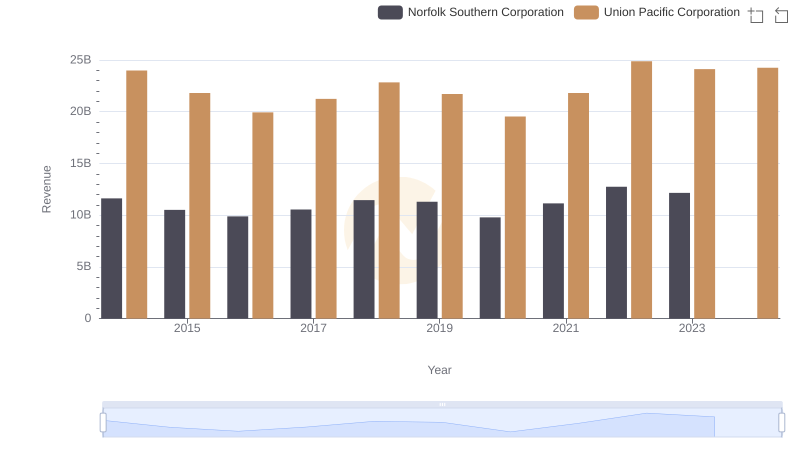

| __timestamp | Norfolk Southern Corporation | Union Pacific Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7109000000 | 14311000000 |

| Thursday, January 1, 2015 | 6651000000 | 12837000000 |

| Friday, January 1, 2016 | 6015000000 | 11672000000 |

| Sunday, January 1, 2017 | 6224000000 | 12231000000 |

| Monday, January 1, 2018 | 6844000000 | 13293000000 |

| Tuesday, January 1, 2019 | 6567000000 | 12094000000 |

| Wednesday, January 1, 2020 | 5749000000 | 10354000000 |

| Friday, January 1, 2021 | 6148000000 | 11290000000 |

| Saturday, January 1, 2022 | 7223000000 | 13670000000 |

| Sunday, January 1, 2023 | 6774000000 | 13590000000 |

| Monday, January 1, 2024 | 7580000000 | 13211000000 |

Igniting the spark of knowledge

In the competitive world of rail transportation, understanding cost dynamics is crucial. Over the past decade, Union Pacific Corporation and Norfolk Southern Corporation have showcased distinct cost trends. Union Pacific's cost of revenue has seen a notable decline of approximately 8% from 2014 to 2023, reflecting strategic efficiency improvements. In contrast, Norfolk Southern's costs have fluctuated, peaking in 2022 with a 10% increase from its 2020 low. This divergence highlights Union Pacific's consistent cost management strategies, while Norfolk Southern navigates a more variable cost landscape. Notably, 2024 data for Norfolk Southern is missing, leaving room for speculation on future trends. As these giants continue to evolve, stakeholders must keep a keen eye on their financial strategies to gauge future performance.

Union Pacific Corporation or Norfolk Southern Corporation: Who Leads in Yearly Revenue?

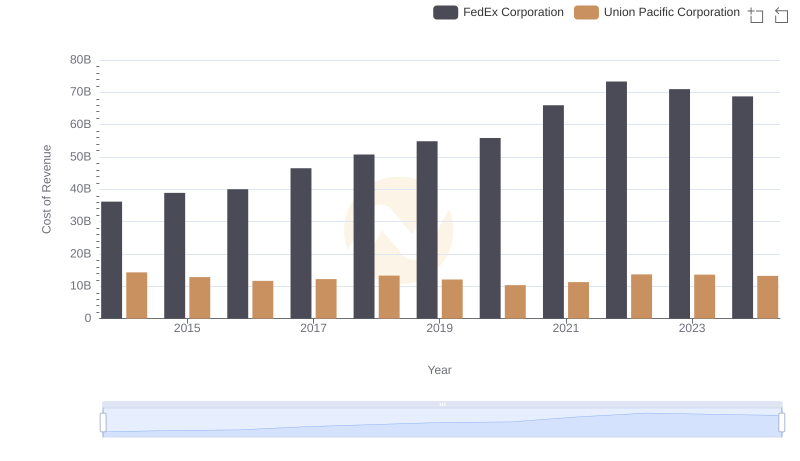

Union Pacific Corporation vs FedEx Corporation: Efficiency in Cost of Revenue Explored

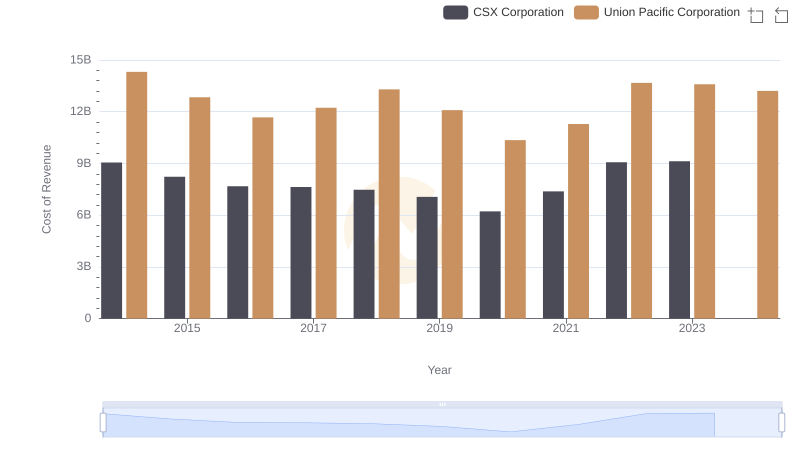

Cost of Revenue Comparison: Union Pacific Corporation vs CSX Corporation

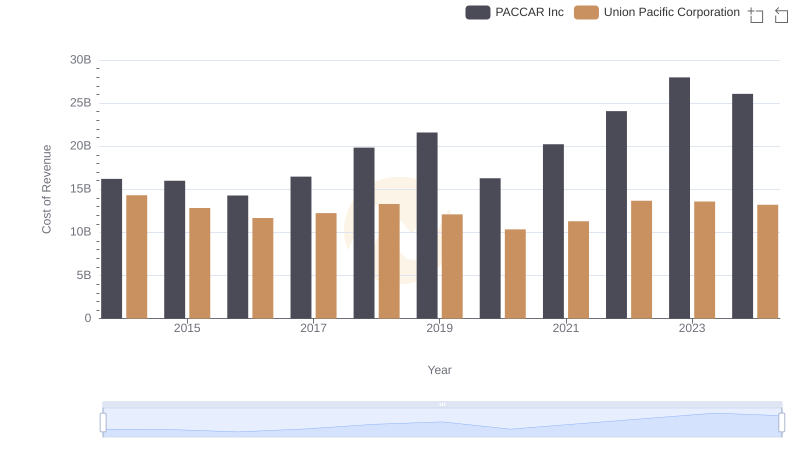

Analyzing Cost of Revenue: Union Pacific Corporation and PACCAR Inc

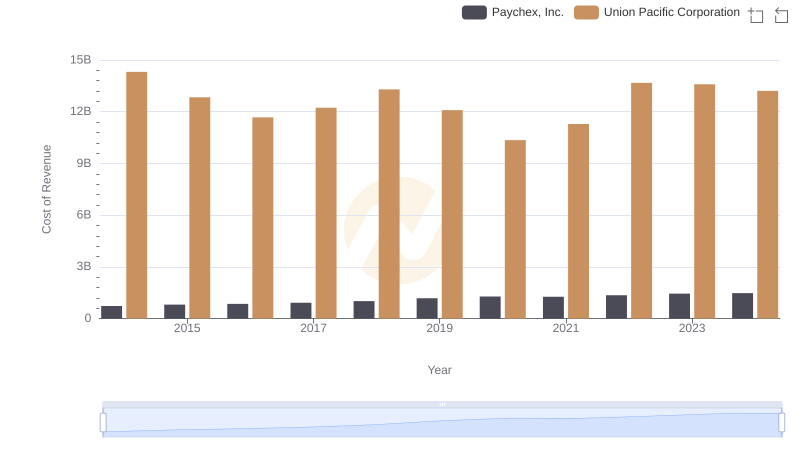

Analyzing Cost of Revenue: Union Pacific Corporation and Paychex, Inc.

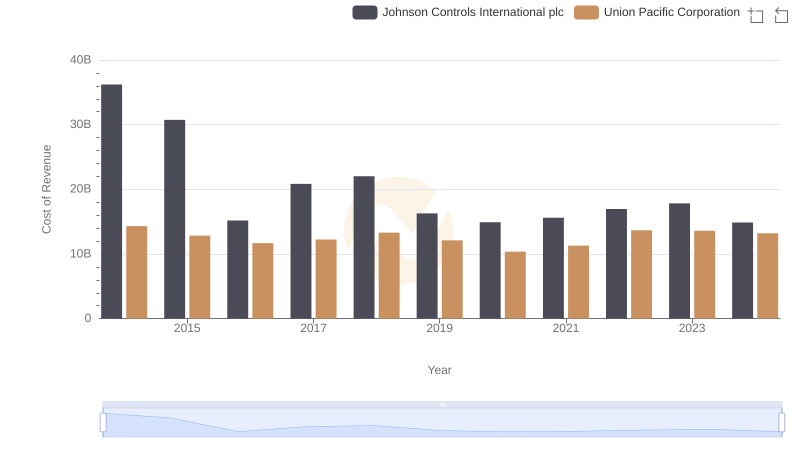

Cost of Revenue Comparison: Union Pacific Corporation vs Johnson Controls International plc

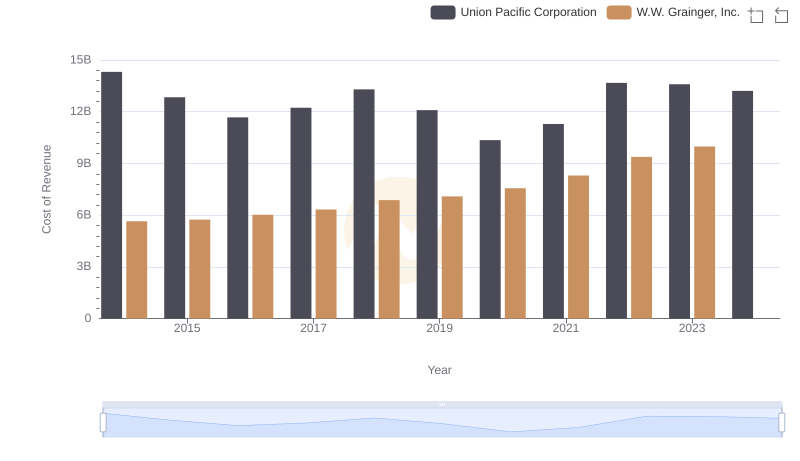

Analyzing Cost of Revenue: Union Pacific Corporation and W.W. Grainger, Inc.