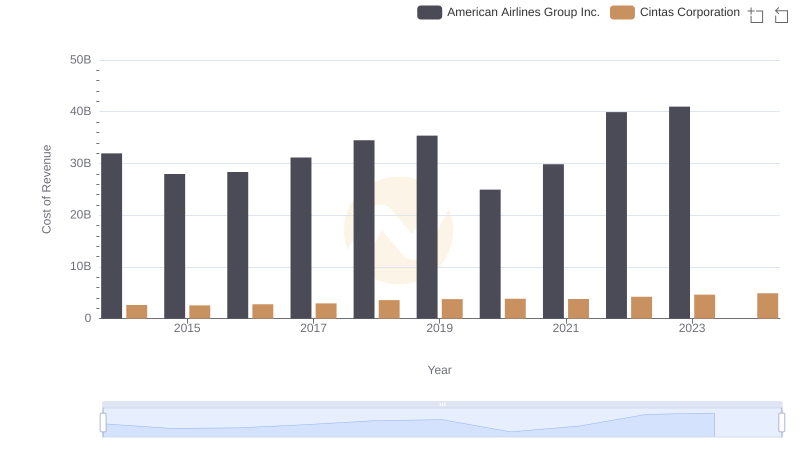

| __timestamp | American Airlines Group Inc. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1544000000 | 1302752000 |

| Thursday, January 1, 2015 | 1394000000 | 1224930000 |

| Friday, January 1, 2016 | 1323000000 | 1348122000 |

| Sunday, January 1, 2017 | 1477000000 | 1527380000 |

| Monday, January 1, 2018 | 1520000000 | 1916792000 |

| Tuesday, January 1, 2019 | 1602000000 | 1980644000 |

| Wednesday, January 1, 2020 | 513000000 | 2071052000 |

| Friday, January 1, 2021 | 1098000000 | 1929159000 |

| Saturday, January 1, 2022 | 1815000000 | 2044876000 |

| Sunday, January 1, 2023 | 1799000000 | 2370704000 |

| Monday, January 1, 2024 | 2617783000 |

Unveiling the hidden dimensions of data

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and American Airlines Group Inc. offer a fascinating comparison. From 2014 to 2023, Cintas consistently demonstrated superior control over its SG&A costs. Despite a 95% increase in expenses over the decade, Cintas maintained a steady growth trajectory, peaking at $2.37 billion in 2023. In contrast, American Airlines faced more volatility, with a significant dip in 2020, likely due to the pandemic, before rebounding to $1.8 billion in 2023. This fluctuation highlights the airline industry's vulnerability to external shocks. Cintas's ability to manage costs effectively, even during challenging times, underscores its operational efficiency. As businesses navigate economic uncertainties, these insights into SG&A management offer valuable lessons for sustaining growth and profitability.

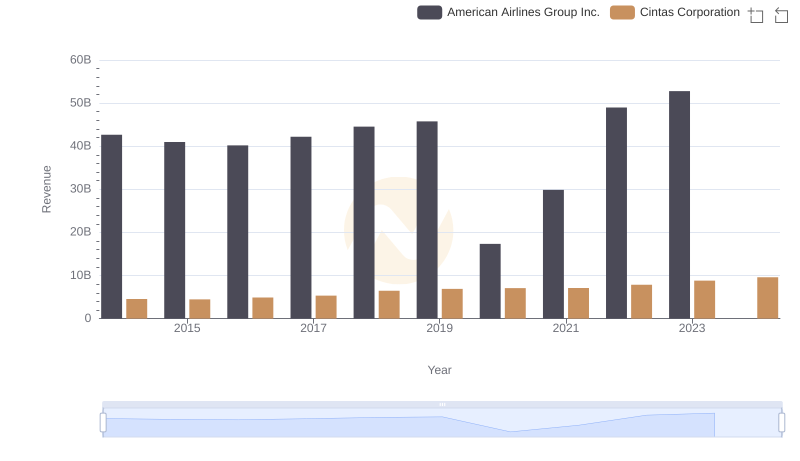

Revenue Showdown: Cintas Corporation vs American Airlines Group Inc.

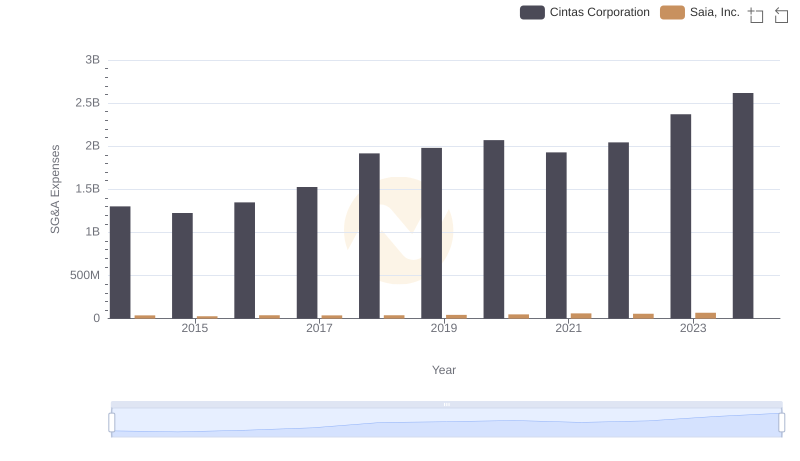

Selling, General, and Administrative Costs: Cintas Corporation vs Saia, Inc.

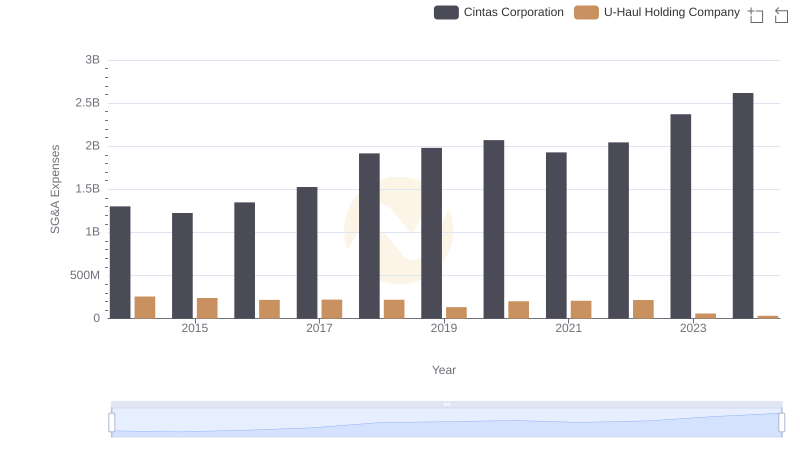

Cintas Corporation vs U-Haul Holding Company: SG&A Expense Trends

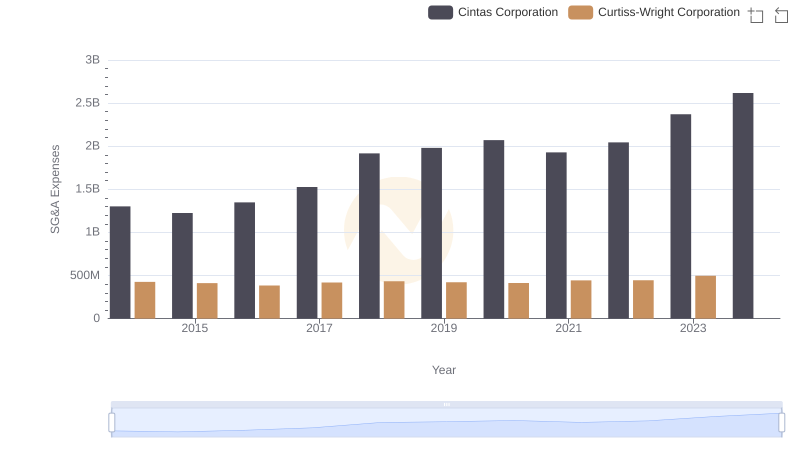

Who Optimizes SG&A Costs Better? Cintas Corporation or Curtiss-Wright Corporation

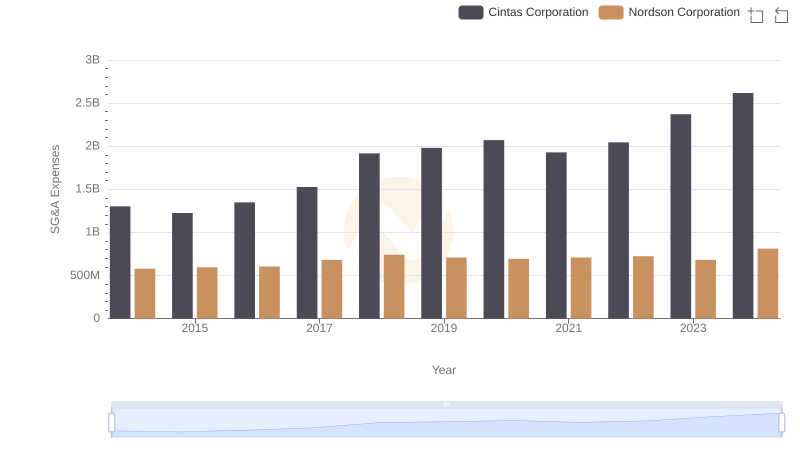

Breaking Down SG&A Expenses: Cintas Corporation vs Nordson Corporation

Comparing Cost of Revenue Efficiency: Cintas Corporation vs American Airlines Group Inc.

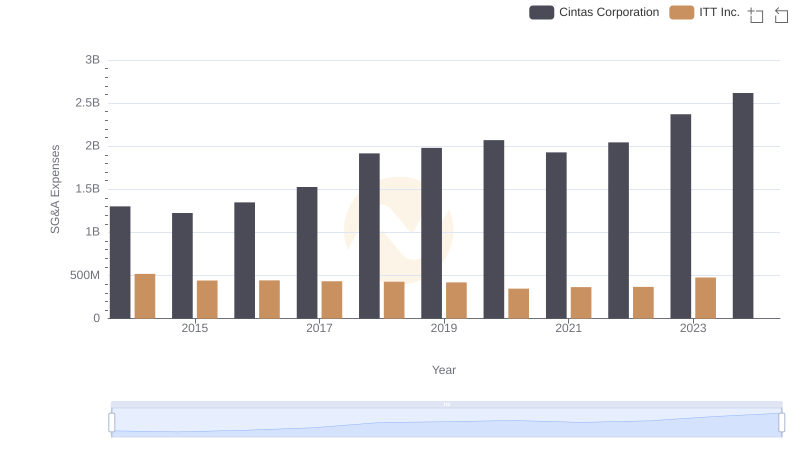

Operational Costs Compared: SG&A Analysis of Cintas Corporation and ITT Inc.