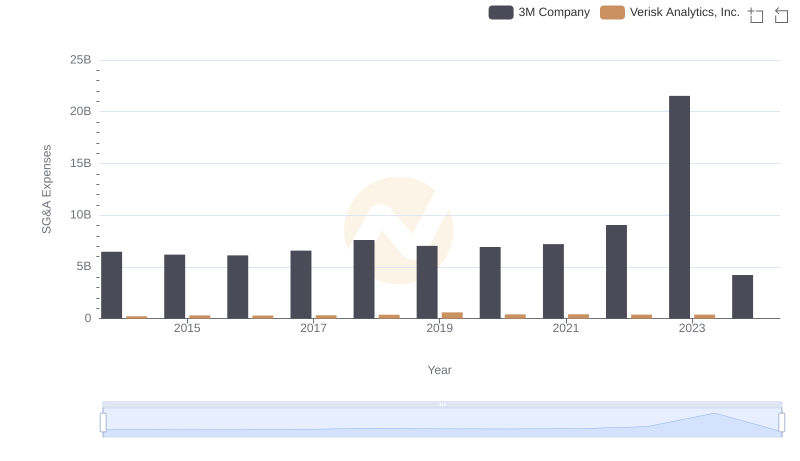

| __timestamp | 3M Company | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 192800000 |

| Thursday, January 1, 2015 | 6182000000 | 233900000 |

| Friday, January 1, 2016 | 6111000000 | 292700000 |

| Sunday, January 1, 2017 | 6572000000 | 322300000 |

| Monday, January 1, 2018 | 7602000000 | 410400000 |

| Tuesday, January 1, 2019 | 7029000000 | 547300000 |

| Wednesday, January 1, 2020 | 6929000000 | 578800000 |

| Friday, January 1, 2021 | 7197000000 | 201500000 |

| Saturday, January 1, 2022 | 9049000000 | 411300000 |

| Sunday, January 1, 2023 | 21526000000 | 674400000 |

| Monday, January 1, 2024 | 4221000000 | 757200000 |

Igniting the spark of knowledge

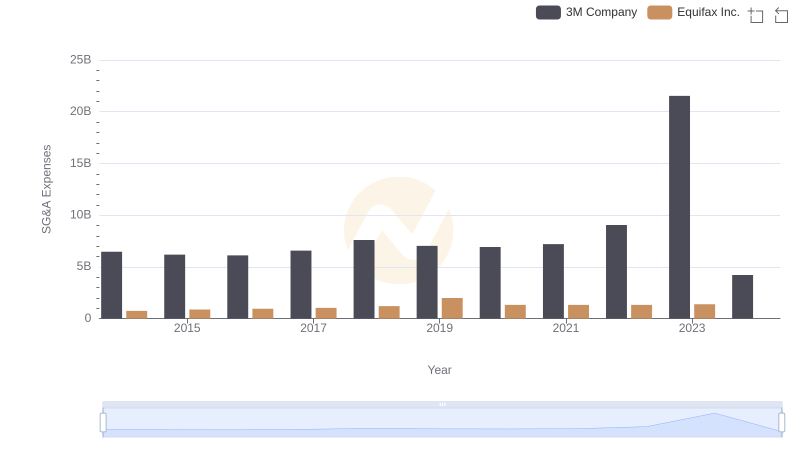

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, 3M Company and Ryanair Holdings plc have showcased contrasting trends in their SG&A expenditures. From 2014 to 2023, 3M's SG&A expenses have seen a significant increase, peaking in 2023 with a staggering 166% rise compared to 2014. This surge reflects strategic investments and operational expansions. In contrast, Ryanair's SG&A expenses have grown more modestly, with a 250% increase over the same period, indicating a more conservative approach to cost management.

The data reveals a fascinating divergence in financial strategies between a manufacturing giant and a leading airline. As businesses navigate post-pandemic recovery, these insights offer valuable lessons in balancing growth with fiscal prudence.

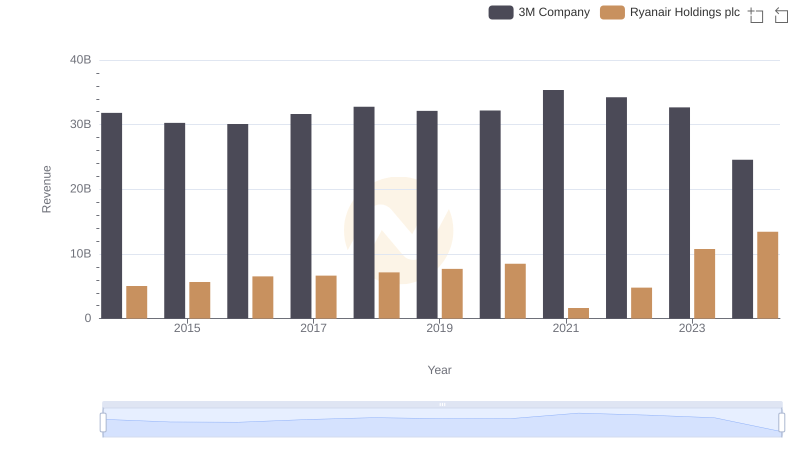

Breaking Down Revenue Trends: 3M Company vs Ryanair Holdings plc

3M Company vs United Airlines Holdings, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: 3M Company vs Verisk Analytics, Inc.

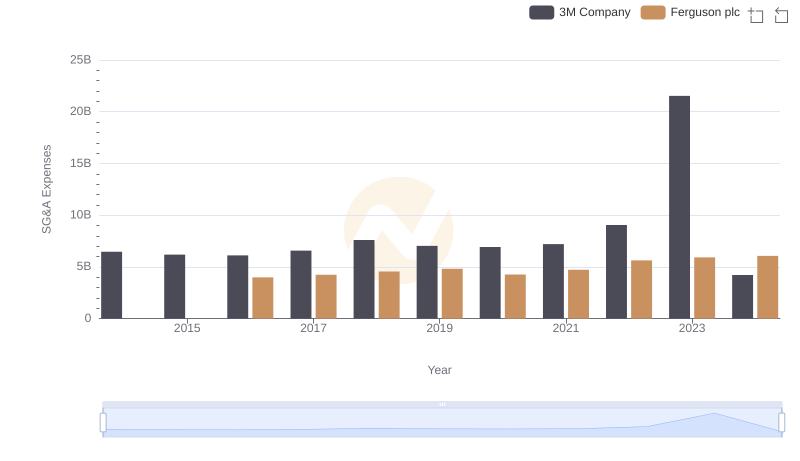

3M Company or Ferguson plc: Who Manages SG&A Costs Better?

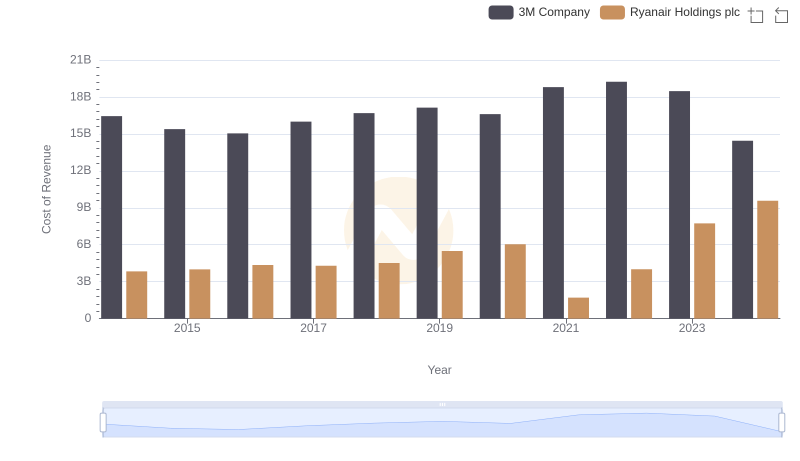

Cost of Revenue Trends: 3M Company vs Ryanair Holdings plc

Comparing SG&A Expenses: 3M Company vs Equifax Inc. Trends and Insights

3M Company or Westinghouse Air Brake Technologies Corporation: Who Manages SG&A Costs Better?