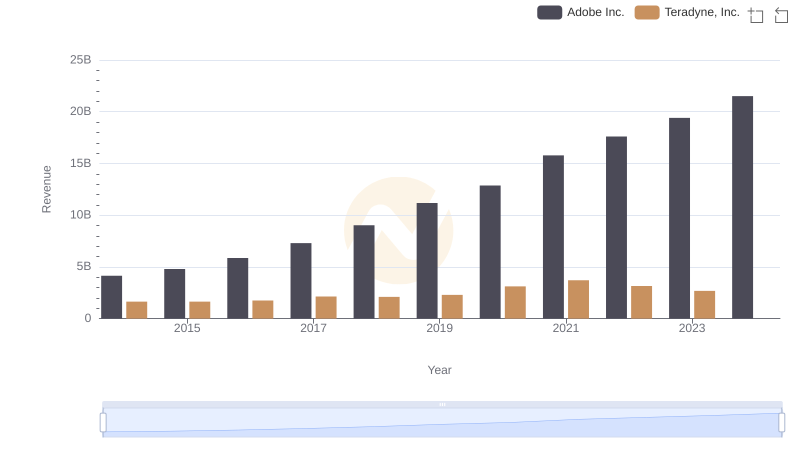

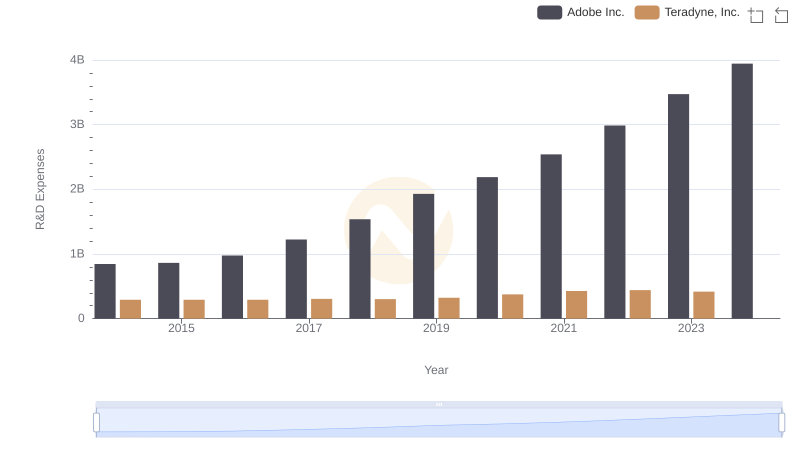

| __timestamp | Adobe Inc. | Teradyne, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 622080000 | 769016000 |

| Thursday, January 1, 2015 | 744317000 | 723935000 |

| Friday, January 1, 2016 | 819908000 | 793683000 |

| Sunday, January 1, 2017 | 1010491000 | 912734000 |

| Monday, January 1, 2018 | 1194999000 | 880408000 |

| Tuesday, January 1, 2019 | 1672720000 | 955136000 |

| Wednesday, January 1, 2020 | 1722000000 | 1335728000 |

| Friday, January 1, 2021 | 1865000000 | 1496225000 |

| Saturday, January 1, 2022 | 2165000000 | 1287894000 |

| Sunday, January 1, 2023 | 2354000000 | 1139550000 |

| Monday, January 1, 2024 | 2358000000 | 1170953000 |

Infusing magic into the data realm

In the ever-evolving tech landscape, understanding cost efficiency is crucial. Over the past decade, Adobe Inc. and Teradyne, Inc. have showcased distinct trajectories in managing their cost of revenue. Adobe's cost of revenue surged by approximately 279% from 2014 to 2023, reflecting its aggressive growth strategy and expansion into new markets. In contrast, Teradyne's cost of revenue increased by about 48% over the same period, indicating a more stable and controlled approach. Notably, Adobe's cost efficiency peaked in 2023, while Teradyne's data for 2024 remains elusive, hinting at potential strategic shifts. This analysis underscores the importance of cost management in sustaining competitive advantage in the tech industry. As we look to the future, these trends offer valuable insights into how these giants might navigate the challenges ahead.

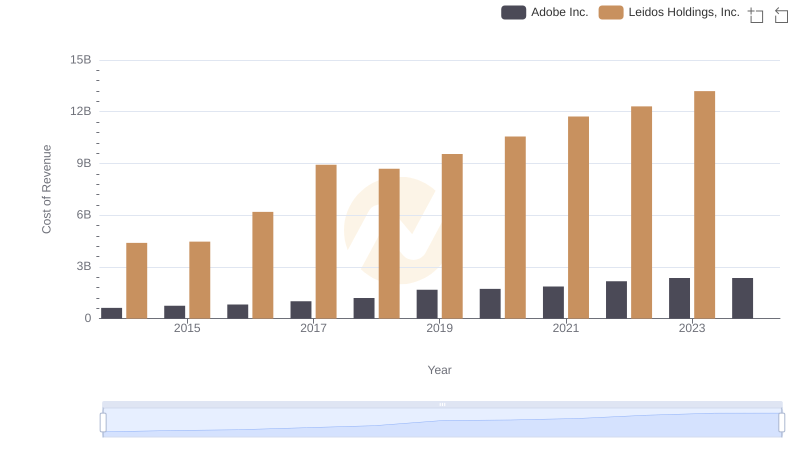

Comparing Cost of Revenue Efficiency: Adobe Inc. vs Leidos Holdings, Inc.

Revenue Insights: Adobe Inc. and Teradyne, Inc. Performance Compared

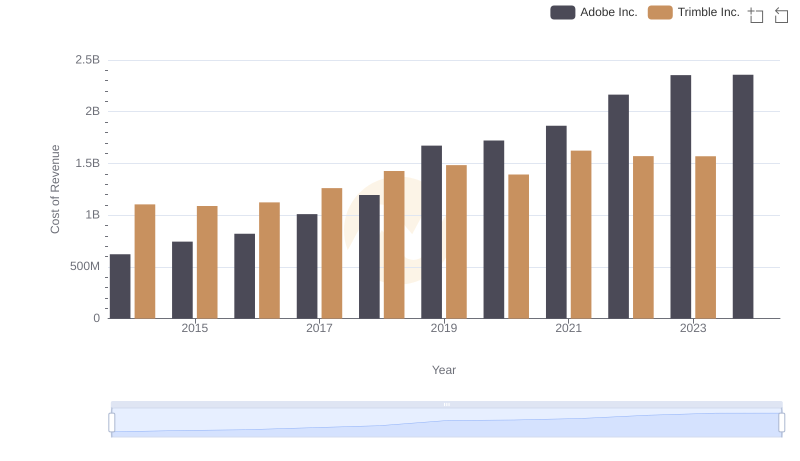

Cost Insights: Breaking Down Adobe Inc. and Trimble Inc.'s Expenses

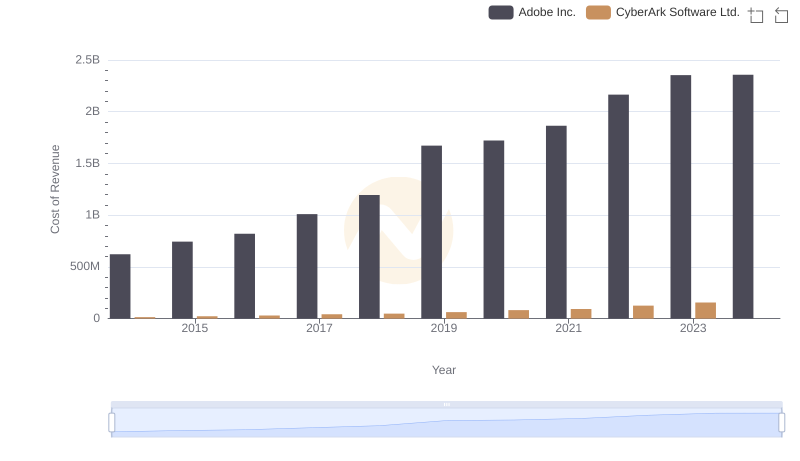

Cost Insights: Breaking Down Adobe Inc. and CyberArk Software Ltd.'s Expenses

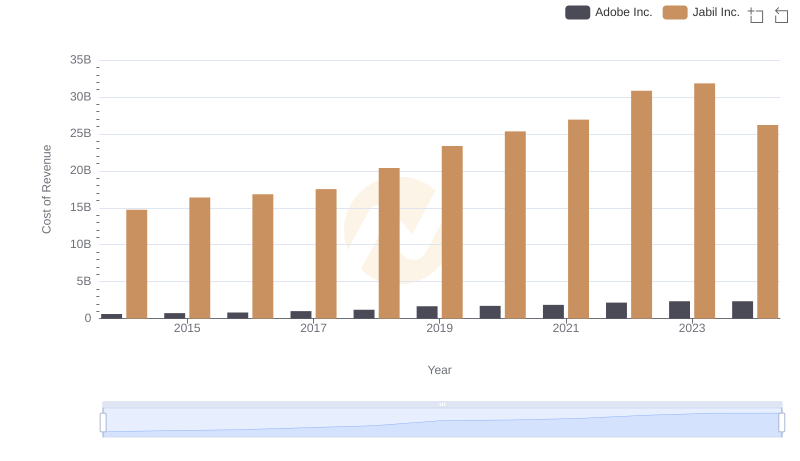

Comparing Cost of Revenue Efficiency: Adobe Inc. vs Jabil Inc.

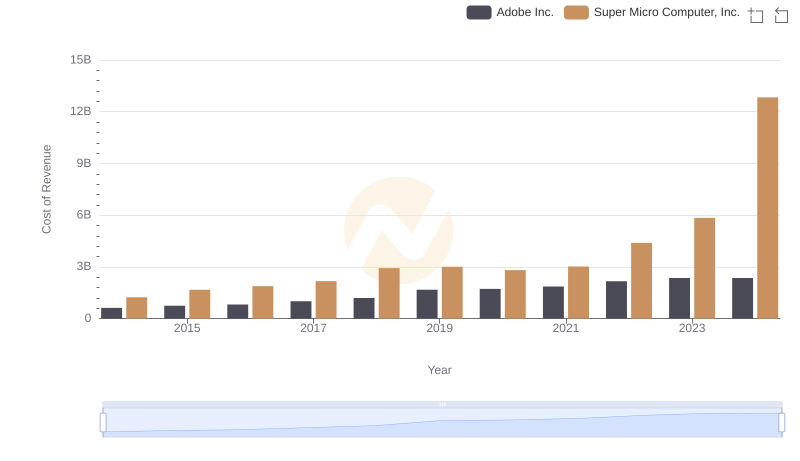

Cost Insights: Breaking Down Adobe Inc. and Super Micro Computer, Inc.'s Expenses

Gross Profit Comparison: Adobe Inc. and Teradyne, Inc. Trends

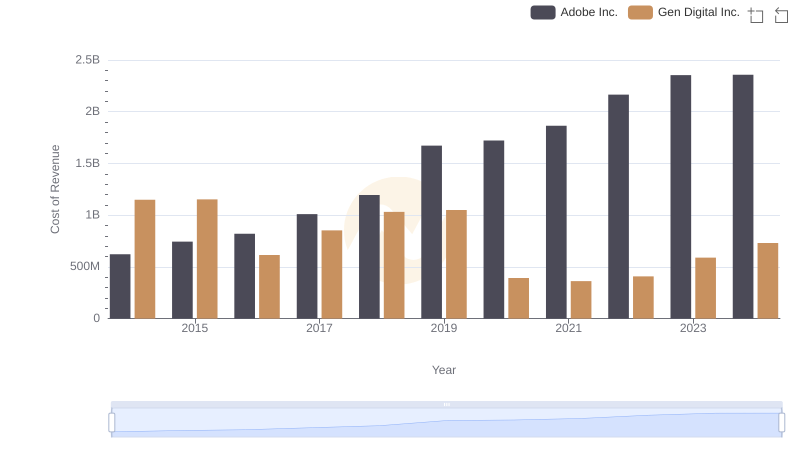

Cost of Revenue Trends: Adobe Inc. vs Gen Digital Inc.

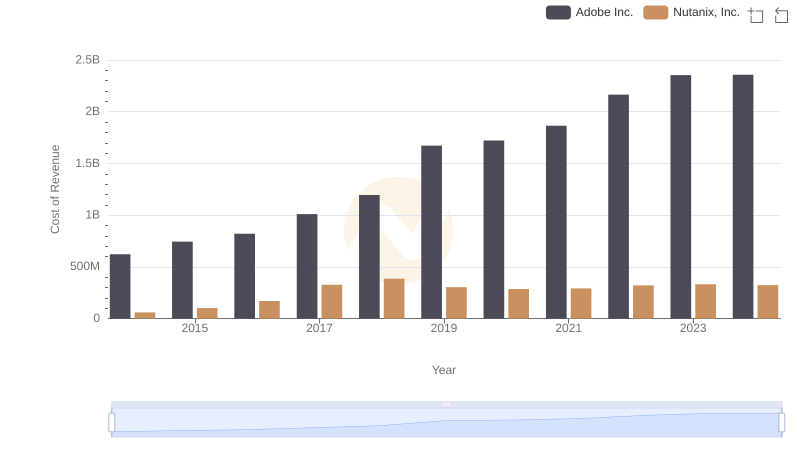

Cost of Revenue Comparison: Adobe Inc. vs Nutanix, Inc.

Who Prioritizes Innovation? R&D Spending Compared for Adobe Inc. and Teradyne, Inc.

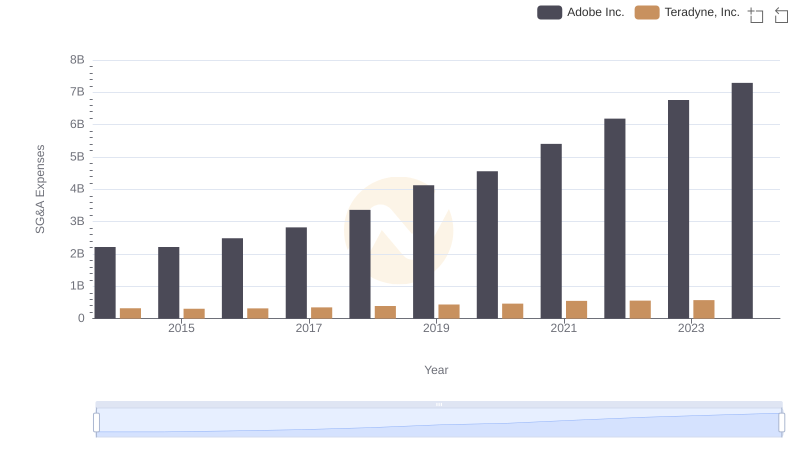

Breaking Down SG&A Expenses: Adobe Inc. vs Teradyne, Inc.

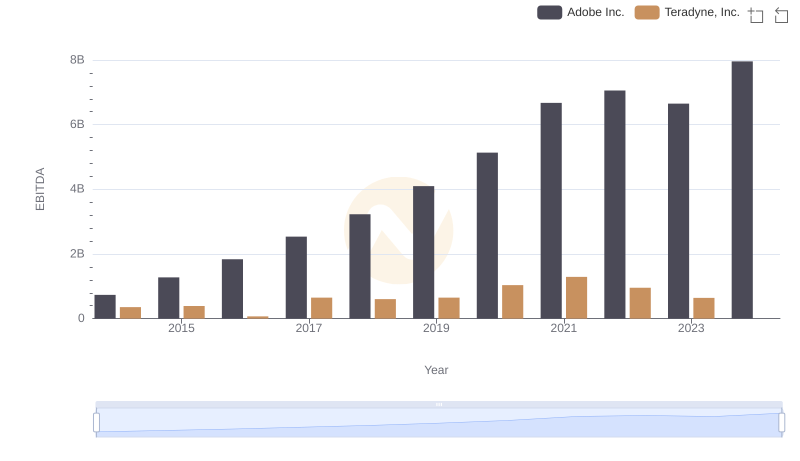

EBITDA Analysis: Evaluating Adobe Inc. Against Teradyne, Inc.