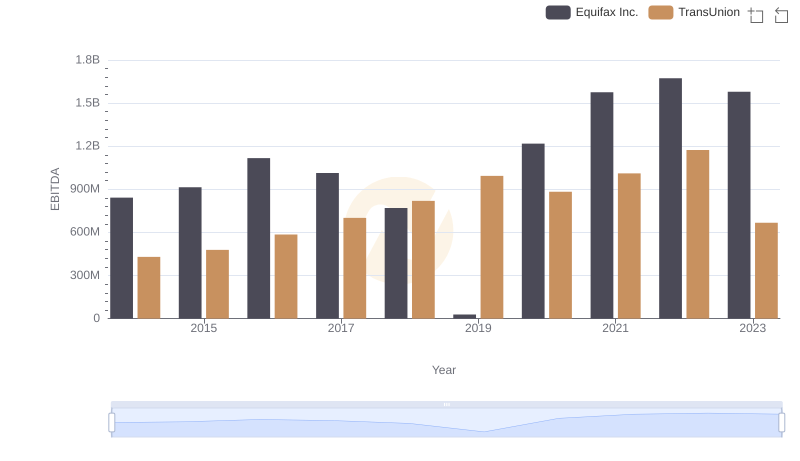

| __timestamp | Equifax Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 842400000 | 1975400000 |

| Thursday, January 1, 2015 | 914600000 | 1741900000 |

| Friday, January 1, 2016 | 1116900000 | 1810200000 |

| Sunday, January 1, 2017 | 1013900000 | 2196000000 |

| Monday, January 1, 2018 | 770200000 | 1791200000 |

| Tuesday, January 1, 2019 | 29000000 | 1920600000 |

| Wednesday, January 1, 2020 | 1217800000 | 2004200000 |

| Friday, January 1, 2021 | 1575200000 | 2345500000 |

| Saturday, January 1, 2022 | 1672800000 | 942800000 |

| Sunday, January 1, 2023 | 1579100000 | 802700000 |

| Monday, January 1, 2024 | 1251200000 | 286300000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational performance. Over the past decade, Equifax Inc. and Stanley Black & Decker, Inc. have showcased contrasting EBITDA trajectories. From 2014 to 2023, Stanley Black & Decker consistently outperformed Equifax, with an average EBITDA approximately 63% higher. Notably, 2019 marked a challenging year for Equifax, with EBITDA plummeting to a mere fraction of its usual performance, while Stanley Black & Decker maintained robust growth. However, Equifax rebounded strongly in 2020, achieving a 3200% increase from the previous year. By 2023, Equifax's EBITDA had stabilized, yet remained 49% lower than Stanley Black & Decker's. This comparative analysis underscores the resilience and strategic adaptability of these industry giants in navigating financial challenges and opportunities.

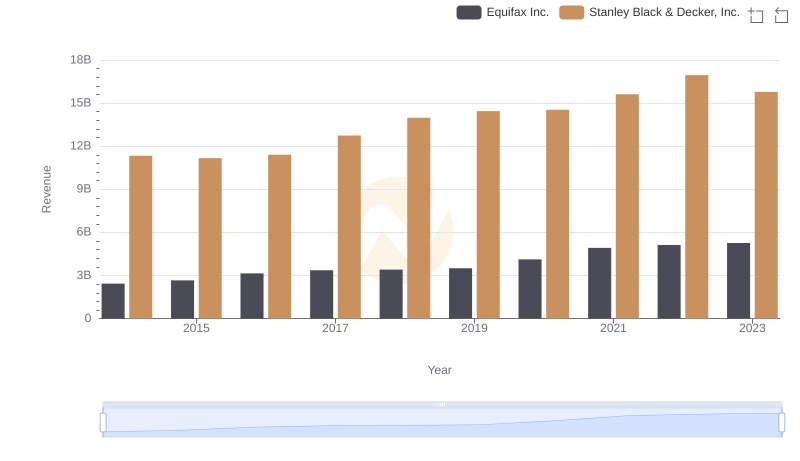

Equifax Inc. or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

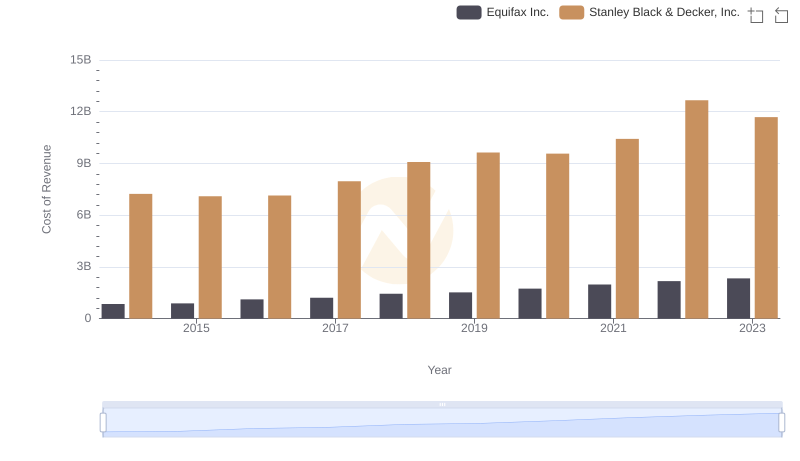

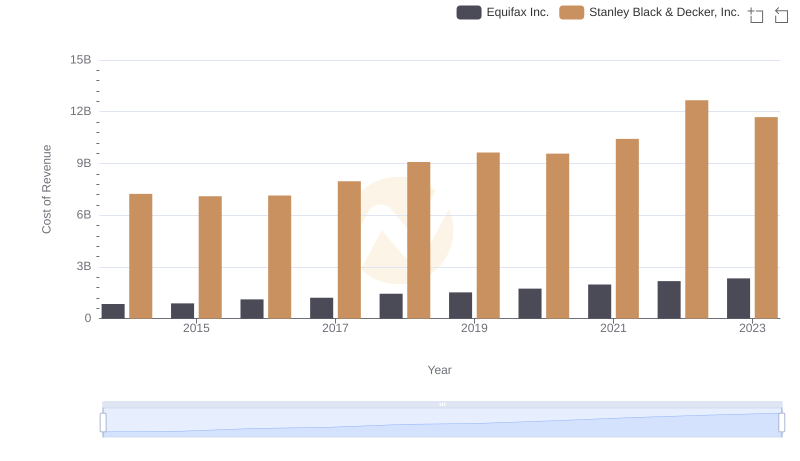

Cost Insights: Breaking Down Equifax Inc. and Stanley Black & Decker, Inc.'s Expenses

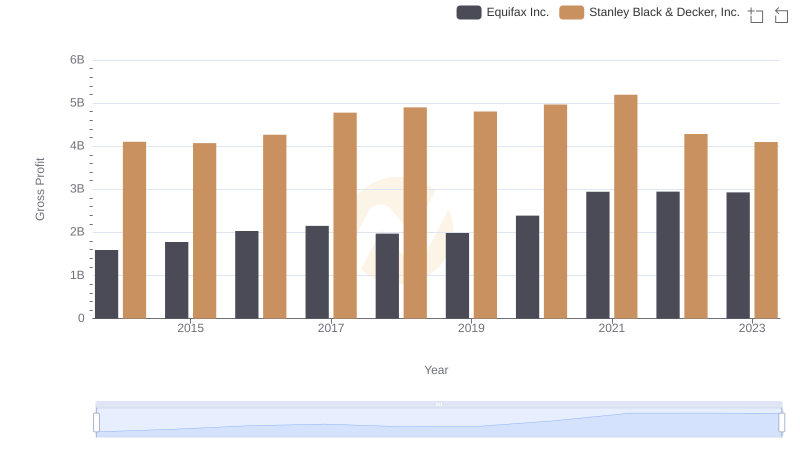

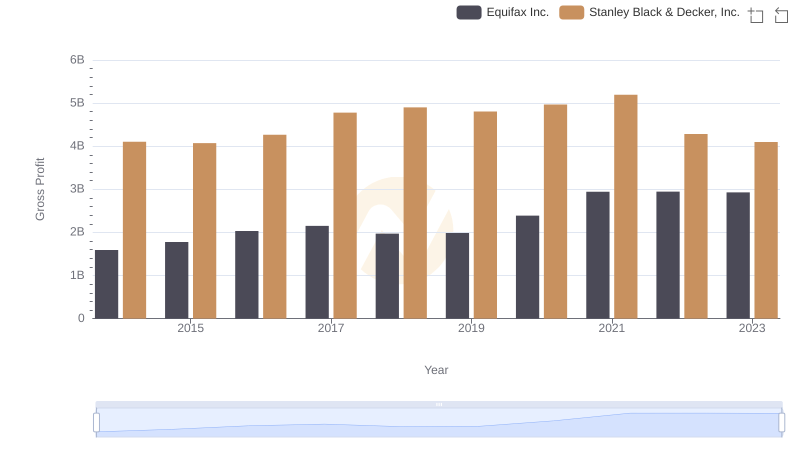

Equifax Inc. vs Stanley Black & Decker, Inc.: A Gross Profit Performance Breakdown

EBITDA Performance Review: Equifax Inc. vs TransUnion

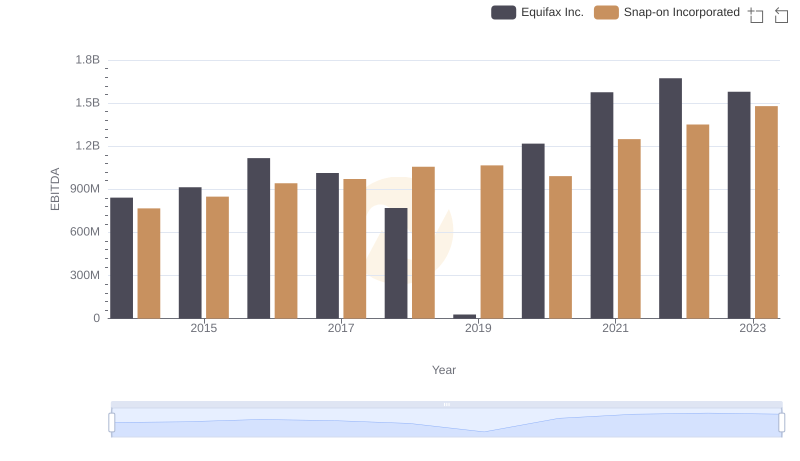

EBITDA Metrics Evaluated: Equifax Inc. vs Snap-on Incorporated

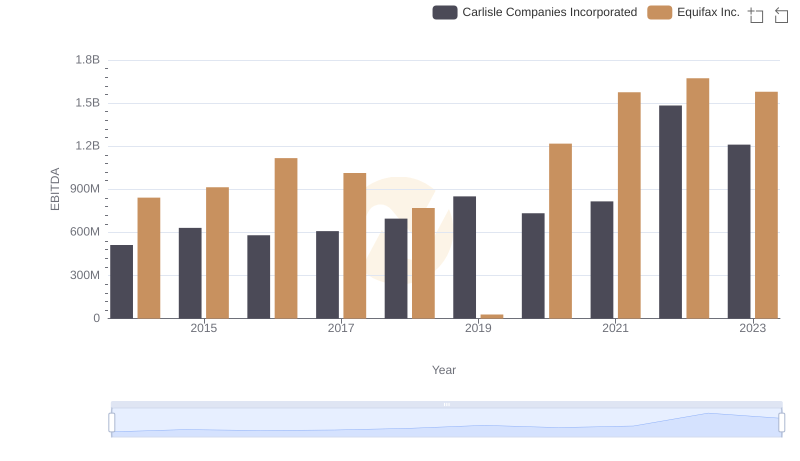

Comparative EBITDA Analysis: Equifax Inc. vs Carlisle Companies Incorporated

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.