| __timestamp | Automatic Data Processing, Inc. | General Dynamics Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 4401000000 |

| Thursday, January 1, 2015 | 2355100000 | 4682000000 |

| Friday, January 1, 2016 | 2579500000 | 4208000000 |

| Sunday, January 1, 2017 | 2927200000 | 4635000000 |

| Monday, January 1, 2018 | 2762900000 | 5222000000 |

| Tuesday, January 1, 2019 | 3544500000 | 5503000000 |

| Wednesday, January 1, 2020 | 3769700000 | 5105000000 |

| Friday, January 1, 2021 | 3931600000 | 5194000000 |

| Saturday, January 1, 2022 | 4405500000 | 5311000000 |

| Sunday, January 1, 2023 | 5244600000 | 5246000000 |

| Monday, January 1, 2024 | 5800000000 | 5819000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Automatic Data Processing, Inc. (ADP) and General Dynamics Corporation have showcased intriguing trends in their EBITDA figures.

From 2014 to 2024, ADP's EBITDA has surged by approximately 122%, reflecting its robust business model and strategic initiatives. Notably, the year 2023 marked a significant milestone, with EBITDA reaching a peak of $5.8 billion, a 32% increase from the previous year.

Conversely, General Dynamics has maintained a steady EBITDA growth, peaking in 2019 with a 25% increase from 2014. However, a slight dip in 2024 suggests potential challenges ahead.

This comparative analysis underscores the dynamic nature of these industry giants, offering valuable insights for investors and stakeholders alike.

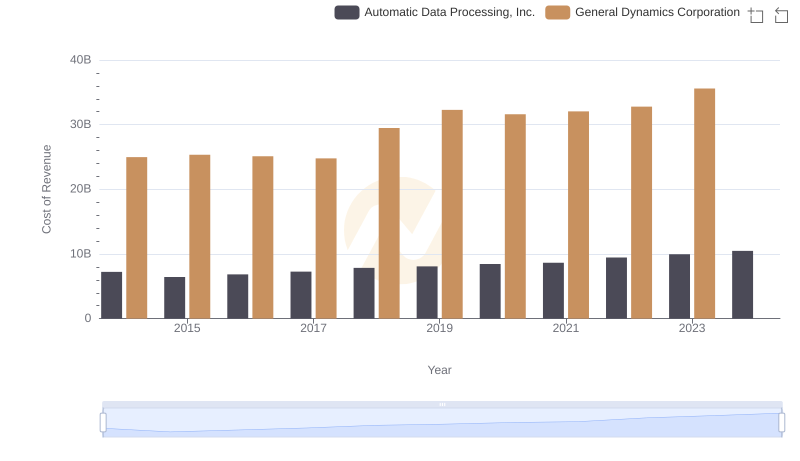

Cost of Revenue Trends: Automatic Data Processing, Inc. vs General Dynamics Corporation

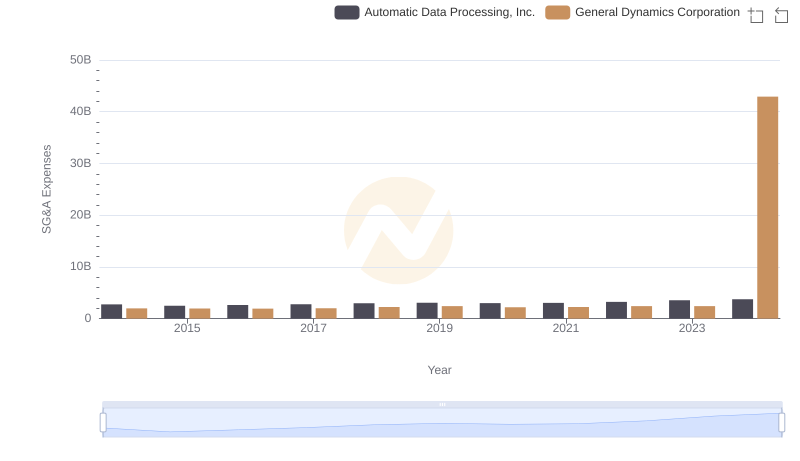

Automatic Data Processing, Inc. or General Dynamics Corporation: Who Manages SG&A Costs Better?

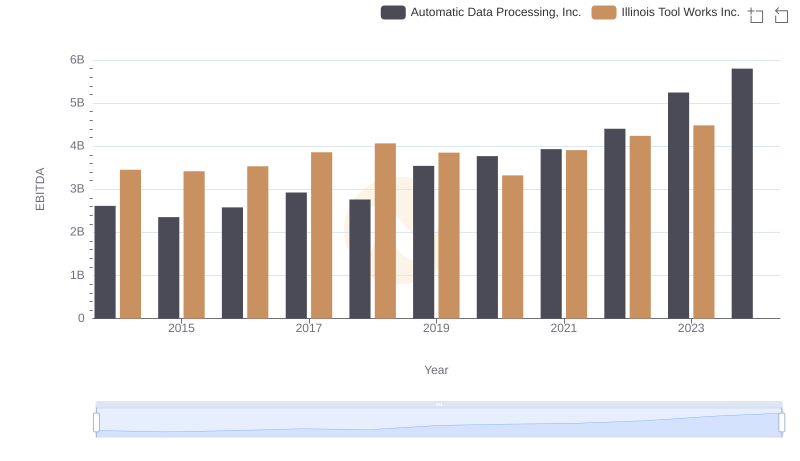

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Illinois Tool Works Inc.

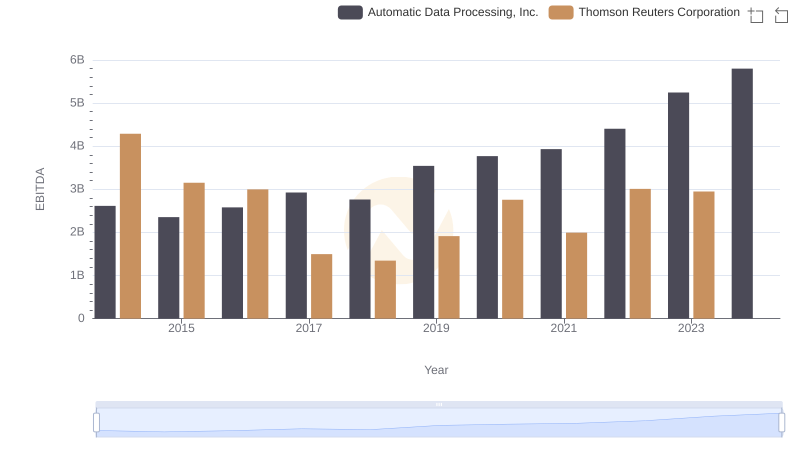

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Thomson Reuters Corporation

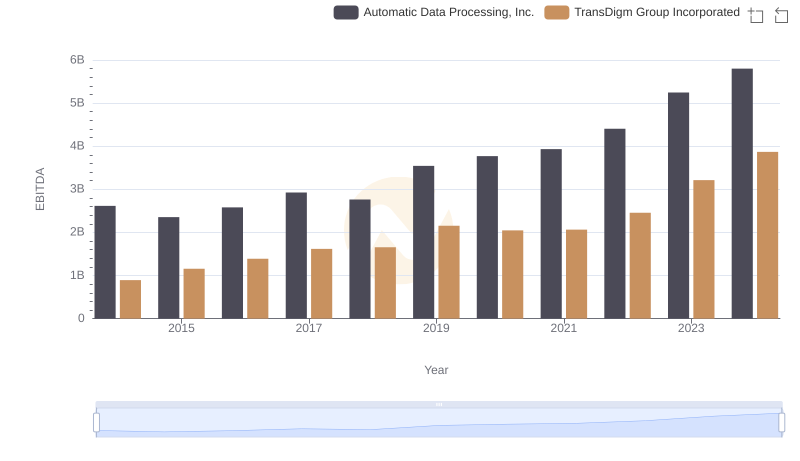

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs TransDigm Group Incorporated

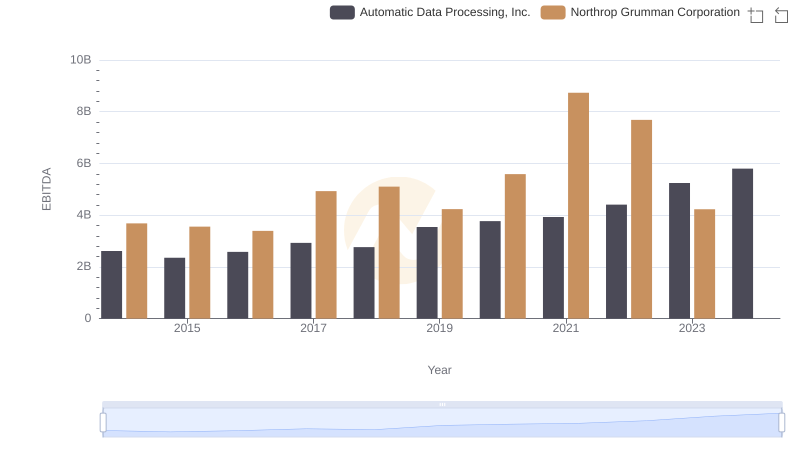

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Northrop Grumman Corporation