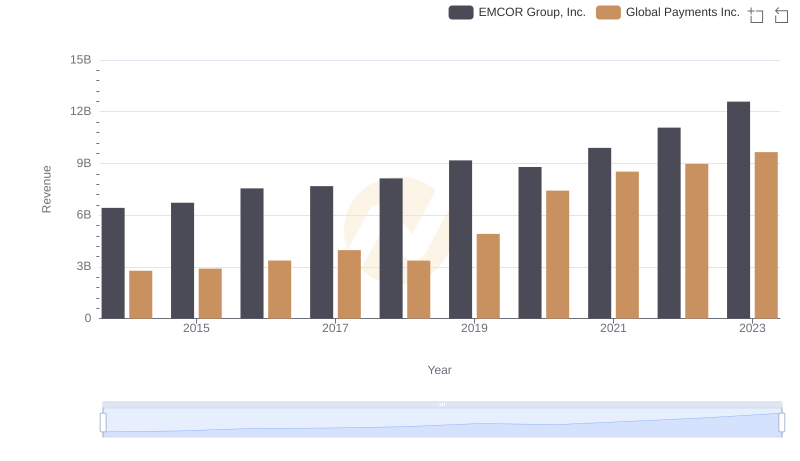

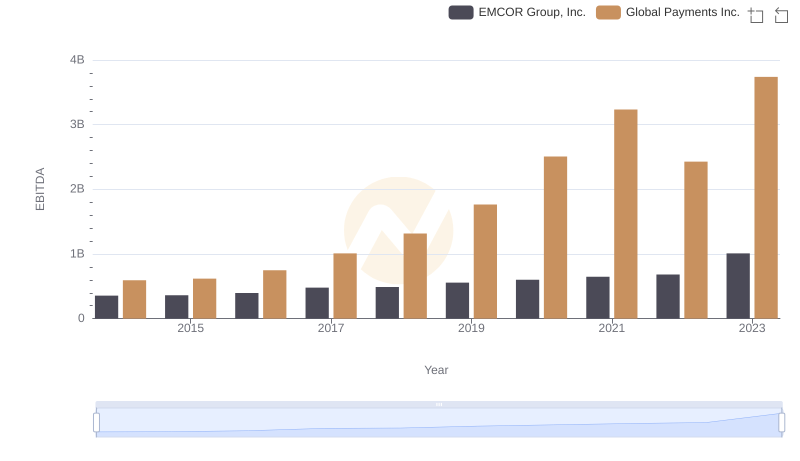

| __timestamp | EMCOR Group, Inc. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5517719000 | 1022107000 |

| Thursday, January 1, 2015 | 5774247000 | 1147639000 |

| Friday, January 1, 2016 | 6513662000 | 1603532000 |

| Sunday, January 1, 2017 | 6539987000 | 1928037000 |

| Monday, January 1, 2018 | 6925178000 | 1095014000 |

| Tuesday, January 1, 2019 | 7818743000 | 2073803000 |

| Wednesday, January 1, 2020 | 7401679000 | 3650727000 |

| Friday, January 1, 2021 | 8401843000 | 3773725000 |

| Saturday, January 1, 2022 | 9472526000 | 3778617000 |

| Sunday, January 1, 2023 | 10493534000 | 3727521000 |

| Monday, January 1, 2024 | 3760116000 |

In pursuit of knowledge

In the ever-evolving landscape of financial efficiency, the cost of revenue is a critical metric for evaluating a company's operational prowess. From 2014 to 2023, EMCOR Group, Inc. consistently outperformed Global Payments Inc. in managing its cost of revenue. EMCOR's cost efficiency improved by approximately 90% over this period, peaking in 2023. In contrast, Global Payments Inc. saw a more modest increase of around 270% in its cost of revenue, indicating a different strategic approach.

EMCOR's steady growth in cost management reflects its robust operational strategies, while Global Payments' fluctuating figures suggest a dynamic adaptation to market demands. This comparison highlights the diverse strategies companies employ to navigate financial challenges. As businesses strive for efficiency, understanding these trends offers valuable insights into the financial health and strategic direction of industry leaders.

Comparing Revenue Performance: Global Payments Inc. or EMCOR Group, Inc.?

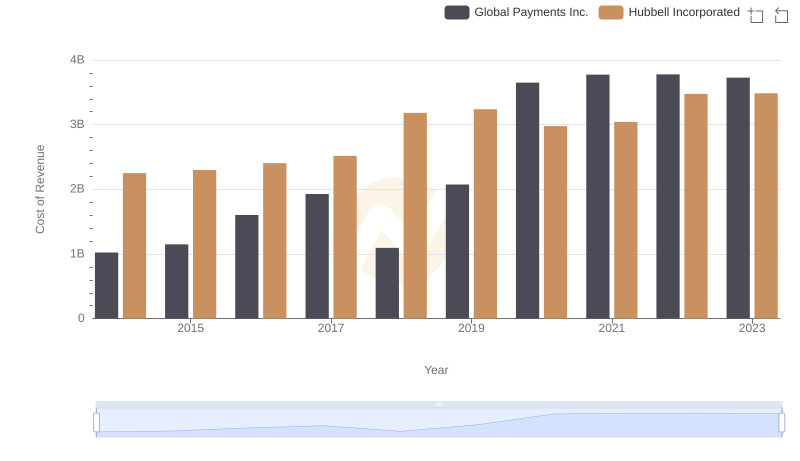

Cost Insights: Breaking Down Global Payments Inc. and Hubbell Incorporated's Expenses

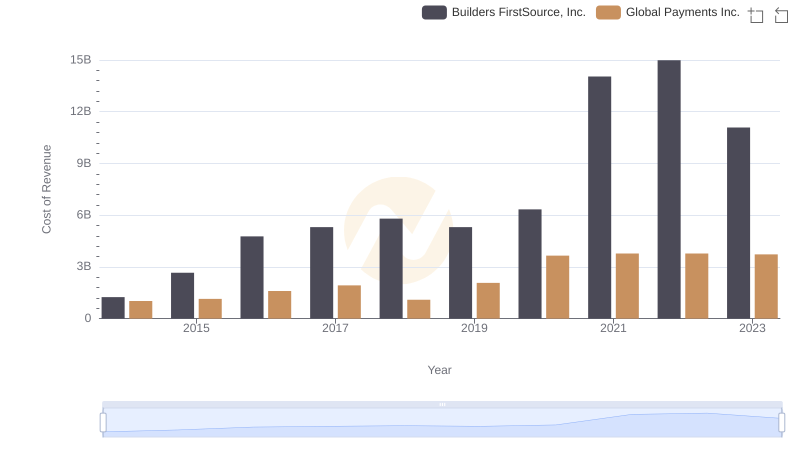

Global Payments Inc. vs Builders FirstSource, Inc.: Efficiency in Cost of Revenue Explored

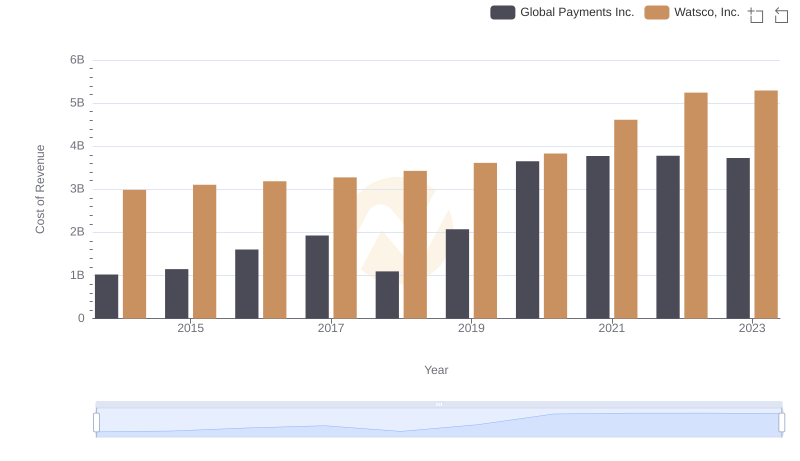

Global Payments Inc. vs Watsco, Inc.: Efficiency in Cost of Revenue Explored

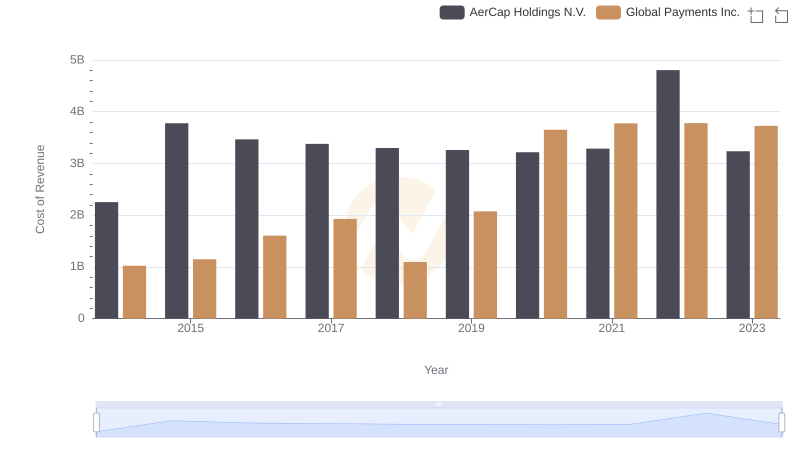

Cost of Revenue: Key Insights for Global Payments Inc. and AerCap Holdings N.V.

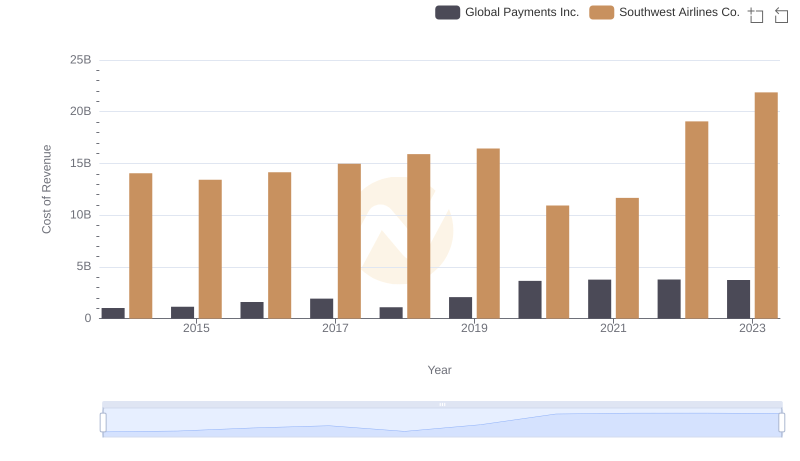

Analyzing Cost of Revenue: Global Payments Inc. and Southwest Airlines Co.

Cost of Revenue Trends: Global Payments Inc. vs TransUnion

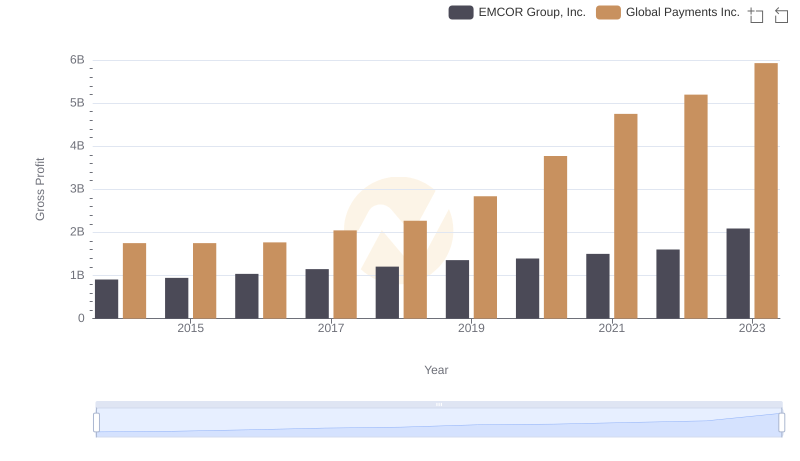

Key Insights on Gross Profit: Global Payments Inc. vs EMCOR Group, Inc.

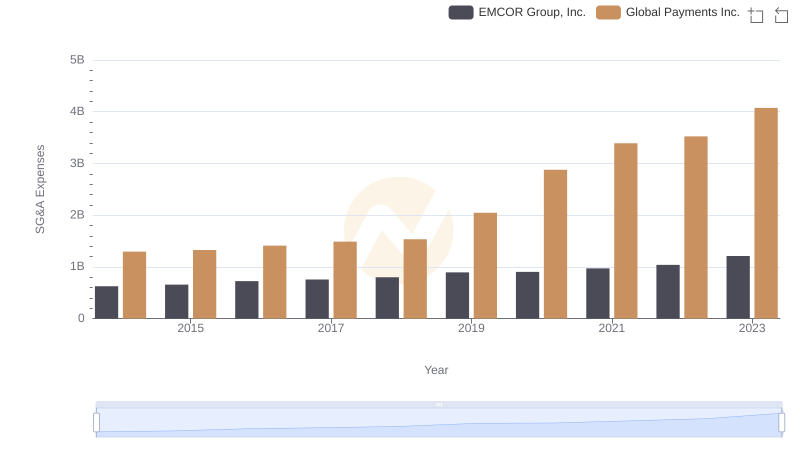

Comparing SG&A Expenses: Global Payments Inc. vs EMCOR Group, Inc. Trends and Insights

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and EMCOR Group, Inc.