| __timestamp | Automatic Data Processing, Inc. | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 4289000000 |

| Thursday, January 1, 2015 | 2355100000 | 3151000000 |

| Friday, January 1, 2016 | 2579500000 | 2999000000 |

| Sunday, January 1, 2017 | 2927200000 | 1495930891 |

| Monday, January 1, 2018 | 2762900000 | 1345686008 |

| Tuesday, January 1, 2019 | 3544500000 | 1913474675 |

| Wednesday, January 1, 2020 | 3769700000 | 2757000000 |

| Friday, January 1, 2021 | 3931600000 | 1994296441 |

| Saturday, January 1, 2022 | 4405500000 | 3010000000 |

| Sunday, January 1, 2023 | 5244600000 | 2950000000 |

| Monday, January 1, 2024 | 5800000000 |

In pursuit of knowledge

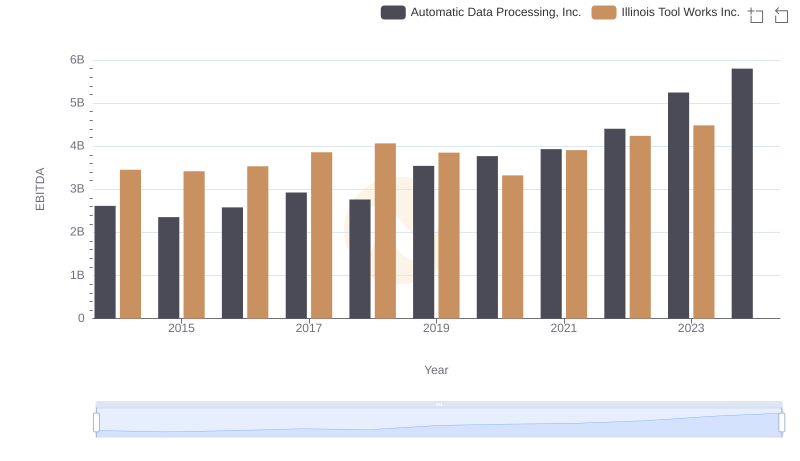

In the ever-evolving landscape of global business, understanding a company's financial health is paramount. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, serves as a crucial indicator of operational performance. This analysis pits Automatic Data Processing, Inc. (ADP) against Thomson Reuters Corporation over a decade, from 2014 to 2023.

ADP has shown a remarkable upward trajectory, with its EBITDA growing by approximately 122% from 2014 to 2023. In contrast, Thomson Reuters experienced a more volatile journey, with a notable dip in 2017 and 2018, where EBITDA fell to nearly half of its 2014 value. By 2023, ADP's EBITDA reached a peak, while Thomson Reuters saw a modest recovery.

The data highlights ADP's consistent growth, suggesting robust operational strategies. Meanwhile, Thomson Reuters' fluctuations indicate potential challenges and opportunities for strategic realignment. Missing data for 2024 suggests a need for cautious optimism in future projections.

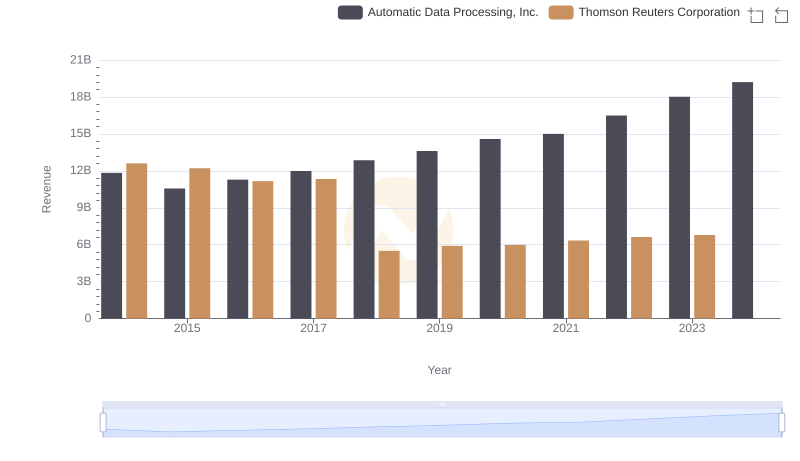

Automatic Data Processing, Inc. or Thomson Reuters Corporation: Who Leads in Yearly Revenue?

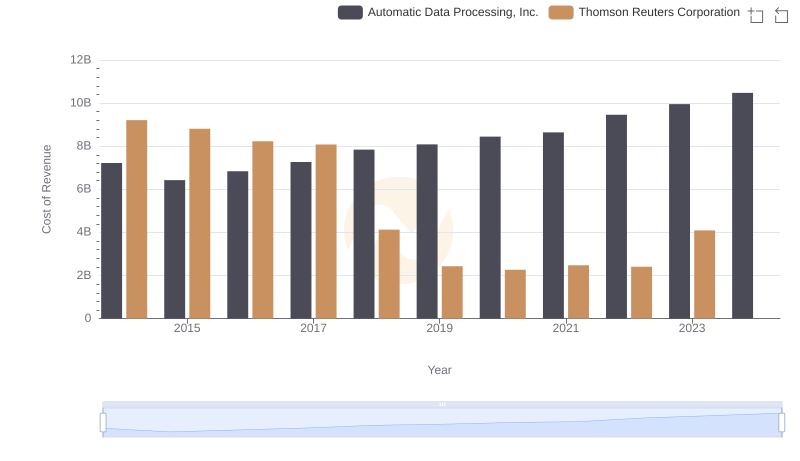

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Thomson Reuters Corporation

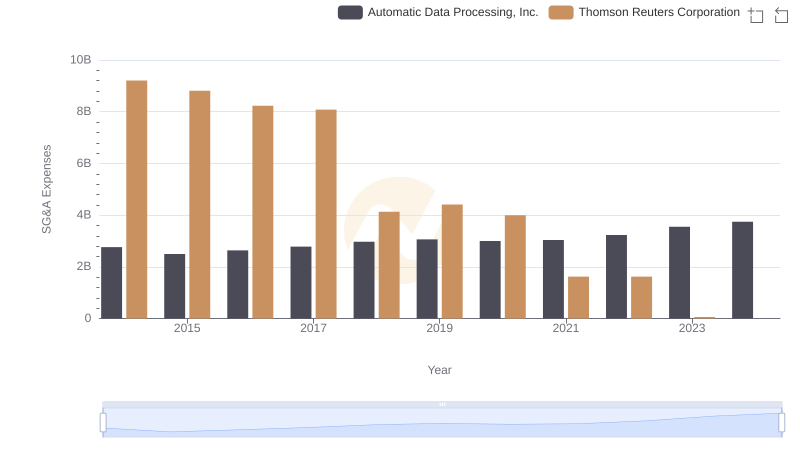

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs Thomson Reuters Corporation

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Illinois Tool Works Inc.

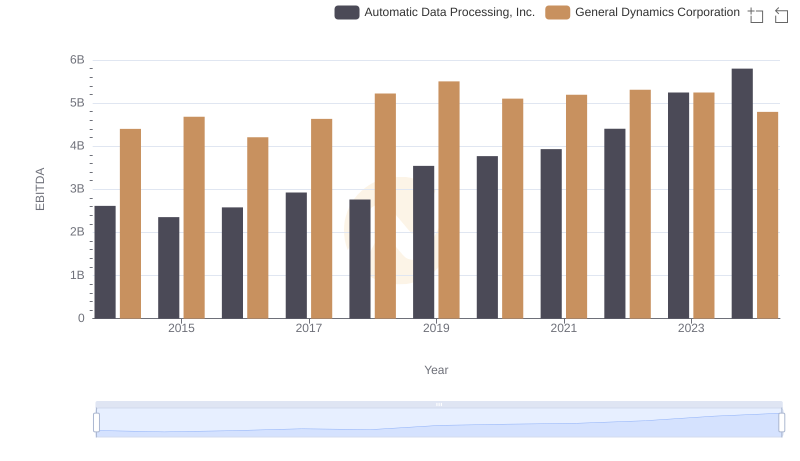

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to General Dynamics Corporation

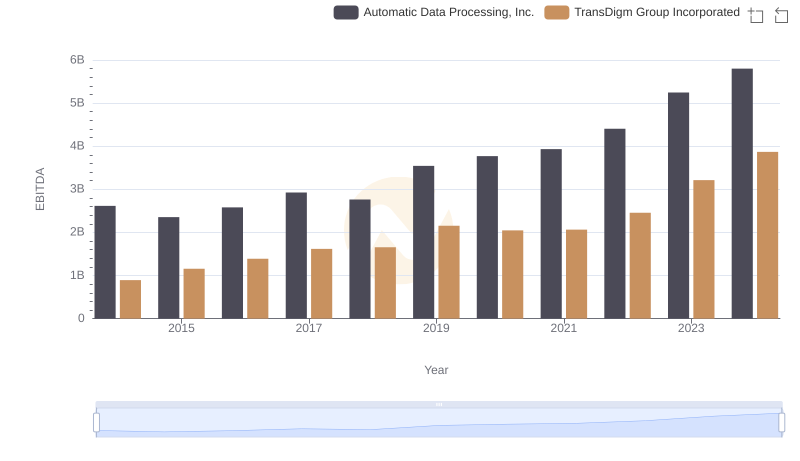

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs TransDigm Group Incorporated

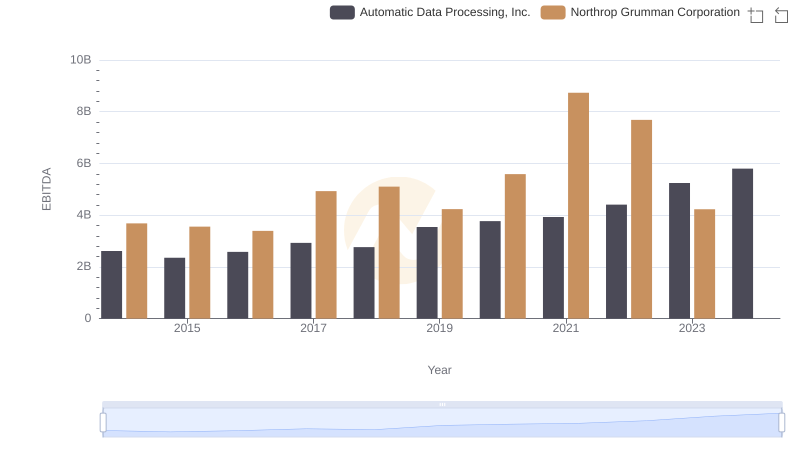

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Northrop Grumman Corporation

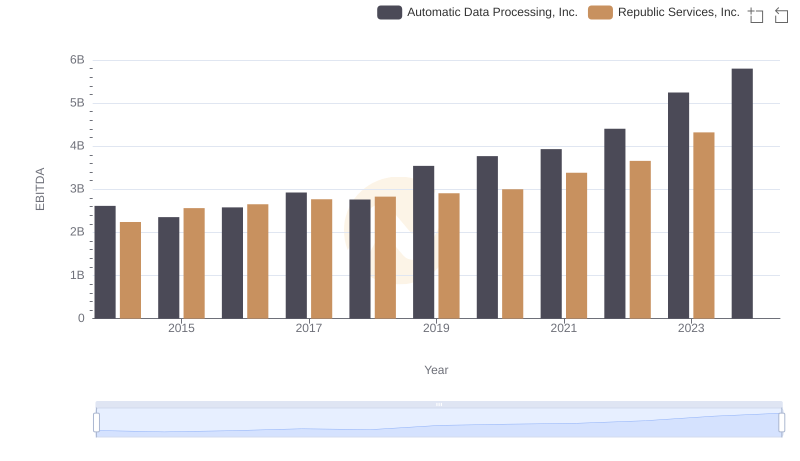

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Republic Services, Inc.