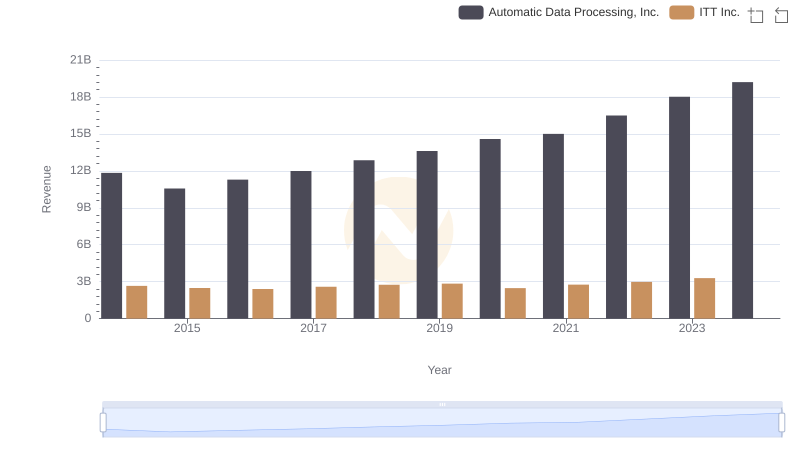

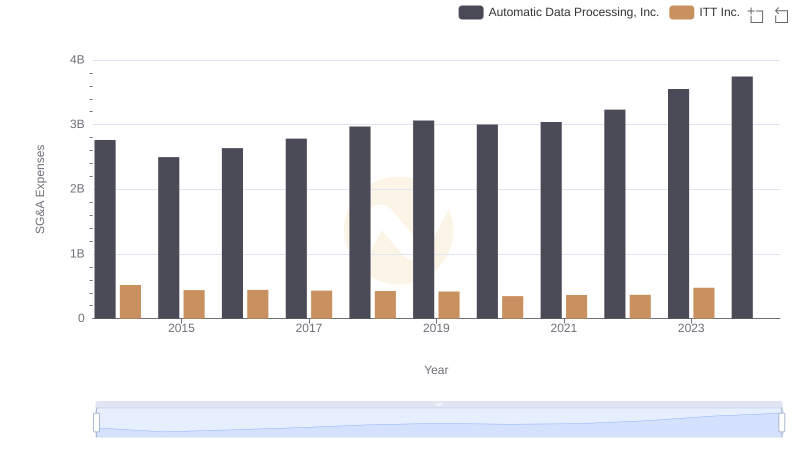

| __timestamp | Automatic Data Processing, Inc. | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 1788200000 |

| Thursday, January 1, 2015 | 6427600000 | 1676500000 |

| Friday, January 1, 2016 | 6840300000 | 1647200000 |

| Sunday, January 1, 2017 | 7269800000 | 1768100000 |

| Monday, January 1, 2018 | 7842600000 | 1857900000 |

| Tuesday, January 1, 2019 | 8086600000 | 1936300000 |

| Wednesday, January 1, 2020 | 8445100000 | 1695600000 |

| Friday, January 1, 2021 | 8640300000 | 1865500000 |

| Saturday, January 1, 2022 | 9461900000 | 2065400000 |

| Sunday, January 1, 2023 | 9953400000 | 2175700000 |

| Monday, January 1, 2024 | 10476700000 | 2383400000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. Over the past decade, Automatic Data Processing, Inc. (ADP) and ITT Inc. have showcased distinct trajectories in managing their cost of revenue. ADP, a leader in human resources management, has seen its cost of revenue grow by approximately 45% from 2014 to 2023, reflecting its expanding operations and market reach. In contrast, ITT Inc., a diversified manufacturer, has maintained a more stable cost structure, with a modest increase of around 22% over the same period.

The data reveals that ADP's cost efficiency has been more dynamic, with significant growth in recent years, peaking in 2023. Meanwhile, ITT's consistent cost management strategy highlights its focus on operational stability. Notably, data for 2024 is incomplete, suggesting a need for further analysis to understand future trends. This comparison underscores the diverse strategies companies employ to navigate financial challenges.

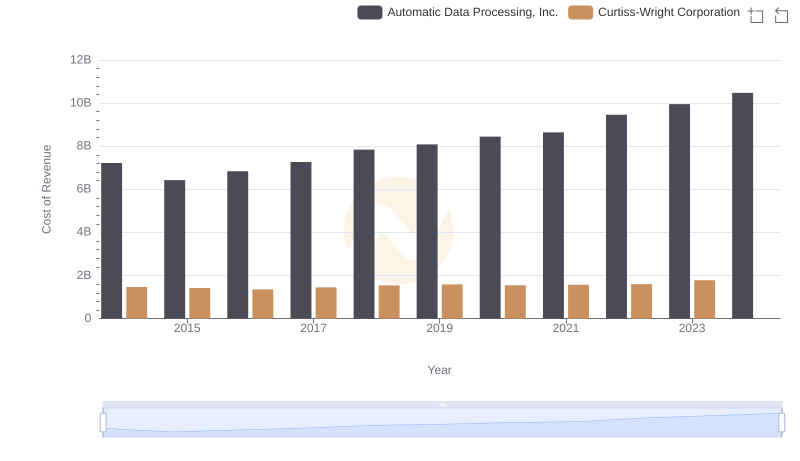

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Curtiss-Wright Corporation

Automatic Data Processing, Inc. and ITT Inc.: A Comprehensive Revenue Analysis

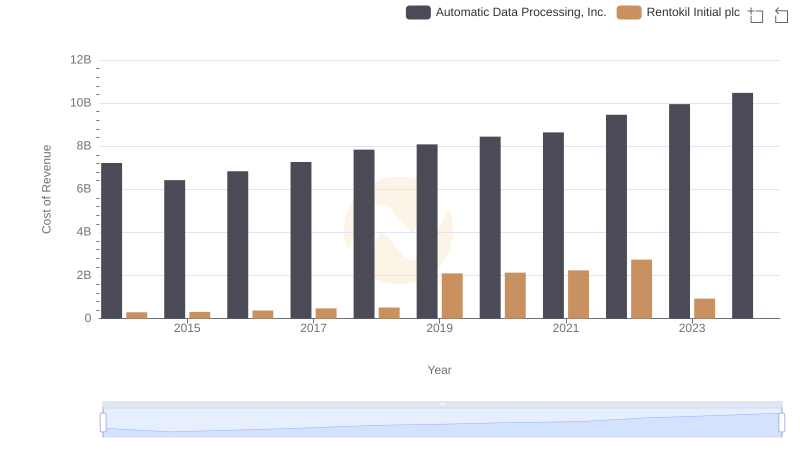

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Rentokil Initial plc

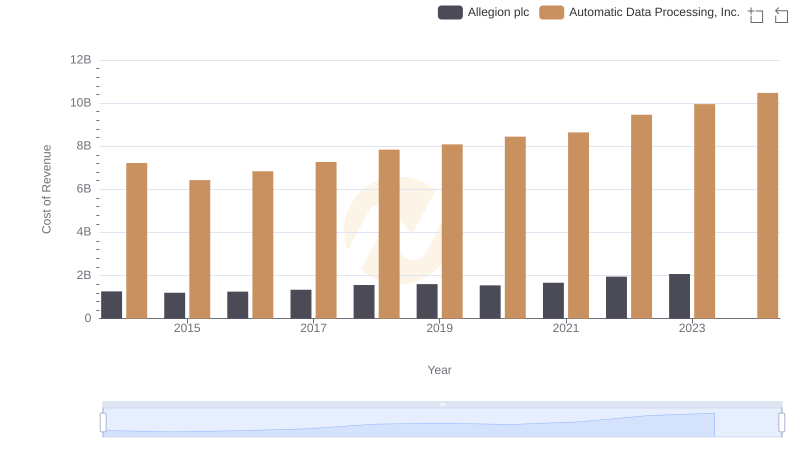

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Allegion plc

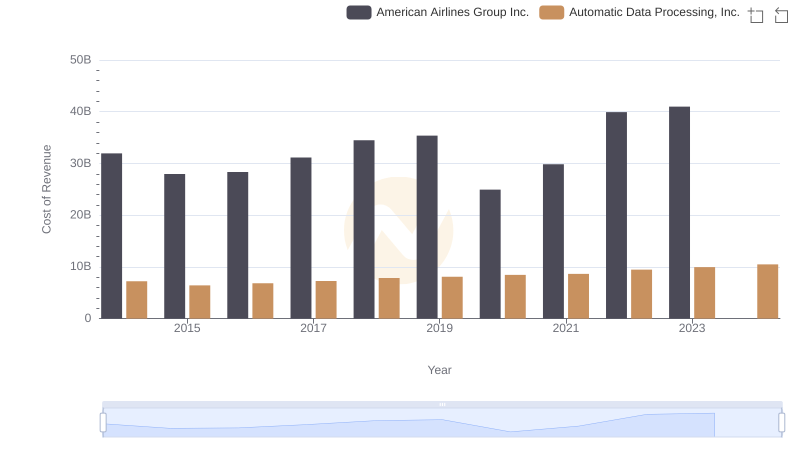

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and American Airlines Group Inc.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or ITT Inc.

EBITDA Performance Review: Automatic Data Processing, Inc. vs ITT Inc.