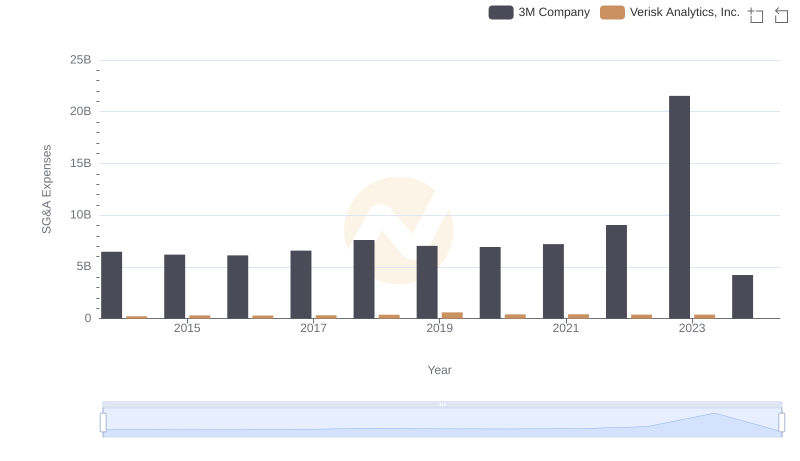

| __timestamp | 3M Company | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 751700000 |

| Thursday, January 1, 2015 | 6182000000 | 884300000 |

| Friday, January 1, 2016 | 6111000000 | 948200000 |

| Sunday, January 1, 2017 | 6572000000 | 1039100000 |

| Monday, January 1, 2018 | 7602000000 | 1213300000 |

| Tuesday, January 1, 2019 | 7029000000 | 1990200000 |

| Wednesday, January 1, 2020 | 6929000000 | 1322500000 |

| Friday, January 1, 2021 | 7197000000 | 1324600000 |

| Saturday, January 1, 2022 | 9049000000 | 1328900000 |

| Sunday, January 1, 2023 | 21526000000 | 1385700000 |

| Monday, January 1, 2024 | 4221000000 | 1450500000 |

Data in motion

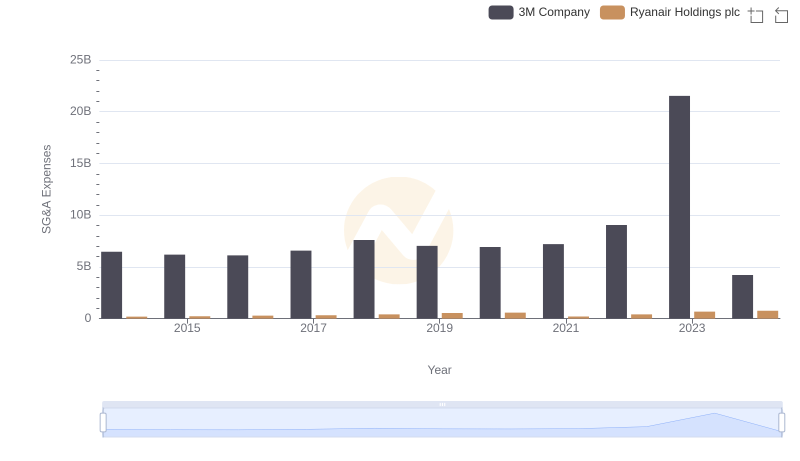

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial. From 2014 to 2023, 3M Company and Equifax Inc. have shown distinct trajectories in their SG&A expenditures. 3M's expenses surged by approximately 233% from 2014 to 2023, peaking in 2023, while Equifax's expenses grew by about 84% over the same period. Notably, 3M's expenses in 2023 were nearly 15 times higher than Equifax's, highlighting a significant divergence in their financial strategies. This disparity underscores the different operational scales and strategic priorities of these two industry leaders. As we look to the future, the absence of data for Equifax in 2024 leaves room for speculation on how these trends will evolve.

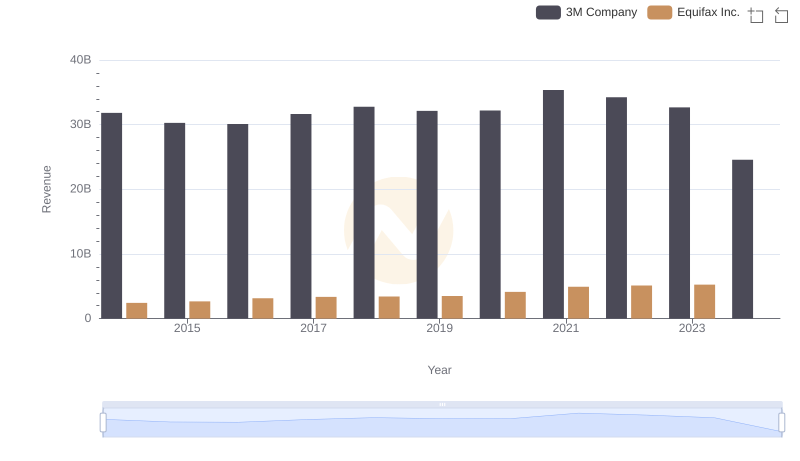

3M Company vs Equifax Inc.: Examining Key Revenue Metrics

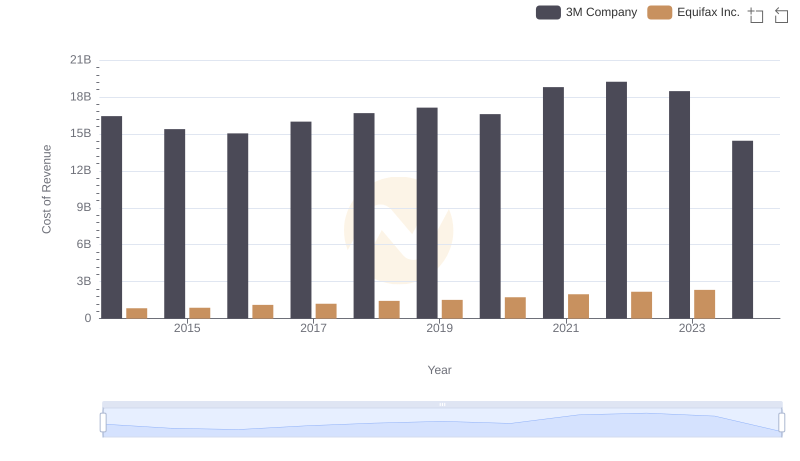

Cost of Revenue Comparison: 3M Company vs Equifax Inc.

3M Company vs United Airlines Holdings, Inc.: SG&A Expense Trends

Key Insights on Gross Profit: 3M Company vs Equifax Inc.

Selling, General, and Administrative Costs: 3M Company vs Verisk Analytics, Inc.

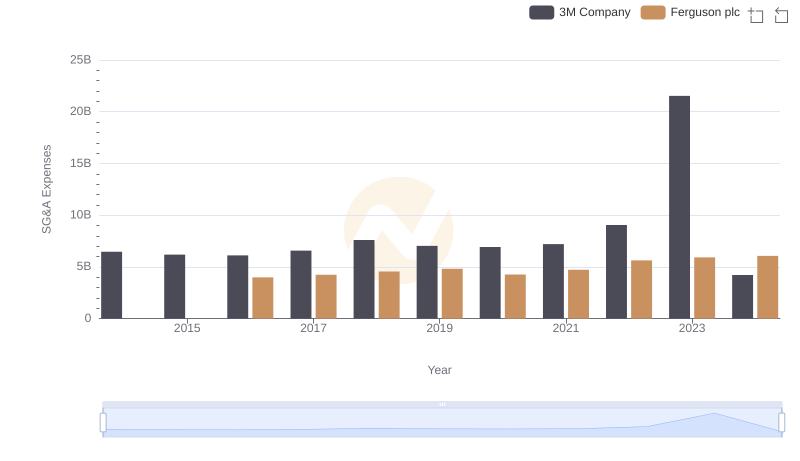

3M Company or Ferguson plc: Who Manages SG&A Costs Better?

Breaking Down SG&A Expenses: 3M Company vs Ryanair Holdings plc

3M Company or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?