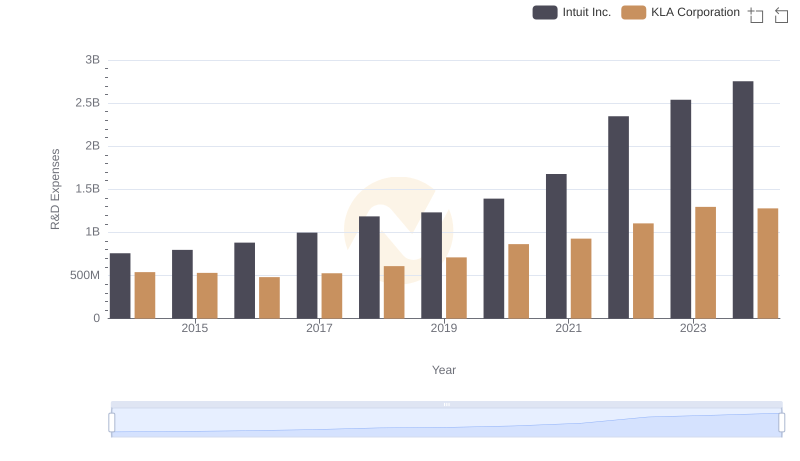

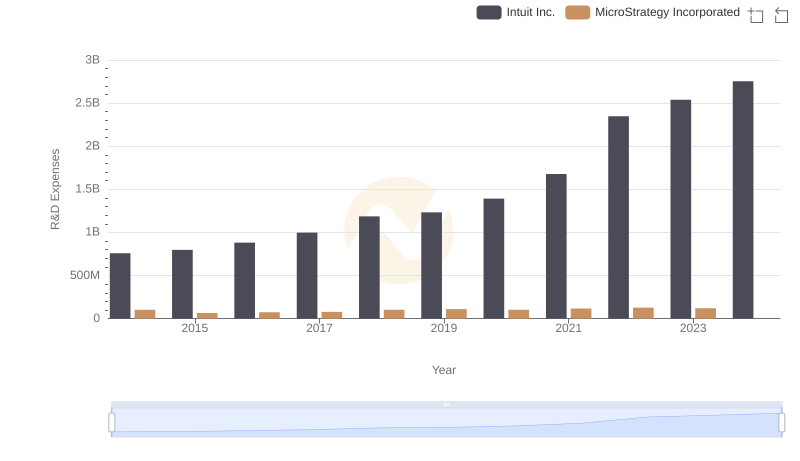

| __timestamp | Intel Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11537000000 | 758000000 |

| Thursday, January 1, 2015 | 12128000000 | 798000000 |

| Friday, January 1, 2016 | 12740000000 | 881000000 |

| Sunday, January 1, 2017 | 13098000000 | 998000000 |

| Monday, January 1, 2018 | 13543000000 | 1186000000 |

| Tuesday, January 1, 2019 | 13362000000 | 1233000000 |

| Wednesday, January 1, 2020 | 13556000000 | 1392000000 |

| Friday, January 1, 2021 | 15190000000 | 1678000000 |

| Saturday, January 1, 2022 | 17528000000 | 2347000000 |

| Sunday, January 1, 2023 | 16046000000 | 2539000000 |

| Monday, January 1, 2024 | 16546000000 | 2754000000 |

Data in motion

In the ever-evolving tech landscape, research and development (R&D) is the lifeblood of innovation. Over the past decade, Intel Corporation and Intuit Inc. have demonstrated distinct strategies in their R&D investments. From 2014 to 2023, Intel's R&D expenses surged by approximately 39%, peaking in 2022. This reflects Intel's commitment to maintaining its leadership in semiconductor technology. Meanwhile, Intuit's R&D spending grew by an impressive 235% over the same period, highlighting its aggressive push into cloud-based financial solutions.

Interestingly, while Intel's R&D spending saw a slight dip in 2023, Intuit continued its upward trajectory, underscoring its focus on innovation. The data for 2024 is incomplete, but the trend suggests Intuit's dedication to expanding its technological capabilities. These insights reveal how two industry leaders allocate resources to stay ahead in a competitive market.

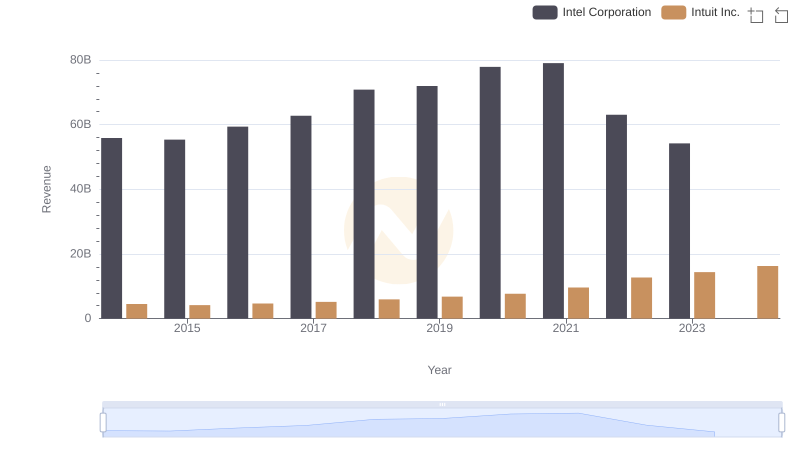

Breaking Down Revenue Trends: Intuit Inc. vs Intel Corporation

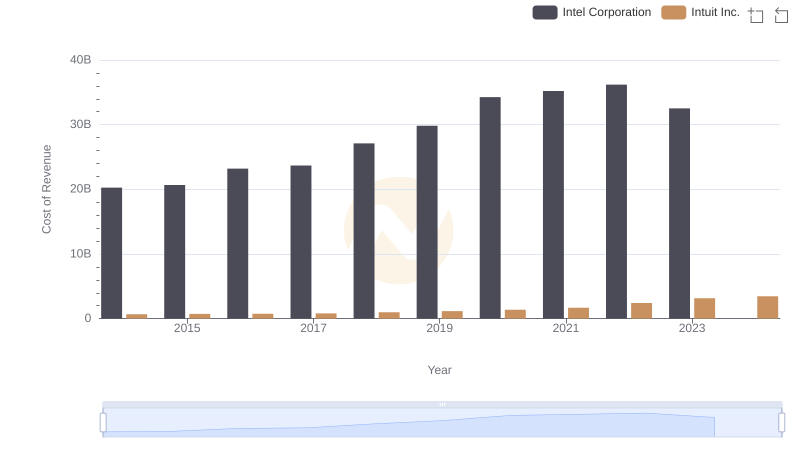

Intuit Inc. vs Intel Corporation: Efficiency in Cost of Revenue Explored

Research and Development: Comparing Key Metrics for Intuit Inc. and KLA Corporation

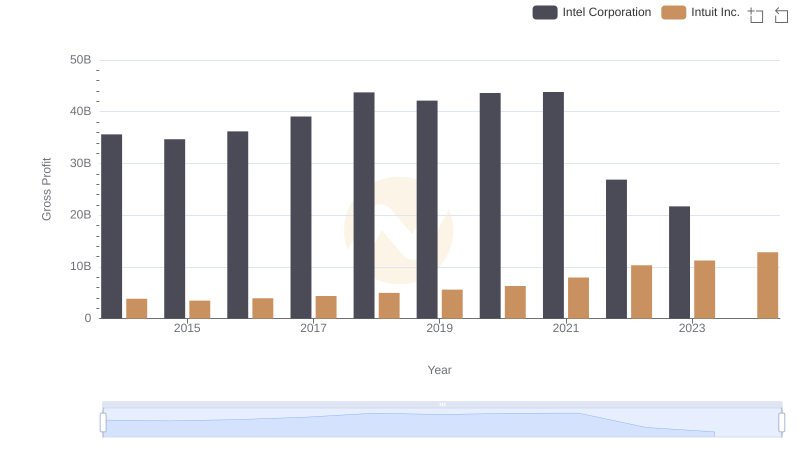

Intuit Inc. vs Intel Corporation: A Gross Profit Performance Breakdown

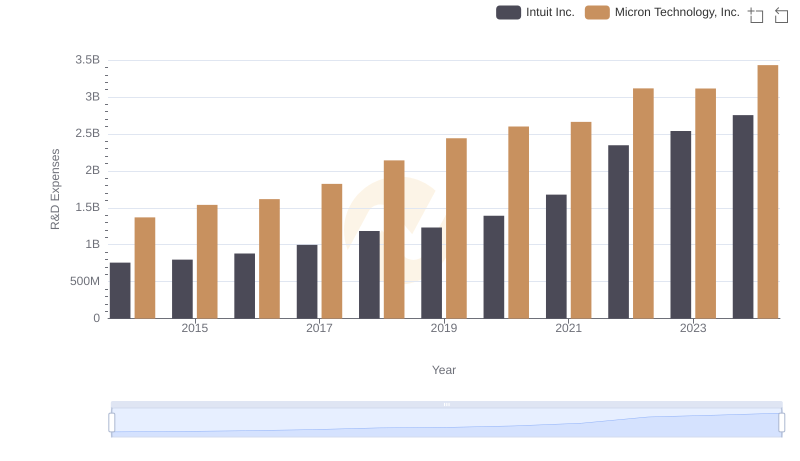

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Micron Technology, Inc.

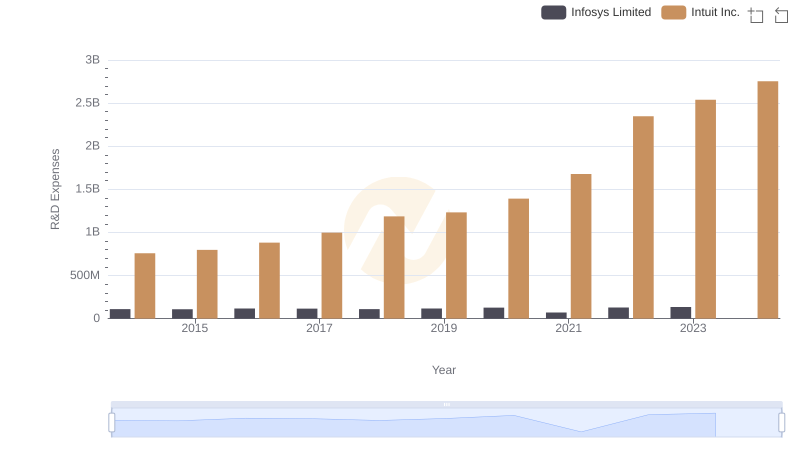

Research and Development Investment: Intuit Inc. vs Infosys Limited

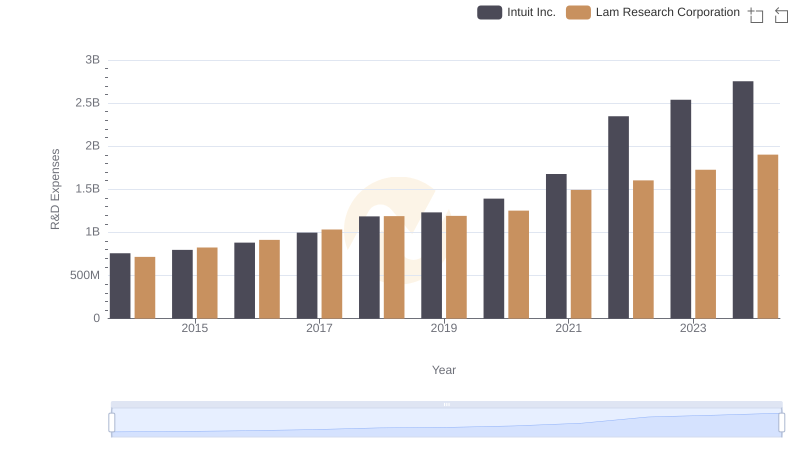

Analyzing R&D Budgets: Intuit Inc. vs Lam Research Corporation

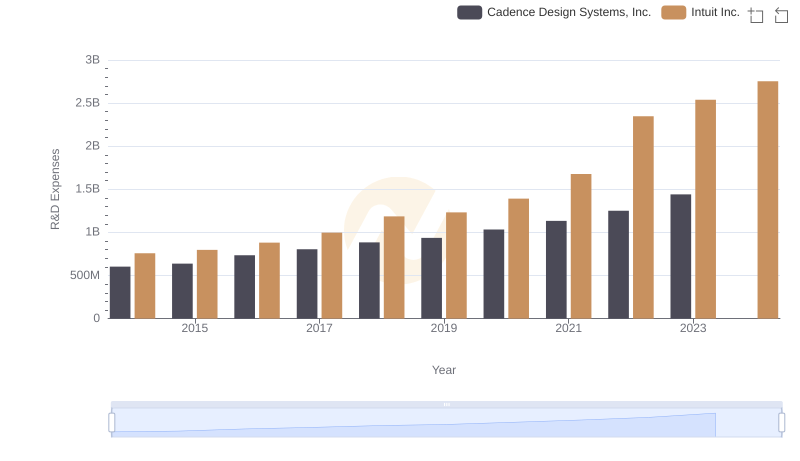

Comparing Innovation Spending: Intuit Inc. and Cadence Design Systems, Inc.

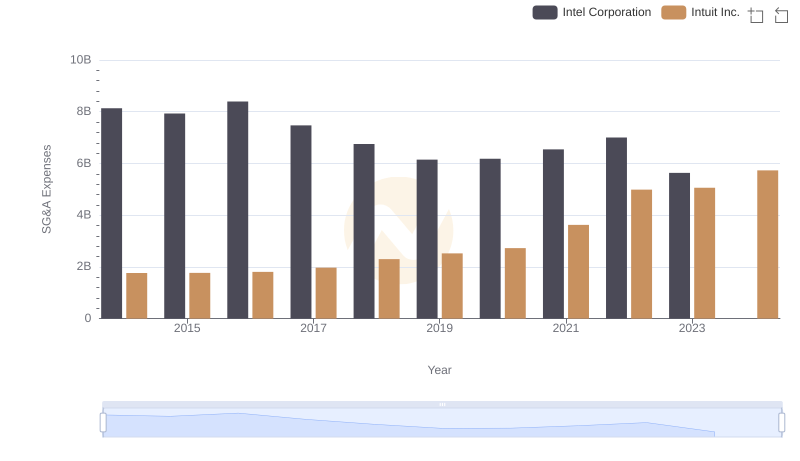

Intuit Inc. and Intel Corporation: SG&A Spending Patterns Compared

Intuit Inc. or MicroStrategy Incorporated: Who Invests More in Innovation?

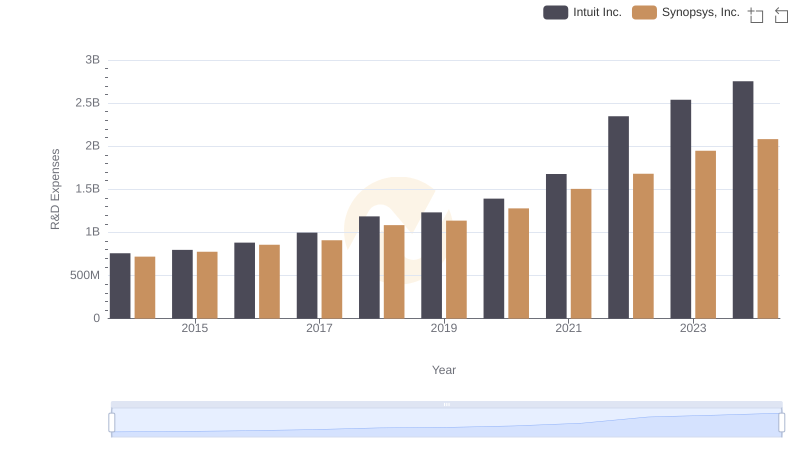

R&D Insights: How Intuit Inc. and Synopsys, Inc. Allocate Funds

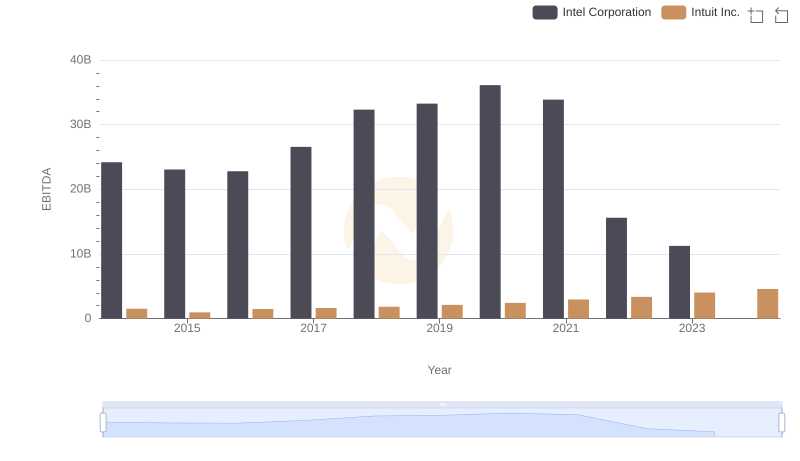

A Professional Review of EBITDA: Intuit Inc. Compared to Intel Corporation