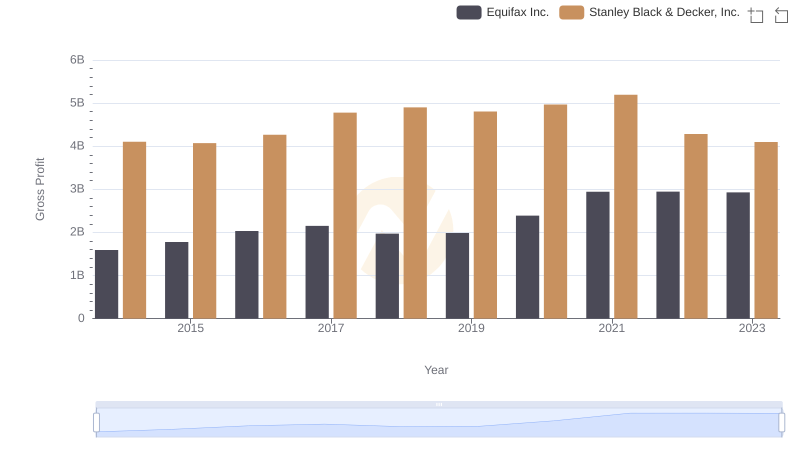

| __timestamp | Equifax Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 4102700000 |

| Thursday, January 1, 2015 | 1776200000 | 4072000000 |

| Friday, January 1, 2016 | 2031500000 | 4267200000 |

| Sunday, January 1, 2017 | 2151500000 | 4778000000 |

| Monday, January 1, 2018 | 1971700000 | 4901900000 |

| Tuesday, January 1, 2019 | 1985900000 | 4805500000 |

| Wednesday, January 1, 2020 | 2390100000 | 4967900000 |

| Friday, January 1, 2021 | 2943000000 | 5194200000 |

| Saturday, January 1, 2022 | 2945000000 | 4284100000 |

| Sunday, January 1, 2023 | 2930100000 | 4098000000 |

| Monday, January 1, 2024 | 5681100000 | 4514400000 |

In pursuit of knowledge

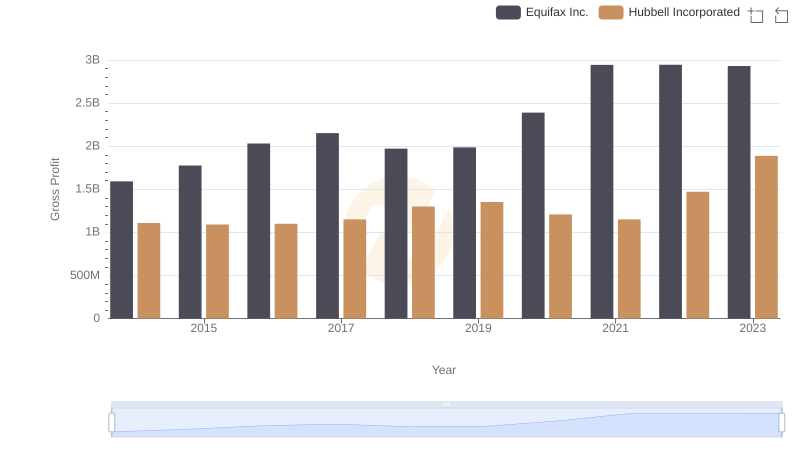

In the world of corporate finance, gross profit is a key indicator of a company's financial health. From 2014 to 2023, Equifax Inc. and Stanley Black & Decker, Inc. have showcased contrasting trajectories in their gross profit performance. Equifax, a leader in consumer credit reporting, saw a remarkable 84% increase in gross profit, peaking in 2022. Meanwhile, Stanley Black & Decker, a titan in the tools and storage industry, experienced a more modest 27% growth, with its highest gross profit recorded in 2021.

Despite the economic challenges of the past decade, both companies have demonstrated resilience. Equifax's strategic investments in data analytics have paid off, while Stanley Black & Decker's focus on innovation and global expansion has kept it competitive. This analysis offers a fascinating glimpse into how two industry leaders navigate the ever-evolving business landscape.

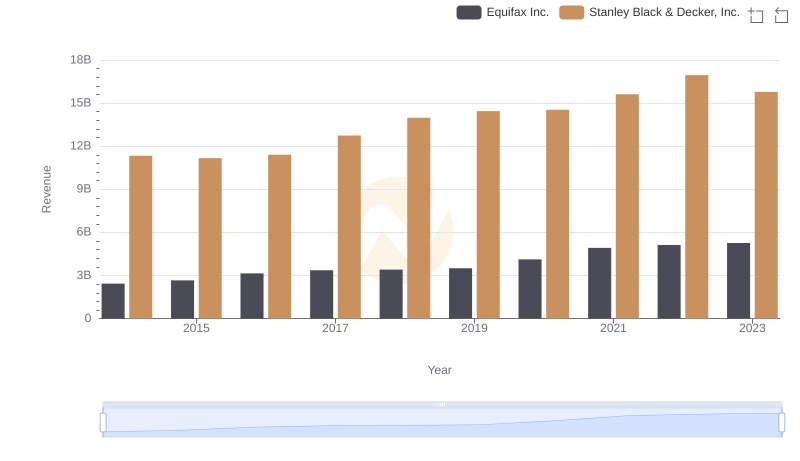

Equifax Inc. or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

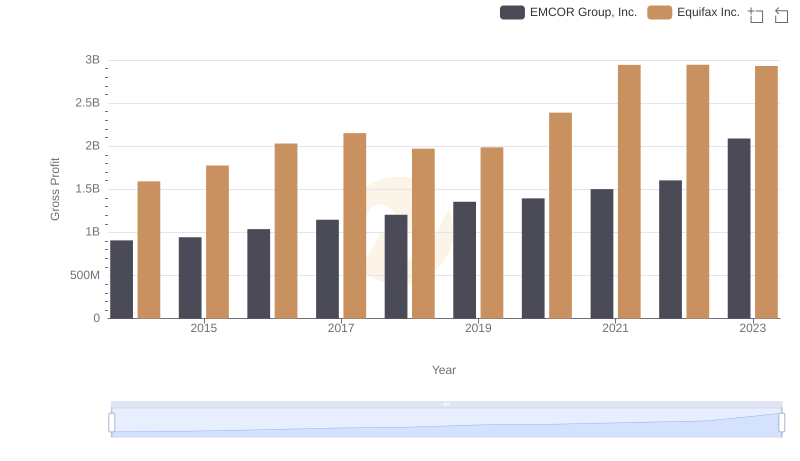

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

Equifax Inc. vs Hubbell Incorporated: A Gross Profit Performance Breakdown

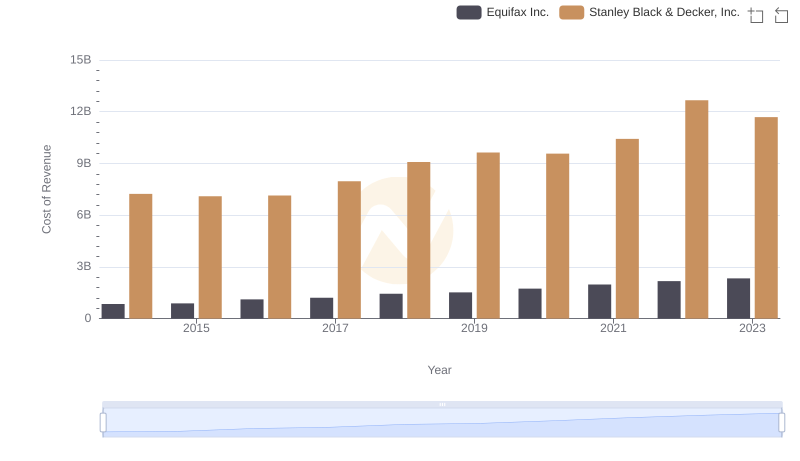

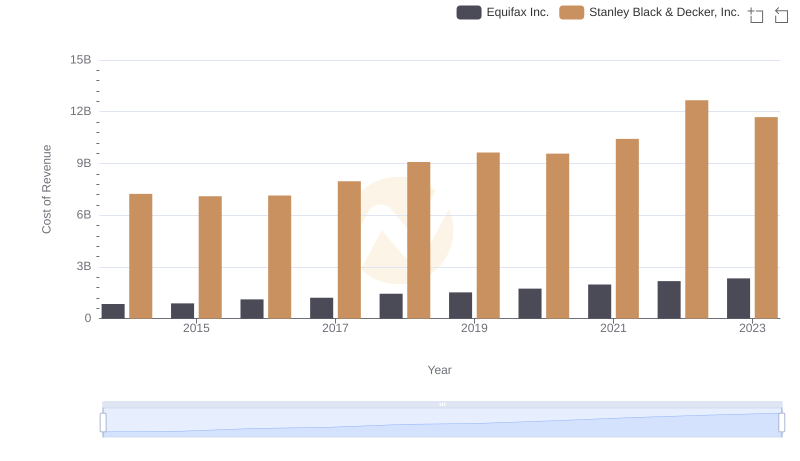

Cost Insights: Breaking Down Equifax Inc. and Stanley Black & Decker, Inc.'s Expenses

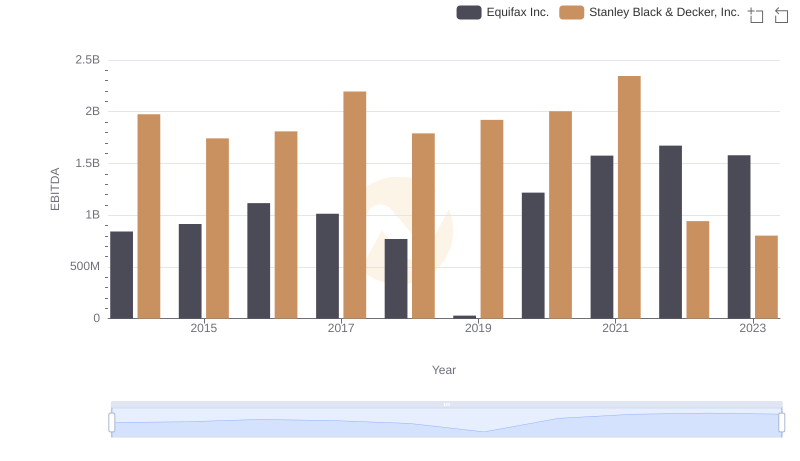

Comparative EBITDA Analysis: Equifax Inc. vs Stanley Black & Decker, Inc.

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.