| __timestamp | Automatic Data Processing, Inc. | United Parcel Service, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11832800000 | 58232000000 |

| Thursday, January 1, 2015 | 10560800000 | 58363000000 |

| Friday, January 1, 2016 | 11290500000 | 60906000000 |

| Sunday, January 1, 2017 | 11982400000 | 65872000000 |

| Monday, January 1, 2018 | 12859300000 | 71861000000 |

| Tuesday, January 1, 2019 | 13613300000 | 74094000000 |

| Wednesday, January 1, 2020 | 14589800000 | 84628000000 |

| Friday, January 1, 2021 | 15005400000 | 97287000000 |

| Saturday, January 1, 2022 | 16498300000 | 100338000000 |

| Sunday, January 1, 2023 | 18012200000 | 90958000000 |

| Monday, January 1, 2024 | 19202600000 | 91070000000 |

Unlocking the unknown

In the ever-evolving landscape of American business, Automatic Data Processing, Inc. (ADP) and United Parcel Service, Inc. (UPS) stand as titans in their respective fields. Over the past decade, these companies have showcased remarkable revenue trajectories, reflecting broader economic trends.

From 2014 to 2023, ADP's revenue has seen a consistent upward trend, growing by approximately 62%. This steady increase highlights ADP's resilience and adaptability in the face of economic challenges, underscoring its pivotal role in the payroll and human resources sector.

UPS, on the other hand, experienced a more volatile journey. While its revenue surged by nearly 72% from 2014 to 2022, the data for 2023 shows a decline, possibly reflecting global supply chain disruptions. The absence of 2024 data leaves room for speculation on UPS's future trajectory.

These trends not only reflect the companies' individual strategies but also mirror broader economic shifts, offering valuable insights for investors and industry analysts alike.

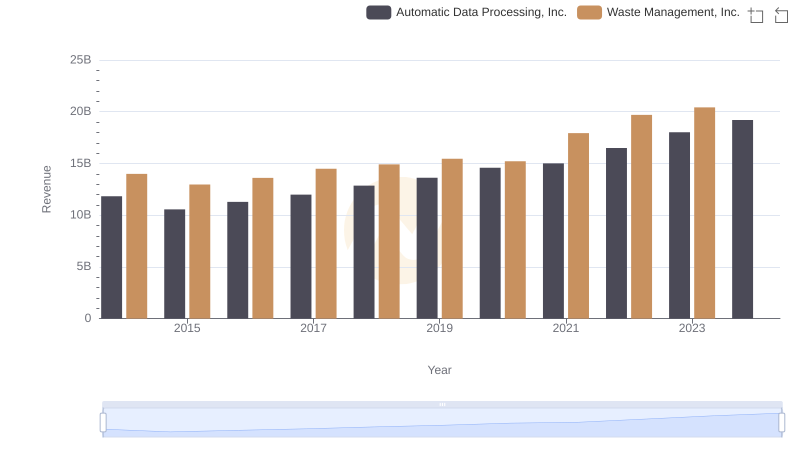

Revenue Showdown: Automatic Data Processing, Inc. vs Waste Management, Inc.

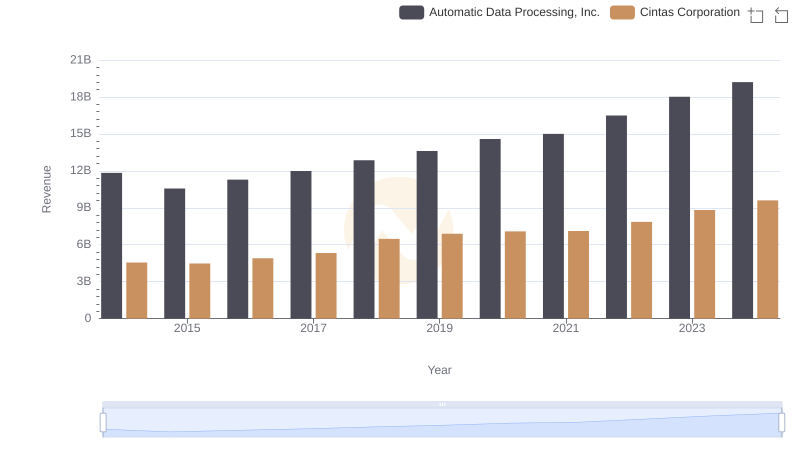

Automatic Data Processing, Inc. or Cintas Corporation: Who Leads in Yearly Revenue?

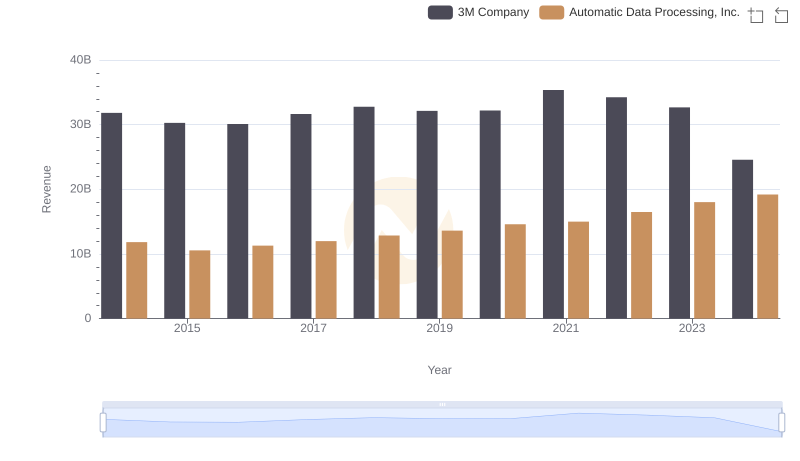

Automatic Data Processing, Inc. vs 3M Company: Examining Key Revenue Metrics

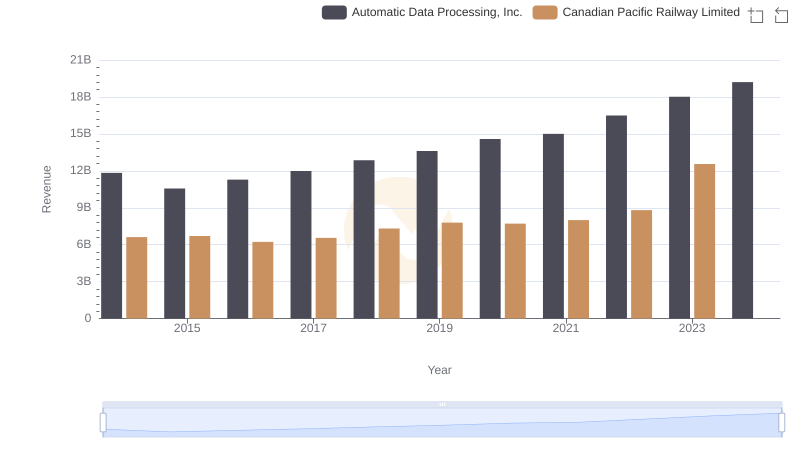

Who Generates More Revenue? Automatic Data Processing, Inc. or Canadian Pacific Railway Limited

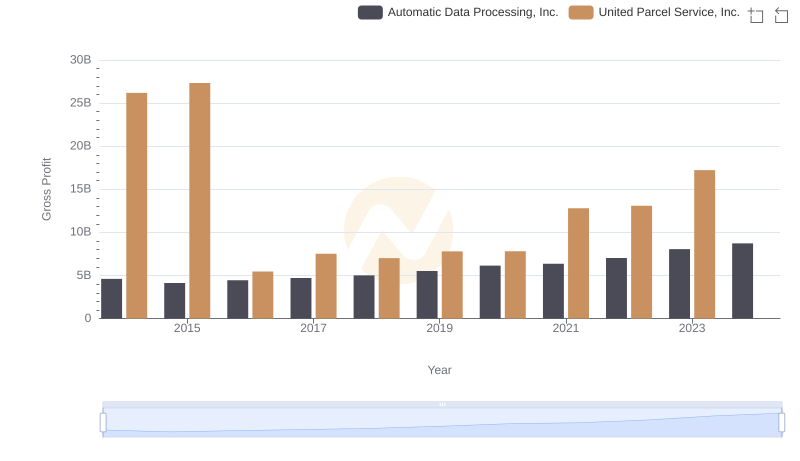

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or United Parcel Service, Inc.

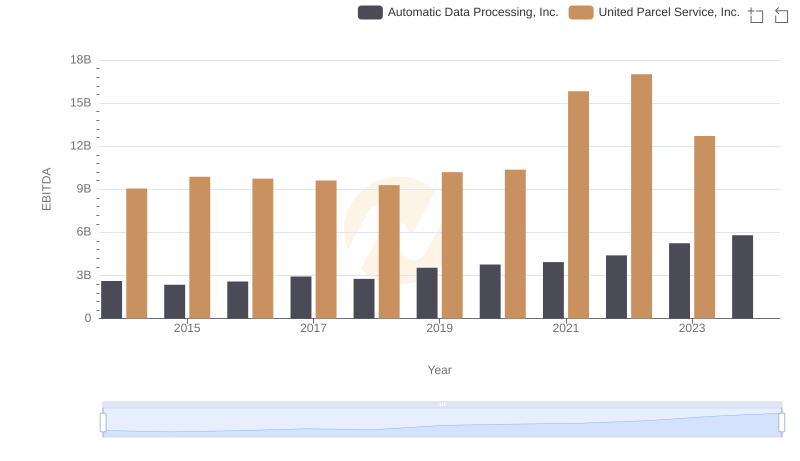

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and United Parcel Service, Inc.