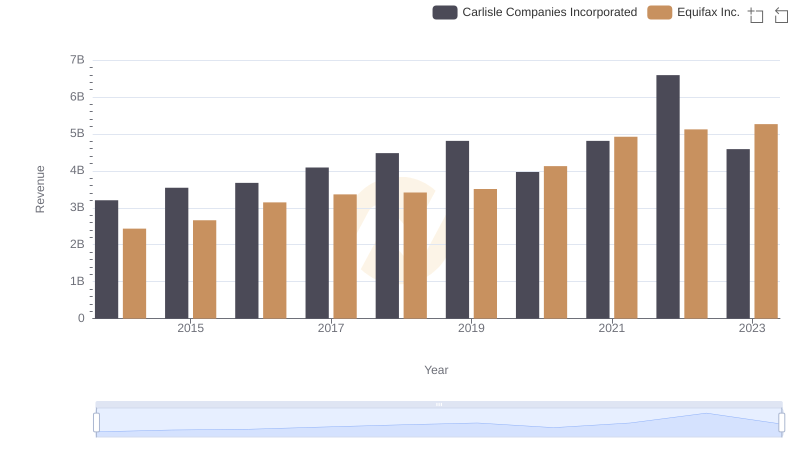

| __timestamp | Carlisle Companies Incorporated | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 512300000 | 842400000 |

| Thursday, January 1, 2015 | 631900000 | 914600000 |

| Friday, January 1, 2016 | 580200000 | 1116900000 |

| Sunday, January 1, 2017 | 609300000 | 1013900000 |

| Monday, January 1, 2018 | 696100000 | 770200000 |

| Tuesday, January 1, 2019 | 851000000 | 29000000 |

| Wednesday, January 1, 2020 | 733100000 | 1217800000 |

| Friday, January 1, 2021 | 816100000 | 1575200000 |

| Saturday, January 1, 2022 | 1483400000 | 1672800000 |

| Sunday, January 1, 2023 | 1210700000 | 1579100000 |

| Monday, January 1, 2024 | 1356800000 | 1251200000 |

Data in motion

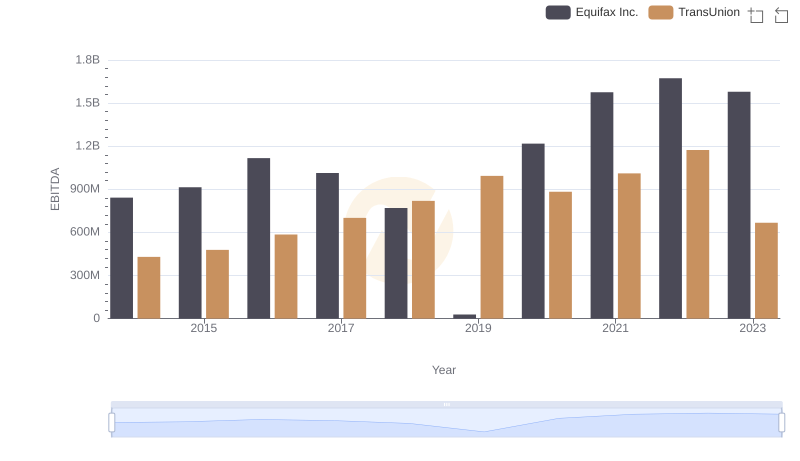

In the ever-evolving landscape of corporate finance, understanding EBITDA trends offers a window into a company's operational efficiency. From 2014 to 2023, Equifax Inc. and Carlisle Companies Incorporated have showcased intriguing trajectories. Equifax, a titan in consumer credit reporting, saw its EBITDA grow by approximately 87% over this period, peaking in 2022. Meanwhile, Carlisle, a leader in diversified manufacturing, experienced a remarkable 190% increase, with its highest EBITDA recorded in 2022 as well.

The year 2019 marked a significant dip for Equifax, with EBITDA plummeting to a mere fraction of its usual performance, highlighting potential operational challenges. Conversely, Carlisle's steady climb underscores its robust growth strategy. As we delve into these financial narratives, the data not only reflects past performance but also hints at future potential, making it essential for investors and analysts alike to keep a keen eye on these industry giants.

Breaking Down Revenue Trends: Equifax Inc. vs Carlisle Companies Incorporated

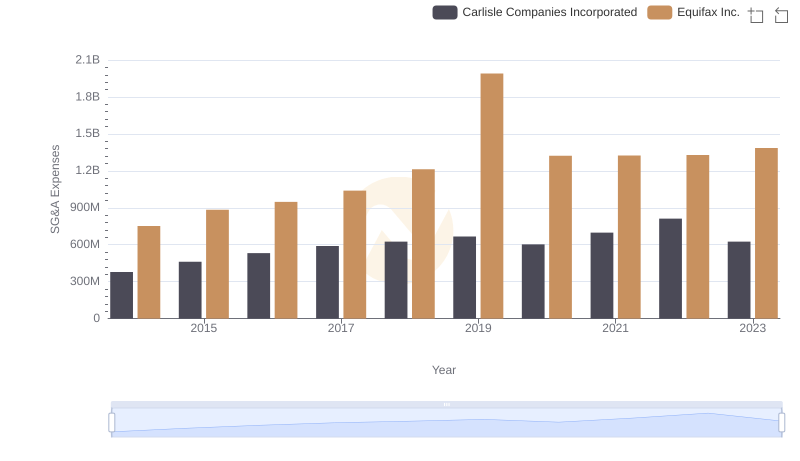

Selling, General, and Administrative Costs: Equifax Inc. vs Carlisle Companies Incorporated

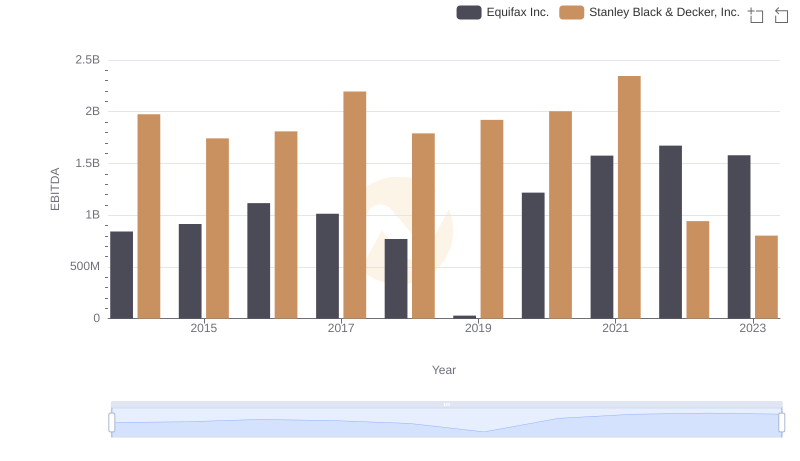

Comparative EBITDA Analysis: Equifax Inc. vs Stanley Black & Decker, Inc.

EBITDA Performance Review: Equifax Inc. vs TransUnion

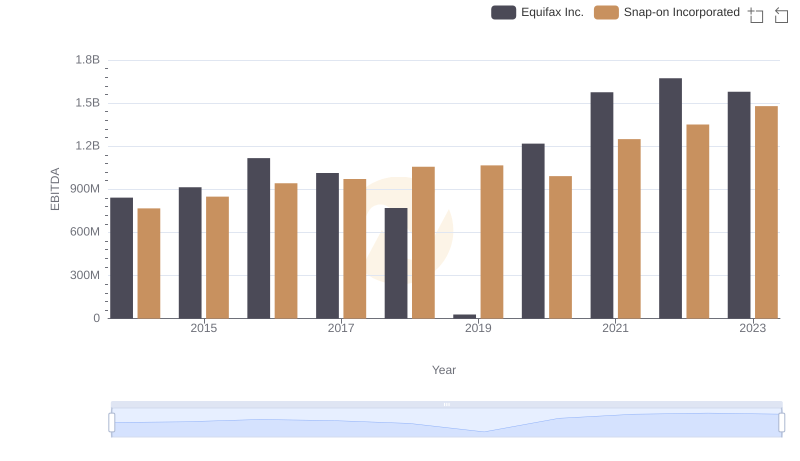

EBITDA Metrics Evaluated: Equifax Inc. vs Snap-on Incorporated

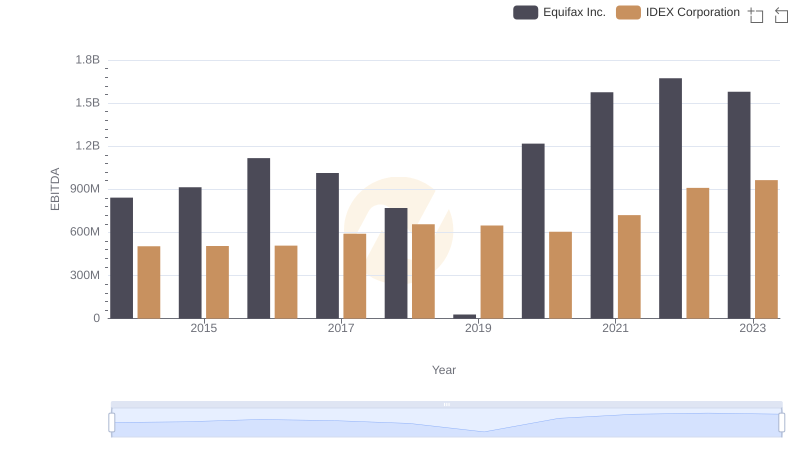

Equifax Inc. and IDEX Corporation: A Detailed Examination of EBITDA Performance

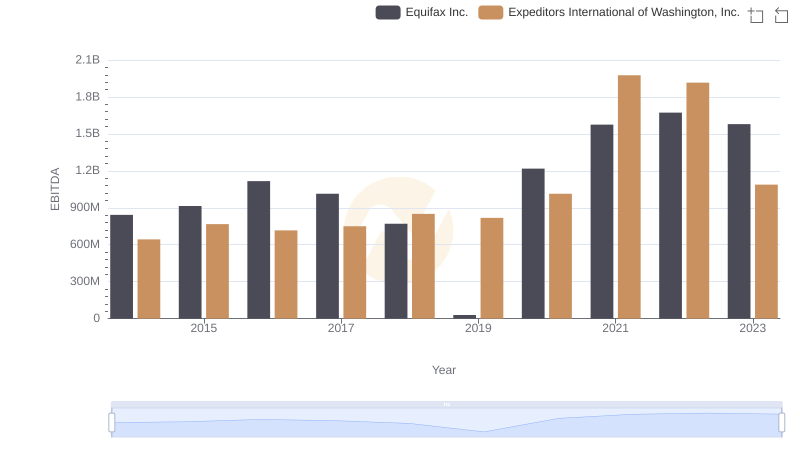

EBITDA Analysis: Evaluating Equifax Inc. Against Expeditors International of Washington, Inc.