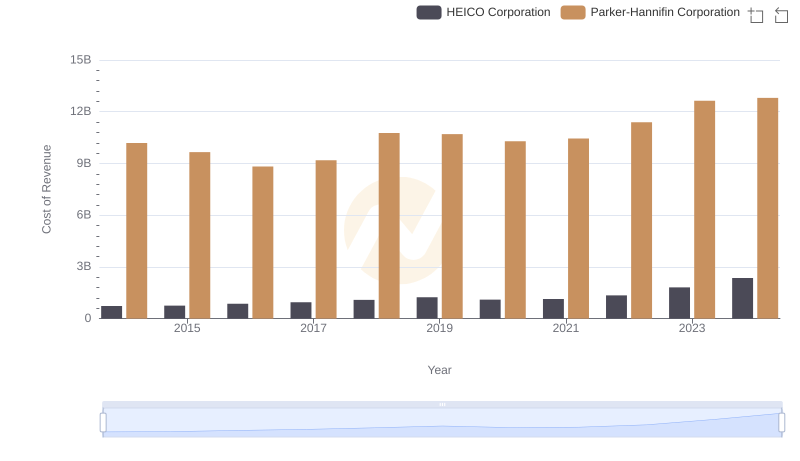

| __timestamp | Equifax Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 10188227000 |

| Thursday, January 1, 2015 | 887400000 | 9655245000 |

| Friday, January 1, 2016 | 1113400000 | 8823384000 |

| Sunday, January 1, 2017 | 1210700000 | 9188962000 |

| Monday, January 1, 2018 | 1440400000 | 10762841000 |

| Tuesday, January 1, 2019 | 1521700000 | 10703484000 |

| Wednesday, January 1, 2020 | 1737400000 | 10286518000 |

| Friday, January 1, 2021 | 1980900000 | 10449680000 |

| Saturday, January 1, 2022 | 2177200000 | 11387267000 |

| Sunday, January 1, 2023 | 2335100000 | 12635892000 |

| Monday, January 1, 2024 | 0 | 12801816000 |

Cracking the code

In the ever-evolving landscape of industrial and financial sectors, understanding cost dynamics is crucial. Parker-Hannifin Corporation, a leader in motion and control technologies, and Equifax Inc., a global data analytics company, present intriguing contrasts in their cost of revenue trends from 2014 to 2023.

Parker-Hannifin's cost of revenue has shown a steady increase, peaking at approximately $12.8 billion in 2023, marking a 26% rise from 2014. This growth reflects the company's expanding operations and market reach. In contrast, Equifax's cost of revenue surged by 176% over the same period, reaching around $2.3 billion in 2023. This sharp increase underscores the growing demand for data services and the associated costs.

While Parker-Hannifin's data extends into 2024, Equifax's data for that year is unavailable, highlighting potential gaps in financial reporting or data collection.

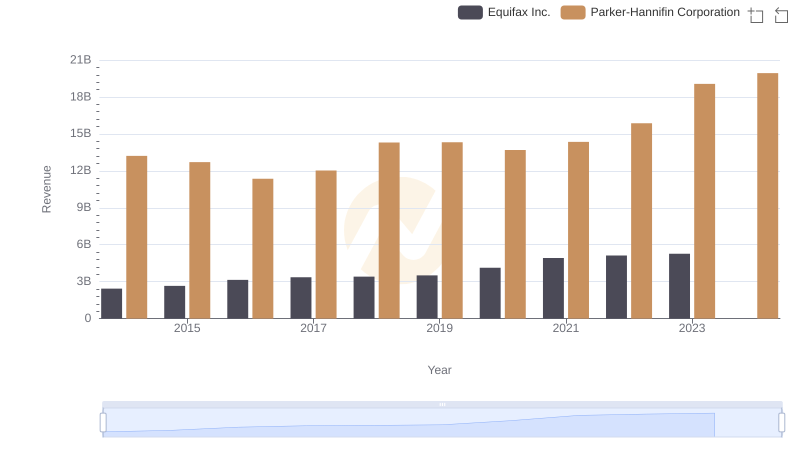

Parker-Hannifin Corporation vs Equifax Inc.: Annual Revenue Growth Compared

Cost of Revenue Comparison: Parker-Hannifin Corporation vs Ferguson plc

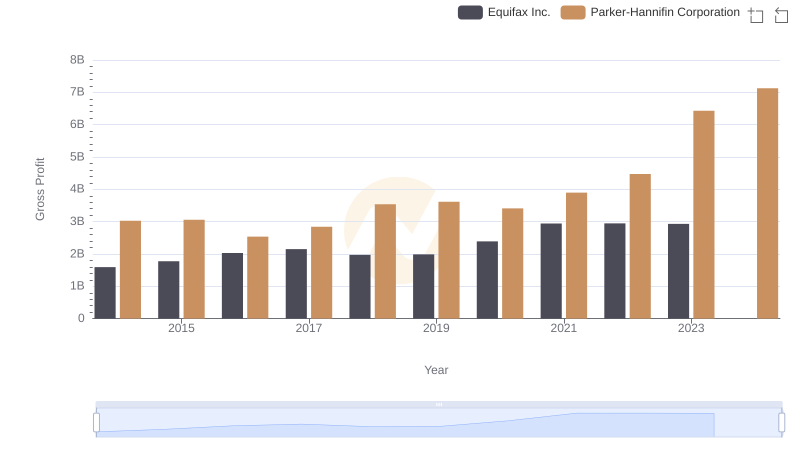

Parker-Hannifin Corporation and Equifax Inc.: A Detailed Gross Profit Analysis

Cost of Revenue Comparison: Parker-Hannifin Corporation vs HEICO Corporation

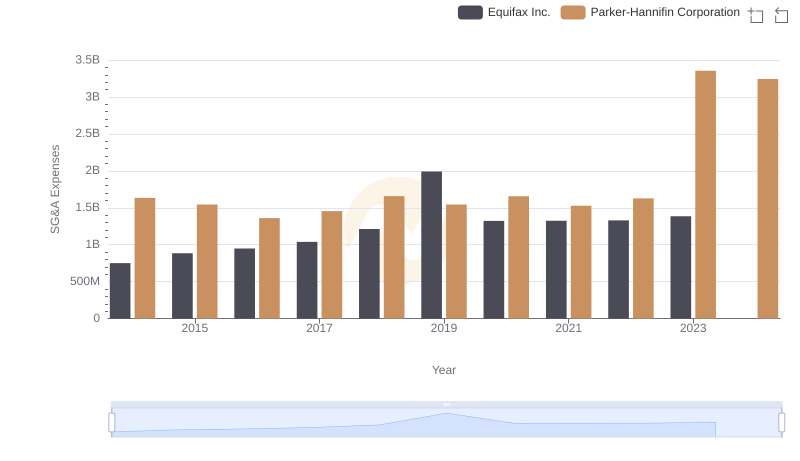

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Equifax Inc.

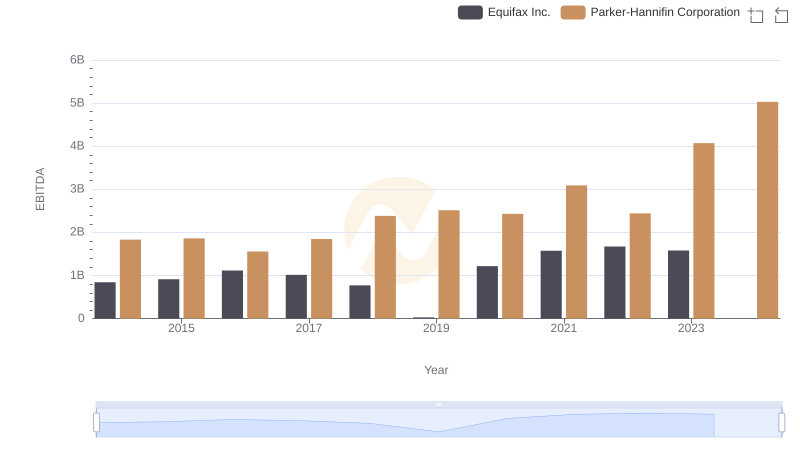

Parker-Hannifin Corporation vs Equifax Inc.: In-Depth EBITDA Performance Comparison