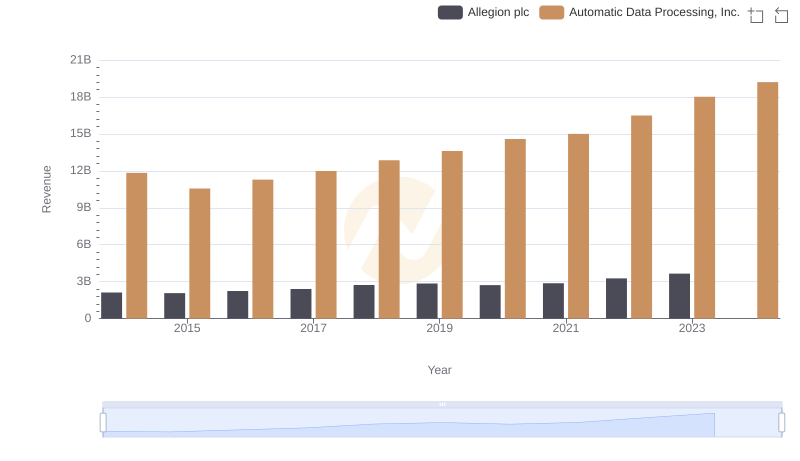

| __timestamp | Allegion plc | Automatic Data Processing, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1264600000 | 7221400000 |

| Thursday, January 1, 2015 | 1199000000 | 6427600000 |

| Friday, January 1, 2016 | 1252700000 | 6840300000 |

| Sunday, January 1, 2017 | 1337500000 | 7269800000 |

| Monday, January 1, 2018 | 1558400000 | 7842600000 |

| Tuesday, January 1, 2019 | 1601700000 | 8086600000 |

| Wednesday, January 1, 2020 | 1541100000 | 8445100000 |

| Friday, January 1, 2021 | 1662500000 | 8640300000 |

| Saturday, January 1, 2022 | 1949500000 | 9461900000 |

| Sunday, January 1, 2023 | 2069300000 | 9953400000 |

| Monday, January 1, 2024 | 2103700000 | 10476700000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis juxtaposes the cost of revenue efficiency between Automatic Data Processing, Inc. (ADP) and Allegion plc from 2014 to 2023. Over this decade, ADP consistently outperformed Allegion, with its cost of revenue peaking at approximately $10 billion in 2023, marking a 38% increase from 2014. In contrast, Allegion's cost of revenue rose by 64% over the same period, reaching around $2 billion in 2023. This disparity highlights ADP's robust scalability and operational efficiency, despite Allegion's faster growth rate. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends. As businesses navigate the complexities of cost management, these insights offer a valuable lens into the strategic maneuvers of industry leaders.

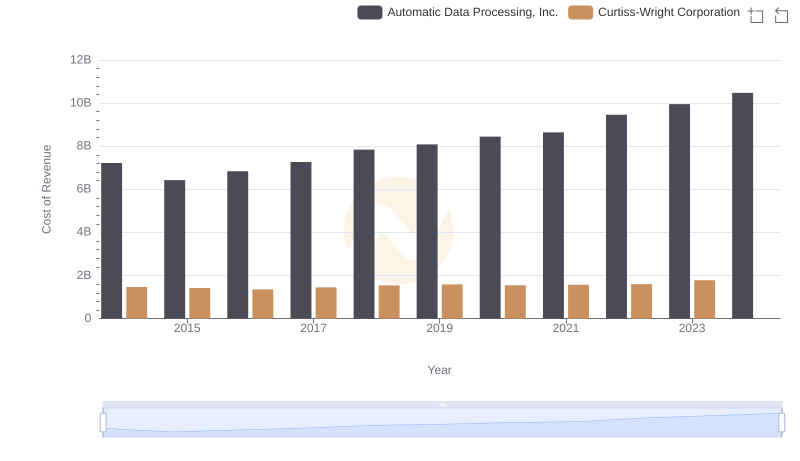

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Curtiss-Wright Corporation

Automatic Data Processing, Inc. and Allegion plc: A Comprehensive Revenue Analysis

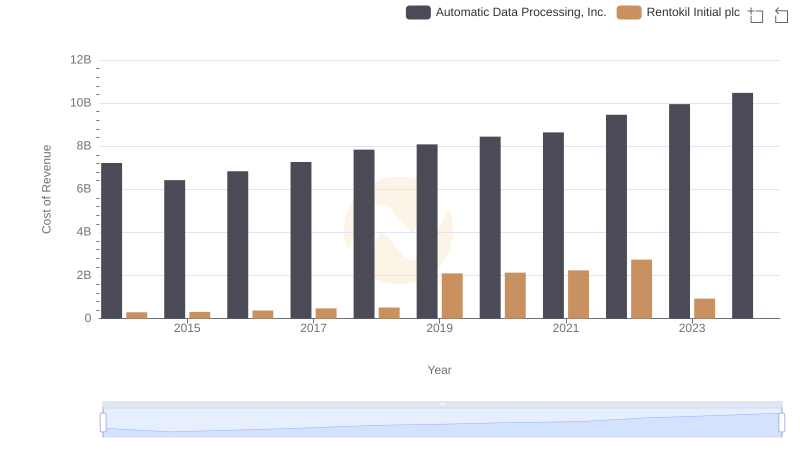

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Rentokil Initial plc

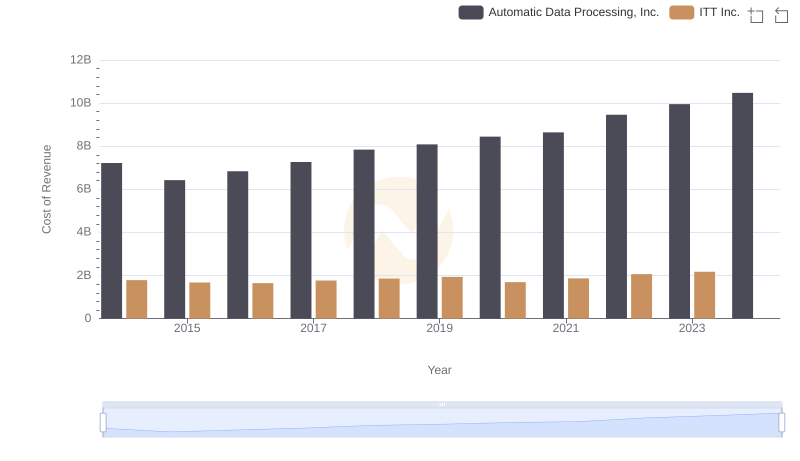

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs ITT Inc.

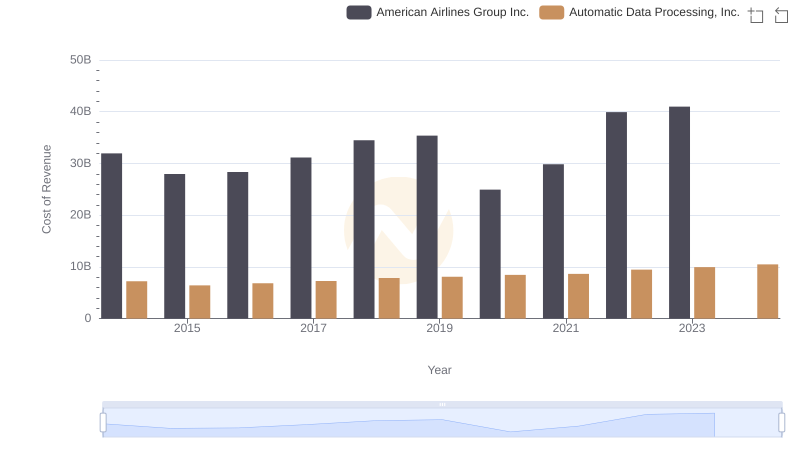

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and American Airlines Group Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Allegion plc