| __timestamp | C.H. Robinson Worldwide, Inc. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 3810000000 |

| Thursday, January 1, 2015 | 358760000 | 3596000000 |

| Friday, January 1, 2016 | 375061000 | 3505000000 |

| Sunday, January 1, 2017 | 413404000 | 3565000000 |

| Monday, January 1, 2018 | 449610000 | 3548000000 |

| Tuesday, January 1, 2019 | 497806000 | 3583000000 |

| Wednesday, January 1, 2020 | 496122000 | 3075000000 |

| Friday, January 1, 2021 | 526371000 | 3256000000 |

| Saturday, January 1, 2022 | 603415000 | 3227000000 |

| Sunday, January 1, 2023 | 624266000 | 3795000000 |

| Monday, January 1, 2024 | 639624000 | 4077000000 |

Data in motion

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A trends of Eaton Corporation plc and C.H. Robinson Worldwide, Inc. over the past decade.

From 2014 to 2023, Eaton Corporation plc consistently managed its SG&A expenses, with a notable dip in 2020, reflecting a strategic response to global economic challenges. By 2023, Eaton's expenses rebounded to nearly 3.8 billion, showcasing a robust recovery strategy.

Conversely, C.H. Robinson Worldwide, Inc. exhibited a steady increase in SG&A expenses, rising by approximately 100% from 2014 to 2023. This growth trajectory highlights the company's expansion efforts and investment in operational capabilities.

Understanding these trends offers valuable insights into each company's strategic priorities and financial health. While Eaton focuses on stability, C.H. Robinson emphasizes growth, each navigating the complex financial waters in their unique way.

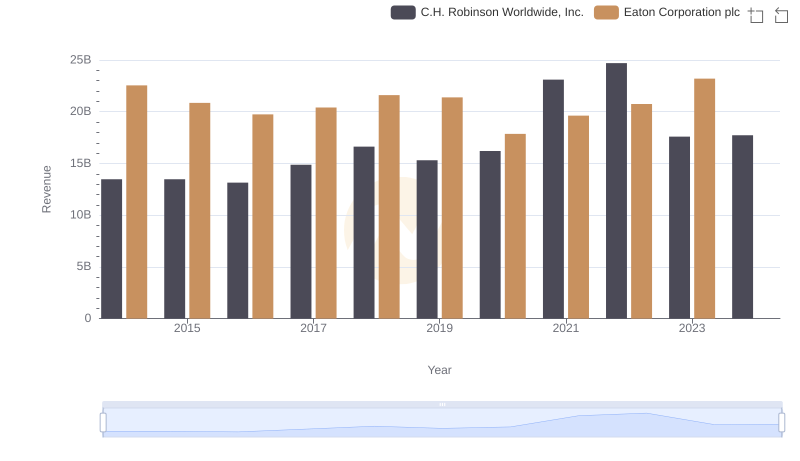

Breaking Down Revenue Trends: Eaton Corporation plc vs C.H. Robinson Worldwide, Inc.

Cost of Revenue: Key Insights for Eaton Corporation plc and C.H. Robinson Worldwide, Inc.

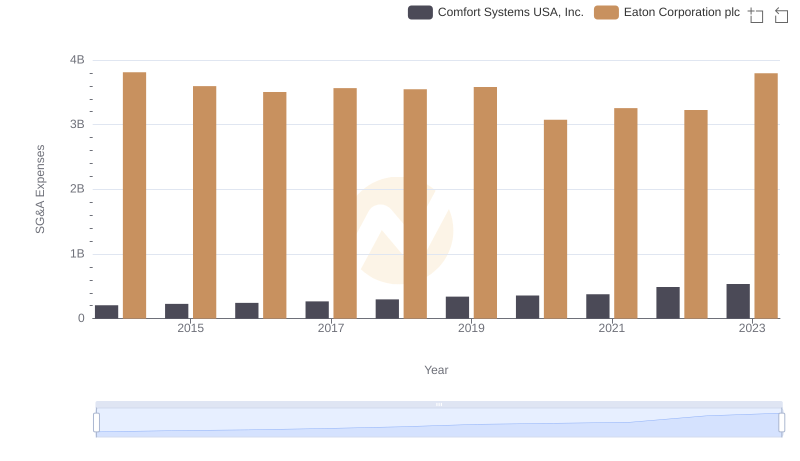

Eaton Corporation plc and Comfort Systems USA, Inc.: SG&A Spending Patterns Compared

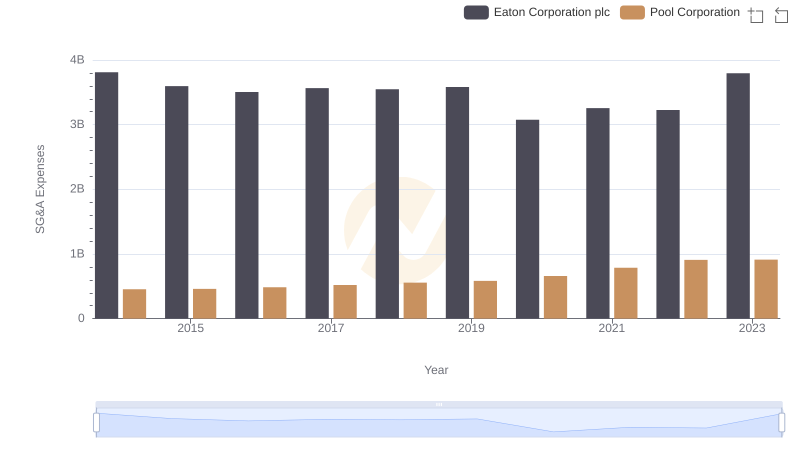

Eaton Corporation plc and Pool Corporation: SG&A Spending Patterns Compared

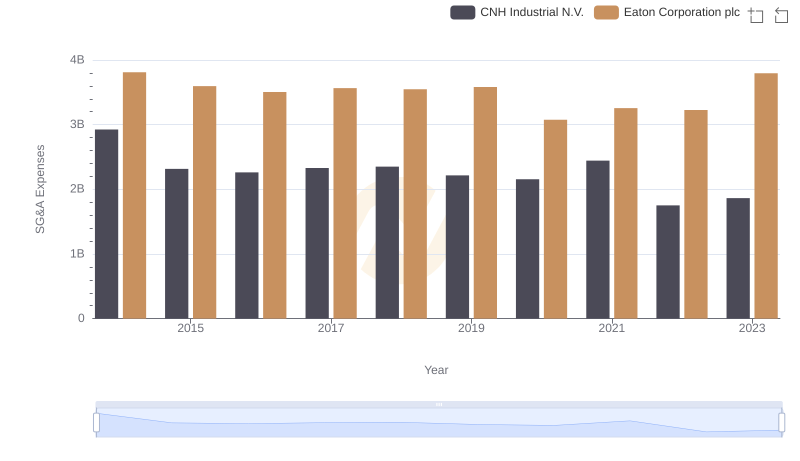

Eaton Corporation plc and CNH Industrial N.V.: SG&A Spending Patterns Compared

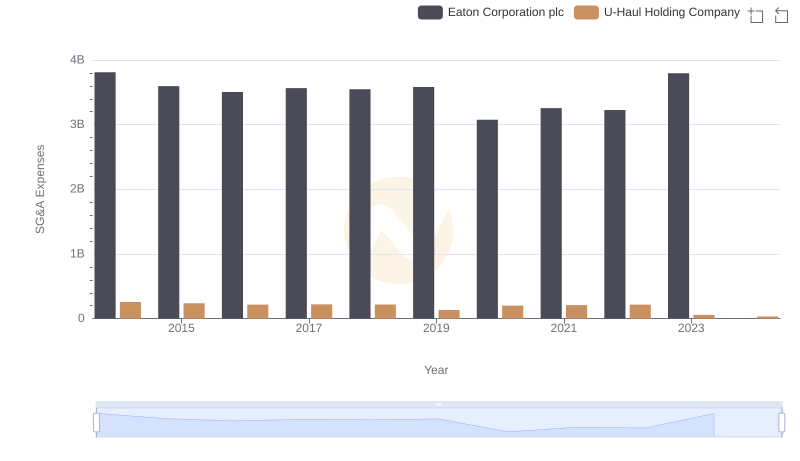

Eaton Corporation plc vs U-Haul Holding Company: SG&A Expense Trends

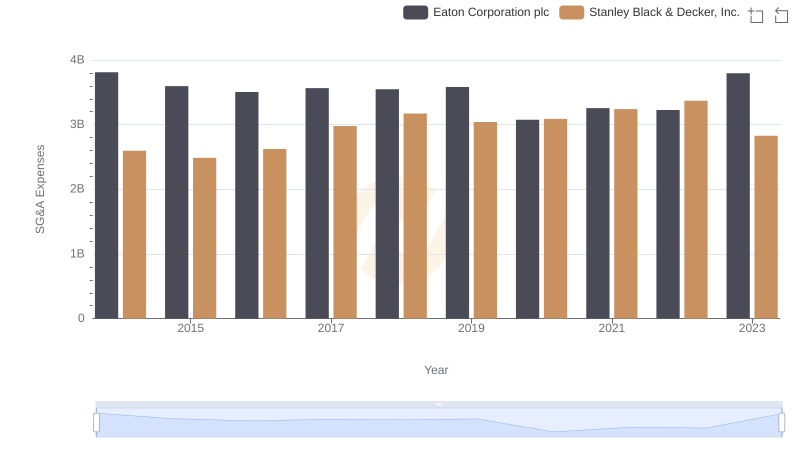

Selling, General, and Administrative Costs: Eaton Corporation plc vs Stanley Black & Decker, Inc.

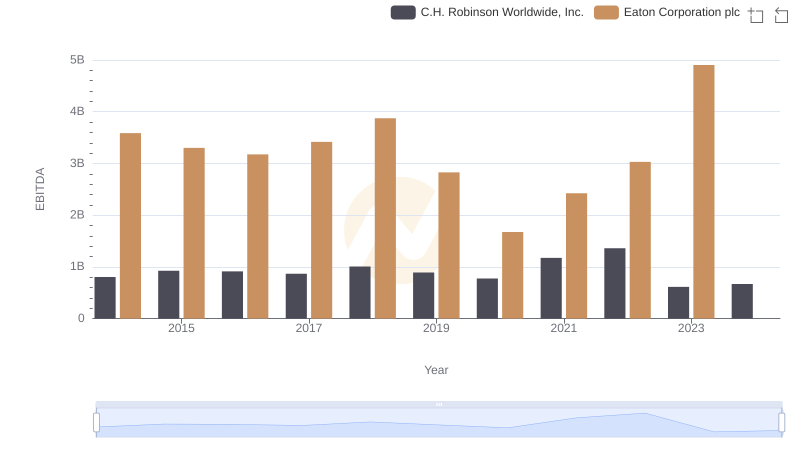

EBITDA Analysis: Evaluating Eaton Corporation plc Against C.H. Robinson Worldwide, Inc.