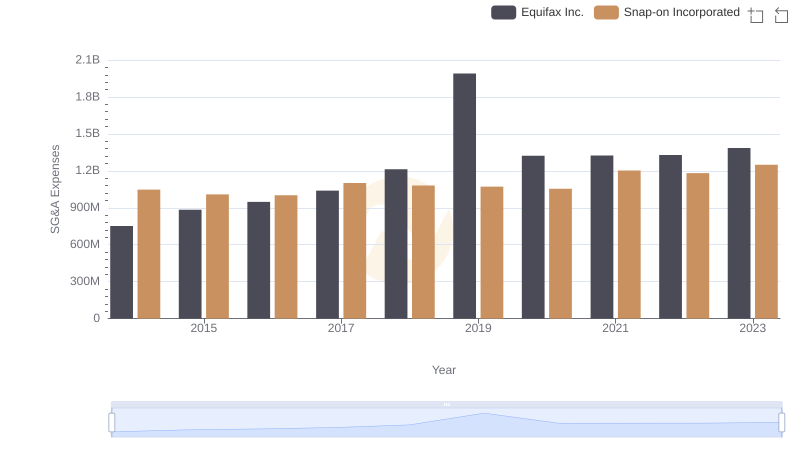

| __timestamp | Carlisle Companies Incorporated | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 751700000 |

| Thursday, January 1, 2015 | 461900000 | 884300000 |

| Friday, January 1, 2016 | 532000000 | 948200000 |

| Sunday, January 1, 2017 | 589400000 | 1039100000 |

| Monday, January 1, 2018 | 625400000 | 1213300000 |

| Tuesday, January 1, 2019 | 667100000 | 1990200000 |

| Wednesday, January 1, 2020 | 603200000 | 1322500000 |

| Friday, January 1, 2021 | 698200000 | 1324600000 |

| Saturday, January 1, 2022 | 811500000 | 1328900000 |

| Sunday, January 1, 2023 | 625200000 | 1385700000 |

| Monday, January 1, 2024 | 722800000 | 1450500000 |

Unveiling the hidden dimensions of data

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. This analysis compares the SG&A expenses of Equifax Inc. and Carlisle Companies Incorporated from 2014 to 2023. Over this period, Equifax consistently outspent Carlisle, with its expenses peaking in 2019 at nearly double that of Carlisle's highest recorded year. Notably, Equifax's SG&A expenses surged by approximately 165% from 2014 to 2023, reflecting its expansive growth strategy. Meanwhile, Carlisle's expenses grew by about 65%, indicating a more conservative approach. The data reveals a fascinating narrative of two companies navigating their financial landscapes with distinct strategies. As we delve into these figures, we gain insights into how each company allocates resources to maintain competitive advantage and drive growth.

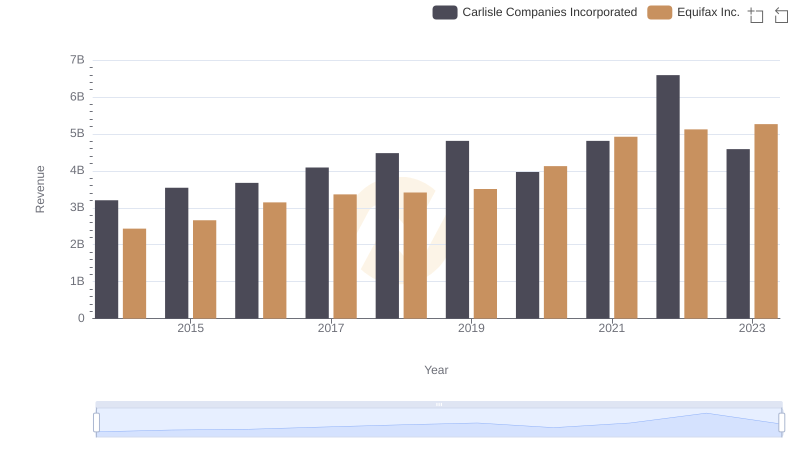

Breaking Down Revenue Trends: Equifax Inc. vs Carlisle Companies Incorporated

Breaking Down SG&A Expenses: Equifax Inc. vs Snap-on Incorporated

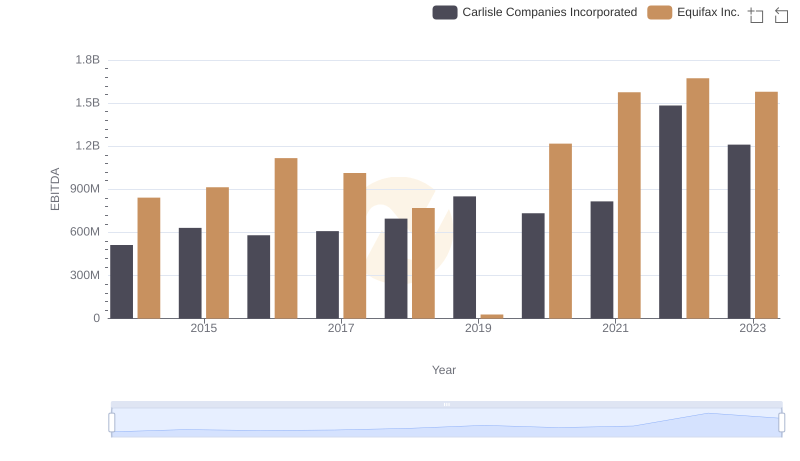

Comparative EBITDA Analysis: Equifax Inc. vs Carlisle Companies Incorporated

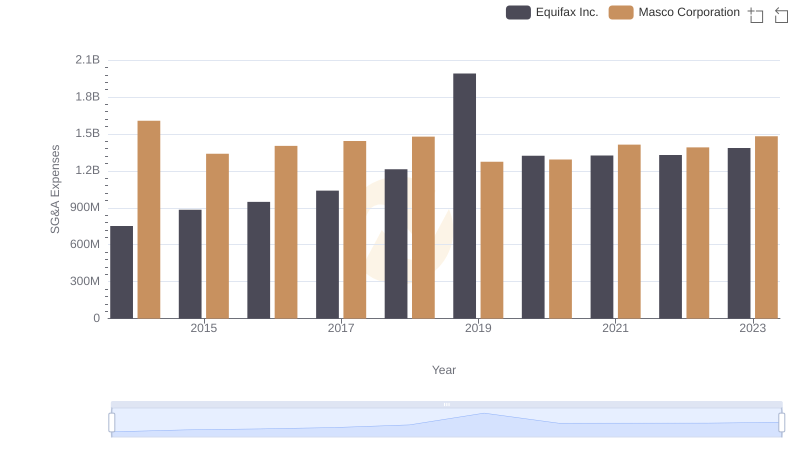

Who Optimizes SG&A Costs Better? Equifax Inc. or Masco Corporation

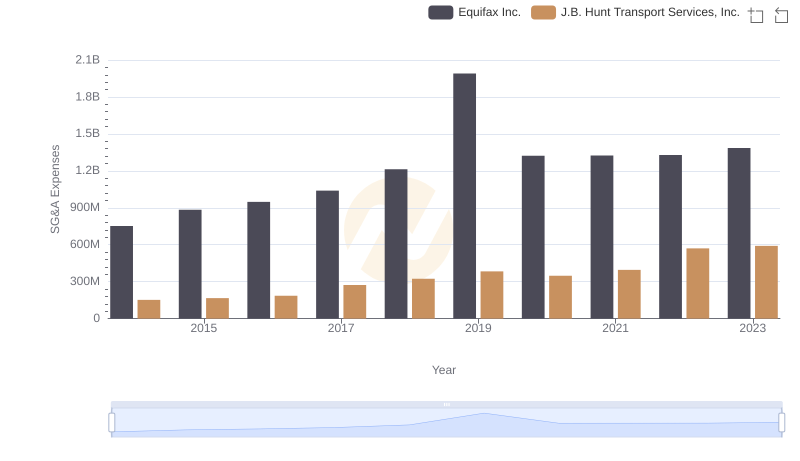

Breaking Down SG&A Expenses: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

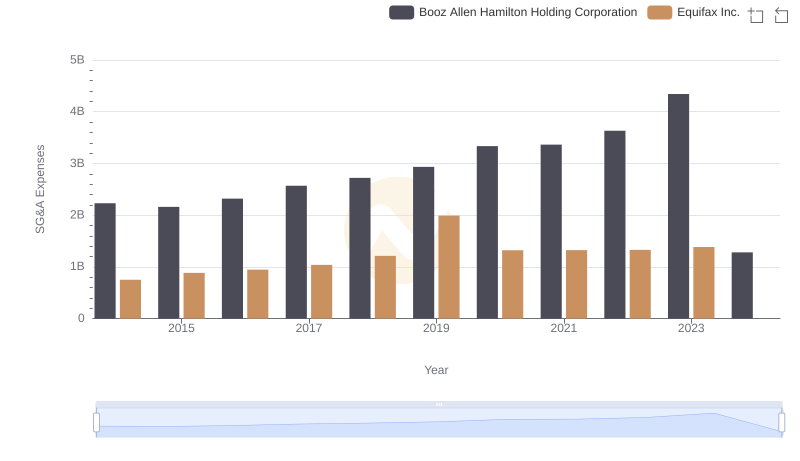

Equifax Inc. and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared