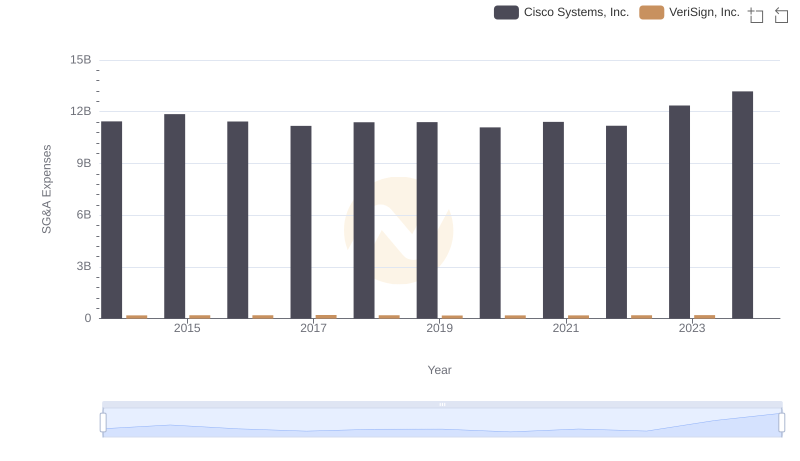

| __timestamp | Cisco Systems, Inc. | SS&C Technologies Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 99471000 |

| Thursday, January 1, 2015 | 11861000000 | 192782000 |

| Friday, January 1, 2016 | 11433000000 | 239563000 |

| Sunday, January 1, 2017 | 11177000000 | 238623000 |

| Monday, January 1, 2018 | 11386000000 | 524900000 |

| Tuesday, January 1, 2019 | 11398000000 | 723100000 |

| Wednesday, January 1, 2020 | 11094000000 | 708600000 |

| Friday, January 1, 2021 | 11411000000 | 752100000 |

| Saturday, January 1, 2022 | 11186000000 | 925100000 |

| Sunday, January 1, 2023 | 12358000000 | 959700000 |

| Monday, January 1, 2024 | 13177000000 | 1002400000 |

Unveiling the hidden dimensions of data

In the ever-evolving tech landscape, understanding spending patterns can offer valuable insights into a company's strategic priorities. Cisco Systems, Inc. and SS&C Technologies Holdings, Inc. present a fascinating case study in contrasting SG&A (Selling, General, and Administrative) expenses over the past decade.

From 2014 to 2023, Cisco's SG&A expenses have shown a steady increase, peaking at approximately $13.2 billion in 2023, marking a 15% rise from 2014. This trend reflects Cisco's commitment to maintaining its market leadership through strategic investments in sales and administration. In contrast, SS&C Technologies has seen a more dramatic growth trajectory, with SG&A expenses surging by nearly 860% from 2014 to 2023, reaching close to $960 million. This rapid increase underscores SS&C's aggressive expansion strategy in the competitive tech sector.

Interestingly, data for 2024 is incomplete, leaving room for speculation on future trends. As these companies continue to navigate the complexities of the tech industry, their SG&A spending patterns will remain a critical indicator of their strategic direction.

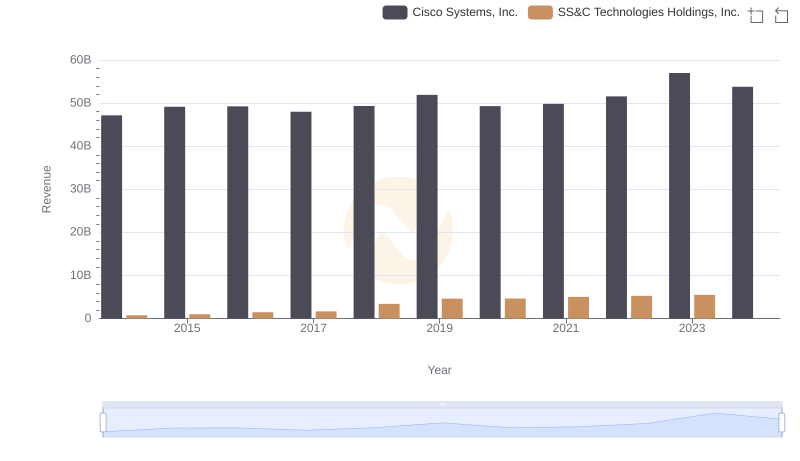

Revenue Showdown: Cisco Systems, Inc. vs SS&C Technologies Holdings, Inc.

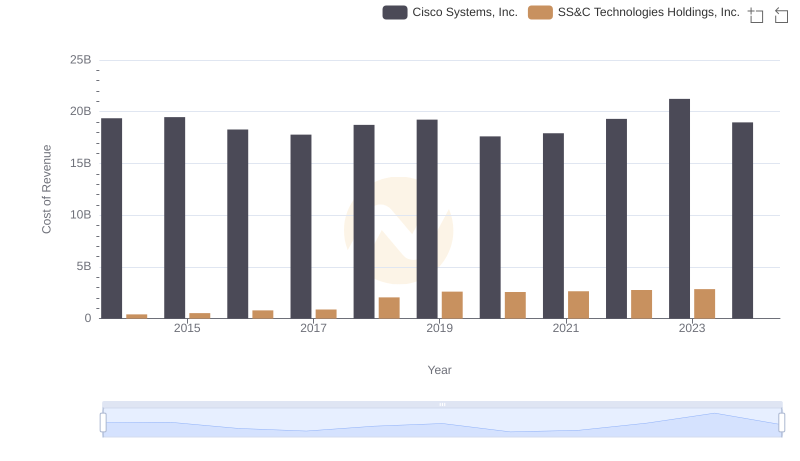

Cisco Systems, Inc. vs SS&C Technologies Holdings, Inc.: Efficiency in Cost of Revenue Explored

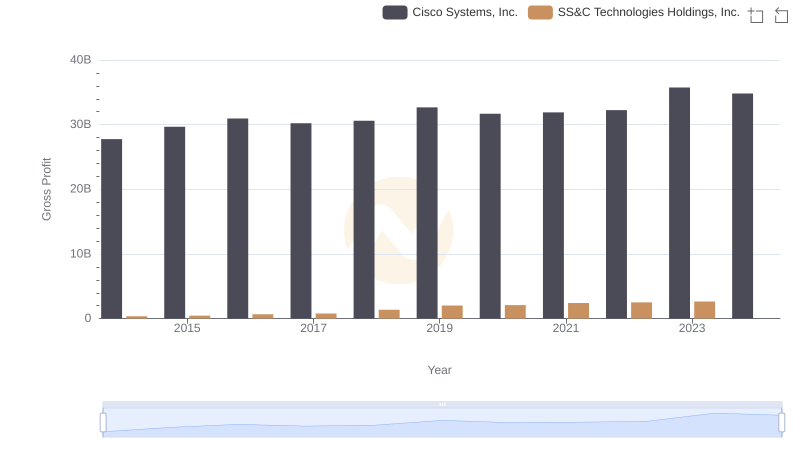

Gross Profit Trends Compared: Cisco Systems, Inc. vs SS&C Technologies Holdings, Inc.

Cisco Systems, Inc. vs VeriSign, Inc.: SG&A Expense Trends

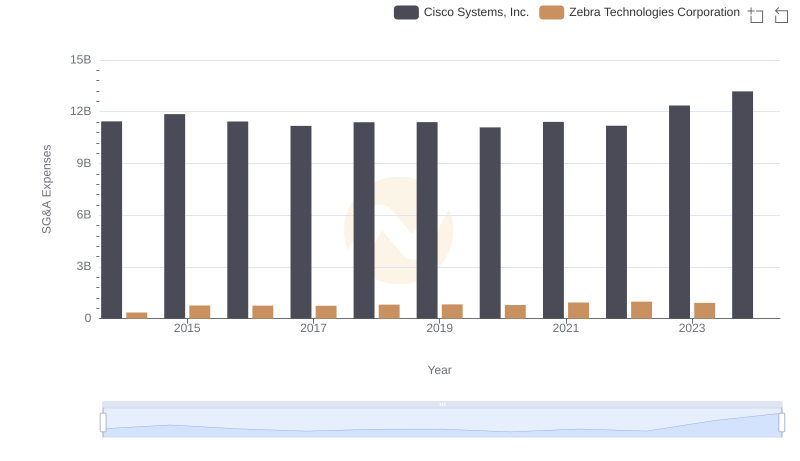

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Zebra Technologies Corporation

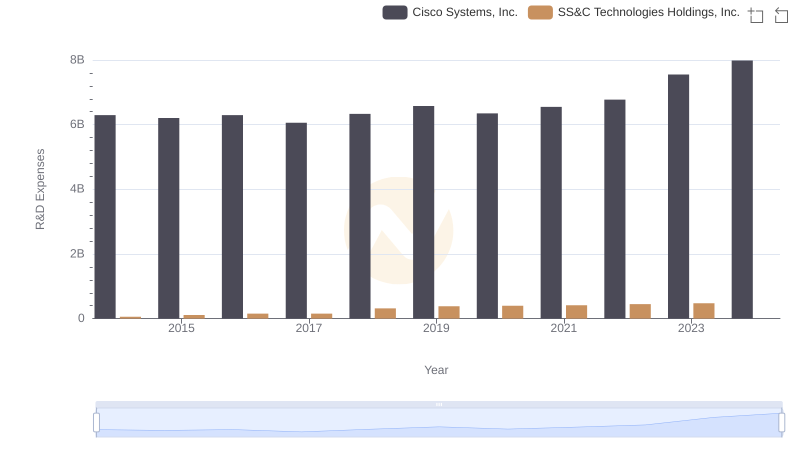

R&D Insights: How Cisco Systems, Inc. and SS&C Technologies Holdings, Inc. Allocate Funds

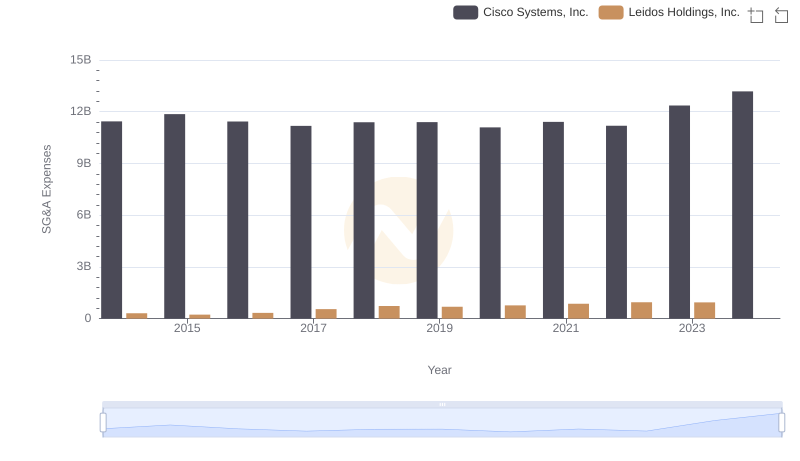

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Leidos Holdings, Inc.

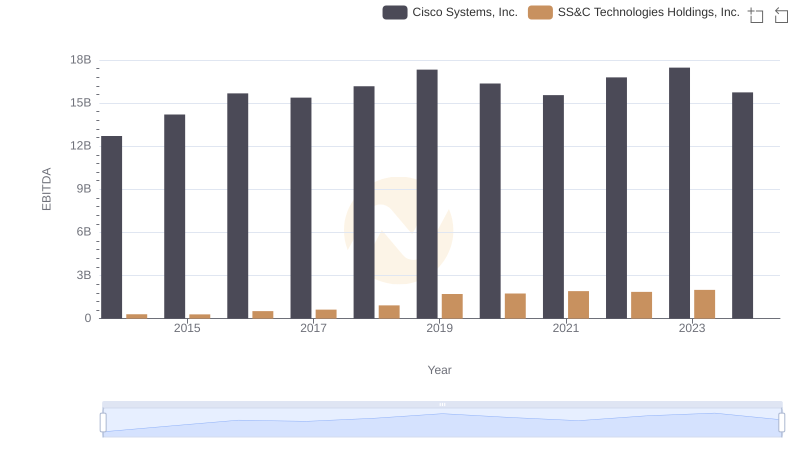

Cisco Systems, Inc. vs SS&C Technologies Holdings, Inc.: In-Depth EBITDA Performance Comparison

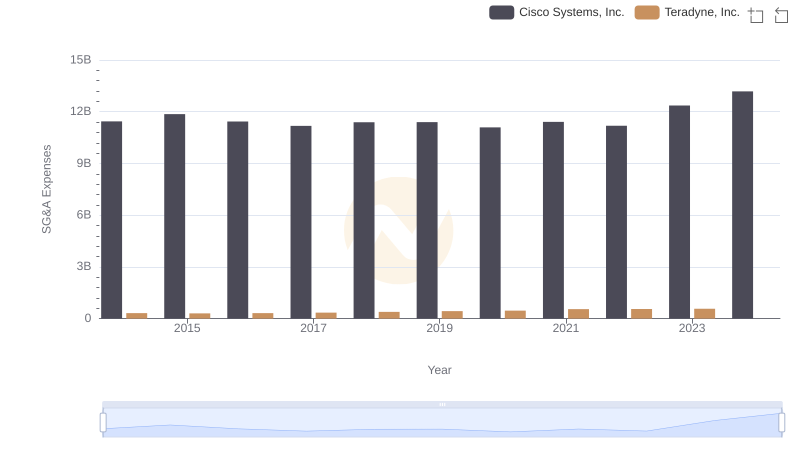

Cisco Systems, Inc. or Teradyne, Inc.: Who Manages SG&A Costs Better?

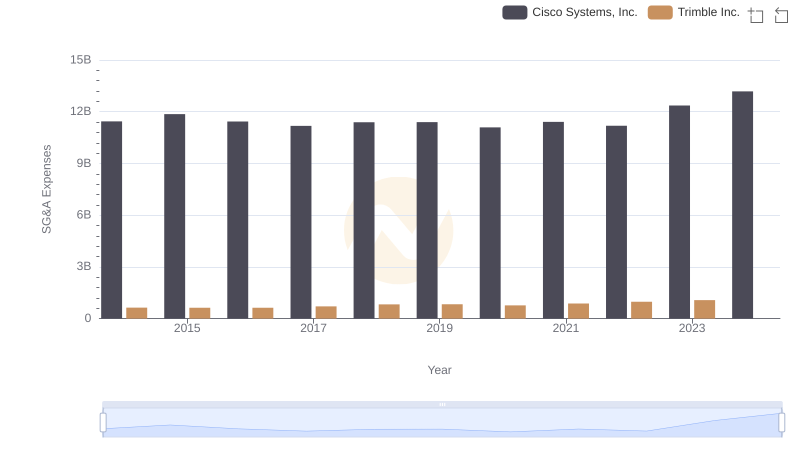

Cost Management Insights: SG&A Expenses for Cisco Systems, Inc. and Trimble Inc.

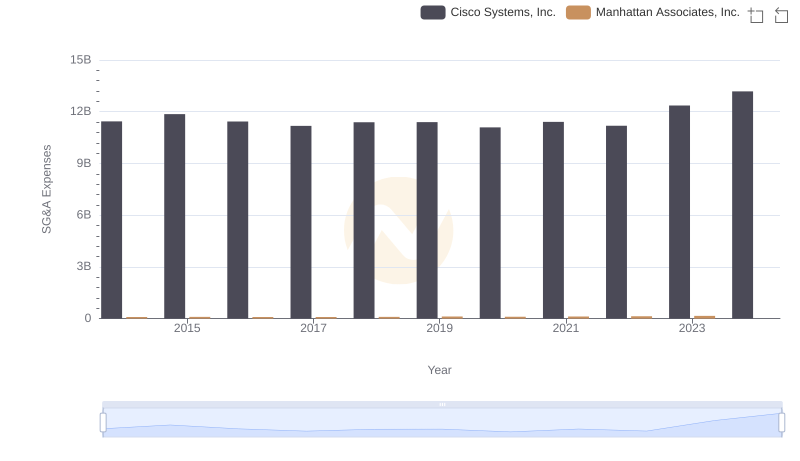

Who Optimizes SG&A Costs Better? Cisco Systems, Inc. or Manhattan Associates, Inc.

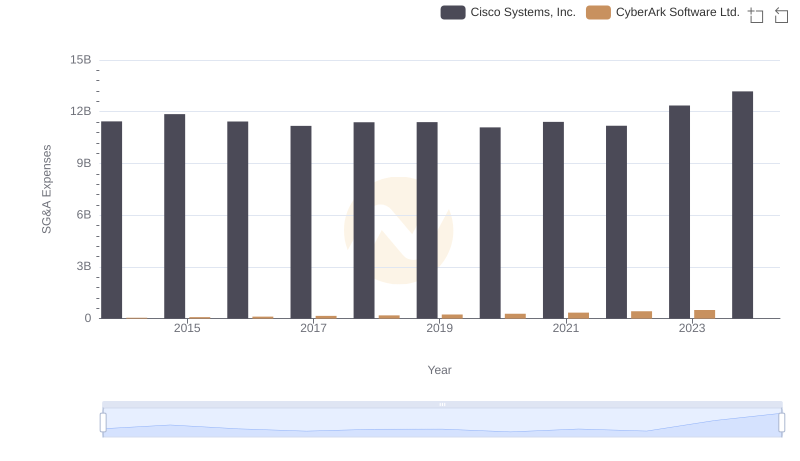

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and CyberArk Software Ltd.