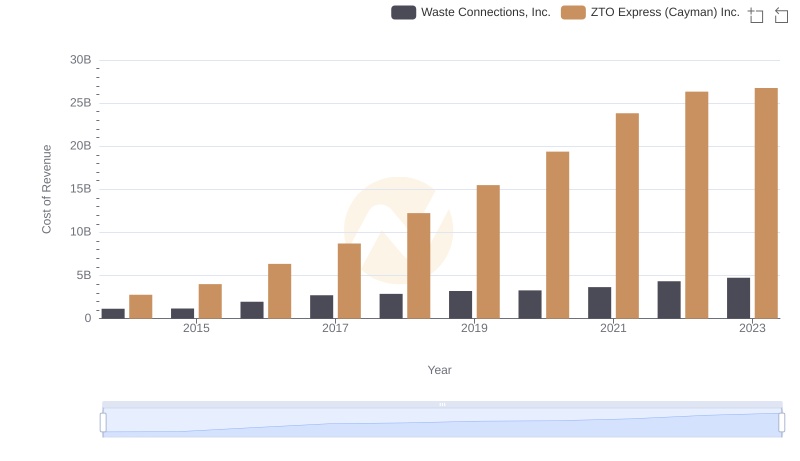

| __timestamp | Waste Connections, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 229474000 | 534537000 |

| Thursday, January 1, 2015 | 237484000 | 591738000 |

| Friday, January 1, 2016 | 474263000 | 705995000 |

| Sunday, January 1, 2017 | 509638000 | 780517000 |

| Monday, January 1, 2018 | 524388000 | 1210717000 |

| Tuesday, January 1, 2019 | 546278000 | 1546227000 |

| Wednesday, January 1, 2020 | 537632000 | 1663712000 |

| Friday, January 1, 2021 | 612337000 | 1875869000 |

| Saturday, January 1, 2022 | 696467000 | 2077372000 |

| Sunday, January 1, 2023 | 799119000 | 2425253000 |

| Monday, January 1, 2024 | 883445000 |

Infusing magic into the data realm

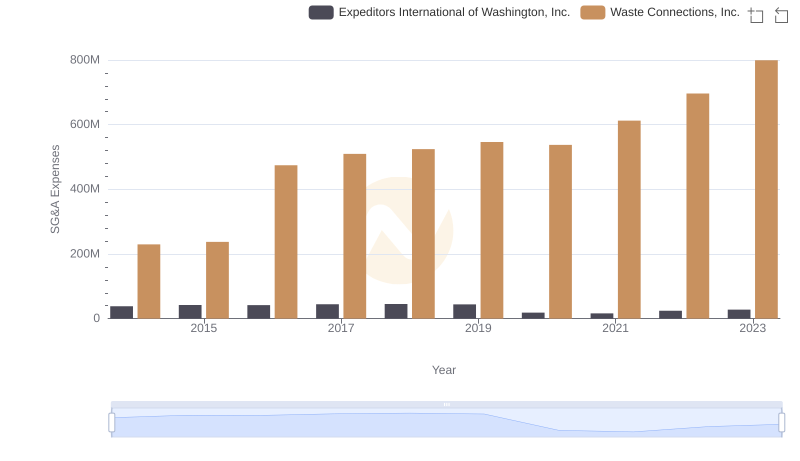

In the evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial for investors and analysts. Over the past decade, Waste Connections, Inc. and ZTO Express (Cayman) Inc. have shown distinct trajectories in their SG&A expenses. From 2014 to 2023, Waste Connections, Inc. saw a steady increase, with expenses growing by approximately 248%. Meanwhile, ZTO Express experienced a more dramatic rise, with expenses surging by around 354% during the same period.

This divergence highlights the differing operational strategies and market conditions faced by these companies. Waste Connections, a leader in waste management, has maintained a consistent growth pattern, while ZTO Express, a major player in logistics, reflects the rapid expansion of e-commerce in China. These insights provide a window into the financial health and strategic priorities of these industry giants.

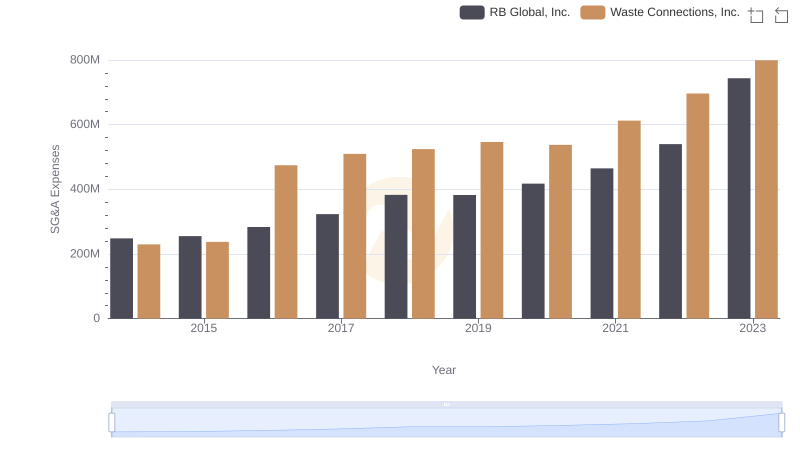

Waste Connections, Inc. vs RB Global, Inc.: SG&A Expense Trends

Cost Insights: Breaking Down Waste Connections, Inc. and ZTO Express (Cayman) Inc.'s Expenses

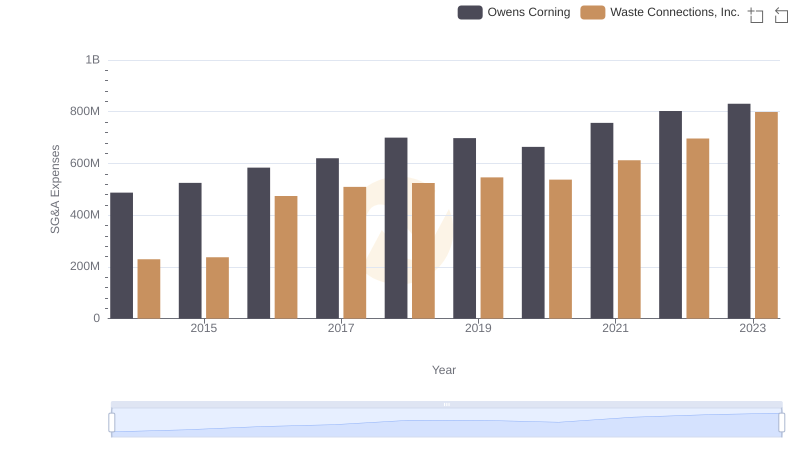

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Owens Corning

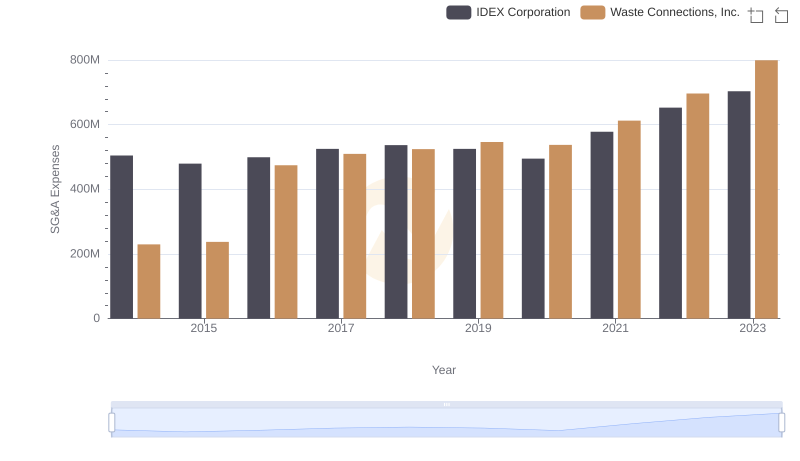

Waste Connections, Inc. and IDEX Corporation: SG&A Spending Patterns Compared

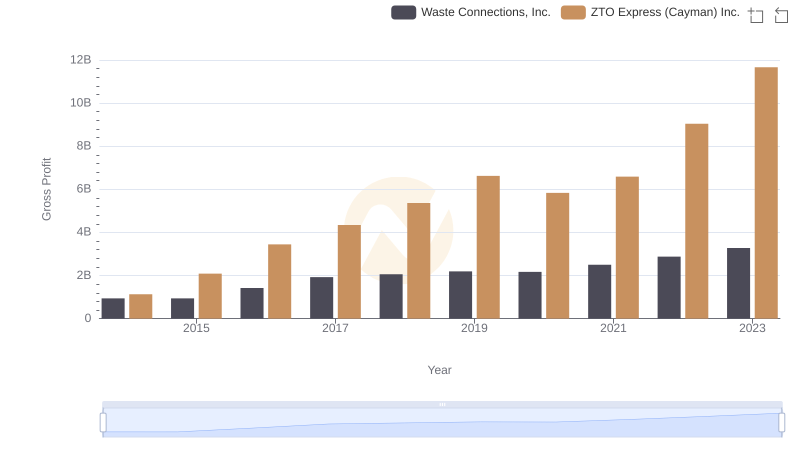

Waste Connections, Inc. vs ZTO Express (Cayman) Inc.: A Gross Profit Performance Breakdown

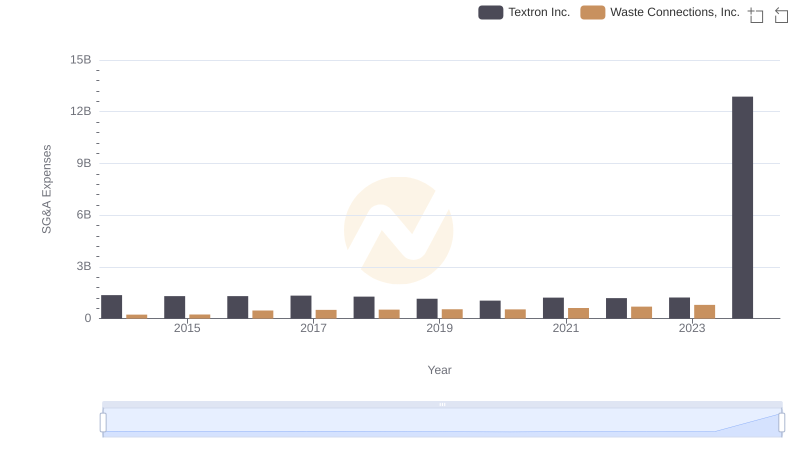

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Textron Inc.

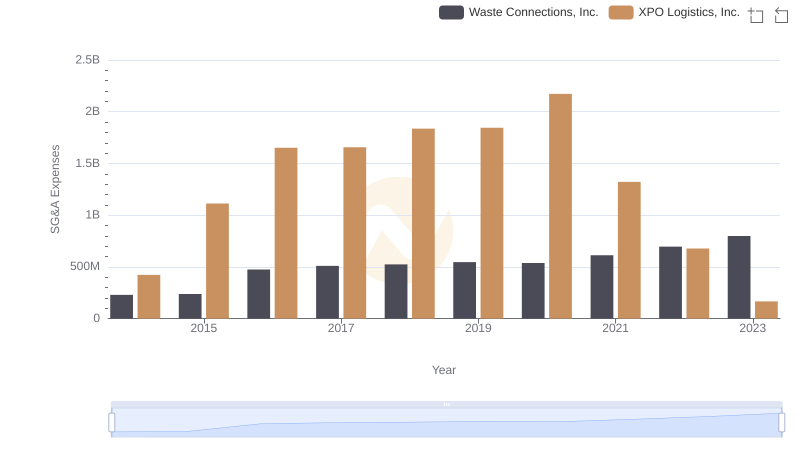

Breaking Down SG&A Expenses: Waste Connections, Inc. vs XPO Logistics, Inc.

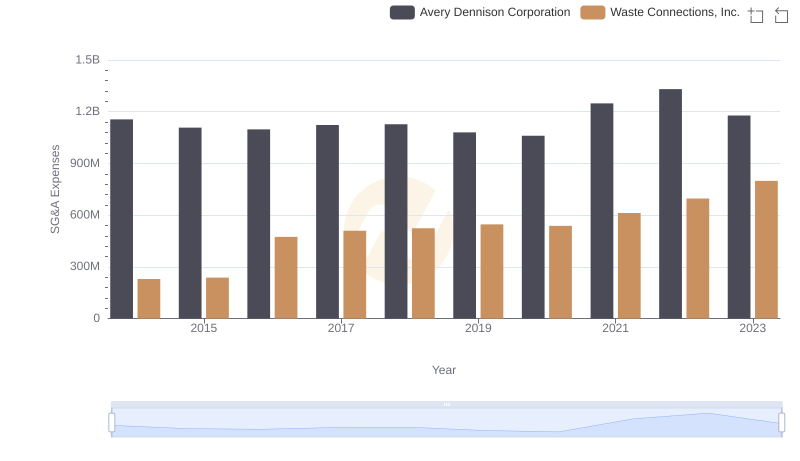

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Avery Dennison Corporation

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Expeditors International of Washington, Inc.