| __timestamp | Automatic Data Processing, Inc. | Cummins Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 4861000000 |

| Thursday, January 1, 2015 | 4133200000 | 4947000000 |

| Friday, January 1, 2016 | 4450200000 | 4452000000 |

| Sunday, January 1, 2017 | 4712600000 | 5090000000 |

| Monday, January 1, 2018 | 5016700000 | 5737000000 |

| Tuesday, January 1, 2019 | 5526700000 | 5980000000 |

| Wednesday, January 1, 2020 | 6144700000 | 4894000000 |

| Friday, January 1, 2021 | 6365100000 | 5695000000 |

| Saturday, January 1, 2022 | 7036400000 | 6719000000 |

| Sunday, January 1, 2023 | 8058800000 | 8249000000 |

| Monday, January 1, 2024 | 8725900000 | 8439000000 |

Infusing magic into the data realm

In the ever-evolving landscape of American industry, Automatic Data Processing, Inc. (ADP) and Cummins Inc. have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, ADP's gross profit surged by approximately 89%, reflecting its robust growth and strategic market positioning. Cummins, a leader in power solutions, also demonstrated a commendable increase of around 70% in the same period, despite facing challenges in 2020 with a dip in profits.

The year 2023 marked a significant milestone, with both companies achieving their highest gross profits in the decade, ADP at $8.1 billion and Cummins at $8.2 billion. However, data for 2024 remains incomplete for Cummins, leaving room for speculation on its future performance. This analysis underscores the resilience and adaptability of these industrial giants in a competitive market.

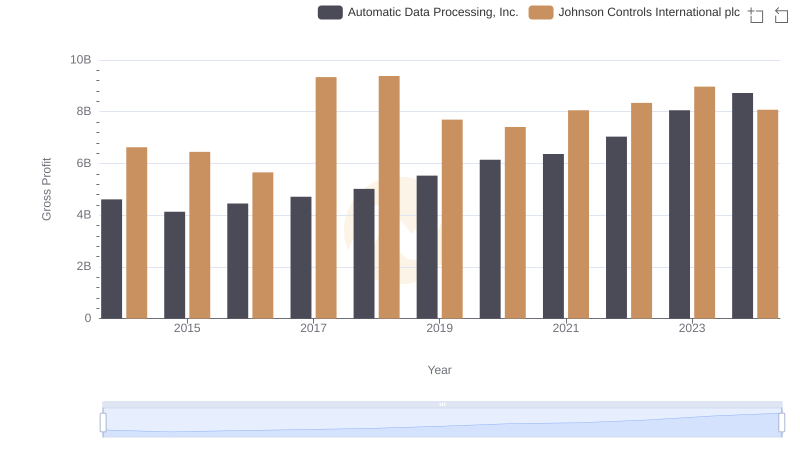

Automatic Data Processing, Inc. vs Johnson Controls International plc: A Gross Profit Performance Breakdown

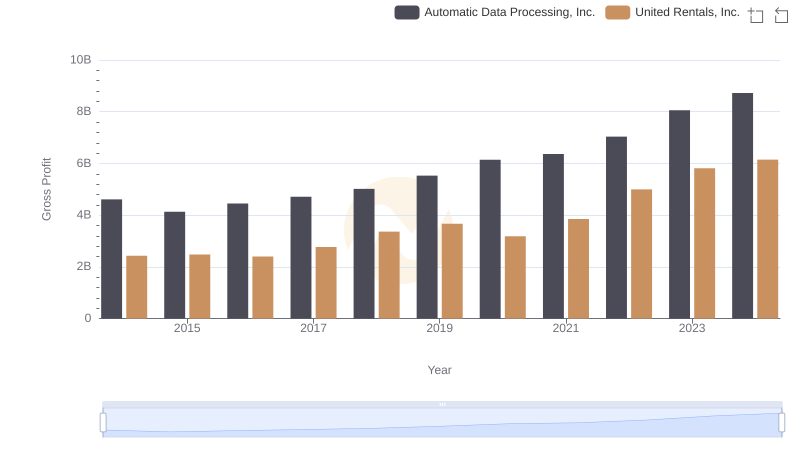

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Rentals, Inc.

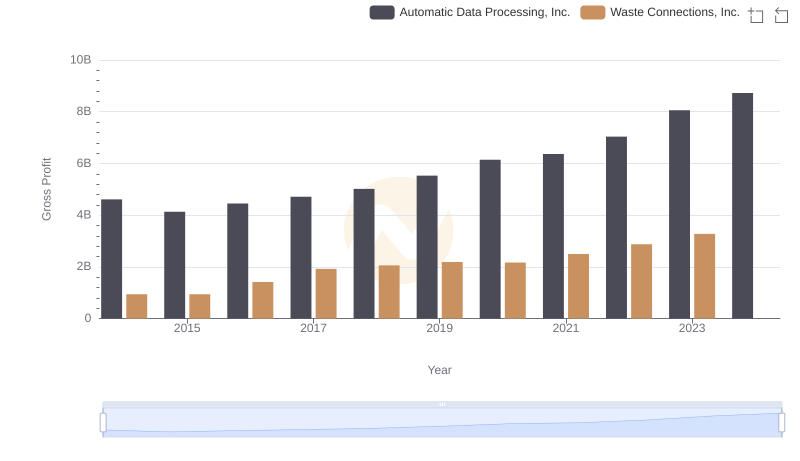

Automatic Data Processing, Inc. and Waste Connections, Inc.: A Detailed Gross Profit Analysis

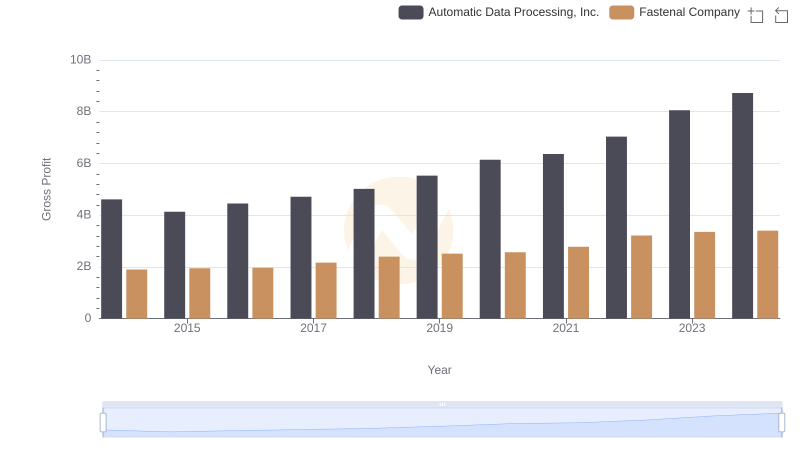

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Fastenal Company