| __timestamp | 3M Company | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 324539000 |

| Thursday, January 1, 2015 | 6182000000 | 319173000 |

| Friday, January 1, 2016 | 6111000000 | 327505000 |

| Sunday, January 1, 2017 | 6572000000 | 482852000 |

| Monday, January 1, 2018 | 7602000000 | 573644000 |

| Tuesday, January 1, 2019 | 7029000000 | 936600000 |

| Wednesday, January 1, 2020 | 6929000000 | 877100000 |

| Friday, January 1, 2021 | 7197000000 | 1005000000 |

| Saturday, January 1, 2022 | 9049000000 | 1020000000 |

| Sunday, January 1, 2023 | 21526000000 | 1139000000 |

| Monday, January 1, 2024 | 4221000000 | 1248000000 |

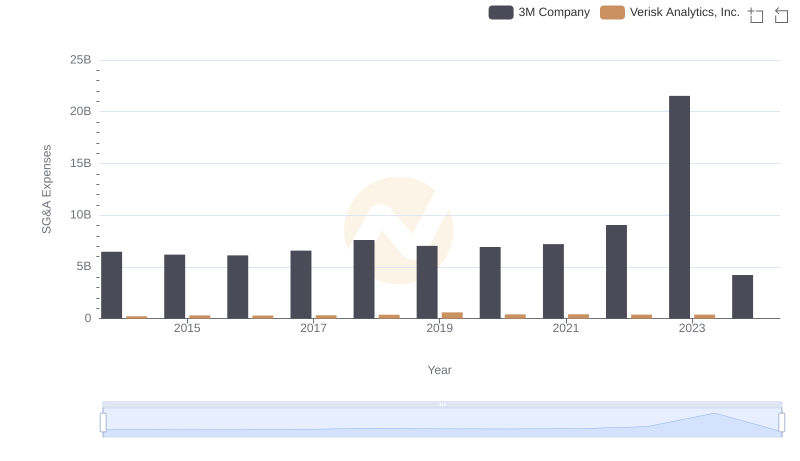

Unlocking the unknown

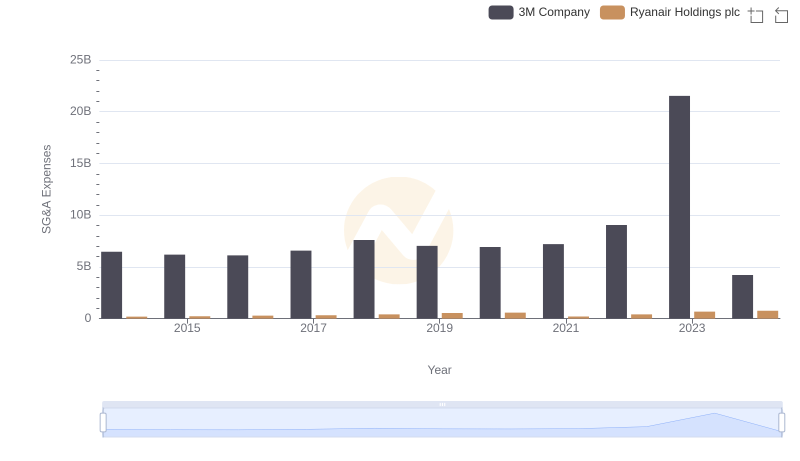

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis compares the SG&A cost management of two industry titans: 3M Company and Westinghouse Air Brake Technologies Corporation (Wabtec) from 2014 to 2023.

3M Company, a global leader in innovation, has seen its SG&A expenses fluctuate over the years, peaking in 2023 with a significant increase. This spike represents a 138% rise from its 2014 levels, indicating potential strategic investments or operational challenges.

Conversely, Wabtec, a key player in rail technology, has maintained a more consistent SG&A expense pattern. Despite a steady increase, their expenses in 2023 were only about 3.5 times higher than in 2014, showcasing a more controlled growth.

This comparison highlights the contrasting strategies of these two companies in managing operational costs amidst evolving market dynamics.

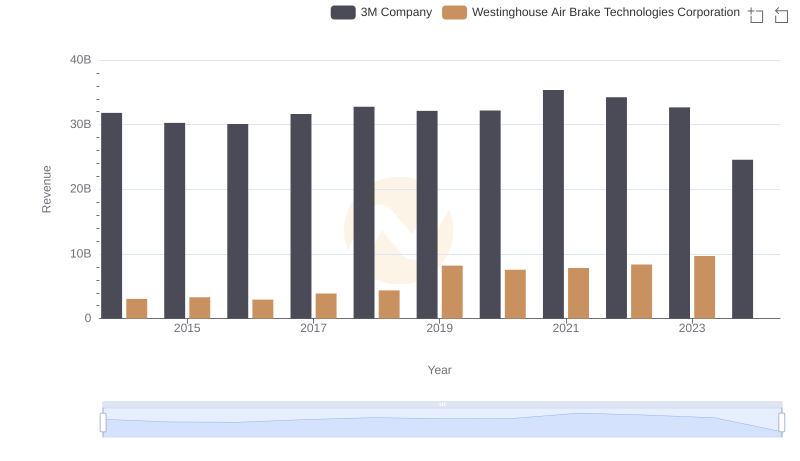

Who Generates More Revenue? 3M Company or Westinghouse Air Brake Technologies Corporation

Selling, General, and Administrative Costs: 3M Company vs Verisk Analytics, Inc.

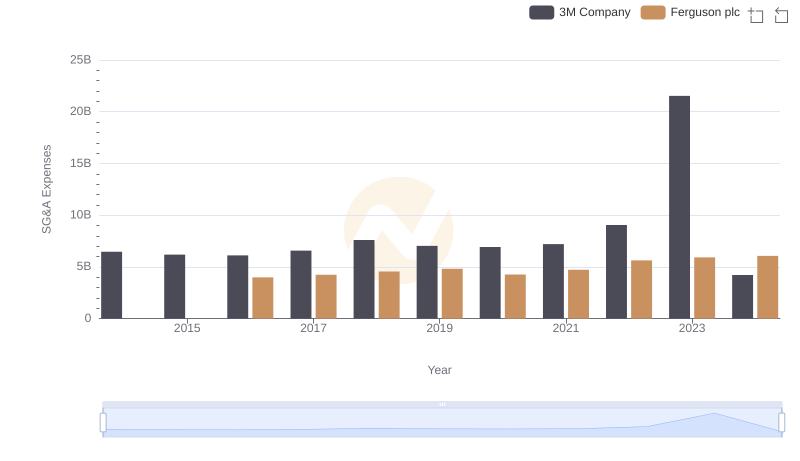

3M Company or Ferguson plc: Who Manages SG&A Costs Better?

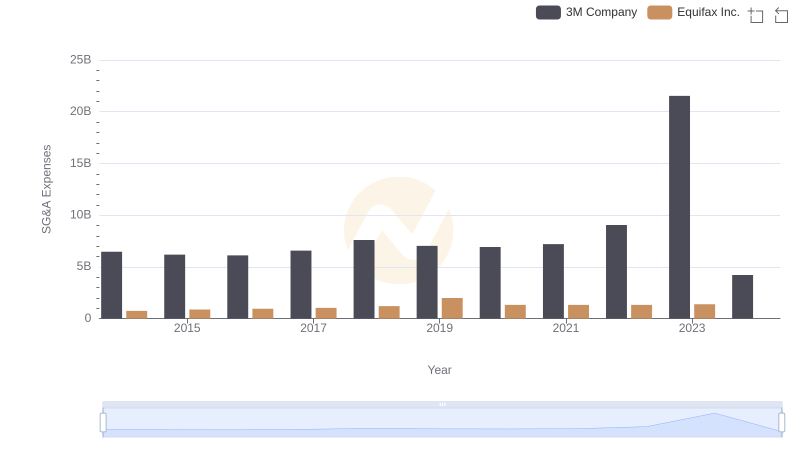

Comparing SG&A Expenses: 3M Company vs Equifax Inc. Trends and Insights

Breaking Down SG&A Expenses: 3M Company vs Ryanair Holdings plc