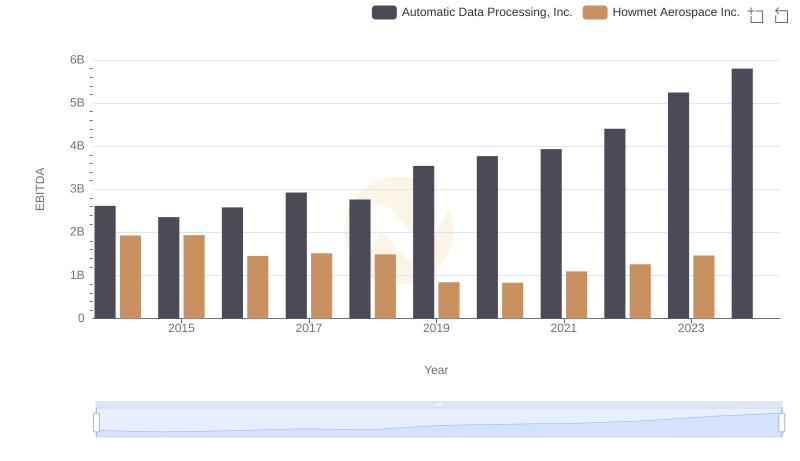

| __timestamp | Automatic Data Processing, Inc. | Howmet Aerospace Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 10349000000 |

| Thursday, January 1, 2015 | 6427600000 | 10104000000 |

| Friday, January 1, 2016 | 6840300000 | 9806000000 |

| Sunday, January 1, 2017 | 7269800000 | 10357000000 |

| Monday, January 1, 2018 | 7842600000 | 11397000000 |

| Tuesday, January 1, 2019 | 8086600000 | 11227000000 |

| Wednesday, January 1, 2020 | 8445100000 | 3878000000 |

| Friday, January 1, 2021 | 8640300000 | 3596000000 |

| Saturday, January 1, 2022 | 9461900000 | 4103000000 |

| Sunday, January 1, 2023 | 9953400000 | 4773000000 |

| Monday, January 1, 2024 | 10476700000 | 5119000000 |

In pursuit of knowledge

In the ever-evolving landscape of American industry, understanding the cost of revenue is crucial for evaluating a company's financial health. Automatic Data Processing, Inc. (ADP) and Howmet Aerospace Inc. offer a fascinating case study. From 2014 to 2023, ADP's cost of revenue has shown a steady upward trend, increasing by approximately 45%, peaking at over $10 billion in 2023. In contrast, Howmet Aerospace experienced a significant drop in 2020, with costs plummeting by nearly 65% from the previous year, reflecting industry-specific challenges. By 2023, Howmet's costs had partially rebounded, yet remained less than half of their 2018 peak. This divergence highlights the resilience of ADP's business model and the volatility faced by aerospace manufacturers. As we look to the future, these trends underscore the importance of strategic cost management in maintaining competitive advantage.

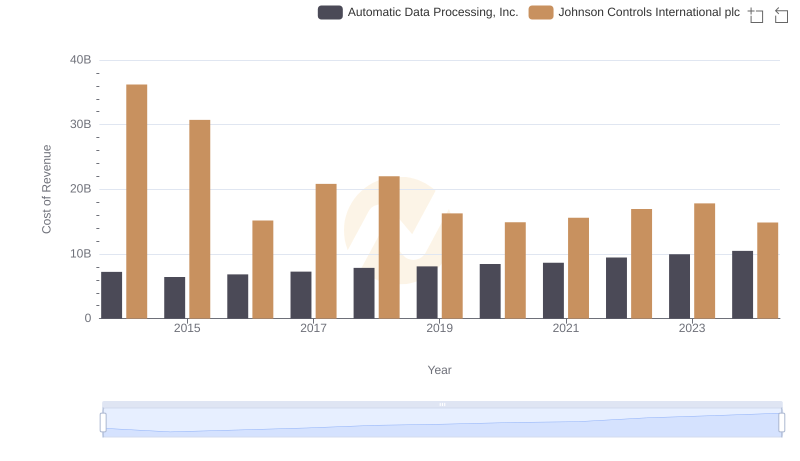

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Johnson Controls International plc's Expenses

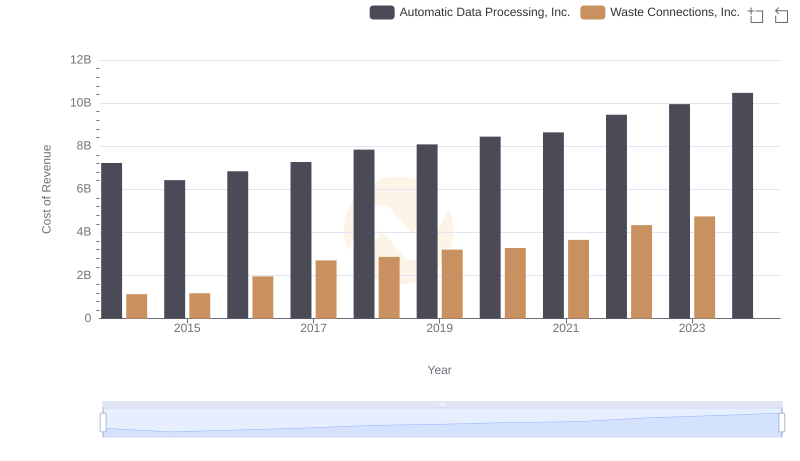

Cost Insights: Breaking Down Automatic Data Processing, Inc. and Waste Connections, Inc.'s Expenses

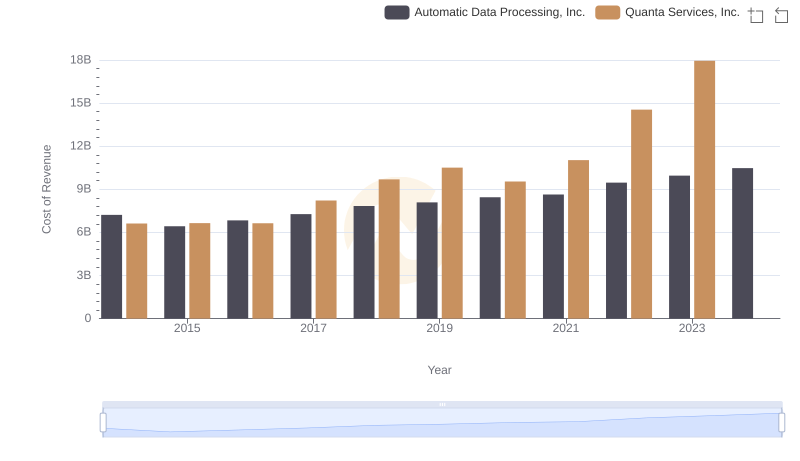

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Quanta Services, Inc.

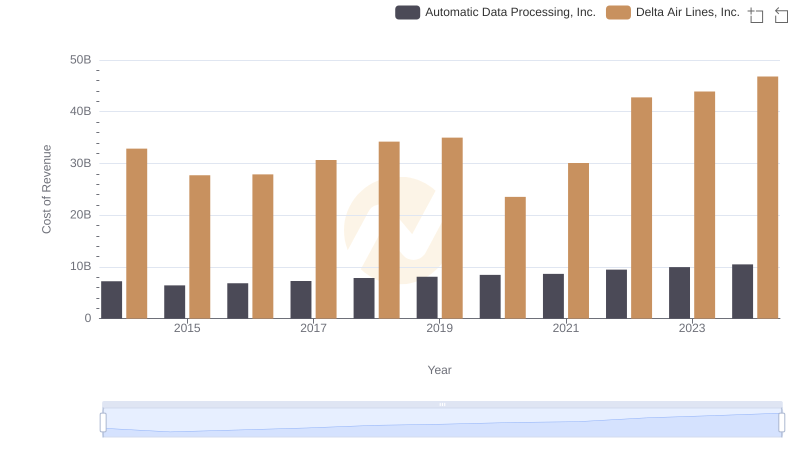

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Delta Air Lines, Inc.

Comparative EBITDA Analysis: Automatic Data Processing, Inc. vs Howmet Aerospace Inc.