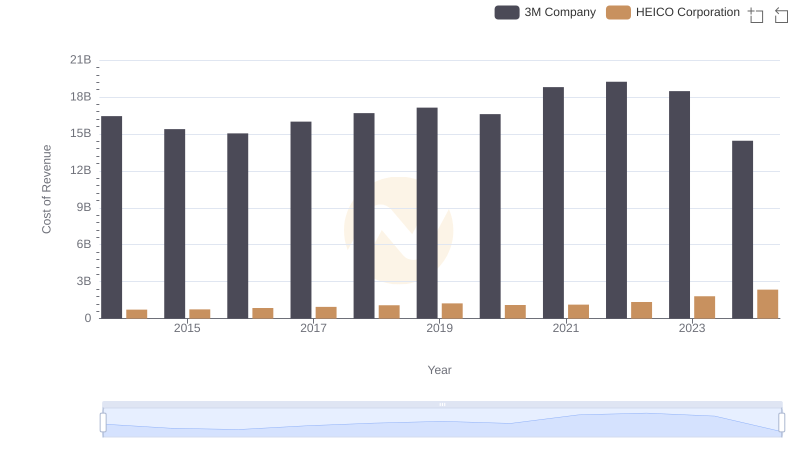

Comparing Cost of Revenue Efficiency: 3M Company vs HEICO Corporation

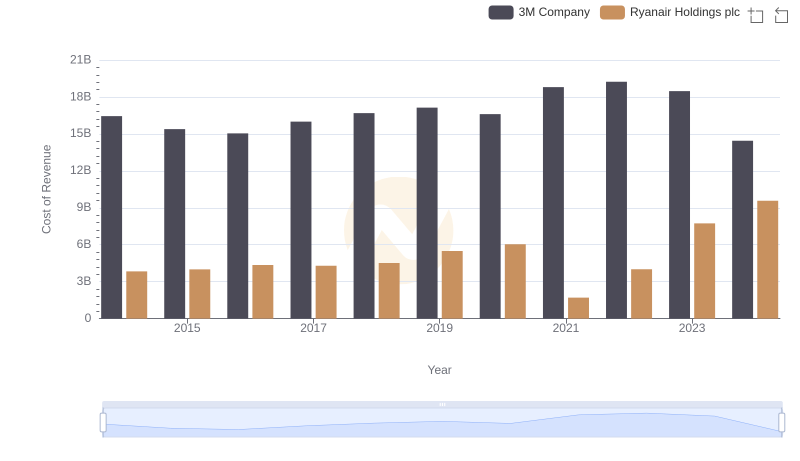

Cost of Revenue Trends: 3M Company vs Ryanair Holdings plc

R&D Insights: How 3M Company and Xylem Inc. Allocate Funds