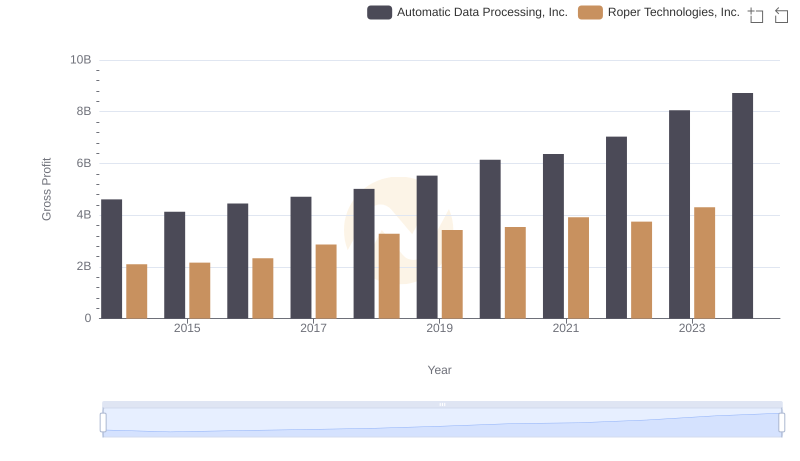

| __timestamp | Automatic Data Processing, Inc. | W.W. Grainger, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 4314242000 |

| Thursday, January 1, 2015 | 4133200000 | 4231428000 |

| Friday, January 1, 2016 | 4450200000 | 4114557000 |

| Sunday, January 1, 2017 | 4712600000 | 4097557000 |

| Monday, January 1, 2018 | 5016700000 | 4348000000 |

| Tuesday, January 1, 2019 | 5526700000 | 4397000000 |

| Wednesday, January 1, 2020 | 6144700000 | 4238000000 |

| Friday, January 1, 2021 | 6365100000 | 4720000000 |

| Saturday, January 1, 2022 | 7036400000 | 5849000000 |

| Sunday, January 1, 2023 | 8058800000 | 6496000000 |

| Monday, January 1, 2024 | 8725900000 | 6758000000 |

Unleashing the power of data

In the competitive landscape of American business, Automatic Data Processing, Inc. (ADP) and W.W. Grainger, Inc. have showcased remarkable growth in gross profit over the past decade. From 2014 to 2023, ADP's gross profit surged by approximately 89%, reflecting its robust business model and strategic market positioning. In contrast, W.W. Grainger, Inc. experienced a 51% increase, highlighting its resilience in the industrial supply sector.

The data for 2024 is incomplete, leaving room for speculation on future trends. Stay tuned for more insights as these industry leaders continue to evolve.

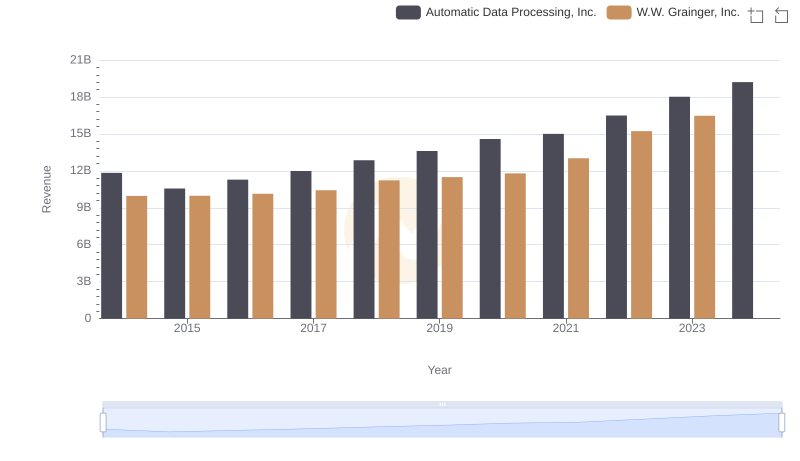

Annual Revenue Comparison: Automatic Data Processing, Inc. vs W.W. Grainger, Inc.

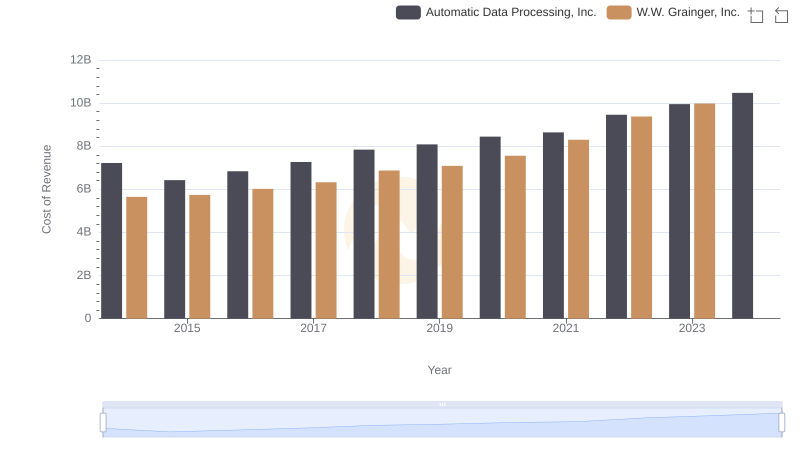

Automatic Data Processing, Inc. vs W.W. Grainger, Inc.: Efficiency in Cost of Revenue Explored

Automatic Data Processing, Inc. and Roper Technologies, Inc.: A Detailed Gross Profit Analysis

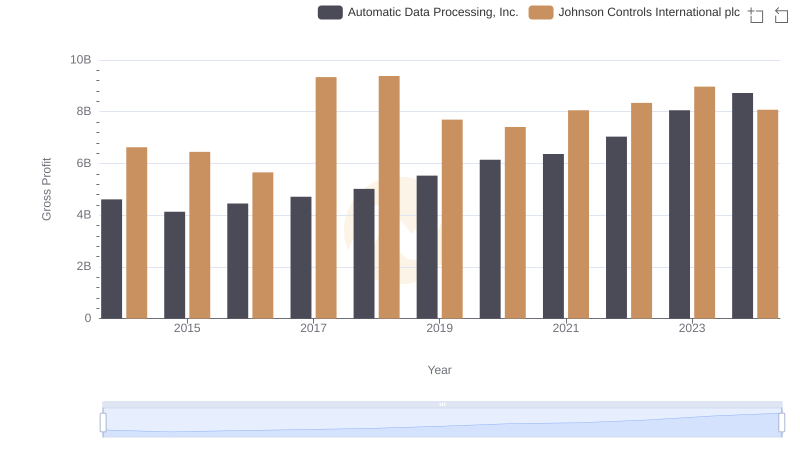

Automatic Data Processing, Inc. vs Johnson Controls International plc: A Gross Profit Performance Breakdown

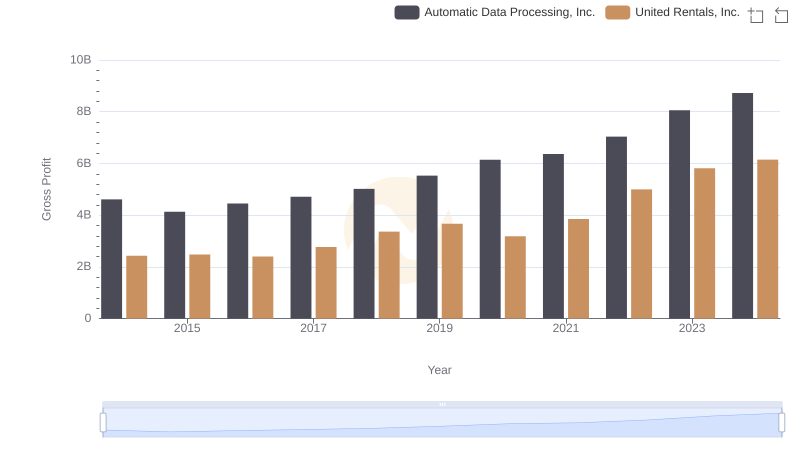

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Rentals, Inc.