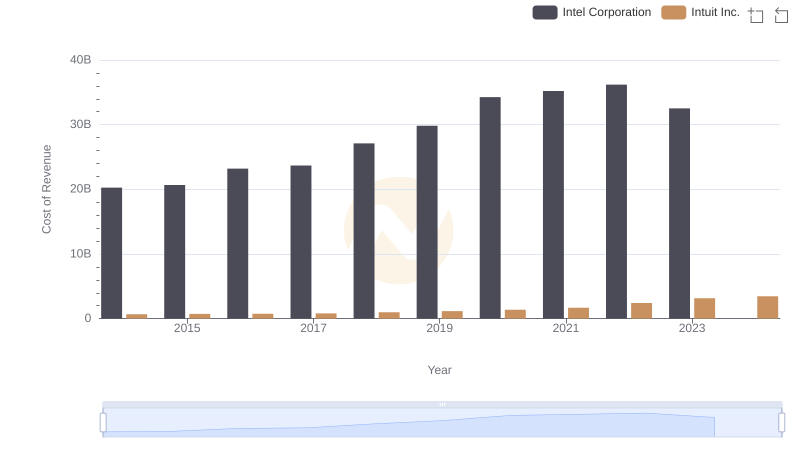

| __timestamp | Intel Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 55870000000 | 4506000000 |

| Thursday, January 1, 2015 | 55355000000 | 4192000000 |

| Friday, January 1, 2016 | 59387000000 | 4694000000 |

| Sunday, January 1, 2017 | 62761000000 | 5177000000 |

| Monday, January 1, 2018 | 70848000000 | 5964000000 |

| Tuesday, January 1, 2019 | 71965000000 | 6784000000 |

| Wednesday, January 1, 2020 | 77867000000 | 7679000000 |

| Friday, January 1, 2021 | 79024000000 | 9633000000 |

| Saturday, January 1, 2022 | 63054000000 | 12726000000 |

| Sunday, January 1, 2023 | 54228000000 | 14368000000 |

| Monday, January 1, 2024 | 53101000000 | 16285000000 |

Cracking the code

In the ever-evolving landscape of technology, Intuit Inc. and Intel Corporation have carved distinct paths over the past decade. From 2014 to 2023, Intel's revenue showcased a rollercoaster journey, peaking in 2021 before experiencing a decline of approximately 31% by 2023. Meanwhile, Intuit Inc. demonstrated a consistent upward trajectory, with revenue growing by an impressive 218% over the same period.

Intel, a stalwart in semiconductor manufacturing, faced challenges in recent years, reflected in its revenue dip. In contrast, Intuit, a leader in financial software, capitalized on the digital transformation wave, achieving record revenues in 2023. This divergence highlights the shifting dynamics in the tech industry, where software solutions are gaining ground over traditional hardware.

As we look to 2024, Intuit's continued growth is anticipated, while Intel's strategy to regain momentum remains a point of interest for industry watchers.

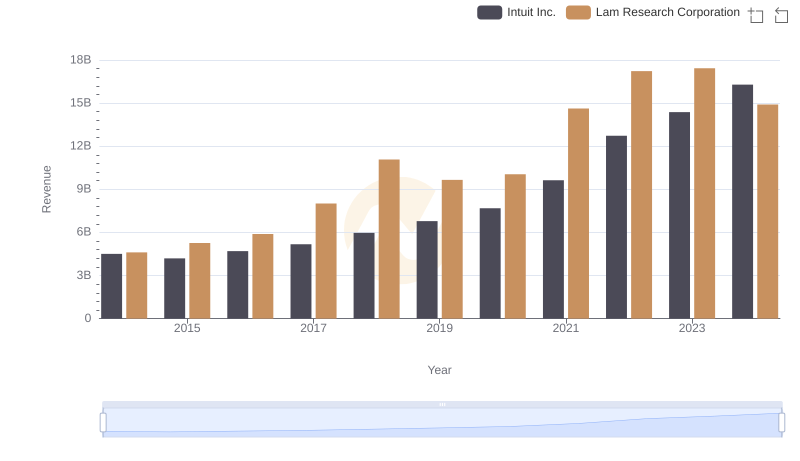

Revenue Insights: Intuit Inc. and Lam Research Corporation Performance Compared

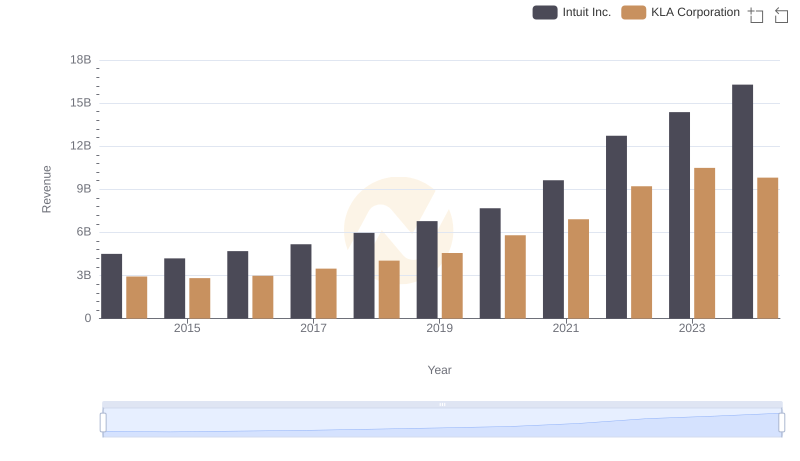

Revenue Showdown: Intuit Inc. vs KLA Corporation

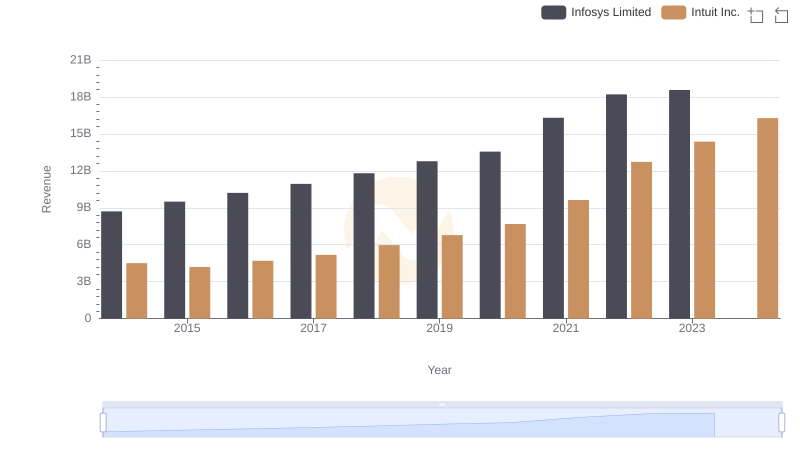

Revenue Showdown: Intuit Inc. vs Infosys Limited

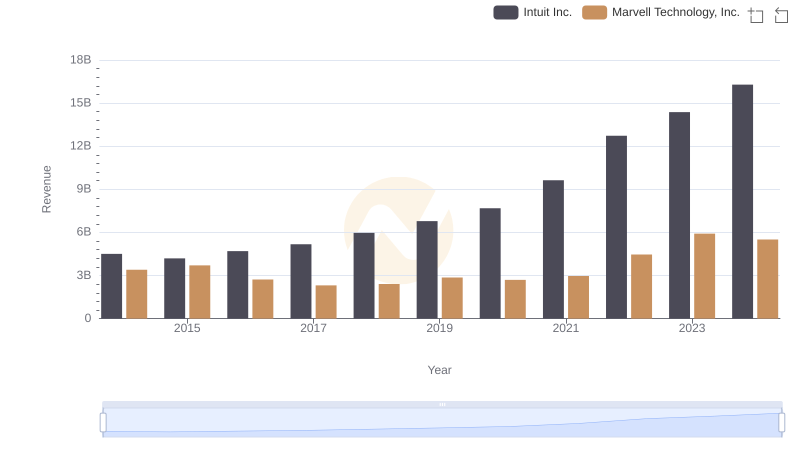

Intuit Inc. vs Marvell Technology, Inc.: Annual Revenue Growth Compared

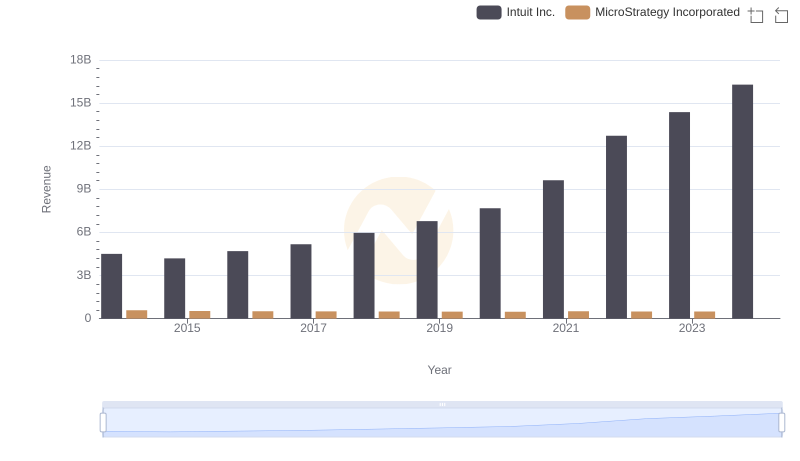

Revenue Showdown: Intuit Inc. vs MicroStrategy Incorporated

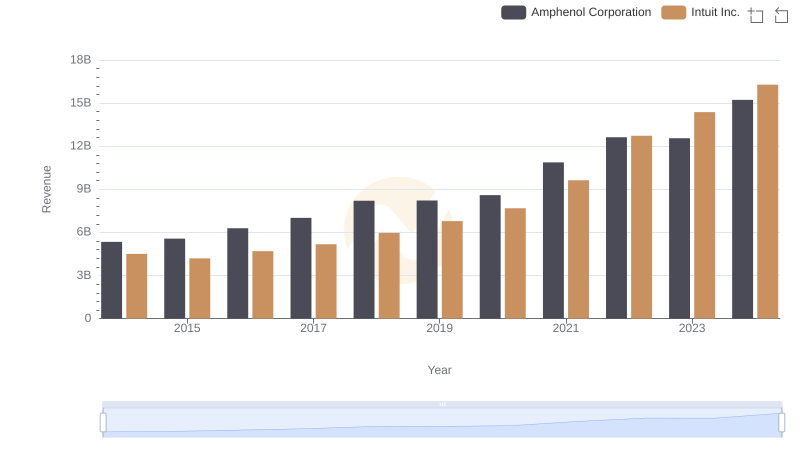

Revenue Insights: Intuit Inc. and Amphenol Corporation Performance Compared

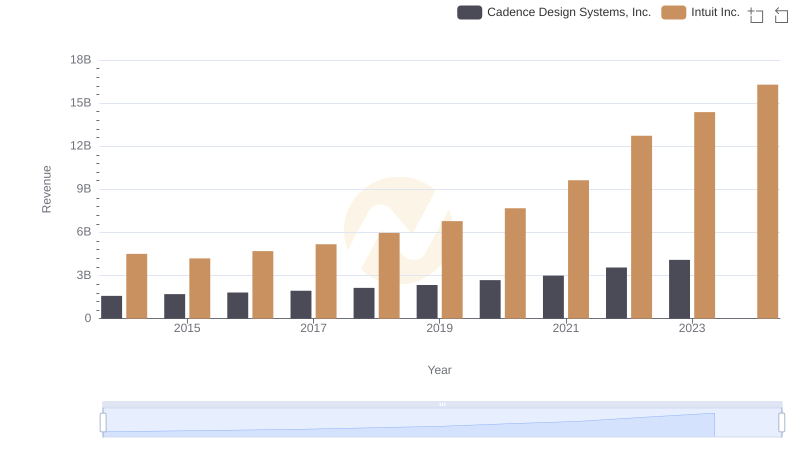

Who Generates More Revenue? Intuit Inc. or Cadence Design Systems, Inc.

Intuit Inc. vs Intel Corporation: Efficiency in Cost of Revenue Explored

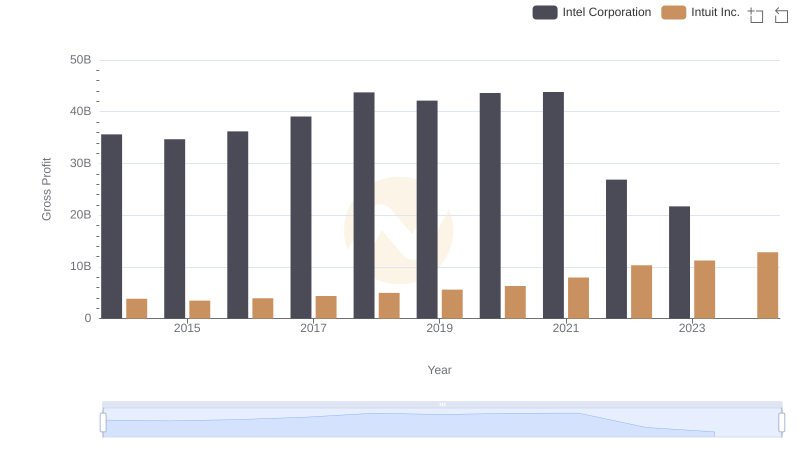

Intuit Inc. vs Intel Corporation: A Gross Profit Performance Breakdown

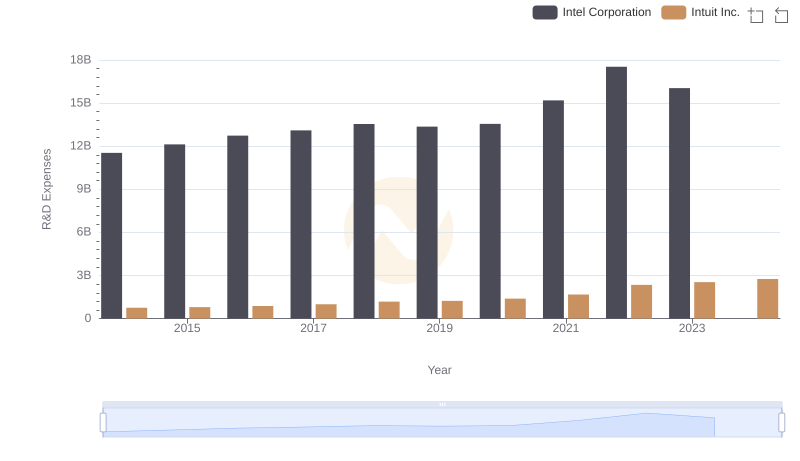

R&D Insights: How Intuit Inc. and Intel Corporation Allocate Funds

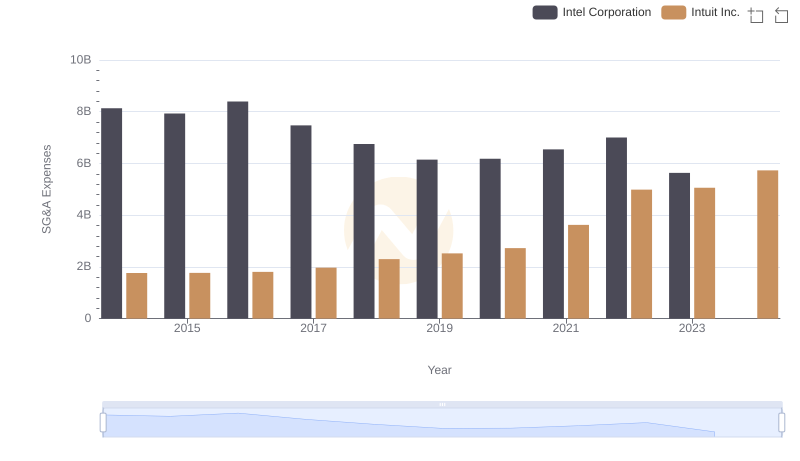

Intuit Inc. and Intel Corporation: SG&A Spending Patterns Compared

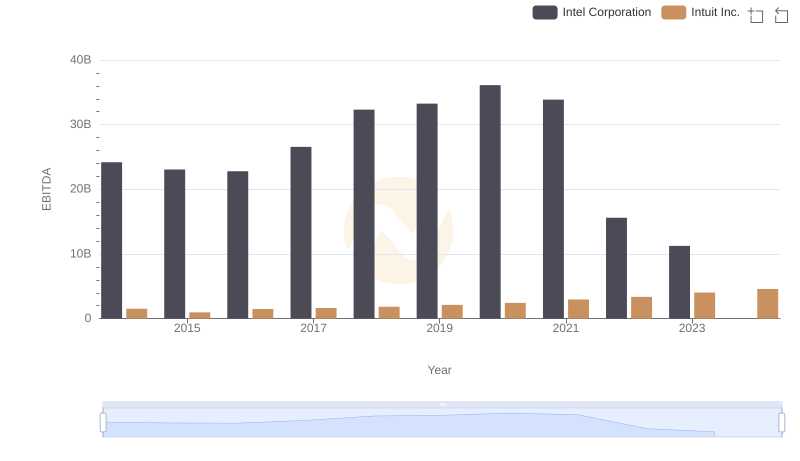

A Professional Review of EBITDA: Intuit Inc. Compared to Intel Corporation