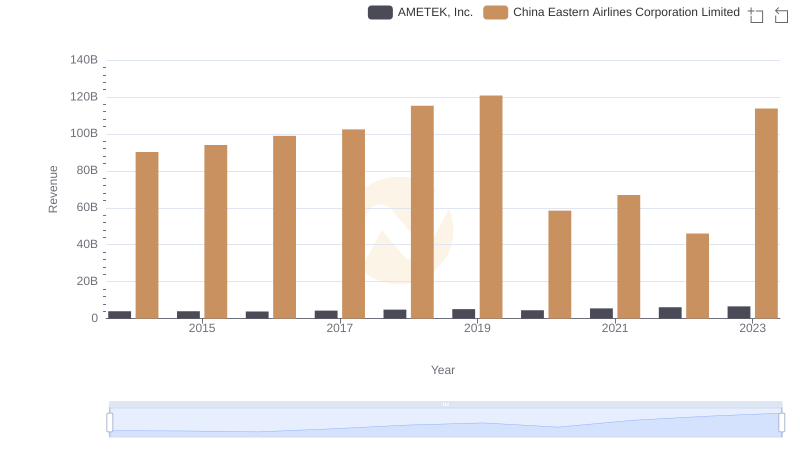

| __timestamp | AMETEK, Inc. | China Eastern Airlines Corporation Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 2597017000 | 78741000000 |

| Thursday, January 1, 2015 | 2549280000 | 77237000000 |

| Friday, January 1, 2016 | 2575220000 | 82676000000 |

| Sunday, January 1, 2017 | 2851431000 | 91592000000 |

| Monday, January 1, 2018 | 3186310000 | 103476000000 |

| Tuesday, January 1, 2019 | 3370897000 | 108865000000 |

| Wednesday, January 1, 2020 | 2996515000 | 72523000000 |

| Friday, January 1, 2021 | 3633900000 | 81828000000 |

| Saturday, January 1, 2022 | 4005261000 | 74599000000 |

| Sunday, January 1, 2023 | 4212484999 | 112461000000 |

| Monday, January 1, 2024 | 0 |

Unleashing the power of data

In the world of corporate finance, understanding cost efficiency is crucial. This chart compares the cost of revenue efficiency between AMETEK, Inc. and China Eastern Airlines Corporation Limited from 2014 to 2023. Over this period, AMETEK, a leading global manufacturer of electronic instruments, maintained a relatively stable cost of revenue, averaging around $3.2 billion annually. In contrast, China Eastern Airlines, one of the major airlines in China, exhibited a much larger scale, with costs averaging approximately $88.4 billion annually.

This comparison underscores the diverse challenges and strategies in managing cost efficiency across different industries.

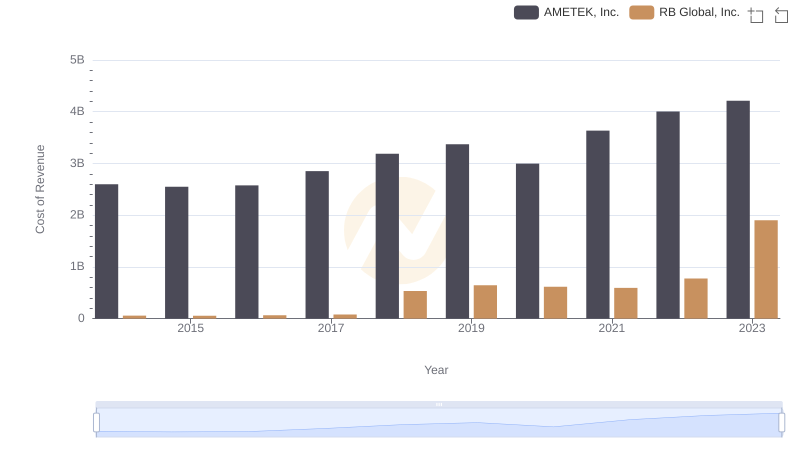

AMETEK, Inc. vs RB Global, Inc.: Efficiency in Cost of Revenue Explored

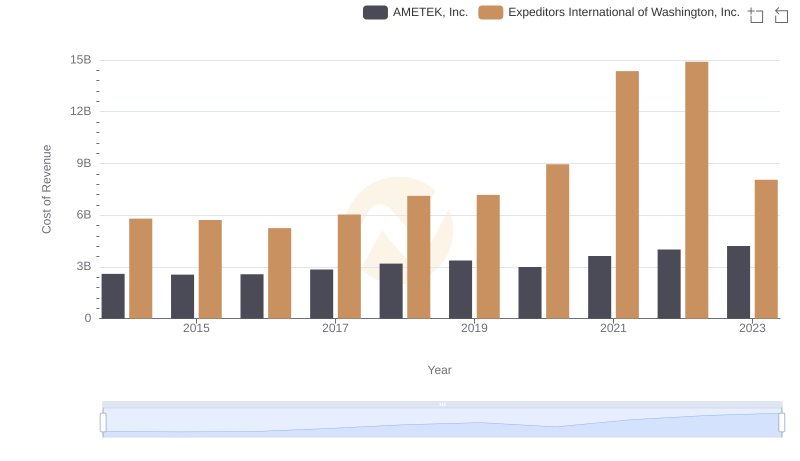

Cost of Revenue Comparison: AMETEK, Inc. vs Expeditors International of Washington, Inc.

AMETEK, Inc. or China Eastern Airlines Corporation Limited: Who Leads in Yearly Revenue?

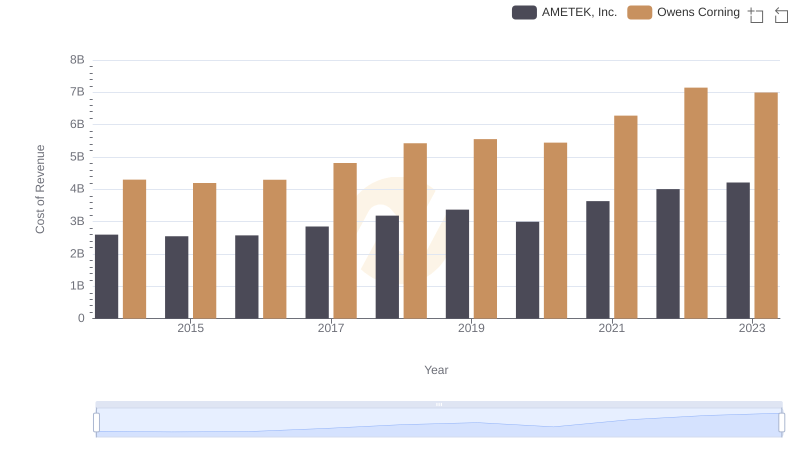

Cost of Revenue Trends: AMETEK, Inc. vs Owens Corning

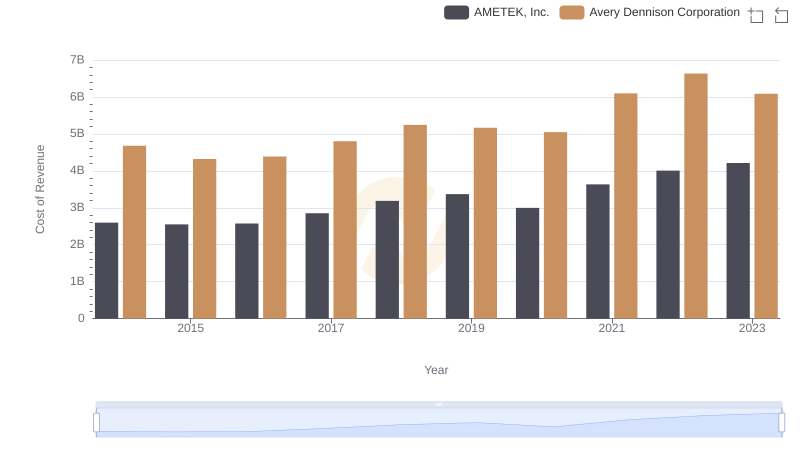

AMETEK, Inc. vs Avery Dennison Corporation: Efficiency in Cost of Revenue Explored

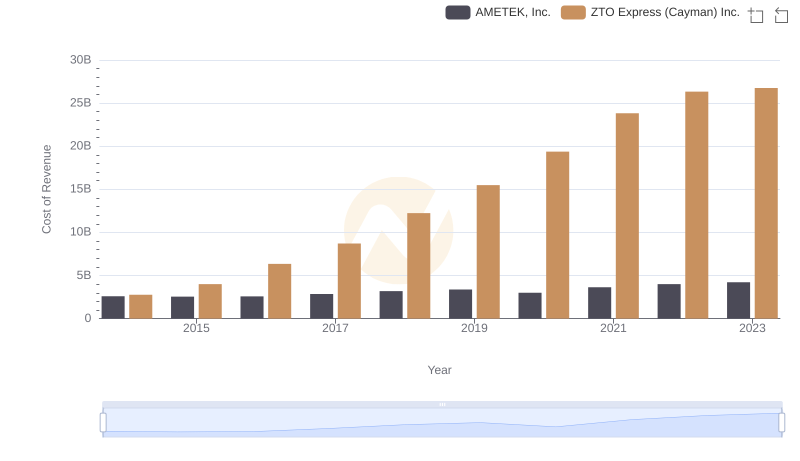

Cost Insights: Breaking Down AMETEK, Inc. and ZTO Express (Cayman) Inc.'s Expenses

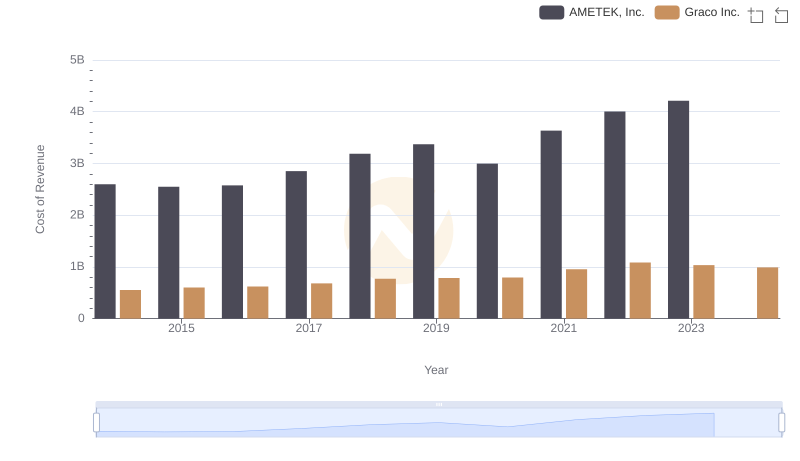

Cost of Revenue Trends: AMETEK, Inc. vs Graco Inc.

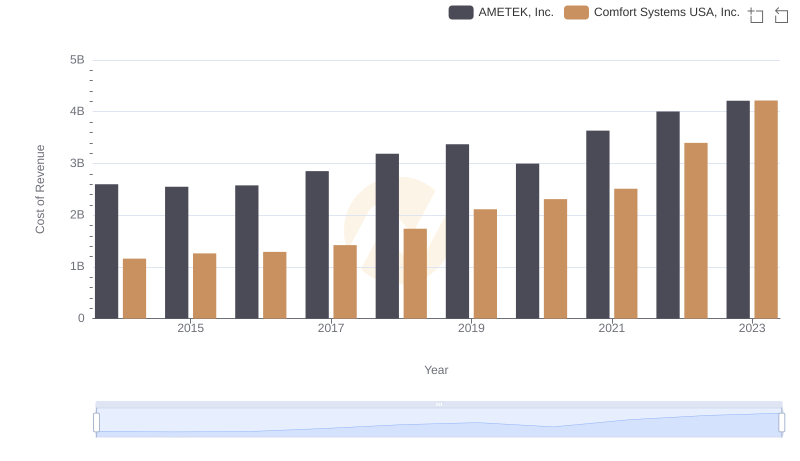

Cost of Revenue Comparison: AMETEK, Inc. vs Comfort Systems USA, Inc.