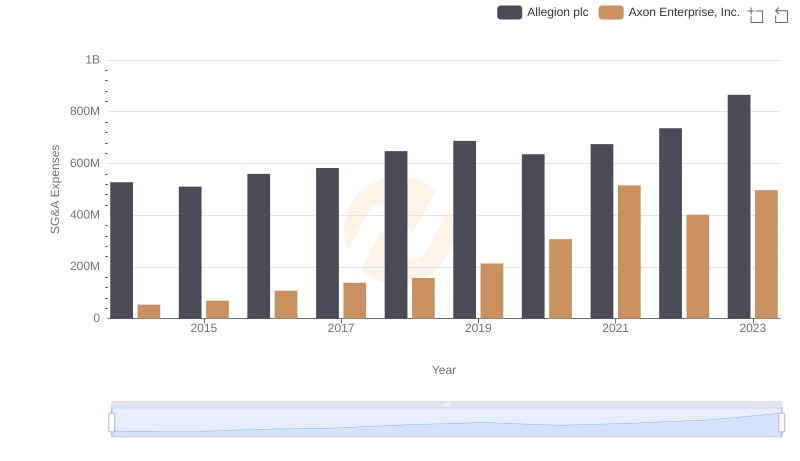

| __timestamp | Allegion plc | Axon Enterprise, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1264600000 | 62977000 |

| Thursday, January 1, 2015 | 1199000000 | 69245000 |

| Friday, January 1, 2016 | 1252700000 | 97709000 |

| Sunday, January 1, 2017 | 1337500000 | 136710000 |

| Monday, January 1, 2018 | 1558400000 | 161485000 |

| Tuesday, January 1, 2019 | 1601700000 | 223574000 |

| Wednesday, January 1, 2020 | 1541100000 | 264672000 |

| Friday, January 1, 2021 | 1662500000 | 322471000 |

| Saturday, January 1, 2022 | 1949500000 | 461297000 |

| Sunday, January 1, 2023 | 2069300000 | 608009000 |

| Monday, January 1, 2024 | 2103700000 |

Unleashing insights

In the ever-evolving landscape of corporate efficiency, the cost of revenue is a critical metric. From 2014 to 2023, Allegion plc and Axon Enterprise, Inc. have showcased distinct trajectories in managing their cost of revenue. Allegion plc, a leader in security solutions, has seen a steady increase, with costs rising approximately 64% over the decade. In contrast, Axon Enterprise, Inc., known for its innovative public safety technologies, has experienced a staggering 866% increase in the same period.

Allegion's cost efficiency reflects a mature market presence, with costs peaking in 2023. Meanwhile, Axon's rapid growth highlights its aggressive expansion and investment in cutting-edge technology. This comparison underscores the diverse strategies companies employ to balance growth and cost management, offering valuable insights for investors and industry analysts alike.

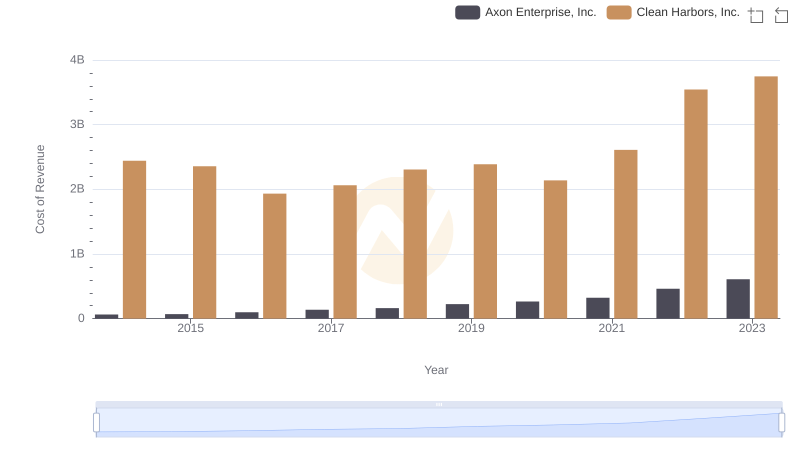

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Clean Harbors, Inc.

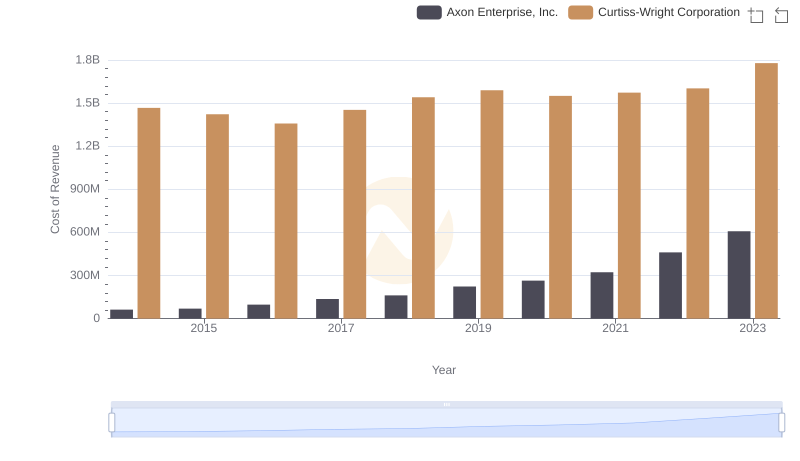

Cost of Revenue Trends: Axon Enterprise, Inc. vs Curtiss-Wright Corporation

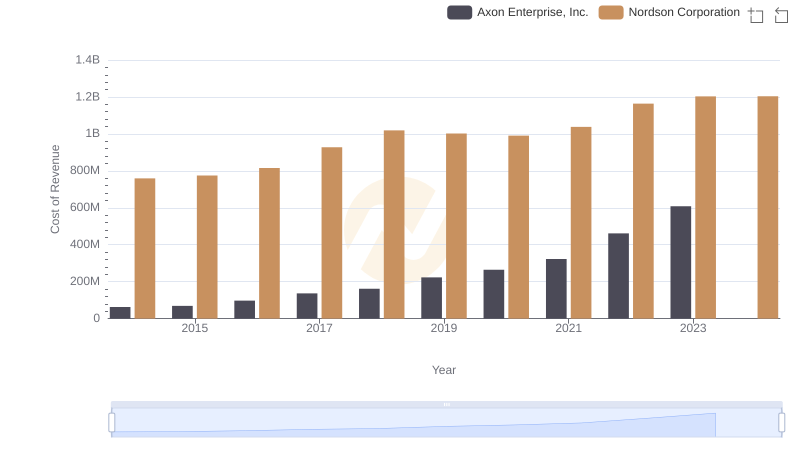

Cost of Revenue Trends: Axon Enterprise, Inc. vs Nordson Corporation

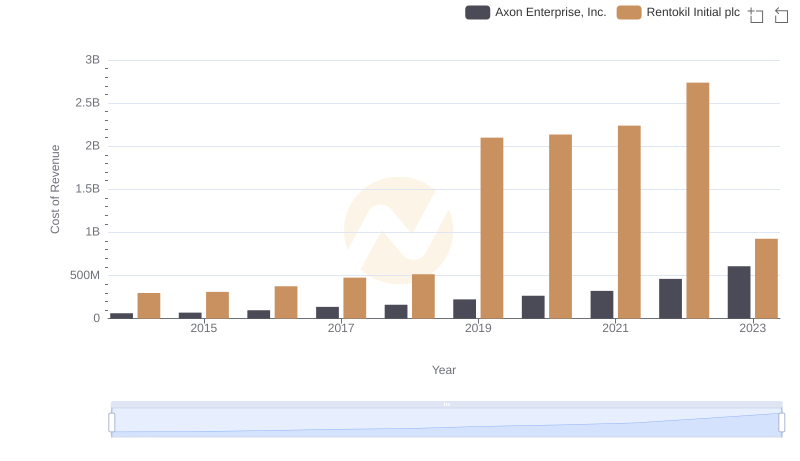

Axon Enterprise, Inc. vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

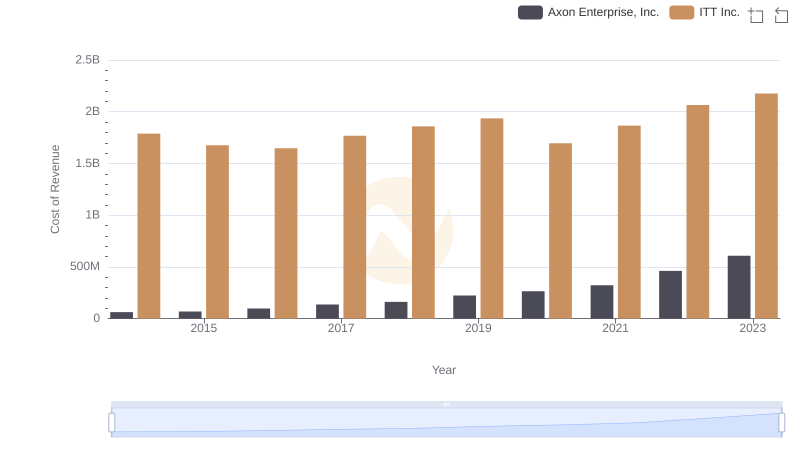

Analyzing Cost of Revenue: Axon Enterprise, Inc. and ITT Inc.

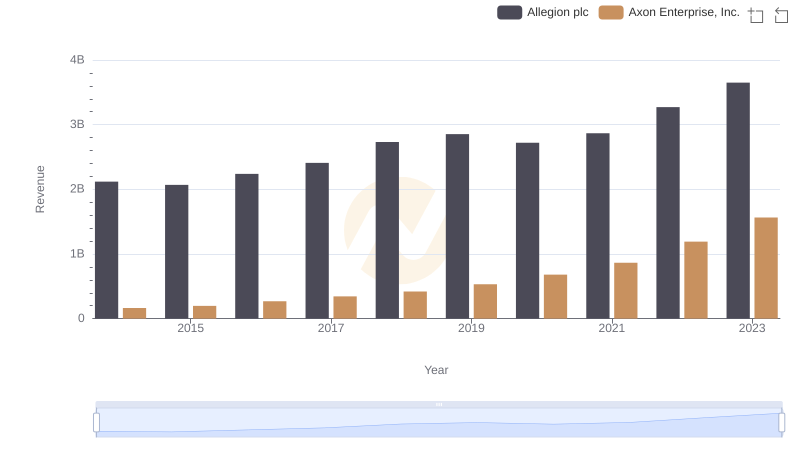

Axon Enterprise, Inc. vs Allegion plc: Annual Revenue Growth Compared

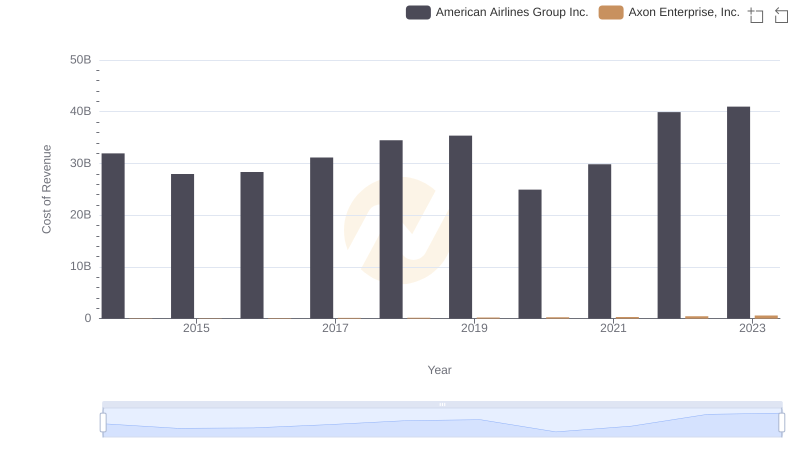

Cost Insights: Breaking Down Axon Enterprise, Inc. and American Airlines Group Inc.'s Expenses

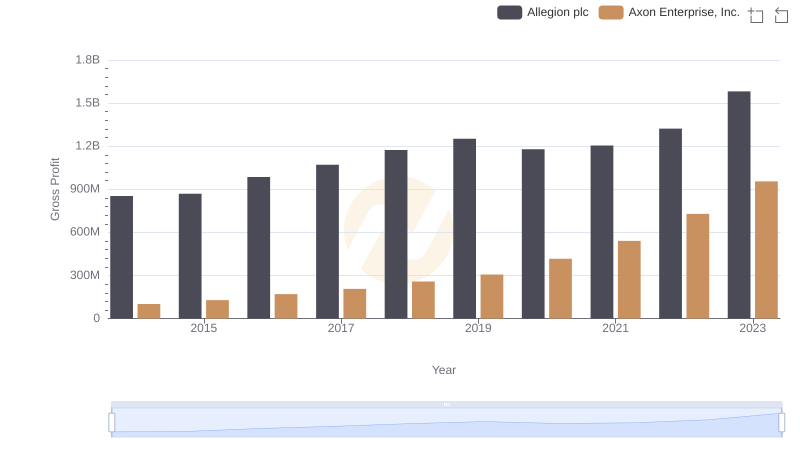

Gross Profit Comparison: Axon Enterprise, Inc. and Allegion plc Trends

Research and Development Investment: Axon Enterprise, Inc. vs Allegion plc

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or Allegion plc