| __timestamp | Automatic Data Processing, Inc. | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1041346000 |

| Thursday, January 1, 2015 | 4133200000 | 1146174000 |

| Friday, January 1, 2016 | 4450200000 | 1185633000 |

| Sunday, January 1, 2017 | 4712600000 | 1199293000 |

| Monday, January 1, 2018 | 5016700000 | 1359217000 |

| Tuesday, January 1, 2019 | 5526700000 | 1506255000 |

| Wednesday, January 1, 2020 | 6144700000 | 1449876000 |

| Friday, January 1, 2021 | 6365100000 | 1869819000 |

| Saturday, January 1, 2022 | 7036400000 | 2472527000 |

| Sunday, January 1, 2023 | 8058800000 | 2396388000 |

| Monday, January 1, 2024 | 8725900000 |

Infusing magic into the data realm

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and J.B. Hunt Transport Services, Inc. (JBHT) stand as titans in their respective industries. Over the past decade, ADP has demonstrated a robust growth trajectory, with its gross profit surging by approximately 89% from 2014 to 2023. This growth reflects ADP's strategic innovations and market adaptability. In contrast, JBHT, a leader in transportation services, has seen its gross profit increase by about 130% from 2014 to 2022, showcasing its resilience and operational efficiency.

However, the data for 2024 reveals a gap for JBHT, indicating either a reporting delay or a strategic shift. This missing data point invites speculation and analysis, emphasizing the dynamic nature of financial reporting. As we delve into these figures, the narrative of growth, adaptation, and market leadership unfolds, offering valuable insights for investors and industry enthusiasts alike.

Automatic Data Processing, Inc. or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

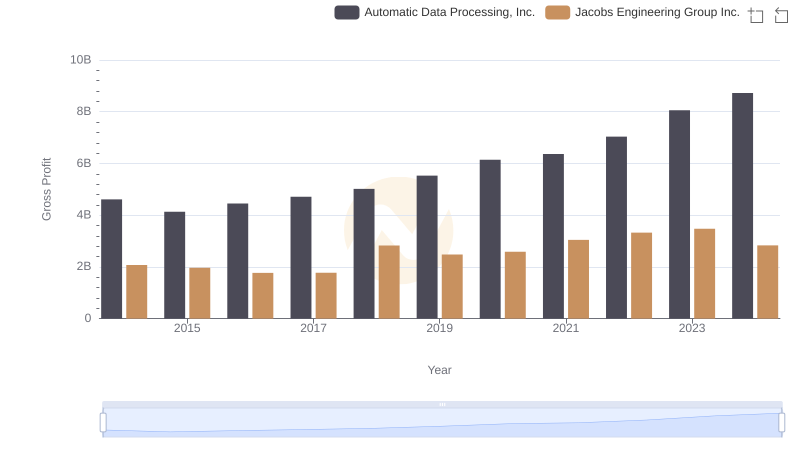

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

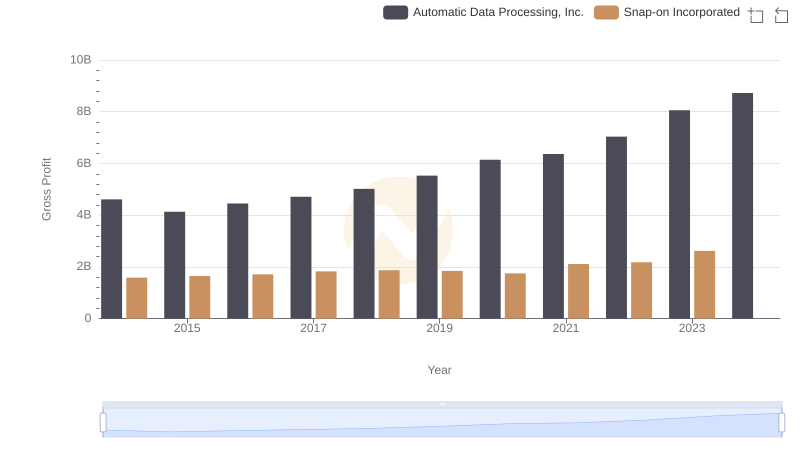

Automatic Data Processing, Inc. and Snap-on Incorporated: A Detailed Gross Profit Analysis

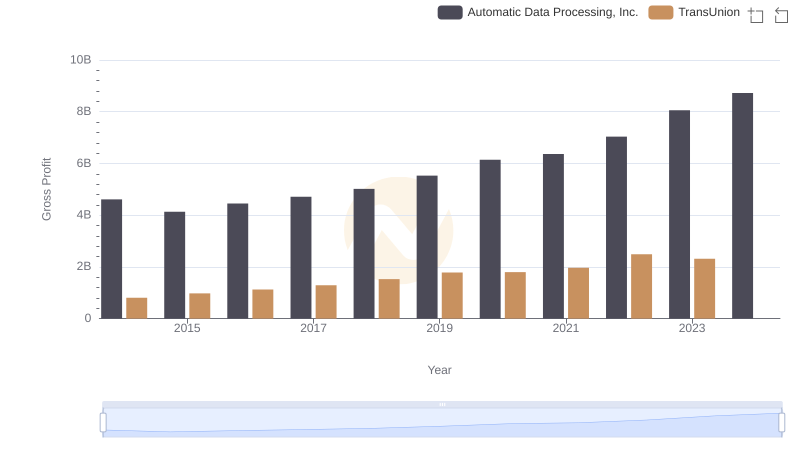

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs TransUnion

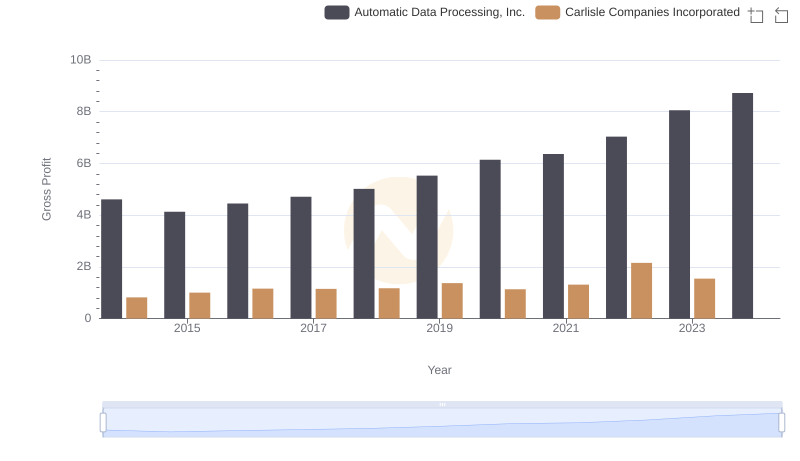

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Carlisle Companies Incorporated

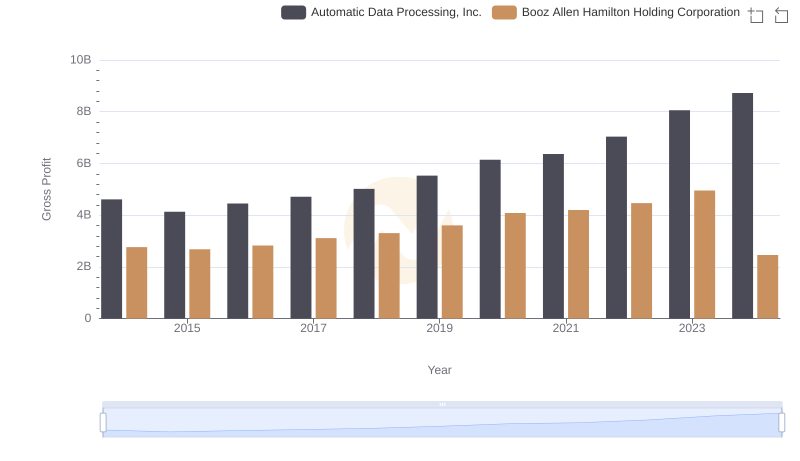

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Booz Allen Hamilton Holding Corporation

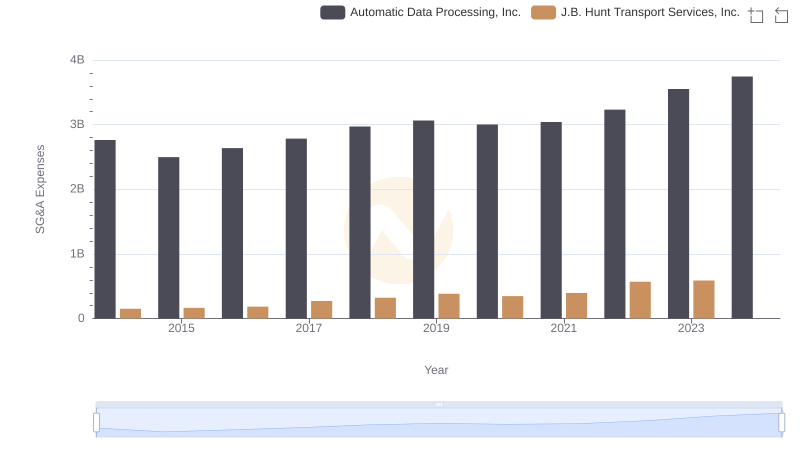

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs J.B. Hunt Transport Services, Inc.

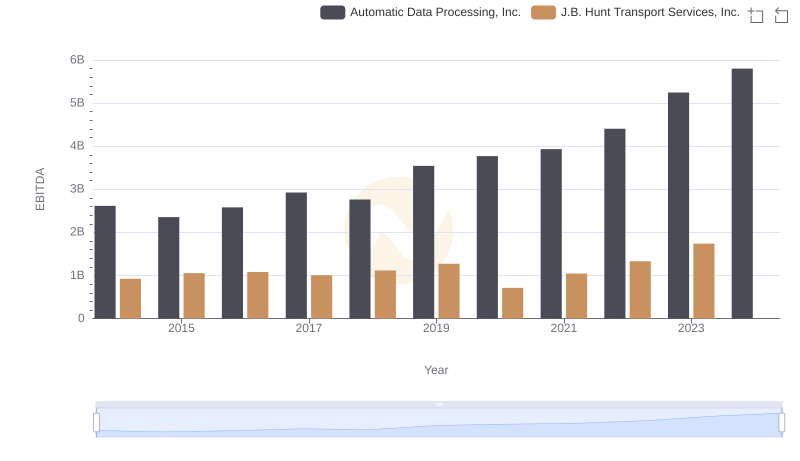

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to J.B. Hunt Transport Services, Inc.