| __timestamp | Automatic Data Processing, Inc. | United Parcel Service, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 9055000000 |

| Thursday, January 1, 2015 | 2355100000 | 9870000000 |

| Friday, January 1, 2016 | 2579500000 | 9740000000 |

| Sunday, January 1, 2017 | 2927200000 | 9611000000 |

| Monday, January 1, 2018 | 2762900000 | 9292000000 |

| Tuesday, January 1, 2019 | 3544500000 | 10194000000 |

| Wednesday, January 1, 2020 | 3769700000 | 10366000000 |

| Friday, January 1, 2021 | 3931600000 | 15821000000 |

| Saturday, January 1, 2022 | 4405500000 | 17005000000 |

| Sunday, January 1, 2023 | 5244600000 | 12714000000 |

| Monday, January 1, 2024 | 5800000000 | 10185000000 |

Infusing magic into the data realm

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and United Parcel Service, Inc. (UPS) stand as titans in their respective industries. From 2014 to 2023, ADP's EBITDA has shown a remarkable growth of approximately 122%, reflecting its robust business model and strategic initiatives. In contrast, UPS, a leader in logistics, experienced a 40% increase in EBITDA over the same period, peaking in 2022. This growth trajectory underscores the resilience and adaptability of these companies amidst economic fluctuations. Notably, ADP's EBITDA surged past the $5 billion mark in 2023, while UPS reached its zenith in 2022 with an EBITDA of $17 billion. However, data for UPS in 2024 remains unavailable, leaving room for speculation on its future performance. This analysis highlights the dynamic nature of these industry leaders and their strategic responses to market demands.

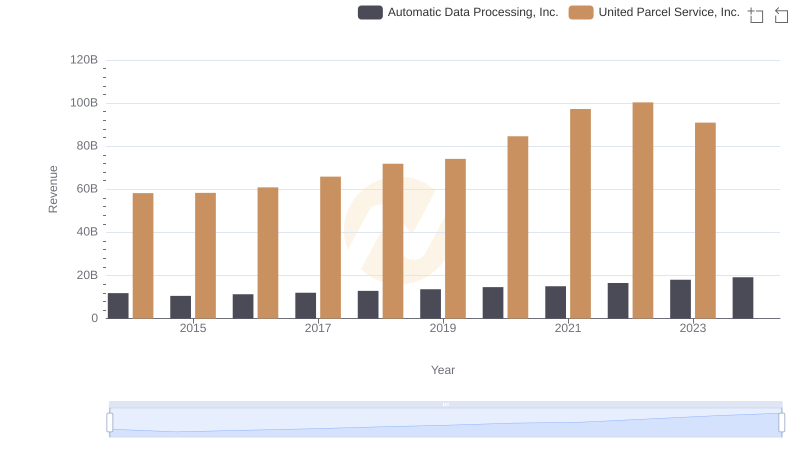

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs United Parcel Service, Inc.

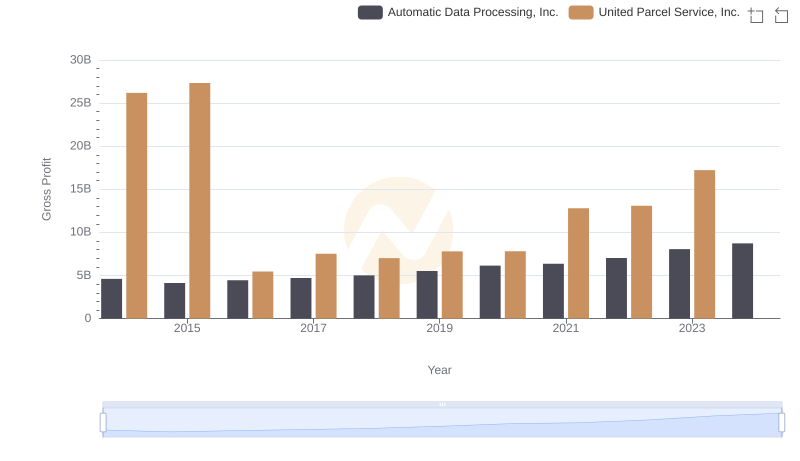

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Parcel Service, Inc.

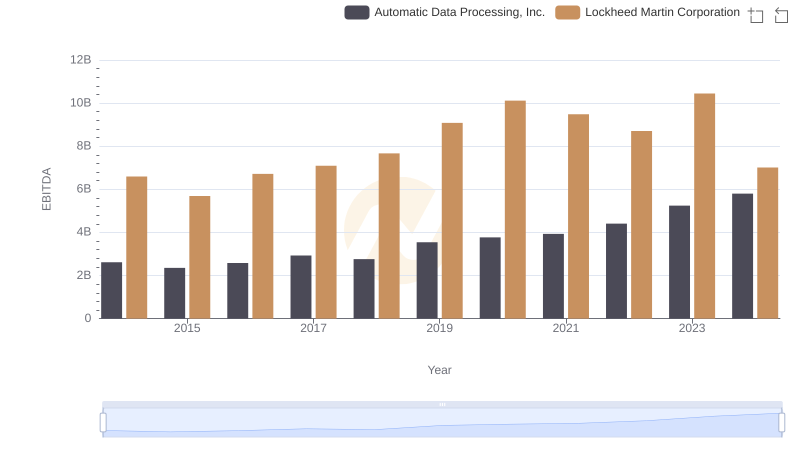

EBITDA Metrics Evaluated: Automatic Data Processing, Inc. vs Lockheed Martin Corporation

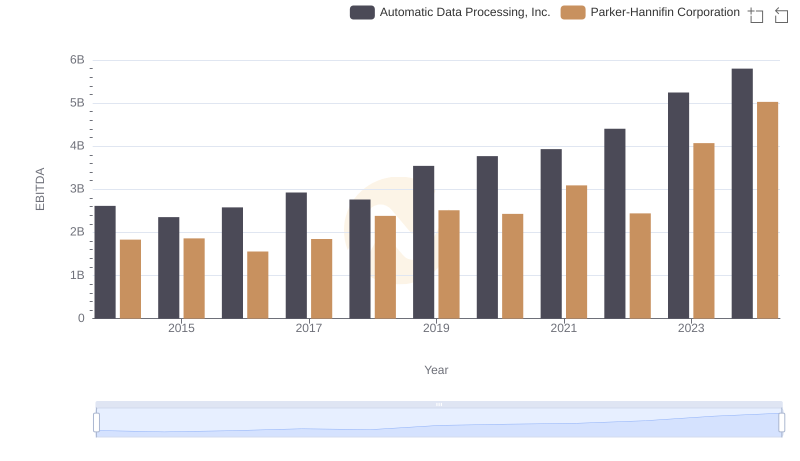

EBITDA Performance Review: Automatic Data Processing, Inc. vs Parker-Hannifin Corporation

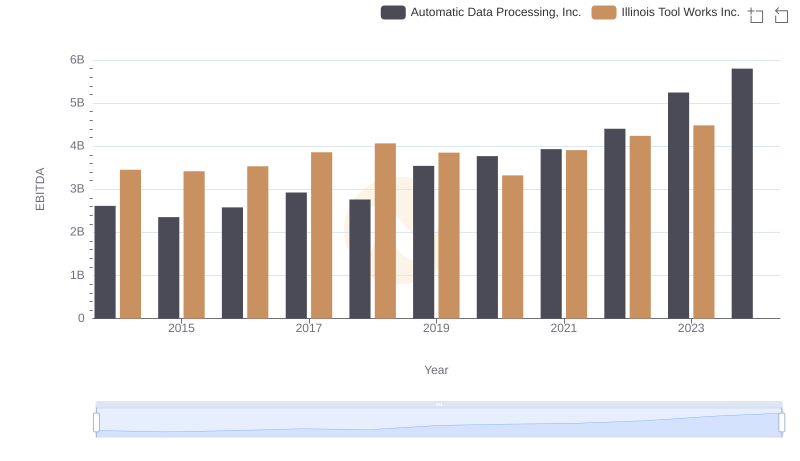

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Illinois Tool Works Inc.

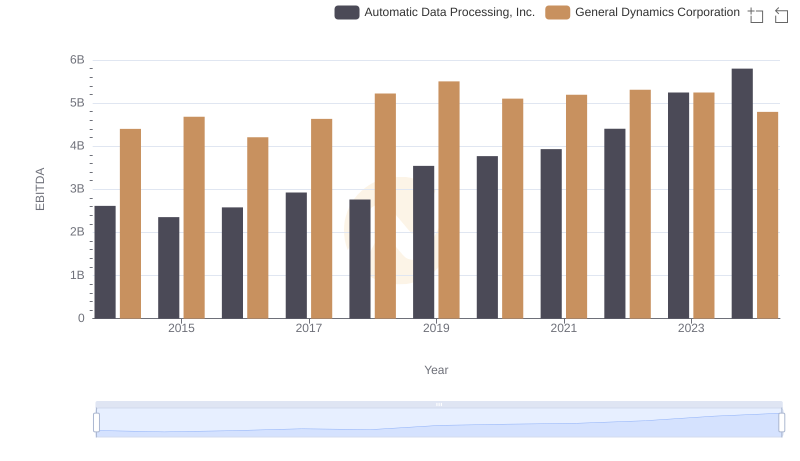

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to General Dynamics Corporation

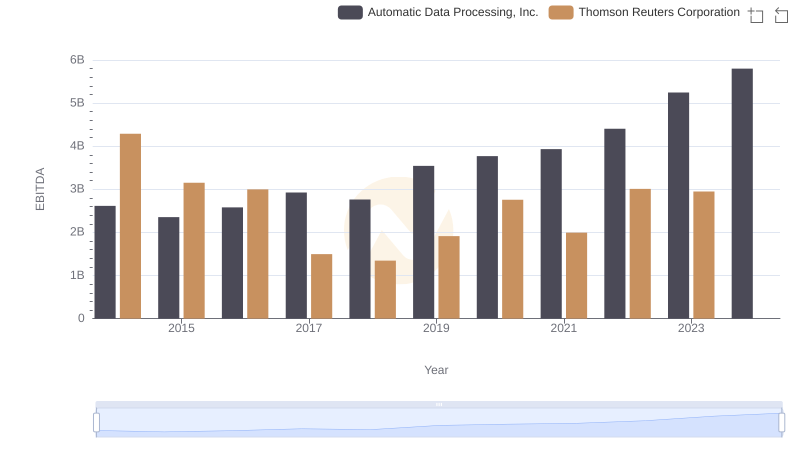

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Thomson Reuters Corporation

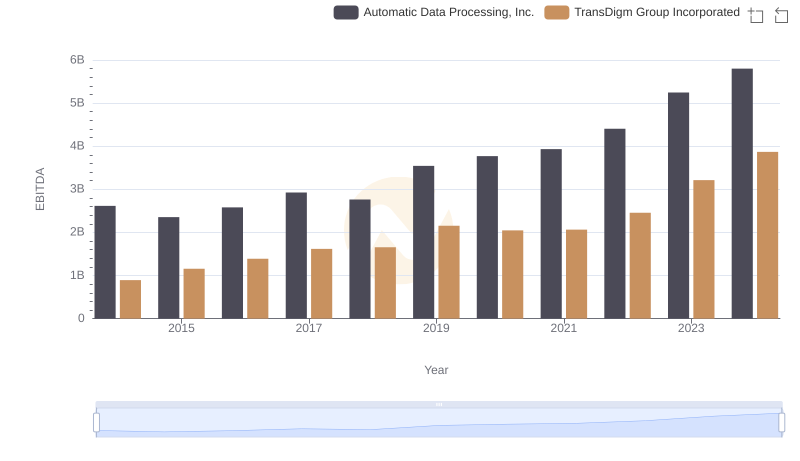

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs TransDigm Group Incorporated